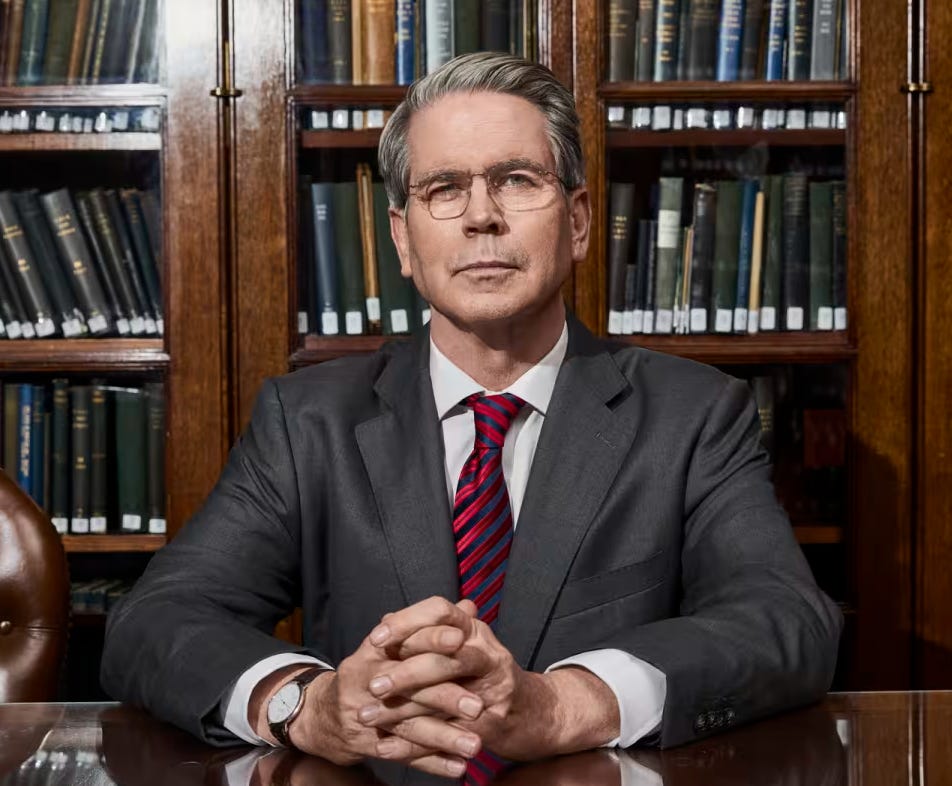

How does Scott Bessent see the world?

Getting to know our potential new U.S. Treasury Secretary - Article #94

In this 14-minute article, The X Project will answer these questions:

I. Why this article now?

II. What are Bessent’s views on macroeconomic and fiscal policy?

III. How does his background in economic history shape his view of the future

IV. What does he see as an economic priority?

V. What is his core belief regarding markets and governments?

VI. What does he see as vital to driving economic growth?

VII. What about his views on social mobility and equity?

VIII. What about geopolitics?

IX. What does The X Project Guy have to say?

X. Why should you care?

Reminder for readers and listeners: nothing The X Project writes or says should be considered investment advice or recommendations to buy or sell securities or investment products. Everything written and said is for informational purposes only, and you should do your own research and due diligence. It would be best to discuss with an investment advisor before making any investments or changes to your investments based on any information provided by The X Project.

I. Why this article now?

It’s official. After weeks of speculation since Donald Trump’s presidential election, the president-elect has announced that Scott Bessent is his nomination for Treasury Secretary. I started hearing about Scott Bessent a couple of months ago, and after the election, I began spending time learning about him and his views.

If you know his name, you probably already know he is the founder of Key Square Capital Management. I didn’t hear much more about who he was, but you can check out his Wikipedia page for a full background and history.

One interesting point is that he was a solid democratic supporter, donating and/or hosting fundraising events for Al Gore, Hilary Clinton, and Barack Obama until 2016, when he donated to President Trump’s 2017 Inaugural Committee.

Here are some of the most relevant YouTube videos from which I learned about Scott Bessent:

Who Is Scott Bessent?: What You Need To Know About Donald Trump's Treasury Secretary Nominee on Forbes (30,055 views Nov 19, 2024)

Trump's Potential Treasury Secretary on Macro Strategy ft. Scott Bessent on Real Vision (20,234 views Nov 12, 2024)

Squawk Pod: Scott Bessent & Trump’s economy 2.0 on CNBC Television (3,026 views Nov 6, 2024)

Scott Bessent on Trump's Economic Proposals | Balance of Power on Bloomberg Podcasts (1,947 views Oct 11, 2024)

Scott Bessent | Industrial Policy as Innovation, Military, and Insurance Policy | NatCon 4 on National Conservatism (1,468 views Jul 22, 2024)

Scott Bessent on the 2024 US presidential election on Bloomberg Television (3,450 views Jul 19, 2024)

Scott Bessent | The Fallacy of Bidenomics: A Return to Central Planning | A New Supply-Side on Manhattan Institute (4,976 views Jun 13, 2024)

And here is what I learned.

II. What are Bessent’s views on macroeconomic and fiscal policy?

Bessent emphasizes the critical need for fiscal discipline in the U.S. He has consistently expressed alarm over unprecedented budget deficits during peace and economic stability. He argues that such deficits weaken economic resilience and set dangerous precedents for future crises.

In particular, Bessent critiques the Biden administration’s fiscal strategies, labeling them as overly reliant on short-term spending without sufficient attention to long-term productivity. He contrasts this approach with historical instances where fiscal restraint contributed to robust economic growth. By highlighting these issues, Bessent positions himself as a potential advocate for reigning in spending to stabilize the U.S. economy.

Furthermore, his views on government expenditure reflect his belief in organic economic growth over central planning. Bessent warns that unchecked spending could push the U.S. toward a debt crisis akin to emerging markets, which is a scenario he seeks to avoid at all costs.

III. How does his background in economic history shape his view of the future?

Bessent frequently applies lessons from history to understand present economic challenges. His academic background as a teacher of economic history at Yale informs his analytical approach. For instance, he often references the failures of previous central planning models to critique current policies that rely heavily on government intervention.

This historical perspective also extends to global systems. Bessent believes we are on the cusp of a significant economic realignment akin to the Bretton Woods agreement. He advocates for leveraging historical precedents to shape forward-thinking policies that address modern challenges like global debt, trade imbalances, and geopolitical tensions.

By framing his strategies within historical analogs, Bessent underscores the importance of grounding policy decisions in proven frameworks while adapting to contemporary realities.

IV. What does he see as an economic priority?

A significant theme in Bessent’s outlook is the evolving relationship between the U.S. and China. He sees the ongoing decoupling as both inevitable and necessary. While acknowledging the challenges of disentangling the two economies, he emphasizes the strategic importance of reducing U.S. reliance on China, particularly in critical industries.

Bessent warns of the continued dependency's economic and geopolitical risks, including the potential for sudden trade disruptions or currency conflicts. He also highlights China’s transition from being the “world’s factory” to a more sophisticated manufacturing hub, which poses challenges for U.S. and allied economies like Germany and South Korea.

Bessent advocates for policies that strengthen U.S. industrial capacity, diversify trade relationships, and leverage alliances to counterbalance China’s economic influence in navigating this decoupling.

V. What is his core belief regarding markets and governments?

One of Bessent’s core beliefs is the supremacy of markets in determining economic outcomes. He draws from his experience during pivotal events, such as the 1992 Black Wednesday currency crisis (when a collapse in the value of the pound sterling forced Britain to withdraw from the European Exchange Rate Mechanism (ERM) on Sept. 16, 1992), to illustrate how market forces can overpower government interventions.

Bessent’s approach to macro investing—grounded in identifying market anomalies and understanding behavioral dynamics—also shapes his policy recommendations. He stresses the importance of governments recognizing their limitations and avoiding policies that attempt to defy market fundamentals.

This belief extends to his critique of monetary policy. Bessent has been critical of central banks, including the Federal Reserve, for policies he views as reactive and poorly timed. He argues for a more disciplined approach that aligns with market realities rather than attempting to manipulate them.

VI. What does he see as vital to driving economic growth?

As a hedge fund veteran, Bessent champions innovation and calculated risk-taking as essential drivers of economic growth. He frequently emphasizes the need for policies that foster entrepreneurship and support industries on the cutting edge of technology.

Bessent admires high-risk, high-reward ventures, which is reflected in his advocacy for maintaining competitive corporate and capital gains tax rates. He argues that such policies incentivize innovation and investment, which are crucial for sustaining long-term economic dynamism.

At the same time, Bessent warns against overregulation and policies that stifle entrepreneurial activity. He believes that maintaining an environment conducive to innovation is vital to the U.S.’s global competitiveness.

That concludes Section VI. I have hit a new paid subscriber threshold, so you must now be a paid subscriber to view the last four sections:

VII. What about his views on social mobility and equity?

VIII. What about geopolitics?

IX. What does The X Project Guy have to say?

X. Why should you care?

If you haven’t done so already, use your free, single-use “unlock” feature to view the rest of this article.

The X Project’s articles always have ten sections. Soon, after a few more articles, the paywall will move up again within the article so that only paid subscribers will see the last five sections, or rather, free subscribers will only see the first Five sections. Please consider a paid subscription.

All paid subscriptions come with a free 14-day trial; you can cancel anytime. Every month, for just the cost of two cups of coffee, The X Project will deliver a weekly article every Sunday, helping you know in a couple of hours of your time per month what you need to know about our changing world at the interseXion of commodities, demographics, economics, energy, geopolitics, government debt & deficits, interest rates, markets, and money.

You can also earn free paid subscription months by referring your friends. If your referrals sign up for a FREE subscription, you get one month of free paid subscription for one referral, six months of free paid subscription for three referrals, and twelve months of free paid subscription for five referrals. Please refer your friends!

VII. What about his views on social mobility and equity?

Keep reading with a 7-day free trial

Subscribe to The X Project’s Substack to keep reading this post and get 7 days of free access to the full post archives.