In this 15-minute article, The X Project will answer these questions:

I. Why this article now?

II. Who is Bob Farrell, and what are the Market Rules to Remember?

III. - VIII. What do rules #1, #2, #4, #5, #7, and #9 mean for today’s market?

IX. What does The X Project Guy have to say?

X. Why should you care?

Reminder for readers and listeners: nothing The X Project writes or says should be considered investment advice or recommendations to buy or sell securities or investment products. Everything written and said is for informational purposes only, and you should do your own research and due diligence. It would be best to discuss with an investment advisor before making any investments or changes to your investments based on any information provided by The X Project.

I. Why this article now?

Many Wall Street Bulls will undoubtedly be hungover this morning after partying hard this weekend and celebrating the S&P 500’s close of over 5,000 this past Friday. The consensus continues to be pretty bullish on several measures, including the popular CNN Business’s Fear and Greed Index:

This Index rose from Extreme Fear in late October last year:

You’ll notice that Extreme Greed corresponds to the market making new recent highs, and Extreme Fear corresponds to the market making new recent lows:

For The X Project, hearing the words “new all-time highs,” “greed,” or “consensus” all invoke the timeless Market Rules to Remember, memorialized by the legendary Bob Farrell.

II. Who is Bob Farrell, and what are the Market Rules to Remember?

According to Wikipedia, “In 1955, Robert "Bob" J. Farrell graduated from Columbia University with a master's in investment finance, where his teachers included Benjamin Graham. After two years of service in the U.S. Army, Farrell joined Merrill Lynch in 1957. By 1967, he was made Chief Market Analyst (CMA) at Merrill, a title he held for over 25 years until stepping down in 1992, then aged 60. For 16 of his last 17 years as CMA at Merrill Lynch, Institutional Investor voted Farrell as America's best analyst in forecasting equity market direction, and he was inducted into the "Hall of F” Farrell is considered a pioneer of technical analysis and he is noted as being the first to incorporate "sentiment analysis" into financial forecasting. In 1970, he was made the first president of what became the CMT Association.

After stepping down as CMA, Farrell stayed with Merrill as a senior investment officer, writing regular reports for clients. In September 1998, as the dot-com bubble was nearing its peak, Farrell published a list of ten "Market Rules to Remember" on the back of one of his reports.

Rule #1. "Markets tend to return to the mean over time."

Rule #2. "Excesses in one direction will lead to an opposite excess in the other direction."

Rule #3. "There are no new eras — excesses are never permanent."

Rule #4. "Exponential rapidly rising or falling markets usually go further than you think, but they do not correct by going sideways."

Rule #5. "The public buys the most at the top and the least at the bottom."

Rule #6. "Fear and greed are stronger than long-term resolve."

Rule #7. "Markets are strongest when they are broad and weakest when they narrow to a handful of blue-chip names"

Rule #8. "Bear markets have three stages — sharp down, reflexive rebound, and a drawn-out fundamental downtrend."

Rule #9. "When all the experts and forecasts agree — something else is going to happen."

Rule #10. "Bull markets are more fun than bear markets."

The rules received little attention when they were first published, and Farrell retired fully in 2002 after 45 years with the firm. Merrill Lynch chief North American economist David Rosenberg re-published the rules in 2003, after the dot-com bubble burst, and they have been quoted by financial advisors ever since.”

III. What does rule #1 mean for today’s market?

Markets tend to return to the mean over time.

The concept of mean reversion is not new. The earliest statistical version of the concept dates back to the 18th century with Sir Francis Galton and his work, “Regression Towards Mediocrity in Hereditary Stature.” The relationship between mean reversion and investing is not a new idea, either. Benjamin Graham highlights the link between the two in his book, The Intelligent Investor, as far back as 1949.

What is the definition of reversion to the mean? Reversion to the mean, also called regression to the mean, is the statistical phenomenon stating that the greater the deviation of a random variate from its mean, the greater the probability that the next measured variate will deviate less far. In other words, an extreme event will likely be followed by a less extreme one.

Moving averages are commonly used to measure a mean in equity prices. There is no one correct moving average to use. If you are so inclined, you can play with different moving averages (5, 10, 20, 500, 100, etc) on daily, weekly, monthly, quarterly, or yearly charts, and you will get different perspectives using different means. Here is a long-term weekly chart from Bank of America Global Research of the S&P 500 using the 200-week moving average to show and explain the concept of mean reversion:

Sticking with the 200-week moving average, here is an updated chart through Friday’s close:

Notice that over the past ten years, the market price came down to the 200-week moving average four times, with the longest stretch between February 1, 2016, and December 24, 2018, being 151 weeks. With the 200-week moving average at 4066.92 and the S&P 500 closing at 5026.61, a reversion to the 200-week moving average at this point would be a 19.1% decline, and it has been 72 weeks since the last time the market traded at the 200-week moving average during the week of September 26, 2022.

Bob Farrell’s Rule #1 tells us that markets tend to return to their mean. It is like a gravitational pull. The rule tells us nothing about timing as to when. Another way to think of this rule is that the market prices stretching away from their mean is like a rubber band. The further from the mean the market goes, the further the rubber band is stretched. You’ll notice in both charts above that when the market reverts to the mean, the “rubber band snaps back” much more quickly than it was stretched away.

IV. What does rule #2 mean for today’s market?

Excesses in one direction will lead to an opposite excess in the other direction.

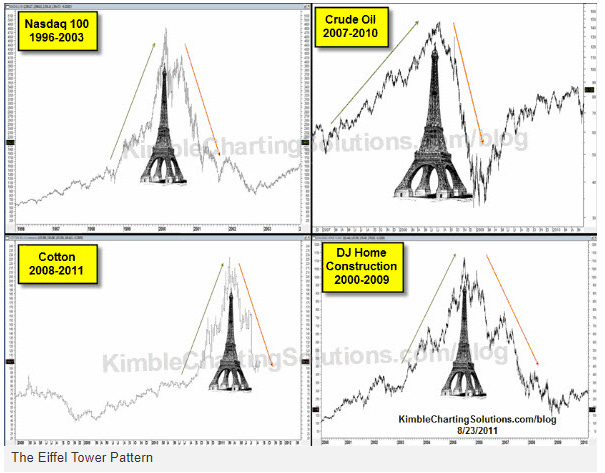

Another way to think of this rule is the Eiffel-Tower chart pattern; here are some examples.

However, Rule #2 doesn’t indicate which direction the initial excessive price action is moving. The Eiffel-Tower pattern is specific to the initial excess in prices going higher. Market crashes that form a V-shape are examples of initial excessive price action going lower. Looking at the S&P chart again, we can see the COVID-19 market crash as a downside example. A minor example is at the end of 2018 and the beginning of 2019.

So, a better way to think of Rule #2 is that sharp rallies often lead to equally sharp corrections, and sudden crashes or sharp sell-offs lead to similarly sudden and sharp rebounds.

V. What does rule #4 mean for today’s market?

Exponential rapidly rising or falling markets usually go further than you think, but they do not correct by going sideways.

In today’s market, the best example of an exponential, rapidly rising market is the price of Nvidia (NVDA), and here is a 10-year weekly chart with the 200-week moving average:

Rule #4 is similar and related to Rule #2: “Excesses in one direction will lead to an opposite excess in the other direction.” As noted in the chart above, NVDA has already shown us it can follow Bob Farrell’s rule #2 with an Eiffel Tower pattern. NVDA broke out to new highs of $163 during the week of May 24, 2020. Its price more than doubled in six months to a high of $346 during the week of November 22, 2020. But then another six months later, it had given back all of those price gains when it fell back to $156 during the week of May 9, 2021.

The difference between Rule #2 and Rule #4 is the warning in the latter. The price gains since the beginning of 2024 and even the beginning of 2023 are even more excessive, or should we say using Rule #4 terminology, that NVDA prices have experienced exponentially rising prices. If we were only focused on Rule #2, we might only ask the question, are we seeing the left side of the Eiffel Tower starting from the $500 price level at the beginning of this year or the $200 price level at the beginning of last year? If we considered Rule #1 and observed how far from the mean as measured by the 200-week moving average, we might be tempted to think the top must be imminent and maybe the current price is a reasonable price to sell short NVDA. Rule #4 is a warning that the price “usually goes farther than you think,” for NVDA, that might mean it goes to $1,000 or even much higher in the weeks ahead.

VI. What does rule #5 mean for today’s market?

The public buys the most at the top and the least at the bottom.

Headlines are breaking news that Jeff Bezos, founder of Amazon, sold $2 billion worth of his Amazon stock last week as his SEC filing became public. He previously sold about $20 billion combined in 2020 and 2021. Tracking corporate insiders’ activity is an indirect way to follow Rule #5 since there isn’t an easy way to track the overall public’s investment activities. But Jeff Bezos is only one person who happens to be within close reach of being the wealthiest person alive, and his actions might not have anything to do with whether or not he thinks Amazon’s stock price is overvalued or not. What about all insiders collectively?

This chart was seen on several Twitter/X feeds over the past couple of weeks:

While it indicates the ratio is back to neutral and bordering on bullish, it had a massive spike in January, indicating a relatively large amount of insider selling, considered bearish. And since the market was making or approaching new highs in January, it appears that Rule #5 might be coming into play depending on which Index. Furthermore, this chart does not seem to include Jeff Bezos’ recent sales.

Digging a little deeper into insiders’ activity, here is a chart from openinsider.com that shows a more extended history:

I have noted the four most significant sales with red numbers and the four largest purchases with green numbers. Let’s see how those compare on the S&P Chart:

We can see here that only the first of the four sales were predictive of a market top, and that was several months early. More significantly, three of the four purchases were good predictors of immediate bottoms, and even the first one was only a few months early, with the price declining a little bit more before a significant bottom. So, insider activity can provide some predictive information sometimes.

Another way to think about Rule #5 is from an individual investor sentiment perspective, assuming that if individual investors feel bullish, they then buy. Likewise, if they are feeling bearish, they then proceed to sell. The American Association of Individual Investors (AAII.com) collects and publishes this data. The sentiment survey measures the percentage of individual investors who are bullish, bearish, and neutral on the stock market short term; individuals are polled from the AAII website every week. Only one vote per member is accepted in each weekly voting period. The Visual Capitalist put together this great chart:

This chart proves Bob Farrell’s Rule #5 in that individual investors are bullish at market tops and bearish at market bottoms.

VII. What does rule #7 mean for today’s market?

Markets are strongest when they are broad and weakest when they narrow to a handful of blue-chip names.

Unless you live in a cave without any Internet connectivity (in which case you would not be reading this), you have no doubt heard of the “Magnificent 7” and the concentration of those seven stocks (Nvidia, Meta, Amazon, Microsoft, Alphabet/Google, Apple, and Tesla). At the end of 2023, these seven stocks accounted for 28% of the S&P 500 index, a weighted index by market capitalization. This means that the rest of the market outside of these seven stocks is not nearly as strong:

The concentration of Mag7 is more significant than that seen during the dot.com bubble of the early 2000s and the Nifty 50 of the early 1970s. Here is an interesting chart that shows the subsequent SPX price declines of 50% and 49% following those prior episodes of market concentration:

There are several market breadth indicators, including:

Percent/Number of Stocks above Moving Average.

Percent/Number of Stocks above Relative Strength 55.

Periodic High and Low.

Advance/Decline.

Net New High and Net New Lows.

If so inclined, you can look at these on your own, but I am running out of space and time for this article.

VIII. What does rule #9 mean for today’s market?

When all the experts and forecasts agree — something else is going to happen.

This is perhaps my favorite rule that I quote most often and feeds my contrarian soul. However, this one is tough to quantify. Who is an expert? How many are there? Who polls them and aggregates their forecasts?

Here is CNBC’s attempt, and it is arguably a tiny sample size:

Even with these forecasts, it is their estimate of where the S&P 500 will be at the end of 2024, which doesn’t tell us anything about the path from here to there over the year and whether it will be a smooth ride and one with stomach-turning volatility.

IX. What does The X Project Guy have to say?

First, I want to thank all subscribers - primarily free and some paid - who have signed up thus far. Gaining additional subscribers daily at this point is a strong vote of confidence propelling The X Project forward. Substack tells me that nearly two-thirds of you have a 4-star or 5-star activity rating, meaning you consistently engage with my content - which is excellent! Please hit the heart icon indicating you like the article. The more “likes” I get, the more Substack will promote my content within the Substack community. If you don’t like my content or have any suggestions, please email me at TheXprojectGuy@gmail.com.

Second, I apologize for the late publication today. Usually, I publish in the early mornings on Wednesdays and Sundays. For today, I originally started writing another article on some non-consensus views on why the stock market may continue rising and why the economy may avoid a recession. However, with the market closing at new all-time highs on Friday, my contrarian soul pulled me in another direction. I will likely publish the original article I started soon.

Third, let me remind readers who have been with me awhile or inform newer readers that my perspective is that of a 53 (soon to be 54) year-old Gen Xer. To support my lifestyle for myself and my family for the rest of my life, I need to continue to grow my assets by earning an income over my expenses to add to my base of assets. However, I have accumulated a substantial base of assets already, so one of my highest priorities is to protect and not lose my assets. That does not mean sticking my money under a pillow or in a big bank savings account, earning little to no interest since inflation will continue to diminish the purchasing power of my money over time. Therefore, I need to “protect” my money by investing it prudently in assets that I can expect to provide a rate of return that will, at a minimum, keep up with inflation and, ideally, outperform it. The X Project exists to help me and others like me do just that, and Bob Farrell’s Rules to Remember are essential to help avoid losses when time is becoming the asset of most significant value due to its limited supply.

To highlight this last point, I am going to share one last chart:

This inflation-adjusted chart of the S&P 500 from 1906-2022 shows a 116-year history where the market spent 91 years, or 78% of the time, just getting back to even.

In the next section, I will explain why you should care and, more importantly, what you can do about it. However, The X Project now requires you to view the final section as a paid subscriber. In a few articles, the paywall will move up within the article so that only paid subscribers will see the last two sections, or rather, free subscribers will only see the first eight sections. I will be moving the paywall up every few weeks, so ultimately, free subscribers will only see the first four or five sections of each article. Please consider a paid subscription.

All paid subscriptions come with a free 14-day trial; you can cancel anytime. Every month, for the cost of two cups of coffee, The X Project will deliver two articles per week ($1.15 per article), helping you know in 1-2 hours of your time per month what you need to know about our changing world at the interseXion of commodities, demographics, economics, energy, geopolitics, government debt & deficits, interest rates, markets, and money.

You can also earn free paid subscription months by referring your friends. If your referrals sign up for a FREE subscription, you get one month of free paid subscription for one referral, six months of free paid subscription for three referrals, and twelve months of free paid subscription for five referrals. Please refer your friends!