Navigating the Golden Tide

A summary of the World Gold Council's Report: "Gold Demand Trends: Full Year and Q4 2023"- Article #31

In this 12 min article, The X Project will answer these questions:

I. Why this article now?

II. What is the World Gold Council?

III. Where is this perspective coming from?

IV. What is the top takeaway from this perspective?

V. What is another top takeaway?

VI. What is a third takeaway?

VII. What is a fourth takeaway?

VIII. What is a fifth takeaway?

IX. What does The X Project Guy have to say?

X. Why should you care?

I. Why this article now?

In a year marked by economic fluctuations and geopolitical uncertainties, gold has once again proven its mettle as a safe haven and strategic asset. The analysis of “Gold Demand Trends: Full year and Q4 2023” reveals critical insights into the global economic landscape, investor behavior, and central bank strategies. With gold prices recently reaching record highs, understanding the forces at play offers valuable lessons for investors, policymakers, and market enthusiasts alike.

It was the first week of December that The X Project published “Gold Prices are at New All Time Highs: Why now? And what does it possibly mean? Article #13” discussing the price event and providing a primer on the gold market. If you missed it before, you should read it now.

Since originally trading at the new all time high price of $2,071 per ounce on 12/1/23, gold prices retreated to a low price of $1,979 on 12/12/23 before rebounding to another new all time high price of $2,077 on 12/27/23. On this past Friday 2/2/24, gold prices closed at $2,042 per ounce.

II. What is the World Gold Council?

According to Wikipedia, the World Gold Council is the market development organization for the gold industry. It works across all parts of the industry, from gold mining to investment, with the aim of stimulating and sustaining demand for gold.

It frequently publishes research advocating for gold as a preserver of wealth. It also provides analysis of the industry, offering insights into the drivers of gold demand. It has also launched various products such as SPDR Gold Shares ETF and gold accumulation plans in India and China.

The World Gold Council is an association whose members comprise the world's leading gold mining companies. It helps to support its members to mine in a responsible way and developed the Conflict Free Gold Standard.

Headquartered in London, United Kingdom, it has offices in India, China, Singapore and the United States.

III. Where is this perspective coming from?

On January 31, 2024, the World Gold Council published the twenty-seven page “Gold Demand Trends: Full year and Q4 2023” Report and published it on their website at the link found here.

IV. What is the top takeaway from this report?

Colossal Central Bank Buying Continued in 2023

Central banks continued their robust purchasing of gold, nearly matching the record high of 2022. This relentless accumulation underscores gold's enduring appeal as a reserve asset amidst global financial instability. The strategic significance of gold for central banks highlights a concerted move towards diversification and a hedge against currency devaluation and inflation, signaling a deeper geopolitical and economic strategy at play.

“The vast majority of purchases continued to come from emerging market central banks, many of whom have been regular buyers in recent years. The People’s Bank of China (PBoC) regained the crown for the largest single gold buyer; it reported a total rise of 225t in its gold reserves over the year. This makes 2023 the country’s highest single year of reported additions since at least 1977. As a result, PBoC gold reserves now stand at 2,235t, although this still represents only 4% of China’s vast international reserves.”

V. What is another top takeaway?

Jewelry Demand Firm in the Face of Record Gold Prices

The resilience of gold jewelry demand, even amidst skyrocketing prices, paints a picture of cultural and economic steadfastness, particularly in key markets like China and India, which together account for more than half of jewelry demand.

This trend not only reflects the intrinsic value ascribed to gold in these cultures but also signals a broader economic recovery and consumer confidence post-pandemic. The stability in jewelry demand amidst such high prices underscores gold's dual role as both an investment and a cultural staple.

VI. What is a third takeaway?

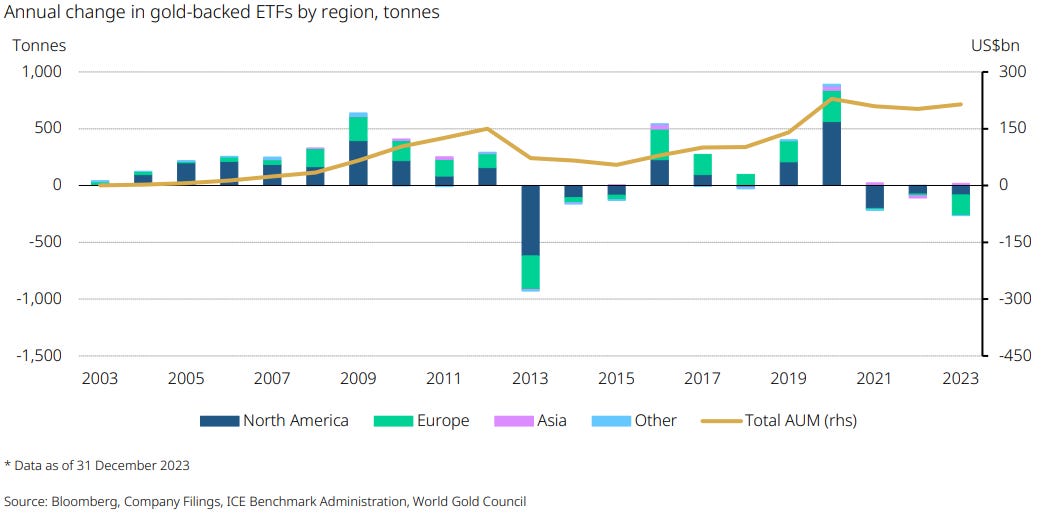

Investment Demand Declined Led by ETF Outflows

The significant outflows from gold ETFs for the third consecutive year, juxtaposed with a modest decline in but still solid demand for physical gold in the form of bars and coins, illustrate a shifting landscape in investor sentiment and strategy.

This next point is very important. This pivot towards tangible assets suggests a search for security and tangibility in investments, possibly driven by a lack of confidence in traditional financial systems and concerns over economic volatility.

VII. What is a fourth takeaway?

Strong Gold Prices Indicate Robust Demand

The remarkable strength of the gold price throughout 2023, setting both yearly and end-of-year records, signals a robust demand across various sectors despite the economic uncertainties.

The London Bullion Market Association (LBMA) gold price ended 2023 at $2,078.4/oz - a record high year-end close - generating an annual return of 15%.

The LBMA average 2023 gold price of $1,940.54/oz - also a record - was 8% higher than 2022.

The price resilience is a testament to gold's role as a hedge against inflation, a safe haven in times of geopolitical stress, and a diversification tool in investment portfolios. The dynamics of the gold market in 2023 reflect broader themes of seeking stability in uncertain times.

VIII. What is a fifth takeaway?

2024 Outlook

The outlook for 2024 suggests continued complex interplay between various factors influencing gold demand and supply. Anticipated central bank buying, shifts in jewelry demand due to economic pressures, and evolving investment strategies all play into forecasts that maintain gold's prominence on the global stage.

“Total investment (including OTC) likely to be higher in 2024 but, akin to the market behaviour last year, much of this demand could come from the less visible OTC segment – which adds a level of uncertainty. Early continued weakness in global gold ETFs is likely to see a turnaround by mid-year, aided by anticipated rate cuts and continued geopolitical risk. European ETF outflows are likely to continue until longer-maturity interest rates are on a firm path lower, but even here regional politics, alongside geopolitics, could shake things up. Bar and coin demand is likely to stay healthy and in line with the 10- year average, as Chinese and Indian demand strength offsets European weakness.”

“Central banks to keep buying at an impressive rate, likely in excess of the pre-2022 annual average of around 500t. They almost matched their 2022 total last year and we believe that a longer-term strategy is at play here and err on being more open-minded to another solid year of buying, albeit somewhat lower than this year.”

“Jewellery demand may struggle to remain lofty, as economic slowdowns and high gold prices start to bite. However, should inflation drop significantly consumers might start to feel wealthier in real terms, which could mitigate some of the drop in demand. Technology demand is expected to benefit from strong positive guidance on semiconductors and from AI fever.”

“Total supply to rise with planned expansions and higher grades taking primary production to new highs, although a downside risk from disruptions remains a factor, as always. Recycling is expected to rise, but not materially, as an economic recovery helped by stimulus measures in China could stymie overall recycling activity there. Elsewhere, economic resilience and a possible geopolitical premium should help contain volumes. This status quo is on somewhat thin ice, however, as many economies are set to slow further. In addition, the bar to recycle, given elevated geopolitical tensions, is likely higher even in the face of high prices.”

The nuanced understanding of these trends is crucial for navigating the future of gold investments and the broader economic implications.

IX. What does The X Project Guy have to say?

First, I want to thank all subscribers - mostly free and some paid - who have signed up thus far. Gaining additional subscribers every day at this point is a strong vote of confidence that continues to propel The X Project forward. Substack tells me that nearly two-thirds of you have a 4-star or 5-star activity rating, meaning you are consistently engaging with my content - which is great! Please hit the heart icon indicating you like the article. The more “likes” I get, the more Substack will promote my content within the Substack community. If you don’t like my content or have any suggestions, please email me at TheXprojectGuy@gmail.com.

Second, I am now going to share a part of what I wrote in Section X (which is behind the paywall and therefore only visible to paid subscribers) in my prior article #30 summarizing the book Money and Empire:

I agree with Luke Gromen that we are in the midst of the first Western sovereign debt bubble bursting in over a hundred years (see article #27 for more on this topic). Of course, the Fed and U.S. Treasury will do everything possible to save the U.S. Treasury market, which means they will ultimately sacrifice the U.S. Dollar by monetizing the debt and attempting to inflate the debt away. Will they succeed, or will the U.S. Dollar bubble they are inflating first burst?

I really don’t know the answer to that question. But it is because of this question and the binary outcome of either persistently higher inflation for a lot longer or worse, the end of the U.S. Dollar and all other fiat currencies that I currently hold 2.5% of my net worth in physical gold in my possession and why I am continuing to accumulate gold and aiming for at least 5% and hopefully as much as 10% within a year. This binary outcome is the biggest risk to everything I have accumulated in my life, and owning gold is my highest conviction investment thesis. More speculatively, I also have about 0.5% of my net worth invested in gold and silver mining companies - with half in blue chip miners and half in junior miners. I will be adding to those positions and looking to bring that allocation up to at least 1% and hopefully 2.5% of my net worth. If we get a recession and a sharp pullback in the equity market, then it is likely both gold and miners will go down as well. And that is why I also have a large cash and short-term U.S. Treasury bill position so I can take advantage of that opportunity should it come to pass.

In the next section, I am going to share how and where I buy my gold coins and bars. However, The X Project now requires you to be a paid subscriber to view the final section. In a few articles, the paywall will move up within the article so that only paid subscribers will see the last two sections, or rather, free subscribers will only see the first eight sections. I will be moving the paywall up every few weeks, so ultimately, free subscribers will only see the first four or five sections of each article. Please consider a paid subscription.

All paid subscriptions come with a free 14-day trial, and you can cancel at any time. Every month, for the cost of two cups of coffee, The X Project will deliver two articles per week ($1.15 per article), helping you know in 1-2 hours of your time per month what you need to know about our changing world at the interseXion of commodities, demographics, economics, energy, geopolitics, government debt & deficits, interest rates, markets, and money.

You can also earn free paid subscription months by referring your friends. If your referrals sign up for a FREE subscription, you get one month of free paid subscription for one referral, six months of free paid subscription for three referrals, and twelve months of free paid subscription for five referrals. Please refer your friends!

X. Why should you care?

First, thank you for your paid subscription. Your support is everything to The X Project and is greatly appreciated. If you agree, please do me the favor of posting positive comments about my articles - assuming you have positive things to say - especially about the final section (soon to be more sections) that only you get to see.

Second, nothing that The X Project writes and says should be considered investment advice or recommendations to buy or sell any securities or investment products. Everything written and said is for informational purposes only, and you should do your own research and due diligence. You should discuss with an investment advisor before making any investments or changes to your investments based on any information provided by The X Project.

The X Project expects a lot of volatility in various markets as we head toward increasingly frequent and intense crises and as our policymakers do everything possible to keep the system functioning, serving the status quo and responding to the crises as they erupt. There will be tremendous opportunities to capitalize on the volatility if you can anticipate certain market reactions and be positioned accordingly.

This final section will be reserved for discussing the investment theses to which The X Project subscribes, which are as follows:

Overweight cash and short-term US T-bills for optionality, given expected volatility related to the remaining list below.

Bullish gold and gold miner equities

Bullish Bitcoin

Bullish oil and oil-related equities

Bullish natural gas and related equities

Bullish uranium and related equities

Bullish industrial commodities and related equities

Bullish agricultural commodities and related equities

Bullish industrial and especially electrical infrastructure equities

Bearish long-dated US and other Western sovereign bonds

These are long-term investments with a 5-10 year time horizon. Many, if not most, of these bullish ideas have a short-term bearish outlook. The X Project sees the overall stock market has relatively little short-term upside potential at current over-valued levels after the rally in the fourth quarter of last year and recent new highs this year. In fact, The X Project sees much larger, short-term downside risk in the stock market at the moment, with the lagged effects of the Fed’s interest rate hikes finally starting to bite and the U.S. and global economies potentially heading for a recession in 2024.

The X Project intends to discuss one or more of these investment theses in the final section of each article; the following section in bold is new for this article.

How does The X Project invest in gold coins and bars (a.k.a. bullion)? In several ways… first, a quarter of the bullion I own is in the form of American Gold Eagle coins that I bought from a local coin shop, an “authorized purchaser” from the U.S. Mint. The coins are “circulating coins” but are in pristine condition with no visible signs of any wear and tear. You can see the U.S. Mint’s definitions here for proof, uncirculated, and circulating coins. You can buy directly from the U.S. Mint, but they usually are unavailable, and the premium is ~40% above the spot price of gold. The disadvantage of buying from a local dealer is that they also do not always have available inventory, so I have learned to call first. One of the advantages of buying locally is that I pay cash; therefore, there is no record of my purchase. This is important because the U.S. has outlawed the private ownership of gold, and it may do so again in an attempt to save and preserve the currency. I have paid dealer premiums of between 7% and 11.5% locally.

I have also bought American Eagle coins and 1 oz—bars from online dealers such as www.nationwidecoins.com and www.goldsilver.com. The dealer premium is currently 8.5% at the latter. They often have promotions for first-time customers, offering a single 1 oz. American Gold Eagle with no premium or free 1 oz. silver eagle coins with your purchase that I have taken advantage of. The first time buying online was a little scary, but they are reputable firms, and I received what I purchased via insured FedEx shipments.

Lastly, I also invest in gold via my brokerage account by buying the VanEck Gold ETF with the ticker OUNZ. I chose this ETF because it allows investors to redeem their shares for physical gold. While I have not yet done this, I intend to do so within the year. One advantage is that there is no taxable event when you take possession of your physical gold. The reason why I do not want to continue holding my gold ETF shares and instead take physical possession is in the event of a financial or currency crisis, there is no guarantee I will realize the entirety of the gold price appreciation.