This Time is Different: Eight Centuries of Financial Folly

A summary of the book written by Carmen Reinhart and Ken Rogoff (2009) = Article #5

I. Why this book, and what’s it about?

This Time is Different: Eight Centuries of Financial Folly is a comprehensive analysis of financial crises over 800 years. The overarching conclusion is that financial crises are not unique or new phenomena but rather a part of a historical pattern characterized by excessive optimism, risky financial behavior, and subsequent painful corrections. The book serves as a reminder that, in finance, history often repeats itself, and the phrase "this time is different" is usually a sign of impending trouble.

II. Who are the authors?

According to Wikipedia, Carmen Reinhart (née Castellanos, born October 7, 1955) is a Cuban-American economist and the Minos A. Zombanakis Professor of the International Financial System at Harvard Kennedy School. Previously, she was the Dennis Weatherstone Senior Fellow at the Peterson Institute for International Economics and Professor of Economics and Director of the Center for International Economics at the University of Maryland. She is a research associate at the National Bureau of Economic Research, a Research Fellow at the Centre for Economic Policy Research, Founding Contributor of VoxEU, and a member of Council on Foreign Relations. She is also a member of American Economic Association, Latin American and Caribbean Economic Association, and the Association for the Study of the Cuban Economy. On May 20, 2020, Reinhart was appointed World Bank Chief Economist, starting on June 15, 2020.

Also according to Wikipedia, Kenneth S. Rogoff (born March 22, 1953) is an American economist and chess Grandmaster. Rogoff received a BA and MA from Yale University summa cum laude in 1975, and a PhD in Economics from the Massachusetts Institute of Technology in 1980. Early in his career, Rogoff served as an economist at the International Monetary Fund (IMF), and at the Board of Governors of the Federal Reserve System. Rogoff was the Charles and Marie Robertson Professor of International Affairs at Princeton University., and he is now the Thomas D. Cabot Professor of Public Policy and professor of economics at Harvard University.

III. How popular is the book?

Here are the book’s rankings on Amazon:

IV. What is one of the top takeaways from the book?

Given the author’s impressive resumes, there was an embarrassing controversy in 2013 when Reinhart and Rogoff’s widely cited study "Growth in a Time of Debt" (whose data and conclusions were mentioned in this book) was shown to contain computation errors that critics claim undermine its central thesis that too much debt causes low growth. One of the main takeaways from the book is that a 90% government debt-to-GDP ratio is a specific tipping point for growth outcomes turning decidedly lower, if not negative. The authors have since disavowed the specific 90% ratio as a tipping point while maintaining their fundamental conclusions were accurate after correcting for the miscalculations.

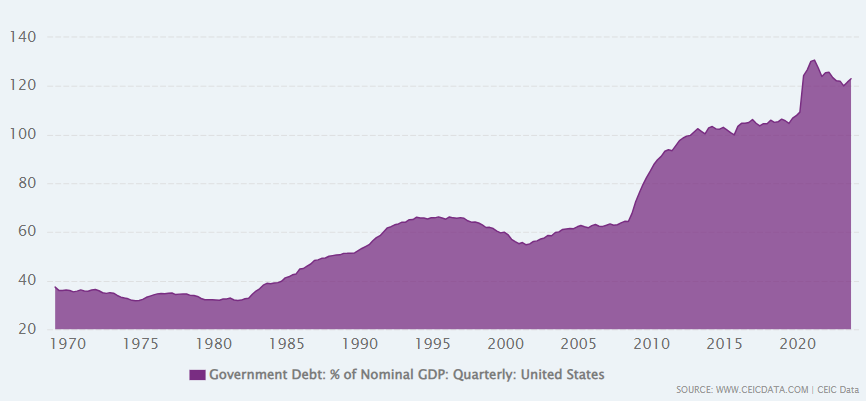

(Side note: The current US government debt-to-GDP ratio is 123%, and here is a historical chart of this ratio.

United States’ Government Debt: % of GDP from March 1969 to September 2023

I will soon publish an article on “Fiscal Dominance,” which is a term that I only recently learned and a problematic outcome of too much debt coupled with budget deficits that are too high).

V. What is another top takeaway from the book?

This Time is Different underscores a recurring pattern where periods of financial prosperity lead to overconfidence and excessive borrowing, setting the stage for a crisis. This cycle of hubris and complacency has repeated across different eras and economies. Moreover, the authors highlight that sovereign debt defaults are common throughout history. They debunk the myth that developed countries are immune to defaults, illustrating that no nation is impervious to financial folly.

VI. What is the third top takeaway from the book?

The authors explore the frequent occurrence of banking crises and their severe consequences on economies. These crises often result in deep recessions, high unemployment, and significant fiscal distress. They examine how financial crises are not isolated events but have international ramifications. They discuss how crises in one country can quickly spread to others through globalization and interconnected financial systems.

VII. What is the fourth top takeaway from the book?

The book challenges the notion of perpetual economic growth, demonstrating how over-optimism during boom times leads to excessive risk-taking and eventually to crises. Couple with these illusions of endless prosperity and growth is historical amnesia. A key theme is the tendency of societies and policymakers to forget past lessons, leading to repeating similar mistakes. The authors argue that the lack of historical perspective contributes to the recurrence of financial crises.

VIII. What is the fifth top takeaway from the book?

The book delves into various policy responses to financial crises, assessing their effectiveness and drawbacks. It suggests that there is no one-size-fits-all solution and that policy responses must be tailored to specific circumstances. Returning to the controversy surrounding this book, many people concluded that if too much debt is bad, then reducing government debt, no matter what it takes, must be good. Another way to say reducing government debt no matter what is “austerity.” Remember that this book came out in September 2009, just after markets bottomed in the depths of the Great Financial Crisis. Several countries received bailout loans from the International Monetary Fund (IMF) that were tied to conditions known as austerity measures, and critics argued these measures exacerbated the economic downturns, increased unemployment, and led to social unrest. The authors have stated that their main finding of a negative association between debt and economic growth is not a unilateral call for austerity.

IX. What does The X Project Guy have to say?

I read this book about a year before the controversy erupted with the discovery of the computational error in the author’s work. The acknowledgment of the error did not change the overarching conclusion of the book or Takeaways 2, 3, and 4 above for me.

I received my bachelor’s degree in Economics in the early 1990s. I enjoyed the field of study so much that I was admitted into the International Honor Society in Economics for high academic achievement. Despite my rigorous and enthusiastic deep embrace of the subject, one question that bothered me from the beginning was never satisfactorily answered. How can our government debt (and deficits) continue to grow yearly without consequence?

Look at the chart above again. In the early 1990s, I was alarmed. But soon after, in the mid-1990s, our debt relative to GDP started coming down, and we even had government surpluses from 1998-2001. And I forgot about my angst over this question.

But then 9/11 happened, and our response was the War on Terror, which was financed with government debt. And the debt-to-GDP ratio started rising again, along with my angst.

And then the Great Financial Crisis happened, and as you can see in the chart above, the debt-to-GDP nearly doubled - as did my angst!

And then I read this book…

X. Why Should You Care?

… which answered my big unanswered question. The answer is that government debt (and deficits) can NOT continue to grow yearly without consequence.

Ok, so what are the consequences? When will they happen? How will we know when they start happening? Who will those consequences affect? How will they affect all of us - me, my family, my community, my employer, my country, the world? What should we do? Should we be concerned?

The X Project exists to answer all these questions and more. And, YES - YOU SHOULD BE CONCERNED.

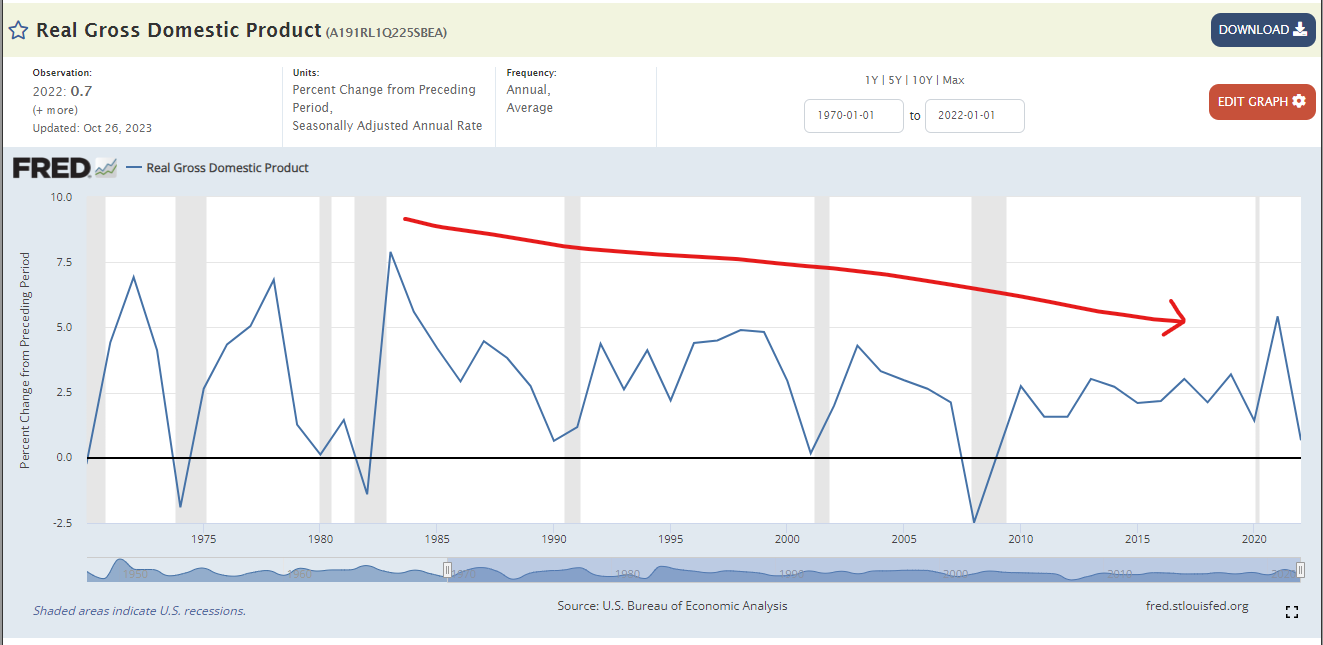

Returning to the book being summarized here and takeaway #5 above, let’s look at one of the first observable consequences. As government debt rises…

Economic growth slows.

This debt issue is a slow-moving train wreck. However, the distance to the wreck is fast approaching, and more consequences are becoming evident. The X Project will work through those consequences and the questions. As was mentioned in takeaway #1 above, The X Project will break from summarizing the recently read influential books, and an article will be published soon on “Fiscal Dominance,” which is the primary consequence of unsustainable government debt.

Until then, The X Project needs your help to continue its mission. What can you do?

Please click on the heart icon at the bottom of this article, indicating you like this (and previous) article(s).

If you still need to do so, please subscribe.

Please consider a paid subscription. Until the end of the year, all paid subscriptions come with a free 60-day trial, and you can cancel any time. For the cost of 2 cups of coffee and 1-2 hours of your time per month, The X Project will deliver ten articles per month, helping you know what you need to know about our changing world at the intersection of commodities, debt, deficits, demographics, economics, energy, geopolitics, interest rates, markets, and money.

If you see value in the articles published so far and you see value in the mission of The X Project, please be generous and aggressive in referring friends. Click the link to see the rewards as well as the link to use for making referrals

Please let me know how The X Project can better serve you. Please send me recommendations, suggestions, critiques, or feedback at theXprojectGuy@gmail.com.

It would appear that the political corporate tax reduction strategies from Reagan forward aren’t working so well at the sovereign level.