"What is the Cost of Being Early?"

A Summary of GoRozen's Latest Quarterly Market Commentary - Article #83

In this 16-minute article, The X Project will answer these questions:

I. Why this article now, and what is “The Cost of Being Early?”

II. - X. What are the conclusions and main takeaways from each of the following sections GoRozen’s article?

Gold Stocks Have Never Been Cheaper

Trump’s Three Arrows

2024 Q2 Natural Resource Market Commentary

US Natural Gas Production is Plummeting

Uranium: A Drama in the Making

The Oil Shales Continue to Decline

Copper’s Crossroads: Navigating the Squeeze, Supply Surge, and China’s Demand Dilemma

A Precarious Grain Market

What Happens to Gold if Interest Rates Fall?

XI. What does The X Project Guy have to say?

XII. Why should you care?

Reminder for readers and listeners: nothing The X Project writes or says should be considered investment advice or recommendations to buy or sell securities or investment products. Everything written and said is for informational purposes only, and you should do your own research and due diligence. It would be best to discuss with an investment advisor before making any investments or changes to your investments based on any information provided by The X Project.

I. Why this article now, and what is the cost of being early?

It is again that time to review the latest GoRozen report, “What is the Cost of Being Early?” which is also the title of the first section of their 34-page commentary.

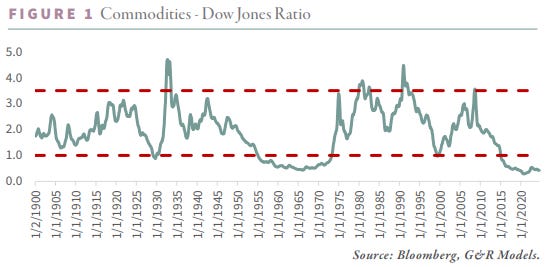

The 2024 Q2 Goehring & Rozencwajg Natural Resource Market Commentary opens with an analysis of the cyclical nature of commodities in relation to equities. The authors present a historical perspective on the valuation cycles between commodities and stocks, emphasizing that commodities tend to become undervalued during equity market booms. These periods of undervaluation are often followed by significant outperformance of commodities relative to equities. The commentary notes that commodities reached extreme undervaluation points in 1929, 1969, 1999, and 2020, followed by a robust commodity market rally. The authors highlight that the current environment shares similarities with previous cycles, particularly the 1950s and 1960s, when commodities remained undervalued for an extended period before experiencing a significant rally.

The second part of the commentary delves into the impact of macroeconomic forces on these cycles. It identifies that periods of extreme commodity undervaluation are often associated with loose monetary policies, where excess liquidity depresses commodity prices while pushing up equity values. This imbalance leads to underinvestment in commodity production, eventually creating supply shortages and triggering commodity price surges. Furthermore, the commentary discusses how shifts in the global monetary system, such as the end of the gold standard in 1930 and the Bretton Woods system in 1971, have historically marked turning points in commodity cycles. Today, with central banks engaging in unprecedented money printing and challenges to the U.S. dollar's dominance, the authors predict a prolonged commodity bull market potentially lasting into the 2030s. However, they caution that this cycle may resemble the gradual recovery seen in the mid-20th century rather than the sharp rebounds of previous cycles.

Now, to answer the question in the title of their article:

“We believe today’s present cycle mirrors that of 1954-1980 in many respects. Commodities first became radically undervalued in 1954 when the ratio broke the 1:1 mark, only to take years to bottom in 1966 and several more before beginning their outperformance in 1970. Similarly, in this cycle, the ratio first broke 1:1 in 2015 and bottomed six years later at 0.3 in 2020. Now, nearly four years past that bottom—akin to where we were in 1970—we believe commodities are poised to begin radically outperforming once more.

In both periods, the fear of being early was misplaced—there was no cost associated with being early. And, as we just discussed, we believe the present cycle is shaping up to be no different.

And so, we return to the perennial question: what is the cost of being early? If history is any guide, the cost is, at worst, negligible, and at best, a gateway to outsized returns. The real peril lies in hesitating--waiting for the perfect moment that may never come.”

II. What are the conclusions and main takeaways from the sections “Gold Stocks Have Never Been Cheaper”?

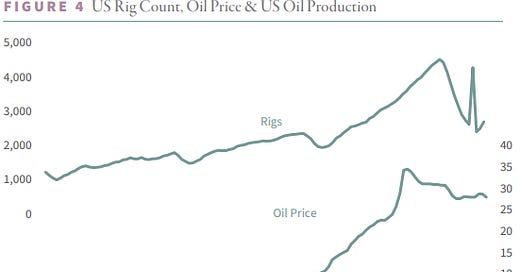

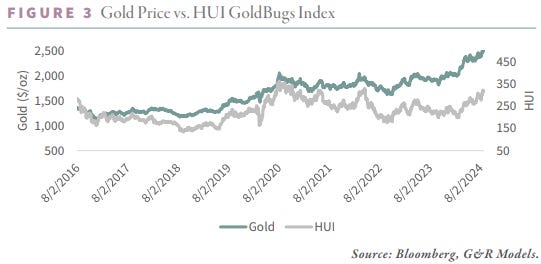

In this section, Goehring & Rozencwajg highlight a paradox in the gold market. Despite gold reaching all-time highs above $2,500 per ounce, gold stocks remain historically undervalued. The authors attribute this disconnect to investor behavior driven by rising interest rates. Since 2020, real U.S. interest rates have climbed, prompting Western investors to sell both gold and gold equities, leading to significant outflows from gold stock ETFs. However, central banks, particularly outside the West, have countered this selling pressure by aggressively purchasing gold, which has helped sustain the rise in gold prices. Despite the strength in gold prices, gold equities have lagged, and their valuations remain near historic lows.

The authors view this disparity between gold prices and gold-stock valuations as an extraordinary investment opportunity. They note that rising production costs have not eroded profit margins as much as some investors fear, and major gold producers are now in a strong financial position. Historical data reveals that gold stocks have been undervalued in past cycles, only to rally significantly when market conditions shifted. Goehring & Rozencwajg argue that gold stocks are currently trading at a discount relative to their net asset value and future earnings potential, making them a compelling investment, particularly for contrarian investors looking to capitalize on the undervaluation before broader market interest returns.

III. What are the conclusions and main takeaways from “Trump’s Three Arrows”?

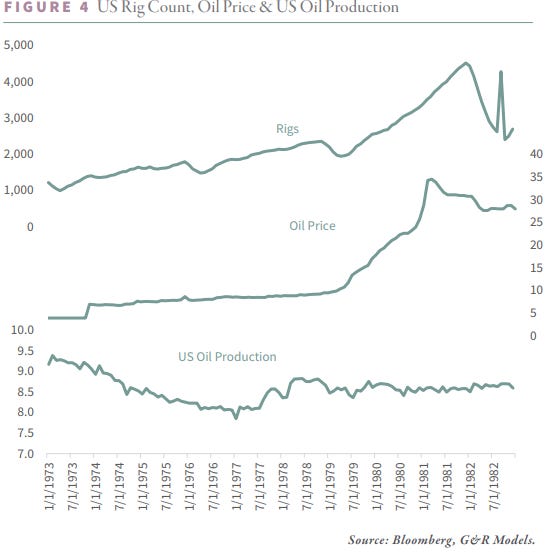

In this section (referring to US rig count, oil price, and US oil production), Goehring & Rozencwajg examine former President Donald Trump's pledge to dramatically increase U.S. oil and natural gas production if re-elected in 2024. Trump’s plan, centered around expanding drilling to reduce energy costs, echoes President Nixon’s 1970s push for energy independence. However, the authors argue that geological constraints, much like those faced during Nixon's era, will limit the effectiveness of such an approach. They suggest that U.S. shale oil and gas production has already peaked and is on the decline, a trend driven by natural depletion rather than a lack of investment or drilling activity. This mirrors the 1970s energy crisis, where despite a massive drilling surge, U.S. oil production continued to fall due to the country having already extracted much of its easily accessible resources.

The authors caution that while Trump’s rhetoric may appeal to voters and temporarily influence markets, the reality of diminishing shale reserves makes it unlikely that the U.S. can achieve sustained growth in oil and gas production through drilling alone. They note that similar promises in the past failed to deliver lasting results due to the geological limitations of resource extraction. As a result, Goehring & Rozencwajg conclude that the U.S. is likely to face ongoing production declines, particularly in shale oil, despite any policy efforts to reverse this trend. These structural challenges will have significant implications for global energy markets, as the U.S. has been a key driver of non-OPEC oil supply growth for the past decade.

IV. What about their “2024 Q2 Natural Resource Market Commentary”?

This section is a summary of the following markets performance in the second quarter 2024:

Copper: The 2024 Q2 saw a significant short squeeze in copper markets, pushing prices to an all-time high of $5.20 per pound. However, the spike was short-lived, with prices retreating by the end of the quarter. Despite strong demand, rising mine supply has led to a more cautious long-term outlook on copper.

Natural Gas: U.S. natural gas prices rebounded after a mild winter, reaching a low of $1.64 per mmcf before climbing nearly 50% by quarter's end. The market remains optimistic about gas prices as North American supply tightens and demand remains robust, particularly due to increasing export capacities.

Oil: Oil prices were volatile in Q2, fluctuating between $73 and $87 per barrel but ending near their starting point at $82. The outlook remains bullish, particularly with U.S. shale production beginning to decline, which could further tighten supply in global markets.

Coal: Global coal demand remained strong, particularly in Asia, despite significant investments in renewable energy. Prices were mixed, with some U.S. coal basins seeing slight price increases, while international markets like Australia and South Africa experienced declines.

Uranium: Uranium prices remained relatively stable during Q2, peaking at $93 per pound before pulling back slightly. The market is poised for potential bullish momentum, particularly with expected production cuts from Kazatomprom, the world’s largest uranium producer.

Grains: Grain prices continued to retreat, with corn, soybeans, and wheat all seeing declines. This trend reflects a bearish sentiment in the market, driven by higher-than-expected supply and weak demand, despite ongoing uncertainties in global agricultural conditions.

Precious Metals: Gold and silver prices surged during Q2, with gold rising nearly 6% and silver up 17%. Despite strong performance in the metals themselves, precious metal equities lagged behind, offering potential opportunities for contrarian investors.

The article goes into more detail on most of these markets in the following sections.

V. Is “US Natural Gas Production is Plummeting”?

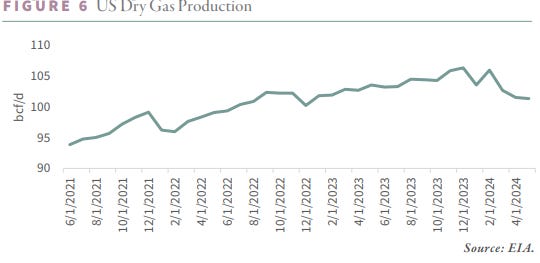

Yes! In this section, Goehring & Rozencwajg analyze a significant decline in U.S. natural gas output during the first half of 2024. U.S. dry gas supply dropped by 5 billion cubic feet per day (bcf/d) between December 2023 and May 2024, marking the sharpest decline since the start of the shale revolution. This reduction stems from both shale and conventional gas production falling, with notable decreases in major shale basins like the Marcellus and Haynesville. Even as prices remain low, the decline is attributed to natural depletion of prime drilling sites rather than just reduced drilling activity.

The authors argue that the U.S. shale basins are running out of high-quality drilling locations, which limits future production growth. While low prices have led to fewer rigs in operation, the geological limits of shale basins are driving the decline. This trend mirrors past downturns in other mature shale fields, where production never fully rebounded even as prices rose. Goehring & Rozencwajg conclude that U.S. natural gas production will continue to face challenges, which could lead to tighter inventories and higher prices, especially as new liquefied natural gas (LNG) export capacities come online in the coming years.

VI. What does the “Uranium: A Drama in the Making” section tell us?

In this section, Goehring & Rozencwajg discuss the potential for significant upheaval in the uranium market, driven by both supply constraints and increasing demand for nuclear energy. The authors highlight that Kazatomprom, the world’s largest uranium producer, is expected to reduce its 2025 production guidance due to ongoing supply challenges. This anticipated cut follows a series of production revisions, attributed to sulfuric acid shortages and construction delays, which have already lowered the company’s 2024 output. As the supply of uranium tightens, the market is poised for potential price surges, particularly as nuclear energy gains traction globally as a reliable and low-carbon power source.

The section also explores the growing interest in nuclear power, especially in countries like Australia, which is now reconsidering its long-standing opposition to nuclear energy. The authors suggest that this shift in sentiment, combined with increased interest from investors like Bill Gates, signals a broader acceptance of nuclear power as part of the energy transition. With demand for uranium rising and supply struggling to keep pace, Goehring & Rozencwajg predict that the uranium market is on the verge of a significant rally, positioning it as a potentially lucrative investment opportunity for contrarian investors.

VII. How about “The Oil Shales Continue to Decline” section?

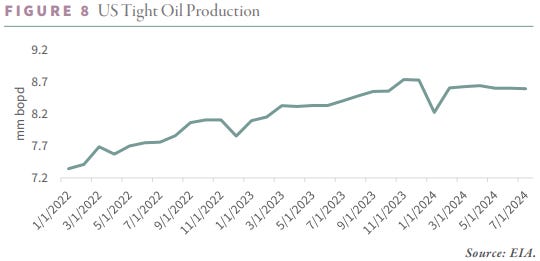

Goehring & Rozencwajg discuss the ongoing reduction in U.S. shale oil production, emphasizing that the peak of the shale revolution has passed. The authors argue that while shale oil production has been a major driver of non-OPEC oil supply growth for over a decade, geological constraints are now coming into play. As high-quality drilling sites are exhausted, the productivity of new wells is declining. This trend is evident in major shale basins like the Permian, where output is beginning to plateau or even fall. Despite attempts to maintain production levels through increased drilling, the natural depletion of shale reserves makes sustained growth increasingly difficult.

The commentary also highlights the broader implications of this decline for global energy markets. With U.S. shale oil production no longer serving as a reliable source of supply growth, the world may face tighter oil markets in the future. This shift could lead to higher oil prices as the balance between supply and demand becomes more strained. Goehring & Rozencwajg suggest that this decline in U.S. shale production will have long-term consequences for global energy security, making it more difficult for countries to rely on U.S. oil to offset disruptions in other parts of the world.

VIII. What are they telling us “Copper’s Crossroads: Navigating the Squeeze, Supply Surge, and China’s Demand Dilemma”?

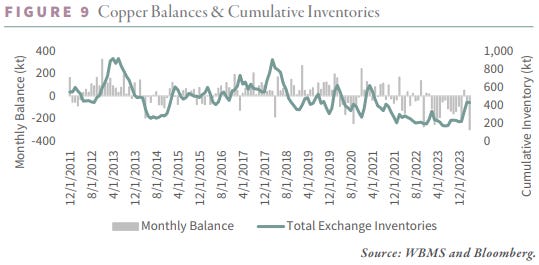

Here, the authors explore the complex dynamics influencing the copper market. The first major factor is a short squeeze that pushed copper prices to new highs due to low inventories and speculative positions betting on price drops. This led to a temporary spike in copper prices as short sellers rushed to cover their positions. However, this squeeze was short-lived, and prices retreated by the end of the quarter. While copper demand remains strong, especially with global infrastructure development and green energy initiatives, supply-side factors are causing tension in the market.

The second key factor is China’s demand dilemma. China, the world’s largest consumer of copper, has been grappling with economic challenges that could affect its demand for the metal. Despite these headwinds, copper supply has started to increase, leading to concerns about a potential oversupply in the near term. While the long-term outlook for copper remains positive, driven by its essential role in electrification and renewable energy technologies, Goehring & Rozencwajg advise caution, as short-term price volatility may persist due to these conflicting supply and demand forces.

IX. What are the conclusions and main takeaways from “A Precarious Grain Market”?

In this section, Goehring & Rozencwajg examine the ongoing challenges in global grain markets, which are marked by falling prices and bearish sentiment among investors. Corn, soybean, and wheat prices have all experienced significant declines, with corn falling by 7%, soybeans by 3%, and wheat by 1% during the second quarter of 2024. This downtrend is largely driven by higher-than-expected supplies, weak demand, and improved weather conditions that have bolstered crop yields. Despite these factors, commercial traders, who represent the "smart money" in the market, have taken bullish positions, suggesting that grain prices could rebound in the future.

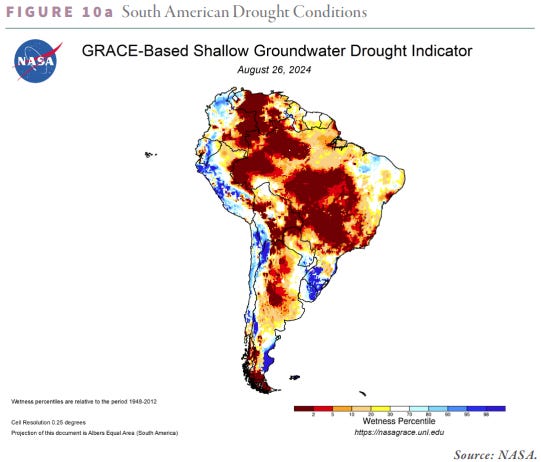

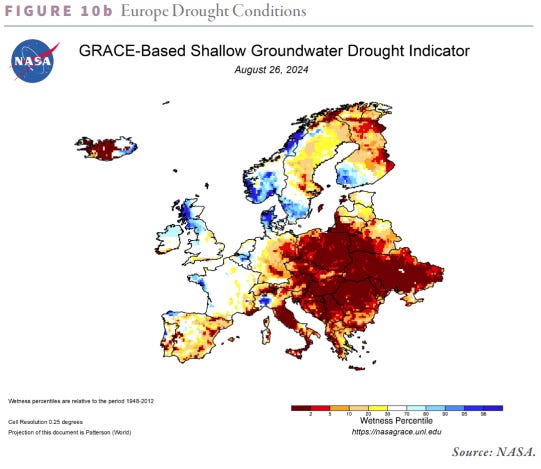

The commentary also highlights the long-term risks posed by changing weather patterns, which could impact global crop production. The authors suggest that the current bearish sentiment may be overlooking potential disruptions linked to sunspot cycles and the recurrence of the Gleissberg cycle, a phenomenon that some scientists believe contributed to the Dust Bowl in the 1930s. Goehring & Rozencwajg emphasize that while short-term fundamentals are driving prices lower, the grain market remains vulnerable to sudden shifts in weather conditions that could lead to significant price increases in the future.

In the next Section, I will tell you about GoRozen’s thoughts on gold and interest rates. Then, in Section XI, what I think, and in Section XII, why should you care and, more importantly, what more can you do about it? However, I have hit a new paid subscriber threshold, so you must now be a paid subscriber to view the last three sections. The X Project’s articles always have ten sections (sometimes more). Soon, after a few more articles, the paywall will move up again within the article so that only paid subscribers will see the last four sections, or rather, free subscribers will only see the first six sections. I will be moving the paywall up every few weeks, so ultimately, free subscribers will only see the first four or five sections of each article. Please consider a paid subscription.

Also, podcasts of the full articles narrated are available only to paid subscribers.

All paid subscriptions come with a free 14-day trial; you can cancel anytime. Every month, for just the cost of two cups of coffee, The X Project will deliver 6-8 articles (weekly on Sundays and every other Wednesday), helping you know in a couple of hours of your time per month what you need to know about our changing world at the interseXion of commodities, demographics, economics, energy, geopolitics, government debt & deficits, interest rates, markets, and money.

You can also earn free paid subscription months by referring your friends. If your referrals sign up for a FREE subscription, you get one month of free paid subscription for one referral, six months of free paid subscription for three referrals, and twelve months of free paid subscription for five referrals. Please refer your friends!