In this 14-minute article, The X Project will answer these questions:

I. Why this article now?

II. Who is Danielle DiMartino Booth?

III. Where is this perspective coming from?

IV. What do underemployment, part-time, and permanent job loss data show?

V. What is happening with healthcare and education jobs?

VI. What are retail and restaurant performance and bankruptcies telling us?

VII. What do the Sahm and McKelvey Rules tell us?

VIII. What about credit card usage and charge-offs?

IX. What does The X Project Guy have to say?

X. Why should you care?

Reminder for readers and listeners: nothing The X Project writes or says should be considered investment advice or recommendations to buy or sell securities or investment products. Everything written and said is for informational purposes only, and you should do your own research and due diligence. It would be best to discuss with an investment advisor before making any investments or changes to your investments based on any information provided by The X Project.

I. Why this article now?

In late December 2023, The X Project published “Santa Felix Came to Town!!!” covering legendary investor and macro strategist Felix Zulauf’s 2024 outlook. Regarding the economy, the article stated:

“For the US specifically, he predicts a mild recession later in the year driven by sectors sensitive to interest rate changes, such as housing and construction, and by rising credit card delinquencies, which he believes will eventually lead to a slowdown in consumer spending.”

At the time, the mild-recession or “soft-landing” outlook seemed to be the consensus view.

Being a good analyst who looks at all perspectives and also believes in Bob Farrell’s rule #9 ( When all the experts and forecasts agree — something else is going to happen), The X Project then published “Don't Miss The Forest For The Trees,” in which Luke Gromen’s call for no recession in 2024 was covered. A week later, “Forecasting the Economic Storm - Dr. Lacy Hunt's Dire Predictions for a Hard Landing in 2024 and Beyond” was published.

By mid-April, a “no-landing” had become the consensus view, and The X Project published “Is a Recession Coming in 2024? David Rosenberg is One of the Last Analysts Still Calling for One.” To be fair, Danielle DiMartino Booth was also still calling for a recession back then. But in recent weeks, she has boldly made the claim that the recession has already started. To my knowledge, she is alone with that call. But, she correctly has made a similarly bold call before and so it is worth paying attention to.

Before moving on, if you missed any of the highlighted and linked articles above, you should go back and read them as they all have important perspectives to consider that are still relevant today,

II. Who is Danielle DiMartino Booth?

She was first introduced to The X Project’s readers in the article “FED UP: An Insider's Take on Why the Federal Reserve is Bad for America - A summary of the book written by Danielle DiMartino Booth (2017).” In addition to being the author to “FED UP,”

is the author of a Substack called The Daily Feather. Back in 2006, she wrote a daily financial column at the Dallas Morning News that gained an international following and Warren Buffet's recognition. In her column, she posited that the subprime housing bubble would culminate in a financial crisis catalyzed by a global systemic risk event.You can find a more extensive bio in the link to the article above covering her excellent book.

III. Where is this perspective coming from?

All of the charts below, except the last two in Section VI and the first one in Section VIII, came from the free preview to her Substack, The Daily Feather. Her views are summarized from the following YouTube appearances:

Danielle DiMartino Booth Latest - WE ARE IN RECESSION with Bloor Street Capital

April 29, 2024 with 42,233 view

The Recession Is Already Here, Argues Danielle DiMartino Booth

May 1, 2024 with 41,413 views

Real Conversations | Danielle DiMartino Booth 1-on-1 with Keith McCullough at Hedgeye Live

May 6, 2024 with 23,242 views

Danielle DiMartino Booth: Why the U.S. is Already in a Recession — Schwab Network

May 9, 2024 with 22,307 views

Did the Federal Reserve Just Admit the Economy is Failing? Danielle DiMartino Booth Explains

May 9, 2024 with 61,870 views

Unemployment Reached 'Critical Mass', Not Since 2008 Has This Happened | Danielle DiMartino Booth

May 22, 2024 with 56,087 views

IV. What do underemployment, part-time, and permanent job loss data show?

The rise in underemployment and the increase in part-time work for economic reasons reflect a significant weakening of the labor market. Many individuals cannot secure full-time employment and are forced to take part-time jobs at lower wages and with fewer benefits. This trend reduces households' income levels and undermines consumer confidence and spending power. The underemployment rate, which includes those working part-time for economic reasons and those marginally attached to the labor force, provides a more comprehensive view of financial distress. This measure shows that a significant portion of the population struggles to find adequate employment, indicating that the economy is not utilizing its labor resources effectively. The high underemployment rate suggests that the economic recovery is uneven and fragile, pointing towards a potential recession.

The rise in permanent job losses, where individuals have been out of the workforce and looking for employment for six months or more, is a significant indicator of economic distress. This trend suggests that the labor market struggles to absorb displaced workers, leading to long-term unemployment. The persistence of high levels of permanent job losses indicates structural issues within the economy, such as mismatches between the skills of job seekers and the requirements of available jobs. This situation not only undermines consumer confidence and spending but also reduces the overall productive capacity of the economy. The high levels of permanent job losses suggest the economy is not recovering as quickly or as robustly as needed, pointing towards a deepening recession.

V. What is happening with healthcare and education jobs?

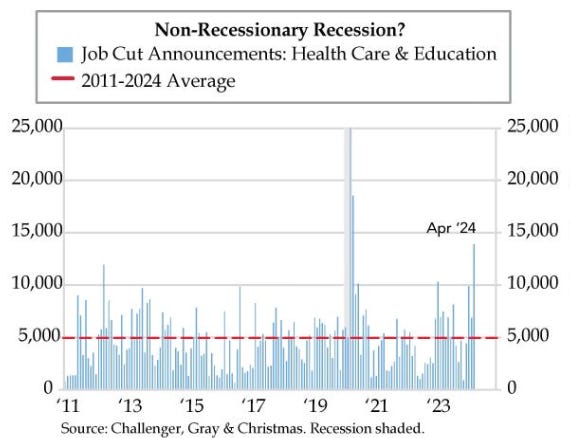

The job cuts in sectors traditionally considered recession-proof, such as healthcare and education, are particularly concerning. These sectors are typically stable because they provide essential services that are always in demand, regardless of economic conditions. However, Booth notes that there has been a spike in job cut announcements in these sectors, indicating that even the most resilient parts of the economy are under strain. This unusual occurrence suggests that the economic challenges are widespread and affecting all sectors. The reduction in jobs within these essential services highlights the severity of the current economic downturn and indicates that the recessionary pressures are more profound and more pervasive than initially thought.

VI. What are retail and restaurant performance and bankruptcies telling us?

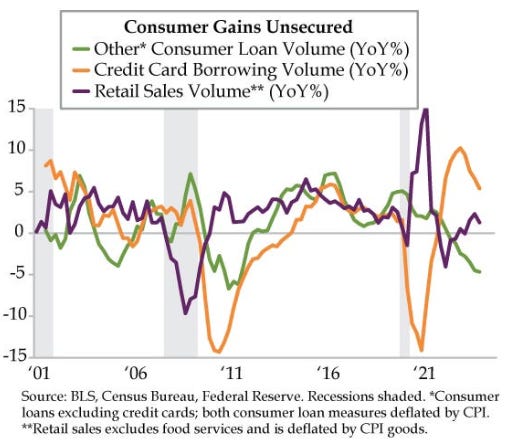

As the charts above indicate, real consumer spending at restaurants and hotels turned negative again in the first quarter for the third time in the last nine quarters. Meanwhile, credit card borrowing and other consumer loan volume continued to slow, and retail sales volume slowed, reversing recent growth.

Furthermore, the widespread closure of retail stores and restaurants is a clear sign of economic trouble. Booth points out that high-profile closures, such as those announced by Red Lobster, Rue 21, The Body Shop, Family Dollar, and others, indicate broader issues within consumer spending. These closures reflect declining consumer demand and financial strain on businesses, often preceding broader economic downturns. The retail and restaurant sectors are particularly sensitive to changes in consumer spending, and their struggles suggest that consumers are tightening their belts and reducing discretionary expenditures. This spending reduction affects the businesses directly and leads to job losses and reduced economic activity in related sectors. Closing these establishments strongly indicates a weakening economy and points towards a recession.

The surge in bankruptcy filings from the historically low levels in 2021 and 2022 indicates increasing financial distress. Booth explains that bankruptcy cycles are closely linked to broader economic downturns, leading to job losses and reduced economic activity. The rising number of bankruptcies indicates that many businesses cannot sustain operations under current economic conditions, further contributing to the recessionary environment. The increase in bankruptcies also reflects the broader financial struggles of companies, which are facing reduced revenue, higher costs, and declining consumer demand. This trend strongly indicates a weakening economy and points towards a prolonged recession.

VII. What do the Sahm and McKelvey Rules tell us?

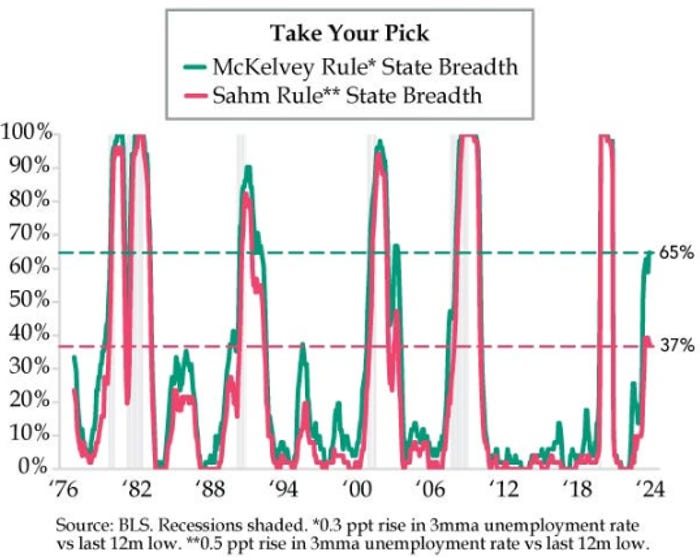

The Sahm Rule, named after economist Claudia Sahm, is a simple yet effective recession indicator. It identifies the onset of a recession by monitoring changes in the unemployment rate. Specifically, the Sahm Rule signals a recession when the three-month average of the national unemployment rate rises by 0.50 percentage points or more above its lowest point during the previous 12 months.

The McKelvey Rule, introduced by Ed McKelvey, the former chief economist at Goldman Sachs, is a recession indicator based on changes in the unemployment rate. According to this rule, if the unemployment rate rises by 0.35 percentage points or more from its lowest point over the previous three months and maintains that elevated level for at least three months, it indicates that the economy is likely in a recession.

As Booth’s chart above indicates, the Sahm Rule has been triggered in 37% of the states and the McKelvey Rule has been triggered in 65% of the states, and both rules’ state breadth is increasing suggesting they will be triggered on a national level soon.

The following section will examine credit card usage and charge-offs. In Section IX, I will tell you what I think. Then, in Section X, why should you care and, more importantly, what more can you do about it. However, I have just hit a new paid subscriber threshold, so you must now be a paid subscriber to view the last three sections. The X Project’s articles always have ten sections. Soon, after a few more articles, the paywall will move up again within the article so that only paid subscribers will see the last four sections, or rather, free subscribers will only see the first six sections. I will be moving the paywall up every few weeks, so ultimately, free subscribers will only see the first four or five sections of each article. Please consider a paid subscription.

Also, podcasts of the full articles narrated are available only to paid subscribers.

All paid subscriptions come with a free 14-day trial; you can cancel anytime. Every month, for just the cost of two cups of coffee, The X Project will deliver 6-8 articles (weekly on Sundays and every other Wednesday), helping you know in a couple of hours of your time per month what you need to know about our changing world at the interseXion of commodities, demographics, economics, energy, geopolitics, government debt & deficits, interest rates, markets, and money.

You can also earn free paid subscription months by referring your friends. If your referrals sign up for a FREE subscription, you get one month of free paid subscription for one referral, six months of free paid subscription for three referrals, and twelve months of free paid subscription for five referrals. Please refer your friends!