De-dollarization - Part 1

What's all this talk, what's it mean, and what's really going on? - Article #77

In this 14-minute article, The X Project will answer these questions:

I. Why this article now?

II. What is a global reserve currency, and the history of GRCs?

III. What is de-dollarization, and who is promoting it?

IV. What is BRICS?

V. What did the Bloomberg article say?

VI. How dominant is the U.S. Dollar today?

VII. What is the recent history of global foreign exchange reserves?

VIII. What about Gold’s role as a central bank reserve asset?

IX. What does The X Project Guy have to say?

X. Why should you care?

Reminder for readers and listeners: nothing The X Project writes or says should be considered investment advice or recommendations to buy or sell securities or investment products. Everything written and said is for informational purposes only, and you should do your own research and due diligence. It would be best to discuss with an investment advisor before making any investments or changes to your investments based on any information provided by The X Project.

I. Why this article now?

On July 18, Bloomberg published “Chinese Investors Dump Record Amount of US Stocks and Bonds.” That article highlighted China’s trend in reducing its holding of U.S. Dollars and dollar-denominated assets, and it prompted me to start writing this article, as I had not yet addressed the concept of de-dollarization or why our geopolitical rivals are pushing for it. As I started writing it, I realized I needed to establish some foundational concepts, so I wrote “Money and Currency - What are they, how are they created, and why does it matter?” instead. If you have not already done so, you should read “Money and Currency” and the other articles cited in it.

II. What is a global reserve currency, and the history of GRCs?

A global reserve currency (GRC) is a currency held in significant quantities by governments and institutions as part of their foreign exchange reserves. It is used for international transactions, investments, and debt obligations. Currently, the U.S. Dollar (USD) is the most widely held reserve currency, followed by the euro (EUR), Japanese yen (JPY), and British pound sterling (GBP). The Bretton Woods Agreement at the end of World War II established the USD as the primary currency of international trade, resulting in commodities like crude oil being priced in USD.

As the primary GRC, the USD is intricately and deeply intertwined with most of The X Project's topics: commodities, debts, deficits, economics, energy, geopolitics, interest rates, markets, and money—all but demographics. Over the past 574 years or so, there have been six significant world reserve currency periods: Portugal 1450-1530 (80 years), Spain 1530-1640 (110 years), Netherlands 1640-1720 (80 years), France 1720-1815 (95 years), Great Britain 1815-1920 (105 years), and the United States 1920-2024 (104 years). The USD is about to be the second longest-serving primary global reserve currency, surpassing Great Britain in a year or so. Assuming it continues past 2030, it may become the longest-serving primary GRC in over half a millennium. Many believe in the continuing supremacy of the United States and - or at least - the continuation of the USD’s role for many years to come into the foreseeable and distant future.

Many also disagree. Earlier this year, I published “Principles for Dealing with The Changing World Order: Why Nations Succeed and Fail - A summary of the book written by Ray Dalio.” One of the key takeaways from the book is the cyclical nature of empires:

“The concept of empire cycles also sheds light on the present global scenario. For instance, the rise of China, juxtaposed against the relative decline of the long-standing power of the U.S., can be contextualized within this cyclical framework. Dalio's analysis suggests that these shifts are not aberrations but part of a predictable pattern of global power realignment.”

The relative decline of the United States’ global power and influence relative to China’s ascendency is one of the many facets that have stoked talk of de-dollarization.

III. What is de-dollarization, and who is promoting it?

What is it? De-dollarization refers to reducing reliance on the U.S. dollar as a reserve currency, medium of exchange, or unit of account. This movement often occurs in countries aiming to decrease the USD's influence over their economies. It seeks to undermine the USD’s dominance in cross-border trade and investments. This process can involve adopting alternative reserve currencies or promoting a country’s currency for international business.

Russia and China, as members of BRICS, have been vocal and active in pursuing de-dollarization, especially since Russia invaded Ukraine when the U.S. and its European allies froze several hundred billion dollars of Russia’s foreign reserves that were held in Western banks. Furthermore, the U.S. and its allies have sanctioned Russian banks such that they can no longer use the SWIFT (Society for Worldwide Interbank Financial Telecommunication) network that allows financial institutions to securely send and receive electronic messages about financial transactions that is a vital part of the global payments system used to facilitate most international money and security transfers.

IV. What is BRICS?

The term's origin goes back to 2001, when an economist, Jim O’Neill, working for Goldman Sachs, identified investment opportunities in the emerging markets of Brazil, Russia, India, and China. The countries recognized opportunities to work together, and they held their first summit in 2009, with South Africa joining a year later.

Here is what a EuroNews article said in 2009 after the first summit:

“The leaders of world’s biggest developing economies – Brazil, Russia, India and China – the so called BRIC group – have met for their first summit in the Russian city of Yekaterinburg.

Presidents Dmitry Medvedev of Russia, Hu Jintao of China, Luiz Inacio Lula da Silva of Brazil and Indian Prime Minister Manmohan Singh discussed how they can better co-operate to counter the effects of recent financial failures and how to get the West to give them a bigger say in how the world’s financial system is run.

Russia particularly was keen to reduce the dominance of the US dollar as the world’s key reserve currency, but the communique issued at the end of the summit spoke only of the need for a more “diversified, stable and predictable” international monetary system.”

This new geopolitical bloc, now known as BRICS, has conducted annual formal summits to coordinate multilateral policies based on mutual benefit, equality, and non-interference. Iran, Egypt, Ethiopia, and the United Arab Emirates joined the organization on January 1, 2024. Saudi Arabia has not officially joined but participates in the organization's activities as an invited nation.

V. What did the Bloomberg article say?

Ok, so let’s return to the Bloomberg article that originally prompted me to write this article. It said:

“Chinese investors sold a record amount of US stocks and bonds in May as diplomatic tensions remained elevated between the world’s largest economies.

Funds in the Asian nation offloaded a net $42.6 billion worth of long-term securities consisting of Treasury, agency, corporate and other bonds as well as equities, according to the latest data from the US Department of the Treasury released Thursday. Sales in the first five months of this year totaled $79.7 billion, an all-time high for the January-May period.

Chinese investors might have sold American securities for a risk reduction due to uncertainty around the US presidential election, said Billy Leung, an investment strategist at Global X Management Co. in Sydney. There’s also “possible political influence to reduce US dollar holdings,” he said.

More than half of the sales were of Treasuries, followed by agency debt and stocks. The yield on the benchmark Treasury 10-year note climbed to the highest since November on April 25.

China is one of the largest foreign holders of Treasuries, and its flows are closely watched by bond investors and geopolitical strategists alike. A rise in Sino-American tensions has often fueled speculation that Beijing may shift its foreign reserves out of US assets — a move that would likely add upward pressure to yields.

“Chinese investors have good reasons to be diversifying away from US assets given an over-valued US dollar, expensive US equity valuations relative to Chinese equities, and an increased need for liquidity given deleveraging,” said Wei Liang Chang, macro strategist at DBS Bank Ltd. “The divestment trend could continue based on economic fundamentals, as well as political uncertainty into US elections.”

The US government data have their own shortcomings: US securities held in a custodial account in a third country don’t show up as China’s.

China’s holdings of Treasury notes and bonds have dropped $440 billion since the end of 2017. During this period, the balance of the securities held in Belgium, widely seen as a home to custodial accounts for the Asian nation, increased $159 billion. China’s holdings of US stocks, agency bonds and other debt also rose, suggesting that the nation might have shuffled its dollar assets rather cutting them.

Still, the prospects for Federal Reserve policy easing and any ensuing weakness in the greenback might discourage Chinese investors from holding too much in the way of dollar assets, said Ken Wong, an Asian equity portfolio specialist at Eastspring Investments Hong Kong Ltd.

A weaker dollar could make investment in local securities “more enticing,” he said.”

The link to de-dollarization here is that as the GRC, USDs are widely held as USDs but also in USD-denominated assets, with U.S. Treasury Bonds (USTs) being of particular interest given the massive supply of new USTs being issued by our government to fund its substantial budget deficits. If foreigners sell their USTs, they are adding to the supply of USTs, which puts downward pressure on their prices and upward pressure on their yields. When foreigners sell their USD-denominated assets and raise USDs, the big question is, what are they doing with those USDs? Many are spending those USDs on oil and other commodities priced in USDs or repatriating those USDs into domestic currency and assets.

VI. How dominant is the U.S. Dollar today?

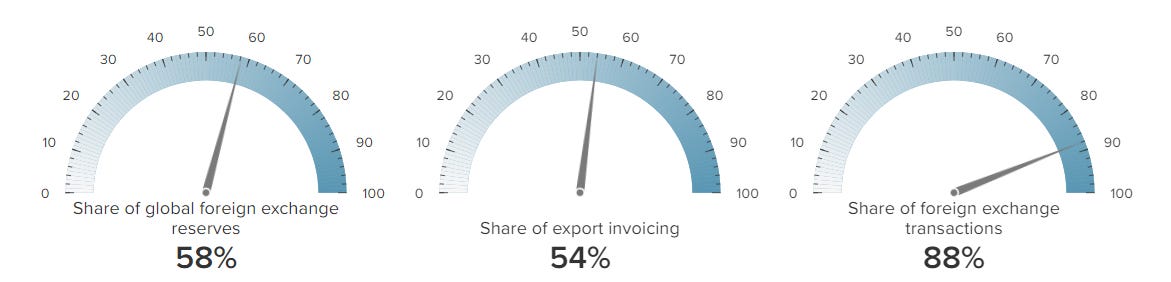

The Atlantic Council’s GeoEconomics Center has developed a “first-of-its kind project on dollar dominance” with the Dollar Dominance Monitor website. It tracks the dollar’s share of global foreign exchange reserves, export invoicing, and foreign exchange transactions:

The key takeaway is:

“The dollar’s role as the primary global reserve currency is secure in the near and medium term. The dollar continues to dominate foreign reserve holdings, trade invoicing, and currency transactions globally. All potential rivals, including the euro, have a limited ability to challenge the dollar in the immediate future.”

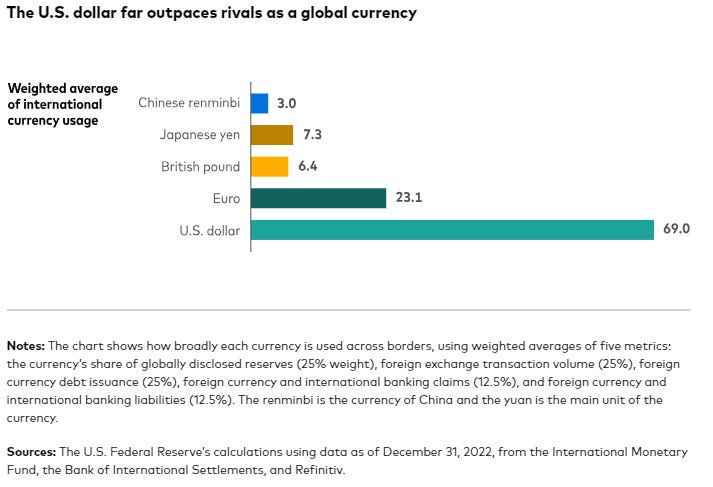

Vanguard published an article, “Why the U.S. dollar remains a reserve currency leader,” earlier this year, and it contained this chart:

VII. What is the recent history of global foreign exchange reserves?

Last month, the International Monetary Fund (IMF) published an article with the title “Dollar Dominance in the International Reserve System: An Update” with the subtitle “The US dollar continues to cede ground to nontraditional currencies in global foreign exchange reserves, but it remains the preeminent reserve currency.” The article points out that

“This recent trend is all the more striking given the dollar’s strength, which indicates that private investors have moved into dollar-denominated assets. Or so it would appear from the change in relative prices. At the same time, this observation is a reminder that exchange rate fluctuations can have an independent impact on the currency composition of central bank reserve portfolios.”

The article also states that:

“Strikingly, the reduced role of the US dollar over the last two decades has not been matched by increases in the shares of the other “big four” currencies—the euro, yen, and pound. Rather, it has been accompanied by a rise in the share of what we have called nontraditional reserve currencies, including the Australian dollar, Canadian dollar, Chinese renminbi, South Korean won, Singaporean dollar, and the Nordic currencies.”

In the next Section, I will tell you about gold’s role as a central bank reserve asset. Then, in Section IX, what I think, and in Section X, why should you care and, more importantly, what more can you do about it? However, I have hit a new paid subscriber threshold, so you must now be a paid subscriber to view the last three sections. The X Project’s articles always have ten sections. Soon, after a few more articles, the paywall will move up again within the article so that only paid subscribers will see the last four sections, or rather, free subscribers will only see the first six sections. I will be moving the paywall up every few weeks, so ultimately, free subscribers will only see the first four or five sections of each article. Please consider a paid subscription.

Also, podcasts of the full articles narrated are available only to paid subscribers.

All paid subscriptions come with a free 14-day trial; you can cancel anytime. Every month, for just the cost of two cups of coffee, The X Project will deliver 6-8 articles (weekly on Sundays and every other Wednesday), helping you know in a couple of hours of your time per month what you need to know about our changing world at the interseXion of commodities, demographics, economics, energy, geopolitics, government debt & deficits, interest rates, markets, and money.

You can also earn free paid subscription months by referring your friends. If your referrals sign up for a FREE subscription, you get one month of free paid subscription for one referral, six months of free paid subscription for three referrals, and twelve months of free paid subscription for five referrals. Please refer your friends!