FED UP: An Insider's Take on Why the Federal Reserve is Bad for America

A summary of the book written by Danielle DiMartino Booth (2017) - Article #14

I. Why this book, and what’s it about?

In Fed Up: An Insider's Take on Why the Federal Reserve is Bad for America,

throws open the doors to one of the most enigmatic institutions in the world: the Federal Reserve. DiMartino Booth, a former Fed insider, doesn't just peek behind the curtain – she tears it down. The book is a whirlwind journey through the corridors of power, revealing a Federal Reserve steeped in orthodoxies and out-of-touch thinking. This is not your typical economics treatise; it's a bold, no-holds-barred critique that exposes the Fed's influence on the American economy and, by extension, the American dream.If you want to relive the Great Financial Crisis from an even scarier perspective than living through it the first time, you’ll enjoy reading this book. Her critique of the Fed is based on her experience working for the Dallas Fed throughout the GFC and its aftermath.

II. Who is the author?

According to her LinkedIn profile (and book), DiMartino Booth earned her BBA as a College of Business Scholar at the University of Texas at San Antonio. She holds an MBA in Finance and International Business from the University of Texas at Austin and an MS in Journalism from Columbia University. DiMartino Booth began her career in New York at Credit Suisse and Donaldson, Lufkin & Jenrette. She worked in the fixed-income, public equity, and private equity markets. After leaving DLJ and moving to Dallas, she wrote a daily financial column at the Dallas Morning News that gained an international following and Warren Buffet's recognition.

In her column, she posited that the subprime housing bubble would culminate in a financial crisis catalyzed by a global systemic risk event. That caught the attention of Richard Fisher, the president of the Federal Reserve Bank of Dallas, who recruited her and for whom she served as an advisor throughout the financial crisis until his retirement in March 2015. Her work at the Fed focused on financial stability and the efficacy of unconventional monetary policy.

A global thought leader in monetary policy, economics, and finance, DiMartino Booth founded Quill Intelligence in 2018 and is its CEO and Chief Strategist. She is also a full-time columnist for Bloomberg View, a business speaker, and a commentator frequently featured on CNBC, Bloomberg, Fox News, Fox Business News, BNN Bloomberg, Yahoo Finance, and other major media outlets.

III. How popular is the book?

Here are the book’s rankings on Amazon:

IV. What is one of the top takeaways from the book?

The Disconnect Between Theory and Reality:

“According to the San Francisco Fed, the Federal Reserve is the single largest employer of PhD economists in the nation, and presumably the world.” (p.47). “Virtually no one [DiMartino Booth] met at the bank had ever worked on Wall Street, managed a business, or handled their own investments. They were discouraged from actively investing in the financial markets because the institution’s access to confidential data could be used for fraudulent purposes. They rarely talked to people outside their spheres.” (p. 46). DiMartino Booth “witnessed the tunnel vision and arrogance of Fed academics who can’t understand that their theoretical models bear little resemblance to real life.” (p.10).

Booth illustrates how the Fed's reliance on theoretical models often leads to policies that don't align with real-world economics. This disconnect is not just academic; it has tangible impacts on everyday Americans, from rising house prices to the precarious job market. Booth's insider perspective reveals a startling gap between the ivory tower and the street.

V. What is another top takeaway from the book?

The Culture of Complacency:

One of the book's striking revelations is the culture of complacency within the Fed. Booth describes an institution more concerned with maintaining the status quo than adapting to a rapidly changing global economy. Referring to the “battalion of economists,” DiMartino asks, “And their standard of success? Getting published in peer-reviewed journals by cranking out academic studies that impressed people just like them. If their work proved wrong, well, no harm, no foul. Nobody was ever fired.” (p. 46).

This complacency, she argues, has led to repeated missed opportunities and missteps, with significant consequences for the economy and society.

VI. What is the third top takeaway from the book?

The Impact of Policy Decisions on Inequality:

Di Martino Booth comes out swinging in the first chapter (emphasis added) : “The Fed’s artificially low interest-rate level has distorted the relationship between stocks and bonds. Rather than one providing cover when the other is in distress, asset classes have increasingly moved in concert. And though portfolio advisors make it sound safe, index investing will prove disastrous when markets finally correct.

The one true growth industry? That would be all that high cotton harvested in high finance. Since 2007, world debt has grown by about $60 trillion, enriching legions of investment bankers one deal at a time.

The Fed’s experiment has widened the inequality gap, angering millions of people who bought into the American dream and know it’s being stripped away from them. The global elite get ever richer while those who work for a living see their earnings stagnate - or worse, get laid off.” (p.9)

She continues to hit the inequality issue throughout the book up to the last chapter when it is 2015. The Fed’s balance sheet is $4.5 trillion then under Yellen’s leadership when she (emphasis added) “wondered what Yellen’s husband, George Akerlof, who had railed against the deficit racked up by the Bush administration, thought about the outrageous balance sheet and Yellen’s obvious role in exacerbating income inequality.” (p.251).

VII. What is the fourth top takeaway from the book?

Questioning the Fed's Independence:

A recurring theme in "Fed Up" is the question of the Federal Reserve's independence: “Yellen dismissed concerns expressed by Fisher and others who were trying to slam on the brakes [on the Fed’s quantitative easing], aware the Fed was being blasted as a political tool of the Obama administration.” (p.173 - emphasis added).

“Financial journalist Alen Mattich warned that Bernanke (and his counterpart Mervyn King in the UK) were at risk of creating another asset bubble by launching yet more QE.

“‘Neither central banker seems to see the 70 percent-plus appreciation of their domestic equity markets over the past 20 months to significantly overvalued level based on historic trends a concern,’ Mattich wrote. ‘Indeed, Bernanke has openly admitted that the second round of quantitative easing he launched last week is designed to promote even further stock market appreciation. Not only has he never been able to identify a bubble in the past, he actively wants to create a new one now.’

The response to QE2 from some sectors of Congress was equally ferocious. The political independence of the Fed was under fire.” (p.199 - emphasis added)

VIII. What is the fifth top takeaway from the book?

Beware the shadow banking system:

In July 2010, the NY Fed Markets Desk released a paper called Shadow Banking by lead author Zoltan Pozsar that detailed banking’s vast interconnectedness between financial subsidiaries such as hedge funds, GSEs (government-sponsored enterprises such as Fannie Mae, Freddie Mac, and the Federal Home Loan Banks), securities lenders, and off-balance sheet entities such as conduits (entities set up by banks to provide financing for companies or fund investments) and structured investment vehicles (SIVs which are non-bank financial entities set up to purchase investments designed to profit from differences in interest rates.) At the time, the traditional banking system was estimated to be $13 trillion, while the shadow banking system dwarfed it at $16 trillion. Before the paper was published, no one at the Fed, besides the four authors, knew it existed, how it worked, and the systemic risks.

IX. What does The X Project Guy have to say?

The shadow banking system emerged and evolved in large part to evade regulations. DiMartino Booth wrote that Poszar pinpointed the 1988 Basel I Accord (international banking regulations) as the primary catalyst for the growth of shadow banking. The same month Pozsar’s Shadow Banking paper was published, the Dodd-Frank Wall Street Reform and Consumer Protection Act was signed into law, and it provides authorities to regulate nonbanks that makeup shadow banking. Who doesn’t think that shadow banking will continue to evolve and evade the newer regulations just as it had successfully evaded the prior ones?

In my third article on The Fourth Turning, I mentioned that I believe in hoping for the best but preparing for the worst. I also believe in Bob Farrell’s 10 Rules for Investing, of which rule #9 is when all the experts and forecasts agree - something else is going to happen. That rule has helped me to develop a general level of healthy skepticism.

After reading this book and listening to DiMartino Booth extensively over the last few years, I am highly skeptical of the Federal Reserve. The X Project will revisit the Fed before long to explore and understand how it works, what it does, and what impact its future actions could have.

X. Why should you care?

You should care because the next financial crisis will give the 2008 Great Financial Crisis a new name.

Here are the main points from a recent speech in September by the FDIC Chairman Martin Gruenberg:

Size and Role of Nonbanks: Nonbanks hold significant assets in the U.S. financial system, around $20.5 trillion in 2021, making up about 30% of global nonbank assets of ~$68.3 trillion. They operate alongside traditional banks but are less regulated.

Historical Context: Nonbanks have been significantly impacted by past crises like the 2008 Global Financial Crisis and the COVID-19 pandemic, requiring fiscal and monetary policy support.

Regulatory Differences: Nonbanks don't have direct access to public safety nets and are subject to less regulation and transparency than banks, often using excessive leverage and volatile funding sources.

Risk Transmission: Nonbanks can transmit risks to other financial system parts during market shocks, amplifying stresses due to their interconnections with banks.

Definition and Categories of Nonbanks: The speech defines nonbanks broadly, focusing on entities like open-ended mutual funds, money market funds, leveraged investment vehicles like hedge funds, and nonbank lenders.

Nonbanks in Past Crises: Nonbanks contributed to financial instability in the 2008 crisis and experienced liquidity issues during the COVID-19 pandemic.

Open-End Mutual Funds and Money Market Funds: These funds face structural vulnerabilities due to mismatches in investment liquidity and investor redemption timelines. The SEC has proposed amendments for better risk management and transparency.

Leveraged Investment Vehicles and Bank Interconnections: High leverage in some nonbanks, like hedge funds, poses financial stability risks. Banks' increasing lending to nonbanks also raises concerns.

Non-Bank Lending and Financial Services: Nonbanks increasingly provide traditional banking services in areas like mortgage finance and business lending, often operating with limited capital and regulatory oversight.

Leveraged Lending Risks: Nonbanks hold substantial leveraged loans, creating interconnected risks with the banking sector.

Future Directions and Regulatory Considerations: The Dodd–Frank Act provides authorities to regulate nonbanks, such as the Financial Stability Oversight Council (FSOC), which is working on various initiatives to address risks, including designating certain nonbanks for heightened supervision. The focus is on creating a tailored regulatory approach, improving transparency, and enhancing the financial system's stability.

Interconnectedness of Banks and Nonbanks: There's a need for a comprehensive strategy that views banks and nonbanks as an interconnected whole, using the authorities of individual agencies and the FSOC.

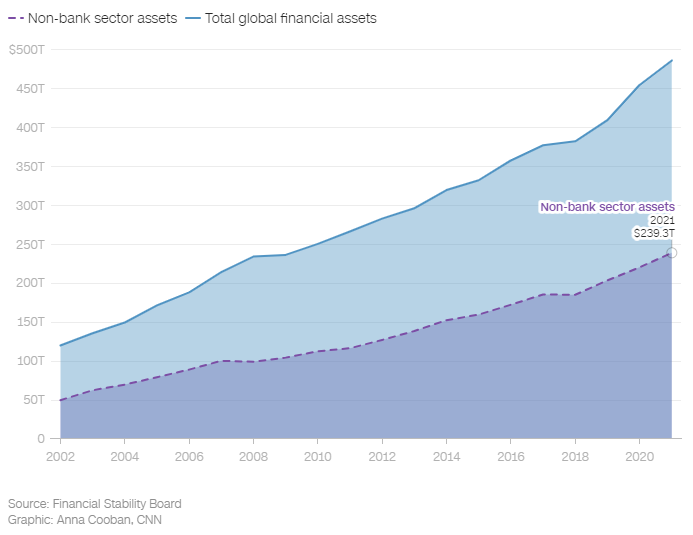

PHEW! Doesn’t that make you feel better? Oh, and those scary and real risks he just laid out were based on a $68.3 trillion global shadow banking system.

But wait…

That $68.3 trillion amount is not correct according to a CNN article in April (Banks are in turmoil but a bigger financial crisis may be brewing elsewhere) and a Barron’s article in June (‘Shadow Banks’ Account for Half of the World’s Assets—and Pose Growing Risks: Regulators lack a clear view into the world of nonbank finance, or 'shadow banking.' Barron's peers into this opaque world.)

Both articles quote the same Financial Stability Board data as the FDIC chairman. And what is the correct size of the global shadow banking system?? $239 trillion!!! That is 2.4x the $99.3 trillion in 2008!

Please help ensure The X Project continues its mission:

Please consider a paid subscription. Until the end of the year, all paid subscriptions come with a free 60-day trial, and you can cancel any time. Every month, for the cost of two cups of coffee, The X Project will deliver ten articles per month ($1 per article), helping you know in 1-2 hours what you need to know about our changing world at the intersection of commodities, debt, deficits, demographics, economics, energy, geopolitics, interest rates, markets, and money.

If you see value in the articles published so far and you see value in the mission of The X Project, please be generous and aggressive in referring friends. Click the link to see the rewards as well as the link to use for making referrals

Please click on the heart icon at the bottom of this article if you like this (and previous) article(s). Please let me know why or how The X Project could better serve you if you did not. Please send me any recommendations, suggestions, critiques, or feedback at theXprojectGuy@gmail.com.