I. What just happened?

In a world where financial markets often reflect the pulse of global events and sentiments, the recent 11% surge in gold prices since the recent low on October 4 sends a clear signal that cannot be ignored. As of last Sunday evening, this age-old bastion of value reached a new unprecedented high price of $2,071 per ounce. This isn't merely a fluctuation in a commodity market — it's a story that intertwines economics, interest rates, government debt and deficits, and the rest of The X Project topics.

As gold prices climb to new levels, we must ask: Why did this happen, and what does it mean? In these tumultuous times, where extraordinary events, inflection points, and long-term trends are changing, accelerating, or reversing, understanding the forces behind this remarkable rise of gold isn't just for the economists or the investors; it's essential knowledge for anyone seeking to navigate our world of accelerating change. In this initial article on gold, we'll explore some history and basic information you should know.

II. What is gold?

At its simplest, gold is a chemical element with the symbol Au (from Latin: aurum) and atomic number 79. But this definition barely scratches the surface of its true significance. Gold is a unique metal: malleable, ductile, resistant to corrosion, and, most notably, enthralling to human society for as long as history has been recorded. Its lustrous yellow sheen has captivated civilizations across the globe, making it a symbol of wealth and status and a key material in jewelry and decorative arts.

Beyond its aesthetic allure, gold's physical properties have made it a valuable resource in various technological and industrial applications. Its excellent conductivity makes it indispensable in electronics, and its resistance to tarnishing and corrosion has applications in dentistry and aerospace. But gold’s role extends beyond these practical uses; it has been a cornerstone in financial systems throughout history. Gold coins were a standard medium of exchange in many ancient cultures, and until the 20th century, the gold standard underpinned significant world currencies.

In the modern world, gold continues to hold immense significance. It's not just a relic of the past but a dynamic player in today’s financial and economic arenas. As an investment, gold is often seen as a safe haven, a hedge against inflation, currency devaluation, and market uncertainty. This multifaceted nature of gold – part commodity, part currency, part cultural icon – is what makes it an endlessly fascinating subject

III. What is the history of gold prices?

The history of gold prices is as rich and multifaceted as the metal itself, chronicling a journey through global economies and market sentiments over centuries. From its early use in ancient civilizations as a symbol of wealth and power, gold's monetary value was largely stable, reflecting its status rather than market dynamics.

The modern era of gold pricing began in earnest with the abandoning of the gold standard in the 20th century, particularly in 1971, when the U.S. ceased to convert dollars to gold at a fixed value. This shift began gold’s transformation into a commodity subject to market forces.

Since then, gold prices have witnessed significant fluctuations, marked by soaring highs in the late 1970s due to inflation fears and again during the financial crisis of 2008 as investors sought a safe haven amid economic uncertainty. The last decade has seen gold prices influenced by a complex interplay of factors, including global financial health, monetary policies of central banks, and geopolitical tensions. This ever-changing landscape makes gold a reflection of current market conditions and a barometer of global economic stability and investor sentiment.

IV. Why do people historically buy gold?

Historically, people have bought gold for many reasons, each deeply rooted in the metal's unique characteristics and the socio-economic context of the times. Primarily, gold has been seen as a store of value. Its scarcity, durability, and the fact that it does not corrode make gold a reliable form of wealth preservation over long periods, often seen as a hedge against inflation and currency devaluation.

Culturally and historically, gold has been a symbol of wealth and status. From ancient Egyptian pharaohs to modern-day investors, owning gold has been associated with power, prestige, and prosperity. This allure has not faded over the centuries; if anything, it has grown stronger.

Additionally, in times of economic uncertainty or political turmoil, gold has often been turned to as a 'safe-haven'. Its value is not directly tied to any specific country's economy, making it less susceptible to economic downturns. This characteristic makes it particularly appealing during times of geopolitical tension, economic crises, or when confidence in governments and financial institutions is low.

V. What historically causes gold prices to go up and down?

A complex interplay of various factors influences the price of gold:

Supply and Demand: Like any commodity, gold prices are heavily influenced by supply and demand dynamics. The discovery of new gold reserves or advancements in mining technology can increase supply, potentially lowering prices. Conversely, increased demand for gold for investment, industrial use, or jewelry can increase prices.

Inflation and Currency Values: Gold is often considered a hedge against inflation. As the value of a currency decreases (inflation), the price of gold typically increases as people turn to gold to preserve their purchasing power.

Interest Rates: There's often an inverse relationship between interest rates and gold prices. When interest rates are low, the opportunity cost of holding non-yielding assets like gold is lower, making gold more attractive to investors.

Economic Uncertainty: During times of economic uncertainty or stock market volatility, investors often turn to gold as a safe investment, driving up its price.

Geopolitical Tensions: Gold prices can spike during times of geopolitical instability. As a universally recognized store of value, it becomes a preferred asset in uncertain times.

Central Bank Policies: Central banks' buying and selling of gold can significantly impact gold prices. These institutions hold significant gold reserves, and their actions in the gold market can influence global perceptions of gold’s value.

Understanding these factors offers insight into the historical ebb and flow of gold prices, reflecting its status as a commodity and a barometer of broader economic and geopolitical trends.

VI. How much gold is there in the world today?

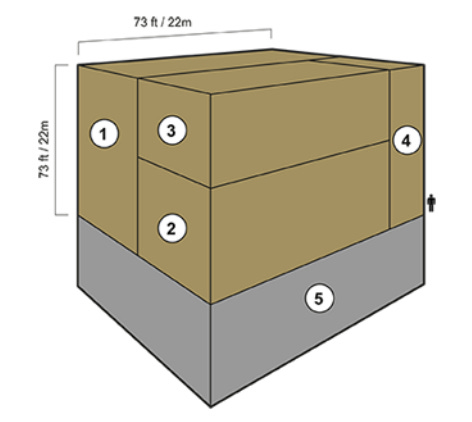

According to the World Gold Council, the best estimates currently available suggest that around 208,874 tonnes of gold have been mined throughout history, of which around two-thirds have been mined since 1950. And since gold is virtually indestructible, this means that almost all of this metal is still around in one form or another. If every single ounce of this gold were placed next to each other, the resulting cube of pure gold would only measure around 73 feet on each side.

Total above-ground stocks (end-2022): 208,874 tonnes

Jewelry ~95,547t, 46%

Bars and coins (including gold-backed ETFs) ~46,517t, 22%

Central banks ~35,715t, 17%

Other ~31,096t, 15%

Proven reserves ~52,000

As of the close on Friday, 12/1/23, the spot price for gold was $65,761,100 per tonne. Therefore, the total value of all the above-ground gold ever mined is $13.736 trillion. By contrast, the market capitalization of the S&P 500 is $38.451 trillion

VII. What are the supply considerations for gold?

The supply considerations for gold involve several key factors influencing how much gold is available in the market. These factors are crucial in understanding the dynamics of gold pricing and availability.

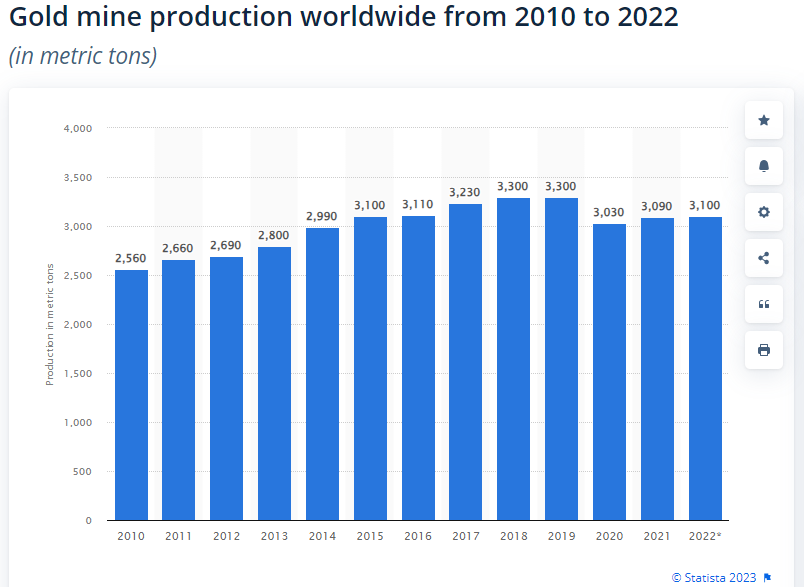

Mining Production: The most significant source of gold supply is mining. The rate at which gold is extracted from the earth is critical in determining its availability. Mining technology, labor costs, environmental regulations, and political stability in mining regions can impact production levels. Major gold-producing countries like China, Australia, Russia, and the United States continuously contribute significant amounts, but changes in their output can affect global supply. In 2022, mining added 1.5% to the above-ground stocks of gold.

Recycling and Repurposing: A substantial portion of the gold supply comes from recycling existing gold, primarily from jewelry and electronics. The price of gold often influences the recycling rate; higher prices can incentivize individuals and companies to sell or recycle gold, increasing the supply.

Central Bank Reserves: Central banks hold significant amounts of gold as part of their foreign exchange reserves. The buying and selling decisions of these banks can have a considerable impact on the gold supply. For instance, when central banks are net buyers of gold, they can reduce the supply available to other buyers in the market, potentially driving up prices.

Technological and Environmental Factors: Advances in mining technology can affect the supply of gold by making it possible to extract gold more efficiently or from previously inaccessible locations. Conversely, environmental regulations and sustainability concerns can limit mining activities, potentially reducing supply.

Geopolitical Stability: Political stability in key gold-producing countries is crucial. Political unrest, regulatory changes, or nationalization of mines can disrupt production, affecting global supply.

Cost of Production: The cost of extracting gold influences its supply. Factors such as energy costs, labor wages, and the need for specialized equipment play a role. When the cost of production is high relative to the gold price, some mines might reduce output or shut down, tightening supply.

Discovery of New Reserves: The discovery of new gold reserves can alter supply projections. However, the rate of significant discoveries has been declining, and new mines often take many years to develop, delaying their impact on supply.

These supply considerations collectively shape the availability and price of gold in the market. They highlight the complex interplay between geological, economic, environmental, and political factors in determining the supply side of the gold market.

VIII. Are Central Banks buying or selling gold?

According to the Financial Times article published on 10/31/23, China leads record central bank gold buying in first nine months of year. The total amount acquired by central banks was 800 tonnes, marking a 14% increase year-on-year.

This surge in buying, as reported by the World Gold Council, was driven by a desire to hedge against inflation and lessen reliance on the US dollar. This trend, alongside surging consumer prices and depreciating currencies, has made gold an attractive store of value. China was the largest buyer, adding 181 tonnes to its reserves, followed by Poland and Turkey. Analysts have been surprised by the continued rapid rate of these purchases. The conflict between Hamas and Israel also contributed to a nearly 10% increase in gold prices over 16 days. The actual level of gold buying by central banks, especially China and Russia, is speculated to be higher than officially reported, with the WGC estimating 129 tonnes more than reported in the third quarter.

In the article Charted: 30 Years of Central Bank Gold Demand published earlier this year, the author, Govind Bhutada explains:

Why Do Central Banks Buy Gold?

Gold plays an important role in the financial reserves of numerous nations. Here are three of the reasons why central banks hold gold:

Balancing foreign exchange reserves

Central banks have long held gold as part of their reserves to manage risk from currency holdings and to promote stability during economic turmoil.Hedging against fiat currencies

Gold offers a hedge against the eroding purchasing power of currencies (mainly the U.S. dollar) due to inflation.Diversifying portfolios

Gold has an inverse correlation with the U.S. dollar. When the dollar falls in value, gold prices tend to rise, protecting central banks from volatility.

The Switch from Selling to Buying

In the 1990s and early 2000s, central banks were net sellers of gold.

There were several reasons behind the selling, including good macroeconomic conditions and a downward trend in gold prices. Due to strong economic growth, gold’s safe-haven properties were less valuable, and low returns made it unattractive as an investment.

Central bank attitudes toward gold started changing following the 1997 Asian financial crisis and then later, the 2007–08 financial crisis. Since 2010, central banks have been net buyers of gold on an annual basis.

Here’s a look at the 10 largest official buyers of gold from the end of 1999 to end of 2021:

IX. What are The X Project Guy’s comments?

Just after graduating college in the mid-1990s, when I was a retail commodity futures broker and trader, I met my first “gold bug,” a person who is a gold perma-bull. Not long before I met several others, they all tried to brainwash me with their ethos of gold’s value based mainly on being a hedge against inflation and currency devaluation. I nodded, smiled as I executed their trades, and watched gold prices go nowhere. I thought, “What inflation? Currency devaluation? We aren’t a third-world country. We are the U.S. of A!” The dollar (index compared to a basket of other currencies) was strong and rising.

In late 1999, I left the commodity futures world and entered technology. I was preoccupied with my new field and didn’t pay as much attention to commodities and currencies as I did the stock market.

By 2007, I felt a lot of extremes. I was burned out from working hard to keep up and barely getting ahead. I was frustrated with equity and real estate markets, where everyone seemed to have more of both than I did and seemed to be getting much richer and faster. So, my wife and I decided to quit our jobs in mid-2007, sell everything we owned, buy a boat, and take a 2-year sabbatical to travel throughout the eastern coast of the US, the Mediterranean coast of Europe, and the Caribbean.

In hindsight, our timing was a stroke of genius (or blind luck). In addition to our good fortune in timing the Great Financial Crisis with selling our modest real estate and equity holdings, it gave me the time to reconnect with my passion for The X Project topics and pay close attention to the unfolding financial crisis, its impacts, and our government’s response.

Back to gold, it was during this time that I noticed I had missed a tremendous bull market in gold (and bear market in the dollar) that started within a couple of months of my leaving the commodity futures business.

After that and ever since then, I have paid a lot closer attention to gold, the dollar, and the rest of The X Project topics. While our sabbatical ended in mid-2009 and I resumed my career, I felt uneasy as nothing seemed solved by the GFC or our government’s response.

According to the gold chart above in Section III, gold peaked at $1,823 in August 2011, then declined to a low of $1,061 in December 2015. In 2019, gold started moving higher, breaking from its sideways channel to the upside.

Meanwhile, here is a historical chart of the US Dollar index.

The X Project will cover much about the US Dollar in the future, but I will briefly introduce you to the US Dollar Index for now. The DXY, or the US Dollar Index, is a financial indicator that measures the value of the United States dollar against a basket of foreign currencies, including the Euro, Japanese Yen, British Pound, Canadian Dollar, Swedish Krona, and Swiss Franc. This index is used as a benchmark for the international value of the US dollar and helps investors and economists analyze the dollar’s strength in global markets. I mentioned above that the gold bull market from 1999-2011 coincided with a bear market in the US Dollar. It is generally understood and sometimes true that there is an inverse correlation between the price of gold, but as you can see in the historical charts above, not always true.

I started buying gold (physical bullion) in 2019, not because of the price action of gold or the US Dollar Index, but because of what I am about to share with you…

X. Why should you care about gold?

If everything you have read here does not compel you to want to own gold, I understand because when I knew most of what I shared with you above, I hadn’t started buying gold either. It was not until I learned and understood that the US Dollar has continuously been losing its purchasing power that I started buying physical gold bullion.

How much in purchasing power has the US Dollar lost? The figures in the infographic above are based on the value of the US Dollar in 2020 and BEFORE our recent spike in inflation.

Here are updated numbers based on the online CPI Inflation Calculator developed by Ian Webster through the latest CPI reports in 2023:

Since 1923, the US Dollar has lost 94% of its purchasing power

Since 1971, the US Dollar has lost 86% of its purchasing power

Since 1998, the US Dollar has lost 47% of its purchasing power

Since 2008, the US Dollar has lost 30% of its purchasing power

Since 2018, the US Dollar has lost 18% of its purchasing power

When I first saw those figures, they were a punch in the gut and took the wind out of me.

So why should you care? Virtually every one of the authors, analysts, strategists, hedge fund or portfolio managers, traders, and investment advisors that I listen to recommend keeping at least 5% of your net worth in gold because of these indisputable facts and because there is no counter-party risk if you hold physical bullion. The rest of your investments need to produce a higher rate of return than inflation to produce a “real” positive rate. The recent breakout to new all-time highs could begin a multi-year bull market for gold, taking prices much higher. The X Project will revisit gold, inflation, and the US Dollar before long.

Please help ensure The X Project continues its mission:

Please consider a paid subscription. Until the end of the year, all paid subscriptions come with a free 60-day trial, and you can cancel any time. Every month, for the cost of two cups of coffee, The X Project will deliver ten articles per month ($1 per article), helping you know in 1-2 hours what you need to know about our changing world at the intersection of commodities, debt, deficits, demographics, economics, energy, geopolitics, interest rates, markets, and money.

If you see value in the articles published so far and you see value in the mission of The X Project, please be generous and aggressive in referring friends. Click the link to see the rewards as well as the link to use for making referrals

Please click on the heart icon at the bottom of this article if you like this (and previous) article(s). Please let me know why or how The X Project could better serve you if you did not. Please send me any recommendations, suggestions, critiques, or feedback at theXprojectGuy@gmail.com.