Is a Recession Coming in 2024?

David Rosenberg is One of the Last Analysts Still Calling for One - Article #50

In this 10-minute article, The X Project will answer these questions:

I. Why this article now?

II—VIII. What are the top seven reasons for David Rosenberg’s recession call?

IX. What does The X Project Guy have to say?

X. Why should you care?

Reminder for readers and listeners: nothing The X Project writes or says should be considered investment advice or recommendations to buy or sell securities or investment products. Everything written and said is for informational purposes only, and you should do your own research and due diligence. It would be best to discuss with an investment advisor before making any investments or changes to your investments based on any information provided by The X Project.

I. Why this article now?

First of all, I stated I would write this article in my last article, “What About the Possibility of Deflation?” But more importantly, the consensus view has shifted to no recession in 2024. As David Rosenberg likes to quote his mentor, Bob Farrell’s Market Rules to Remember, Rule #9 states, "When all the experts and forecasts agree — something else is going to happen."

Who is David Rosenberg? He “is the Founder and President of Rosenberg Research & Associates Inc., an economic consulting firm he established in January 2020. He and his team have as their top priority providing investors with analysis and insights to help them make well-informed investment decisions.

Prior to Rosenberg Research, David was Chief Economist & Strategist at Gluskin Sheff + Associates Inc. from 2009 to 2019. From 2002 to 2009, he was Chief North American Economist at Merrill Lynch in New York, during which he was consistently ranked in the Institutional Investor All-Star analyst rankings. Prior thereto, he was Chief Economist and Strategist for Merrill Lynch Canada, based out of Toronto, where he and his team placed first in the Brendan Wood survey of Canadian economists for ten years in a row.”

Where do we find the reasons for his recession call? He has made five appearances on YouTube since February 15:

The Economy Is Weaker Than The Narrative Suggests

February 15, 2024 with 42,786 views

David Rosenberg on Why We’re Sticking to Our Guns

March 17, 2024 with 4,092 views

Here's why Rosenberg Research founder is still expecting a recession this year

March 18, 2024 with 28,480 views

I’d Rather Be A Bull with David Rosenberg

March 29, 2024 with 22,354 views

What Action Should FED Take? with David Rosenberg

April 4, 2024 with 117 views

II. What is one reason for Rosenberg’s recession call?

Historical Analogies and Persistent Economic Indicators

Rosenberg notes a significant contraction in key economic indicators: real retail sales are down by 1.8% annualized and industrial production by 5.6% in the first quarter. He argues that when production and sales contract together, the economy typically faces a heightened risk of recession, suggesting that the current data trends are more severe than commonly perceived.

III. What is another reason for Rosenberg’s recession call?

Weak Labor Market Underneath the Surface

Rosenberg highlights the rise in part-time employment, noting that all job growth in the past year was part-time - not a single full-time job. He also points to increasing continuing unemployment claims as an indication that it’s becoming harder for the unemployed to find new jobs. He suggests that the low unemployment claim numbers may not fully represent labor market realities, especially considering that part-time workers laid off may not qualify for unemployment benefits, thus not appearing in initial claims data.

IV. What is a third reason for Rosenberg’s recession call?

Inflation and Monetary Policy Concerns

Rosenberg notes the Federal Reserve's rate hikes, drawing parallels with past situations where such monetary tightening led to economic downturns. He reflects on historical contexts where delayed effects of rate hikes contributed to recessions, emphasizing the potential lag between policy actions and their economic impact. Notably, in 2008, he was one of the last two Wall Street economists still calling for a recession when everyone else had “thrown in the towel,” which he claims is similar to today.

V. What is a fourth reason for Rosenberg’s recession call?

Overvaluation in Financial Markets

Rosenberg notes that the stock market's forward multiple expanded from 18 to 21 within a year, a rate of multiple expansion that is highly unusual and indicative of overvaluation. He compares this scenario to past market bubbles, suggesting that the market valuation is not supported by earnings growth but rather by speculative momentum, which is unsustainable.

VI. What is a fifth reason for Rosenberg’s recession call?

Sectoral Shifts and Slowdowns

Citing the Beige Book, he notes a cooling off in sectors like travel, leisure, and restaurants, which were previously hot due to reopening and stimulus spending. Rosenberg argues that the decline in these sectors, which helped drive post-pandemic recovery, indicates a broader economic slowdown as the stimulus effect wears off.

VII. What is the sixth reason for Rosenberg’s recession call?

Global Economic Weaknesses

Rosenberg discusses global economic issues, including the economic slowdown in China and Europe. Given its interconnectedness with global markets, he suggests that these global weaknesses will inevitably affect the U.S. economy, exacerbating domestic economic challenges.

In the next section, I will explain Rosenberg’s last reason for a recession call. In Section IX, I will tell you what I think about all of this. And then in Section X, why you should care and, more importantly, what more you can do about it. However, I have just hit a new paid subscriber threshold, so you must now be a paid subscriber to view the last three sections. The X Project’s articles always have ten sections. Soon, after a few more articles, the paywall will move up again within the article so that only paid subscribers will see the last four sections, or rather, free subscribers will only see the first six sections. I will be moving the paywall up every few weeks, so ultimately, free subscribers will only see the first four or five sections of each article. Please consider a paid subscription.

All paid subscriptions come with a free 14-day trial; you can cancel anytime. Every month, for the cost of two cups of coffee, The X Project will deliver two articles per week ($1.15 per article), helping you know in a couple of hours of your time per month what you need to know about our changing world at the interseXion of commodities, demographics, economics, energy, geopolitics, government debt & deficits, interest rates, markets, and money.

You can also earn free paid subscription months by referring your friends. If your referrals sign up for a FREE subscription, you get one month of free paid subscription for one referral, six months of free paid subscription for three referrals, and twelve months of free paid subscription for five referrals. Please refer your friends!

VIII. What is the last reason for Rosenberg’s recession call?

Government and Fiscal Policy

Rosenberg is critical of the 25% increase in the U.S. fiscal deficit last year despite full employment, which he finds unsustainable. He believes that the artificial boost from government spending is fading, with significant implications for real economic growth as these non-recurring factors cease to prop up the economy.

IX. What does The X Project Guy have to say?

I have a lot of respect for Rosenberg. I have been following him for many years and always listen to what he says. And so, it is not easy for me to disagree with him, but I lean towards a no-recession call for 2024. This is not a strong conviction call; it is more like 60-40 or 65-35 in terms of the probability of no recession vs. a recession in 2024.

There are two big reasons why I disagree with Rosenberg’s call. The first one is that I believe this time differs from prior Fed hiking cycles, yield curve inversions, and other historical comparisons that Rosenberg makes regarding our high debt-to-GDP ratio and our high deficits. Said another way, I don’t think Rosenberg believes in or gives any credence to the notion of fiscal dominance. Secondly, this is an election year, and I believe our policymakers are doing everything possible to ensure no recession before an election.

But, I am a contrarian at heart, and come back to Bob Farrell’s Rule #9. And hence my low conviction call that we’ll avoid a recession in 2024.

X. Why should you care?

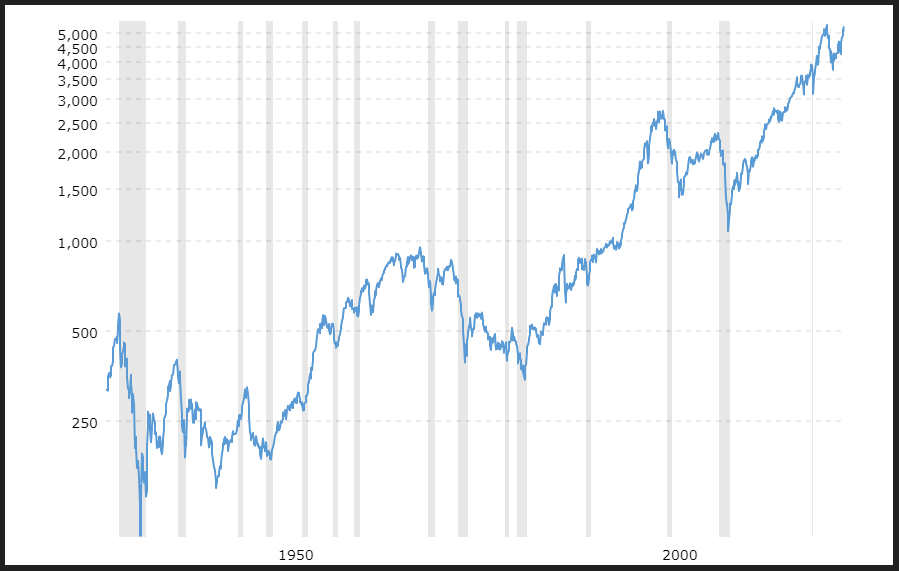

Most recessions are associated with big market declines, as you can see in the 90 year, log scale, chart of the S&P 500 with the shaded areas showing recessions:

And if you look closely, the market typically leads the economy - especially since 1950.

Was the S&P 500 closing high on March 28 at 5254 the high? We are down 3.9% since then. Is Rosenberg right, and are we already or about to be in a recession?

I don’t know. And that is why the first of ten investment themes I subscribe to is to maintain an “overweight” cash position “for optionality, given expected volatility.” How much is that? Enough so that if there were a sharp drop in stock prices, I would not feel queezie from the value of the rest of my portfolio going down, and I would feel fortunate to able to buy stocks I like at cheaper prices. But not so much cash that if the markets continued marching higher (without any pull-backs of greater than 5%) that I’d feel frustrated that I missed out.

Here are the investment themes to which I subscribe and adhere:

Overweight cash and short-term U.S. T-bills for optionality, given expected volatility related to the remaining list below.

Bullish gold and gold miner equities

Bullish Bitcoin

Bullish oil and oil-related equities

Bullish natural gas and related equities

Bullish uranium and related equities

Bullish industrial-associated commodities and equities

Bullish agricultural-associated commodities and equities

Bullish industrial and primarily electrical infrastructure equities

Bearish long-dated U.S. and other Western sovereign bonds

By the time we get to that ultimate financial crash, the goal is to have very little cash or cash equivalents left, as our currency is ultimately going to be worthless.

Thank you for your paid subscription. Your support is everything to The X Project and is greatly appreciated. If you agree, please do me the favor of hitting the like button and posting positive comments about my articles - assuming you have positive things to say - especially about these final sections (soon to be more sections) that only you as a paid subscriber get to see.