Navigating the Tides of Black Gold

Exploring the Bullish and Bearish Perspectives in the Crude Oil Market - Article #23

In this 12 min article, The X Project will answer these questions:

I. Why this article now?

II. Who represents each case?

III. What is one of the top 3 reasons to be bullish?

IV. What is a second reason to be bullish?

V. What is a third bullish reason?

VI. What is one of the top 3 reasons to be bearish?

VII. What is a second reason to be bearish?

VIII. What is a third bearish reason?

IX. What does The X Project Guy have to say?

X. Why should you care?

I. Why this article now?

Understanding the crude oil market has never been more critical in an era where the ebb and flow of global energy markets can shift the sands of economic stability. As we stand at a pivotal juncture, with geopolitical shifts, technological leaps, and environmental concerns colliding, the need to dissect and comprehend the complex dynamics driving oil prices is paramount. This article delves into the heart of these currents, unraveling the bullish and bearish perspectives that shape the future of our most contentious yet vital resource.

In The X Project’s article 21, Energy Transition Crisis, summarizing Erik Townsend’s 8-part docuseries, the underlying premise of the “crisis” is a shortage of fossil fuels leading to spiking prices based on the underinvestment in the development of fossil fuels over the last decade or two in which policies favored investment in “green” energy sources, primarily wind and solar.

That premise is reasonable as the underinvestment in the crude oil market is well known, as I initially introduced in The X Project’s article 15, U.S. Crude Oil Production at New All-Time High. In that previous article,

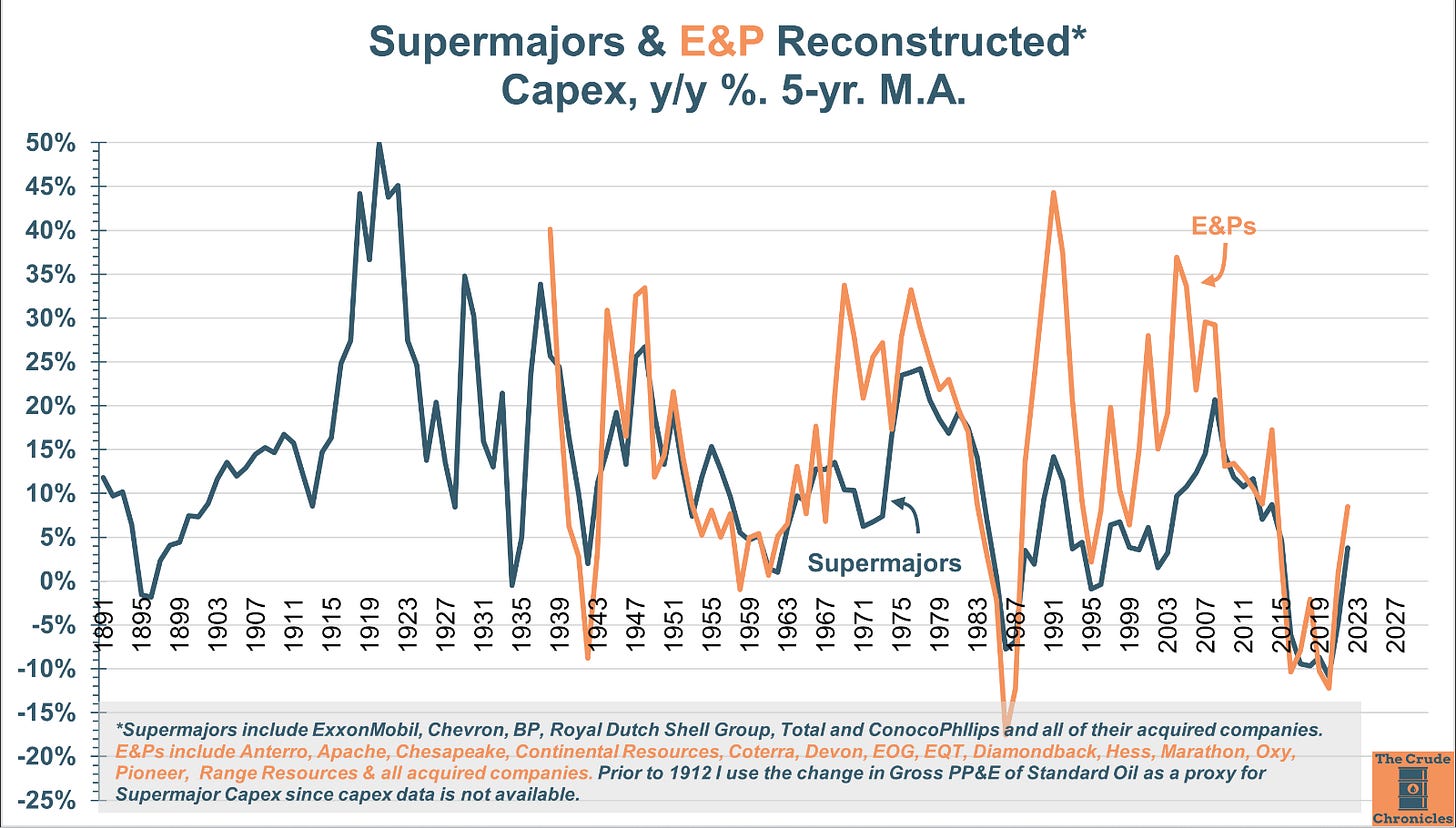

’ great chart showing historical capital expenditures (Capex) or investment by the oil industry was shared, and it is worth sharing again:And yet, crude oil prices have been down for the last three months, closing out 2023 in the low $70s. Right on cue, one of our favorite and highly respected Substack authors published an article on December 22 titled Peak Cheap Oil is a Myth.

II. Who Represents Each Case?

Of course, that Substack author representing the bearish case for crude oil is none other than our favorite green chicken

. For those of you who do not know, Doomberg is a small team of former executives from the commodities sector. They “started writing Doomberg in May of 2021 to highlight the fundamentals missing from many economic and policy decisions, and it quickly grew to be one of the most widely read finance newsletters on Substack … the content is borne out of [their] team’s deep experience in heavy industry, private equity, and the hard sciences. Family offices and c-suite executives hire [them] to deliver innovative thinking and clarity to complex problems – [they] operate as though [their] subscribers share those same expectations.”Quite a few analysts are short-term bearish on the price of crude oil based on a short-term recessionary outlook. Doomberg’s position on the longer-term bearish case for crude oil is unique and somewhat contrarian, as I am unaware of anyone else sharing the same views. Doomberg recently appeared on

YouTube channel:In that interview, Doomberg acknowledged that oil prices are highly inelastic and that we are always one geopolitical disaster away from a huge spike in oil prices. He also clarified that his team’s longer-term view is that in 50 years, we will produce far more oil than we are producing today at affordable prices. Lastly, affordable prices mean roughly the same price of oil in gold, not dollars, since oil can and probably will go up in price in dollars due to the dollar’s continuing loss of value.

As for the bullish case for oil, there are seemingly a lot more analysts subscribing to that view, and for this article, we turn to Leigh Goehring and Adam Rozencwajg, managing partners of their natural resource investment firm, Goehring and Rozencwajg.

“Mr. Goehring has [32] years of investment experience specializing in natural resource investments. From 2005 until the end of 2015, Mr. Goehring was the portfolio manager of Chilton Global Natural Resources Fund. This dedicated natural resources focused hedge-fund grew to over $5 billion of assets under management at its peak. Prior to joining Chilton Investment Company, Mr. Goehring served as the manager of the Prudential-Jennision family of natural resources funds between 1991 and 2005. These funds accumulated over $3 billion of assets under management at their peak. Mr. Goehring started working on Wall Street in 1982 in the Trust Department of the Bank of New York.”

“Mr. Rozencwajg has [17] years of investment experience. Between 2007 and 2015, Mr. Rozencwajg worked exclusively on the Global Natural Resources Fund at Chilton Investment Company with Mr. Goehring. Prior to joining Chilton Investment Company, Mr. Rozencwajg worked in the Investment Banking department at Lehman Brothers between 2006 and 2007.”

They publish an extended quarterly commentary, and their bullish case is taken from their latest commentary published on November 29, 2023, titled Dr. Jevons or: How I Learned to Stop Worrying and Love Demand. In it, they acknowledge the shorter-term bearish case for oil based on fears of a looming recession, for which they are not concerned. “Even if a severe coordinated slowdown took hold, we believe the impacts would be less painful and shorter-lived than most analysts expect. There have been four global recessions since 1965: 1975, 1982, 1991, and the Global Financial Crisis (GFC) in 2009. In the first three instances, global energy demand fell by 1%, driving average per capita energy demand lower by 4.4%. Energy per capita took eight years on average to recover to pre-recession highs. The GFC was much worse in terms of economic dislocation. Global per capita GDP fell by 2.5% -- nearly three times the average of the previous three worldwide recessions. However, because of the rising influence of energy-hungry emerging market economies, per capita energy demand only fell by 2.9% -- one third less than in the previous three recessions despite a nearly three times sharper slowdown in economic activity. Instead of taking eight years, per capita energy demand surpassed the pre-crisis high by 2010. If we experience another global slowdown (of which we have no evidence presently), the impact would be much less than people expect.”

They also acknowledge the longer-term bear case for oil, predicated on the International Energy Agency’s outlook for demand for oil (gas and coal) having already peaked. And that leads us to the bull case…

III. What is one of the top 3 reasons to be bullish?

Demand Exceeding Expectations

First, Goehring and Rozencwajg (GoRozen) attack the bearish demand outlook. “The IEA is leading the bearish chorus. In their most recent World Energy Outlook 2023, published in October, the IEA lays out its “Announced Pledges Scenario” for global energy demand. Between 2022 and 2030, the IEA estimates demand (which it oddly calls Total Energy Supply [TES]) will fall by 1%. By 2040, it will fall by 3.2%. These numbers are not possible given our understanding of global energy consumption. Our models tell us the IEA uses fundamentally flawed mythologies that introduce a systematic downward bias. Their bias has been apparent since at least 2010. Over that time, the IEA has chronically underestimated global oil demand in twelve of the fourteen years (including COVID-impacted 2020). Excluding 2020, the IEA increased demand by an incredible 800,000 b/d on average from its initial expectation. If the IEA’s error were a country, it would be the world’s 21st largest oil consumer.” (p.4)

In dissecting where GoRozen believes IEA’s methodology is flawed, they end up with a completely different conclusion. “Using the IEA’s methodology, between now and 2040, global energy demand is projected to fall by 3%, with real GDP per capita growing by 40%, demand per GDP (somehow) falling by 40%, and population growing by 15%.”

GoRozen states: “Our demand models are fundamentally different. We believe economic development drives energy demand, and our models capture that relationship explicitly. The result is our S-Curve demand model, where we plot per capita energy demand against real GDP. When an economy is very poor, it consumes little energy; any growth goes towards subsistence. As it reaches middle-income, its energy demand grows materially. Finally, energy demand begins to flatten at $20,000 of real per capita GDP.” (p.7)

“While the IEA assumes global energy demand will peak around now, our model predicts it will grow by 217 EJ between now and 2040, representing the fastest seventeen-year period of growth in human history.” (p.7)

IV. What is a second reason to be bullish?

A Structural Deficit

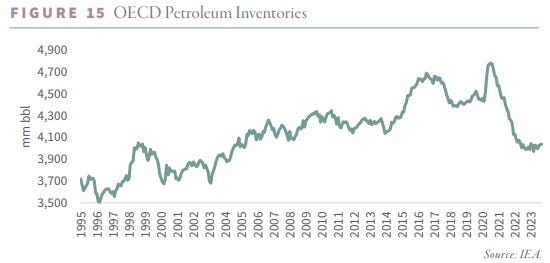

“When the realization dawns that oil and gas demand is not in free fall, investors will be forced to confront how little the industry has invested to offset declines. According to our modeling, global oil markets have already fallen into a “structural deficit” masked by massive releases from government-controlled strategic stockpiles.” (p.3) They go on to state: “Crude demand exceeded production as early as 2021; however, massive releases from government strategic reserves masked the deficit throughout 2022 and the first half of 2023. Over that period, global SPRs (strategic petroleum reserves) released nearly 300 mm bbl, equating to a massive 500,000 b/d – the most significant release in history. The US stopped releasing its SPR in the last week of June, and oil rallied from $67 to $90 per barrel. Although it has recently pulled back to $75, we believe it is a temporary correction in an otherwise strong bull market.” (p.27)

V. What is a third bullish reason?

U.S. Shale is Peaking and Rolling Over

First, GoRozen points out that prime Permian Basin (the highest-producing oil field in the U.S.) acreage was selling for about $5,000 per acre for the net royalties a few years ago. Recently, the price of the net royalty acre in the Permian Basin is closer to $25 - $30,000. They also point out the historically large corporate acquisitions by Exxon of Pioneer Natural Resources and by Chevron of Hess. They suggest that royalty and corporate buyers are aware that prime undrilled acreage is quickly running out.

Second, they point out that according to their calculations, the Permian has produced half of its reserves and that sequential growth is expected to turn negative within the next few months. “With a growing degree of confidence, we expect 2024 will be the peak in Permian production. Over the last fifteen years, the US shales have represented all non-OPEC growth. In the previous five years, the Permian has dominated US shales. If correct, we are entering an unprecedented period of tightness in global oil markets.” (p.29)

The third point worth mentioning as it relates to Doomberg’s position, which we’ll get to next, is that the productivity surge per well seen between 2015 and 2017 was NOT driven by advances in drilling and completion techniques but rather by where companies were drilling wells. In other words, the industry was not upgrading its Tier 2 sites into Tier 1 but rather hollowing out its best Tier 1 sites.

VI. What is one of the top 3 reasons to be bearish?

Technological Advancements and Efficiency Gains

Disagreeing with GoRozen’s last point above, Doomberg’s article emphasizes the significant technological progress made in the oil and gas sector, which is often perceived as technologically stagnant. Innovations in drilling techniques, fracking methods, and well development have made oil extraction more efficient and cost-effective. For example, advancements in electric pump technology and the use of high-tech underground equipment have increased crude extraction efficiency. These technological improvements have continuously transformed resources previously deemed too expensive or challenging to exploit into economically viable reserves.

VII. What is a second reason to be bearish?

Political, Regulatory, and Geopolitical Factors and Dynamics

Doomberg discusses how political and regulatory decisions significantly impact the cost of oil production. In many Western countries, elevated costs are often the result of political choices, such as stringent permitting requirements, high litigation costs from lawsuits, and regulatory uncertainties that deter investment. The article suggests that these political factors are mutable and can change more swiftly than geological constraints, implying that a shift in political and regulatory landscapes could reduce the costs associated with oil production

In Doomberg’s next article on December 29, 2023, The New World’s Oil: When it comes to energy, a united Western Hemisphere could neutralize the Middle East, he points out that the Western Hemisphere, including North America and Latin America, has immense untapped oil potential, largely due to political constraints rather than geological limitations. As it stands, the Western Hemisphere is already producing more than the Middle East:

Doomberg does state: “With Venezuela acting in the interests of the OPEC cartel (of which it is a founding member) and Brazil’s stated desire to join it, the prospects of a meaningful alliance on energy between Latin America and the US seem as dim as ever, but that doesn’t mean such a worthy objective should be dismissed. Combining the technical prowess of the major Western oil companies with the huge swaths of undeveloped hydrocarbons south of the equator represents a generational opportunity for wealth creation and strategic advancement for all parties.” Political changes or policy shifts in these regions could unlock significant additional oil supplies, contributing to the global abundance.

VIII. What is a third bearish reason?

Redefining Oil and Broadening Sources

Going back to Doomberg’s Peak Cheap Oil is a Myth article, Doomberg states: “Technology and politics aside, alarmists also hold on to a definition of the commodity that is too narrow. There are hundreds of grades of oil trading hands around the world each day, and as refineries become more flexible in their ability to switch between them, the very definition of “oil” is undergoing a semantic shift. In our view, analysts would do well to adopt our preferred characterization of the stuff: Oil is any hydrocarbon that finds its way into a refinery.”

Take natural gas liquids (NGLs), a mixture of ethane, propane, butanes, pentanes, and other light hydrocarbons that are co-produced alongside oil and natural gas in huge volumes in the shale patch. As our friend Rory Johnston, author of the excellent Substack Commodity Context, described to us in private correspondence, US NGL volumes alone would make it the second-largest producer in OPEC. Because it carries a different moniker than traditional oil and is not included in the official crude production statistics, the glut of NGLs produced is often overlooked, as are the vast global energy resources now theoretically unlocked by these developments.”

The article argues that this broader understanding of oil, coupled with the large-scale infrastructure developed for NGLs, contributes to a more abundant and diverse supply of oil resources, countering the notion of dwindling cheap oil supplies.

IX. What does The X Project Guy have to say?

There are three things: first, there is a third, more neutral case for oil. I first introduced Luke Gromen in article #6, Fiscal Dominance, as a major influencer of The X Project. I also mentioned in article 15, U.S. Crude Oil Production at New All-Time High, that he believes we are past “Peak Cheap Oil.” In his latest Tree Rings report, Luke suggests that oil will trade in a range this year between $60 and $90 because if prices fall lower than $60, then U.S. shale starts shutting down, reducing supply. If oil trades above $90, the U.S. Treasury market starts to become dysfunctional as oil-importing countries need to sell assets to raise the U.S. Dollars to buy oil. Therefore, he believes the U.S. Government and the Fed will do whatever it takes to keep oil below that level.

Secondly, all three arguments are compelling, and all can be correct. As for the difference in opinion between GoRozen and Doomberg, it really comes down to whether demand outpaces supply or vice versa. GoRozen’s article talks about Dr. Jevons, known for the Jevons paradox: Improved efficiency increases consumption. The corollary to the paradox that GoRozen points out is this: only high prices reduce demand. And I don’t think Doomberg would disagree in dollar terms, as he stated in the interview that the price in dollars is expected to be an upward-sloping sine wave with bull and bear markets. Nothing I am about to say should be considered investment advice as it is only for informational purposes. Despite Doomberg’s theses regarding long-term, abundant supply, which I find believable and hard to argue with, I am generally bullish on oil in U.S. Dollar terms because, ultimately, I believe we will see multiple future waves of inflation and a continuing decline in the purchasing power and value of the dollar. Doomberg admits the same in the interview with Adam Taggert and states that is why he owns physical gold.

Thirdly, I currently own stock in most of the major oil companies, several oil service companies, some offshore oil drillers, and some oil pipeline and oil royalty companies. For many of these, I am earning dividends of 3-5%, and with some as much as 7-9+%, and since I am reinvesting those dividends, I am comfortable waiting out short-term weakness in prices, especially since my investment horizon is 5-10 years. I also like having a hedge against a geopolitical crisis. But, as I laid out in the ten investment themes I subscribe to in the conclusion to article #6, Fiscal Dominance, I am also long cash and cash equivalents for optionality, given expected volatility in oil and all my other investment themes. If oil prices fall below $70 and toward $60 per barrel, I will add to my positions, happy with the dividend yield, and comfortable with the long-term prospects. If there is a spike due to geopolitics, I will likely take some profits, as price spikes generally don’t last.

X. Why should you care?

First of all, because there is potential money to be made investing in this sector - which you should not do based on this article - but only after doing your own research and/or consulting with an investment advisor.

Secondly, if prices rise well above $110 per barrel and persist at those elevated levels, you should expect economic weakness. As the chart below shows, aside from the COVID-19 recession, each recession preceded or coincided with a rise in oil prices above the previous range. From 2011-2015, our economy endured prices in an approximate range of $90-110 per barrel without a recession, and so exceeding that level on a sustained basis should negatively impact the economy.

The X Project is here to keep you informed, helping you know what you need to know. Please help The X Project continue its mission by…

Hitting the heart icon indicating you like this article

Sharing this article (and prior articles) with anyone and everyone you know and care about.

Considering a paid subscription. The paywall will go up starting with the next article, restricting each new article's final sections to paid subscribers only. All paid subscriptions in January will come with a free 30-day trial. Every month, for the cost of two cups of coffee, The X Project will deliver ten articles per month ($1 per article), helping you know in 1-2 hours of your time per month what you need to know about our changing world at the intersection of commodities, demographics, economics, energy, geopolitics, government debt & deficits, interest rates, markets, and money.

Being generous and aggressive in referring friends. Click the link to see the rewards where you can earn free paid subscriptions as well as the link to use for making referrals.

Thanks for the shout out!