U.S. Crude Oil Production at New All-Time High

Amid record global oil demand: An Intro to some crude oil market basics - Article 15

I. Why is this a topic now?

Drawing insights from Peter Zeihan's The Accidental Superpower and The Absent Superpower, we see a geopolitical landscape deeply influenced by energy dynamics. The US, defying some expectations, has hit a new record high in oil production in September and October of this year, coinciding with an unprecedented global demand for oil that was also unexpected by many. This synchronicity of events is a significant driver in Zeihan’s geopolitical expectations and a crucial pivot point in our global energy narrative.

II. What is historical and current US oil production?

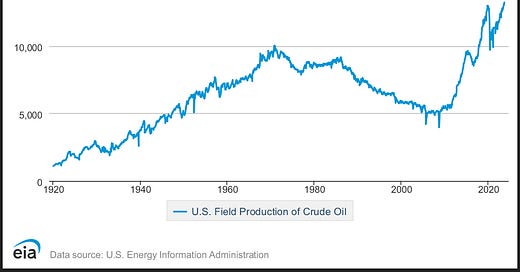

The tale of US oil production is a rollercoaster of innovation, geopolitics, and market forces from the humble beginnings of the 19th century to becoming a world leader in oil production that initially peaked in 1970, to production declining in half by 2005, exacerbating a significant vulnerability to the American way of life, to the shale revolution and re-taking the mantle of the largest producer in the world.

In the chart above, oil production peaked in October 1970 at 10 million barrels per day (mb/d). Production dropped below 5.0 mb/d in September 2005 at 4.2 mb/d and then again in September 2008 at 3.97 mb/d. Then came the shale revolutions that lifted output to new highs for the first time in November 2017 and peaked pre-Covid at 13.0 mb/d in November 2019. According to the latest EIA report on 11/30/23, U.S. production made new highs of 13.012 mb/d in August and then again in September at 13.236 mb/d.

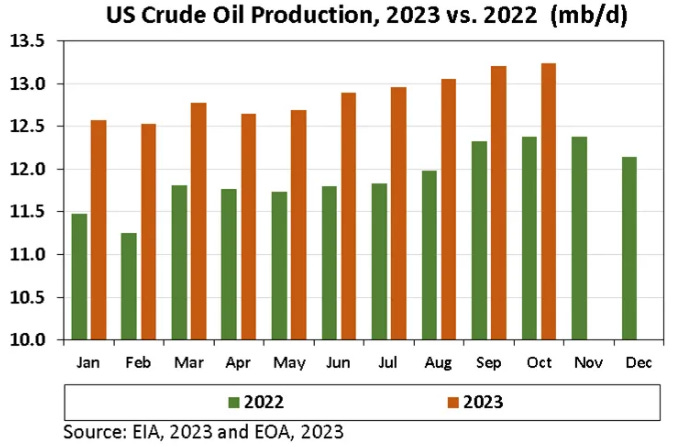

According to the highly regarded

of the Energy Outlook Advisors and Daily Energy Report, he expects yet another new high in October as per the chart below from the 11/30/23 DER:III. What is the U.S. crude oil export and import status?

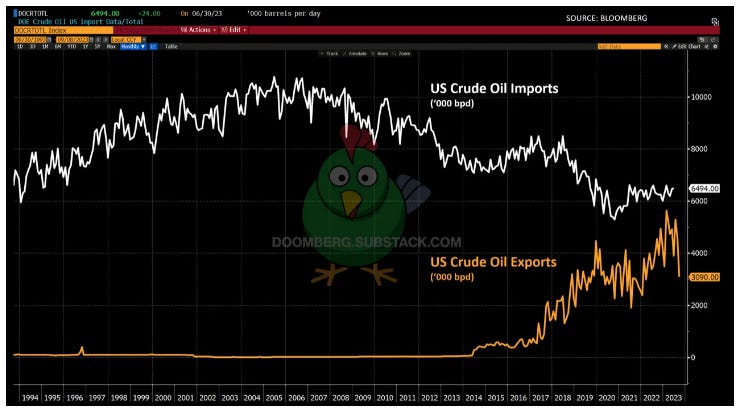

You may have heard that the United States is now a net energy exporter, as

published yesterday in an great article, The new American century, which is true as of 2019 for the first time since 1957.However, while oil is a big part of energy, energy also includes natural gas and petroleum products.

explains in Molecular Tourism that we are a substantial net importer of crude oil:“Despite reclaiming the mantle of the world’s largest producer of oil, the US still imports nearly 6.5 million barrels per day (bpd) of the stuff. At the same time, the country has grown to become a significant exporter of oil, crossing upwards of 5 million bpd in both 2022 and 2023. All this shuttling of barrels between borders seems rather inefficient, no? Why not just net things out domestically and import only what is needed? If only it were so easy…Unraveling the riddle requires an understanding that not all crude grades are created equal, each individual refinery is tantamount to a bespoke chemical plant, and the journey from crude oil to finished products like gasoline and diesel is not nearly as straightforward as many politicians believe.”

IV. What is historical global oil production?

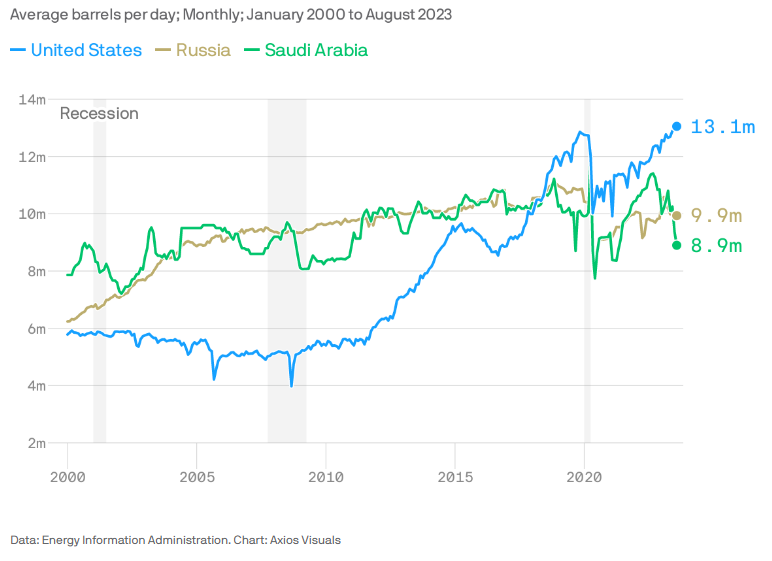

Thanks to the Axios AM newsletter yesterday morning (and

for his Tweet or X-post of it), here is a chart showing the historical production of the top three producers:In case you miss the significance of what this chart shows you, since the United States’ low point in production of just under 4 mb/d in 2008, the U.S. has added roughly the same amount of output as Saudi Arabia. Echoing Zeihan’s sentiment of geopolitical significance,

stated in his 12/6/23 Daily Energy Report:“Just imagine the world without the shale revolution. Where would oil prices be now? Would Europe be united against Russia? Would the US be able to impose sanctions on Iran and Venezuela? Would the US relations with Saudi Arabia be any different from what we have seen since Biden came to office? The economic and political impact of the shale revolution is of historic proportion, and that is why we call it a “revolution”. It is a failure of the US education system and the US media that citizens are unaware of the enormous positive impact shale (and oil/gas production more broadly) has had on their everyday lives.”

V. What is current global oil production?

According to Trading Economics, here is a list of the top 25 global producers:

As far as the current total global oil production, the EIA’s November 2023 Oil Market Report states: “Record output from the United States, Brazil and Guyana underpin this year’s 1.7 mb/d increase in global oil supplies, to a record 101.8 mb/d.”

VI. What about the OPEC cuts and spare capacity?

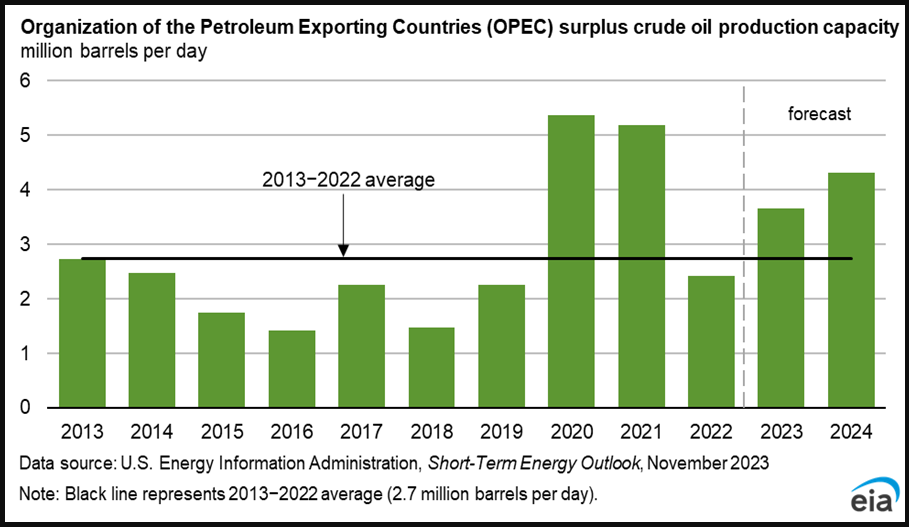

Of course, most of you have heard the news of recent OPEC meetings and some members’ commitments to voluntary cuts. When producers cut production, they create spare capacity. According to the EIA, OPEC countries will have approximately 4.3 mb/d in spare capacity held mainly by Saudi Arabia and the United Arab Emirates.

VII. What is the outlook for supply and demand?

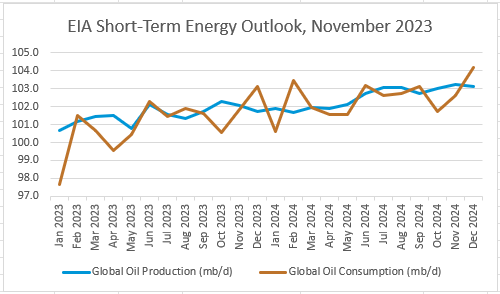

According to the EIA’s 11/7/2023 Short-Term Energy Outlook, here is what the global oil production and consumption is for 2023 and its forecast for 2024:

VIII. What are others saying?

We are anxiously awaiting the 2024 market outlook from

as his 2023 market outlook nailed it.The International Energy Agency (IEA, not to be confused with the U.S. Energy Information Agency or EIA) has been and continues to forecast peak demand for oil and other fossil fuels. However, Goehring & Rozencwajg point out that IEA has “chronically underestimated global oil demand in twelve of the fourteen years (including COVID-impacted 2020). Excluding 2020, the IEA increased demand by an incredible 800,000 b/d on average from its initial expectation. If the IEA’s error were a country, it would be the world’s 21st largest oil consumer.”

Goehring & Rozencwajg couldn’t be more opposite the IEA and more bullish on the demand side, and they articulate their case well for demand growing by 35% over the next 17 years (pages 4-8).

They are also bearish on supply, adding to their bullishness on prices:

IX: What are The X Project Guy’s comments?

I am running long and need to wrap up, so will add two more points. Much of the shale revolution was financed by much lower interest rates than today.

Secondly, there has been significant underinvestment in CAPEX as per

in the article I got something for ya (again). 114 years of capex - 2023 edition, and it takes many years to turn CAPEX into output:X. Why should you care?

If Goehring & Rozencwajg are correct and the global oil (and energy) markets are or will soon be in a structural deficit for years to come, or if Luke Gromen is right that we are past Peak Cheap Oil, or if Lyn Alden is correct, and many others, then we can expect extreme volatility in geopolitics, the economy, equity and bond markets, and energy prices. There is much there for The X Project to explore.

Please help ensure The X Project continues its mission of helping you know what you need to know at the X of commodities, demographics, economics, energy, geopolitics, government debt and deficits, interest rates, markets, and money.

Please consider a paid subscription. Until the end of the year, all paid subscriptions come with a free 60-day trial, and you can cancel any time. Every month, for the cost of two cups of coffee, The X Project will deliver ten articles per month ($1 per article), helping you know in 1-2 hours what you need to know about our changing world at the intersection of commodities, debt, deficits, demographics, economics, energy, geopolitics, interest rates, markets, and money.

If you see value in the articles published so far and you see value in the mission of The X Project, please be generous and aggressive in referring friends. Click the link to see the rewards as well as the link to use for making referrals

Please click on the heart icon at the bottom of this article if you like this (and previous) article(s). Please let me know why or how The X Project could better serve you if you did not. Please send me any recommendations, suggestions, critiques, or feedback at theXprojectGuy@gmail.com.

Thanks for the shout out!

Thanks for the @mention 🙌 ... and someone, somewhere will have to start filling up the SPR at some point which will impact demand.