"Not QE QE" and "Not YCC YCC"

Michael Howell's Latest Thoughts on Liquidity and Markets - Article #91

In this 14-minute article, The X Project will answer these questions:

I. Why this article now?

II. What is the driver of asset prices globally?

III. What is “not QE QE” and “not yield curve control yield curve control”?

IV. What is the “Maturity Wall” we should be concerned about?

V. Should we be worried about inflation?

VI. What are China’s challenges, according to Howell?

VII. How vulnerable is the U.S. Treasury market?

VIII. What are the long-term implications of ‘stealth’ monetary easing?

IX. What does The X Project Guy have to say?

X. Why should you care?

Reminder for readers and listeners: nothing The X Project writes or says should be considered investment advice or recommendations to buy or sell securities or investment products. Everything written and said is for informational purposes only, and you should do your own research and due diligence. It would be best to discuss with an investment advisor before making any investments or changes to your investments based on any information provided by The X Project.

I. Why this article now?

Two weeks ago, I wrote, “The Dollar and Other Financial Markets are on the MOVE! Examining recent market moves, correlations, and breakdowns,” in which I highlighted the bond volatility MOVE index had ripped from a low of 90 during the last week of September to over 120. This past Friday, it closed at 135.

This means that stress is building in the U.S. Treasury market. As we have seen in five previous episodes since 2019 when stress has reached similarly high levels, the Fed and/or the Treasury supply dollar liquidity to ease the stress.

This is an excellent reason to check in with Michael Howell, the CEO of CrossBorder Capital, who is considered by many to be the foremost expert on global liquidity and its impact on markets. I introduced him to The X Project readers earlier this year in “The Rising Tide of Global Liquidity Lifting All Assets—Michael Howell's Powerful Analysis and Provocative Forecast.” It is an excellent idea to revisit that article, as it is a good foundation for what will be discussed in this article.

Here are six recent YouTube videos I watched for this article:

“A Concerned Fed Will Drive Liquidity & Markets Higher | Michael Howell” on Wealthion (September 18, 2024 with 33,520 views)

“Michael Howell: Did The Fed Just Make A Mistake?” on The Lead-Lag Report (September 19, 2024 with 11,750 views)

“FNArena talks with CrossBorder's Michael Howell on global liquidity driving gold, financial markets” on FNArena Videos (September 26, 2024 with 5,818 views)

“Get Long China? | Michael Howell” with Jimmy Connor (September 28, 2024 with 70,795 views)

“Liquidity Drain Threatens To Disrupt Markets In 2025 | Michael Howell” with Adam Taggart on Thoughtful Money (October 17, 2024 with 45,151 views)

“BRICS Weaponizing GOLD, Dollar Under Attack | Michael Howell” on Soar Financially (October 21, 2024 with 17,069 views)

Given what has been happening in the U.S. Treasury market, I put extra emphasis on the most recent two.

II. What is the driver of asset prices globally?

Howell emphasizes that liquidity is a central driver of asset prices globally. Since 2022, liquidity has been injected steadily into markets, even when central banks, like the Federal Reserve, publicly maintained a stance of tightening. The "not QE QE" operations in the U.S. are a subtle form of liquidity infusion despite quantitative tightening, which Howell attributes to a need to stabilize the bond markets and maintain government financing channels. These measures show how significant liquidity injections are in sustaining financial markets.

Howell’s liquidity index demonstrates a cyclical trend, with the current liquidity cycle expected to peak by late 2025.

As liquidity wanes, particularly in 2026, Howell anticipates a shift in asset performance due to reduced liquidity injections. This anticipated shift serves as a warning for market participants about potential headwinds as liquidity levels decline.

Despite favorable market conditions in 2024, Howell warns that the landscape could change significantly as this liquidity wave recedes. Investors should prepare for this shift by considering liquidity-sensitive assets, such as gold and high-quality equities, that may better withstand reduced liquidity. Liquidity dynamics play a crucial role in financial market movements, and Howell stresses the importance of monitoring central bank policies and broader economic conditions for future trends.

III. What is “not QE QE” and “not yield curve control yield curve control”?

"Not QE QE" describes actions by central banks that effectively increase market liquidity despite official claims of quantitative tightening (QT) or no active QE policy. While traditional QE involves central banks purchasing long-term securities to inject liquidity directly into the financial system, "Not QE QE" encompasses subtler, often less transparent measures that achieve similar outcomes. Examples Howell gives include:

Fed Balance Sheet Adjustments: Specific operations in the Fed's balance sheet, especially since the British gilt crisis in 2022 and the Silicon Valley Bank (SVB) collapse in 2023, have provided liquidity even as the Fed publicly commits to reducing its balance sheet. These adjustments indirectly reflect an easing of monetary conditions.

Treasury General Account (TGA) Operations: The Fed runs down the TGA balance (the Treasury's account at the Fed), effectively pushing liquidity into the market. When the TGA is lowered, funds flow back to the banking system, boosting reserves and liquidity.

Reverse Repo Facility Usage: Adjusting the volume in the reverse repurchase (repo) facility manages short-term liquidity levels. For example, changes in reverse repo volumes can redirect liquidity into financial markets, supporting the broader economic environment similarly to traditional QE.

These actions increase liquidity to benefit risk assets and reduce financial stress, even as they are presented as neutral or standard policy measures, thus earning the "Not QE" label.

Similarly, "Not Yield Curve Control Yield Curve Control" involves manipulating the shape of the yield curve without overtly declaring a yield curve control policy. Yield curve control typically entails setting targets for different points on the yield curve to ensure borrowing costs remain low, commonly done by central banks buying specific maturities to cap yields.

Howell notes that recent U.S. Treasury issuance strategies resemble this form of control:

Shorter-Dated Issuance: The U.S. Treasury has issued more short-term debt (bills) than longer-term notes or bonds. By focusing on short-term securities, the Treasury influences the yield curve indirectly by depressing longer-term rates, as the demand for these bonds pushes yields down without explicit intervention.

Treasury Buybacks and Liquidity Management: The Treasury has also implemented buybacks of less liquid, longer-term securities while issuing new, more liquid short-term ones. This keeps the yield curve stable and influences market expectations without a formal yield curve control announcement.

By manipulating debt issuance and managing market liquidity indirectly, the Fed and Treasury attempt to control the yield curve’s behavior without announcing a formal YCC policy, which Howell dubs "Not Yield Curve Control Yield Curve Control."

IV. What is the “Maturity Wall” we should be concerned about?

Howell introduces the concept of a “maturity wall” – the anticipated increase in global debt refinancing needs. With an estimated $350 trillion in global debt, approximately $50 trillion must be rolled over annually. Howell warns that as interest rates remain high, this refinancing will significantly strain economies and financial markets by drawing liquidity away from other assets.

Corporations facing higher debt costs may struggle to refinance effectively. This issue is particularly concerning for sectors heavily reliant on borrowing, as they could be forced to cut costs or even restructure. Howell sees 2025 as a critical year as markets begin to feel the weight of this maturity wall, ultimately challenging both corporate and sovereign borrowers.

The maturity wall reflects Howell’s broader thesis about the economic shift from growth-oriented financing to debt refinancing. Rather than funding new capital investments, markets are increasingly dominated by the need to refinance existing debt. This shift could limit economic growth and investment in productive assets, impacting long-term global financial stability.

V. Should we be worried about inflation?

Howell notes that ongoing liquidity injections through “not QE” policies have fueled concerns about rising inflation. Although central banks claim inflation remains under control, Howell points to evidence suggesting it may be understated. He argues that ‘true’ inflation, adjusted for these interventions, may be closer to 3%, a rate higher than official figures imply.

This understated inflation could lead policymakers to misjudge economic stability. Howell indicates that Treasury and other government securities are priced based on artificially low inflation expectations, driven by the Fed's manipulation of market signals through these "not QE" interventions. These skewed metrics risk misinforming investors and governments alike.

Howell sees the potential for inflation to reemerge as a destabilizing factor, particularly as the FED may be forced to taper its interventions if inflation rises significantly. Higher inflation could further strain liquidity, exacerbating the maturity wall's challenges. Investors should consider assets that hedge against inflation, such as Treasury Inflation-Protected Securities (TIPS), gold, and real estate.

VI. What are China’s challenges, according to Howell?

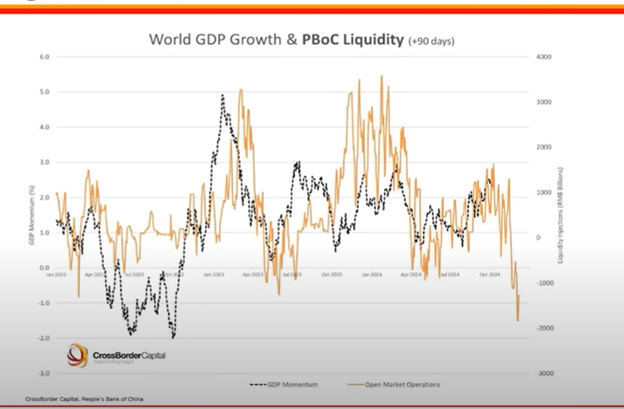

Howell analyzes China’s economic challenges in-depth, describing the country’s model as “red capitalism.” Initially, China relied heavily on exports to fuel its economy, but this approach is now faltering. With high domestic debt levels and restrictions on capital flows, China is in a precarious position, facing economic deceleration and deflationary pressures.

China’s approach to managing its debt differs from that of Western economies. It has implemented conservative fiscal measures rather than loosened monetary policy to stimulate growth.

This restraint limits its ability to counteract domestic economic weaknesses and risks exacerbating global financial instability. Howell underscores the importance of closely monitoring China’s policies, as these decisions can impact global liquidity, especially in emerging markets.

As China’s economy slows, its demand for commodities and capital imports could decrease, affecting global trade partners. Additionally, Howell suggests that if China eventually devalues its currency, this shift could increase volatility in global currency markets. Investors should be aware of the interconnectedness of global economies and the potential for China’s slowdown to create ripple effects across international markets.

That concludes Section VI. I have hit a new paid subscriber threshold, so you must now be a paid subscriber to view the last four sections:

VII. How vulnerable is the U.S. Treasury market?

VIII. What are the long-term implications of ‘stealth’ monetary easing?

IX. What does The X Project Guy have to say?

X. Why should you care?

If you haven’t done so already, use your free, single-use “unlock” feature to view the rest of this article.

The X Project’s articles always have ten sections. Soon, after a few more articles, the paywall will move up again within the article so that only paid subscribers will see the last five sections, or rather, free subscribers will only see the first Five sections. Please consider a paid subscription.

All paid subscriptions come with a free 14-day trial; you can cancel anytime. Every month, for just the cost of two cups of coffee, The X Project will deliver a weekly article every Sunday, helping you know in a couple of hours of your time per month what you need to know about our changing world at the interseXion of commodities, demographics, economics, energy, geopolitics, government debt & deficits, interest rates, markets, and money.

You can also earn free paid subscription months by referring your friends. If your referrals sign up for a FREE subscription, you get one month of free paid subscription for one referral, six months of free paid subscription for three referrals, and twelve months of free paid subscription for five referrals. Please refer your friends!