The Capital Rotation Event is Almost Here

Revisiting the Technical Analysis of Northstar & Badcharts - Article #129

In this 12-minute article, The X Project will answer these questions:

I. Why this article now?

II. What does their technical analysis say about stock markets?

III. What does their technical analysis say about silver?

IV. Gold and silver miners?

V. Uranium miners?

VI. Oil?

VII. Bond yields?

VIII. Bitcoin?

IX. What does The X Project Guy have to say?

X. Why should you care?

However, this article contains a couple dozen charts that you will probably want to spend a least a few minutes studying each one.

Reminder for readers and listeners: nothing The X Project writes or says should be considered investment advice or recommendations to buy or sell securities or investment products. Everything written and said is for informational purposes only, and you should do your own research and due diligence. It is recommended to consult with an investment advisor before making any investments or changes to your investments based on information provided by The X Project.

I. Why this article now?

Last week in “Navigating Uncharted Territory,” I wrote about “Gold's Historical Rise and How Long It Can Continue.” In Section VIII of that article, I highlighted the technical analysis of Northstarbadcharts.com, of which I am a paid subscriber. However, these guys a fairly profilic and open with posting a lot of their work for free on X @NorthstarCharts and @badcharts1 . I first introduced their work in these articles:

It would be good to review those articles and see what their charts show then vs. what has happened since and what we know now.

In any event, with two trading days left in the quarter and before the quarterly charts close out their current bar, this is a great time to revisit their work not only as it relates to the capital rotation event that they predict, but also many of the markets and positions aligned with the investment themes to which I subscribe.

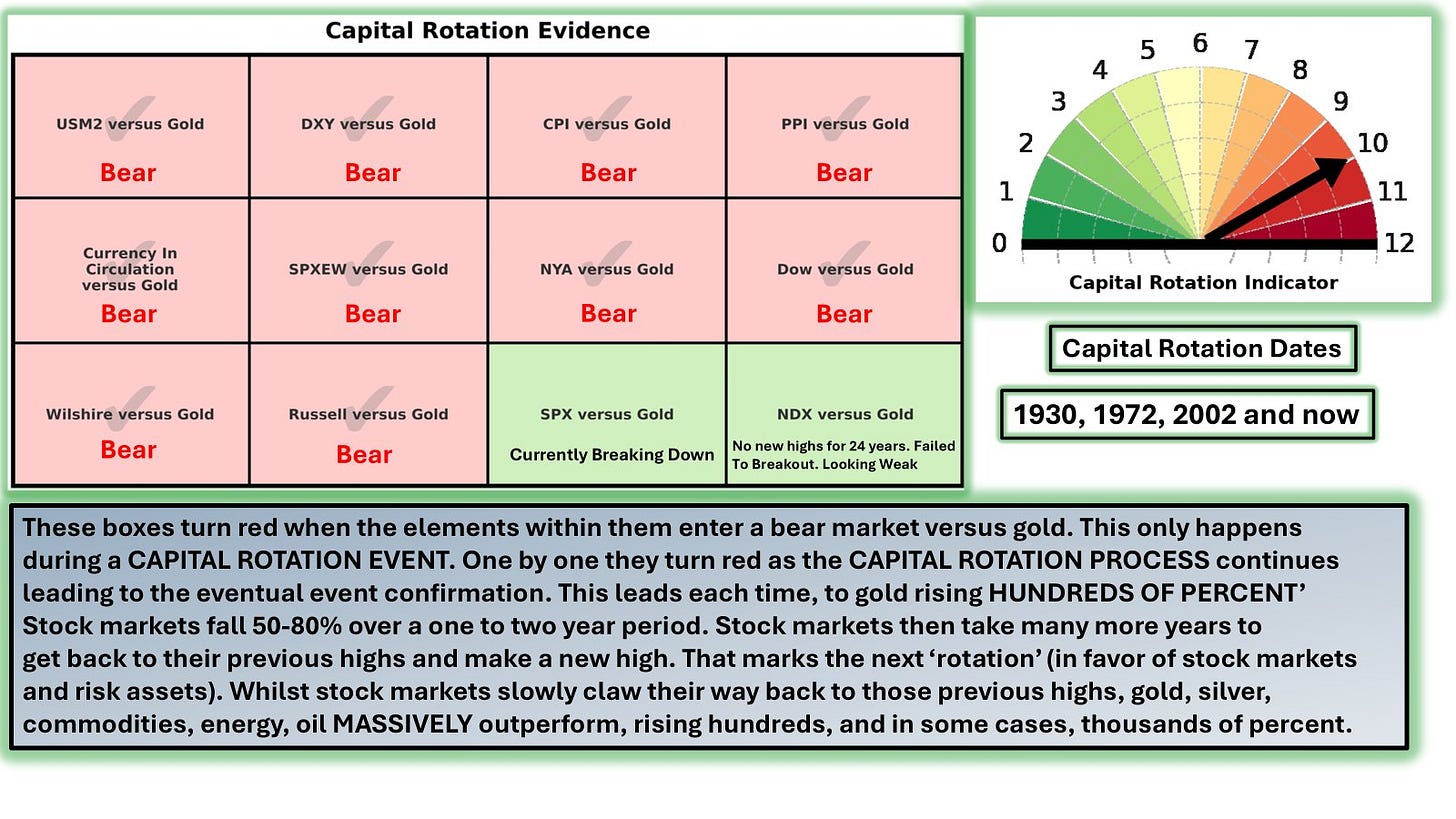

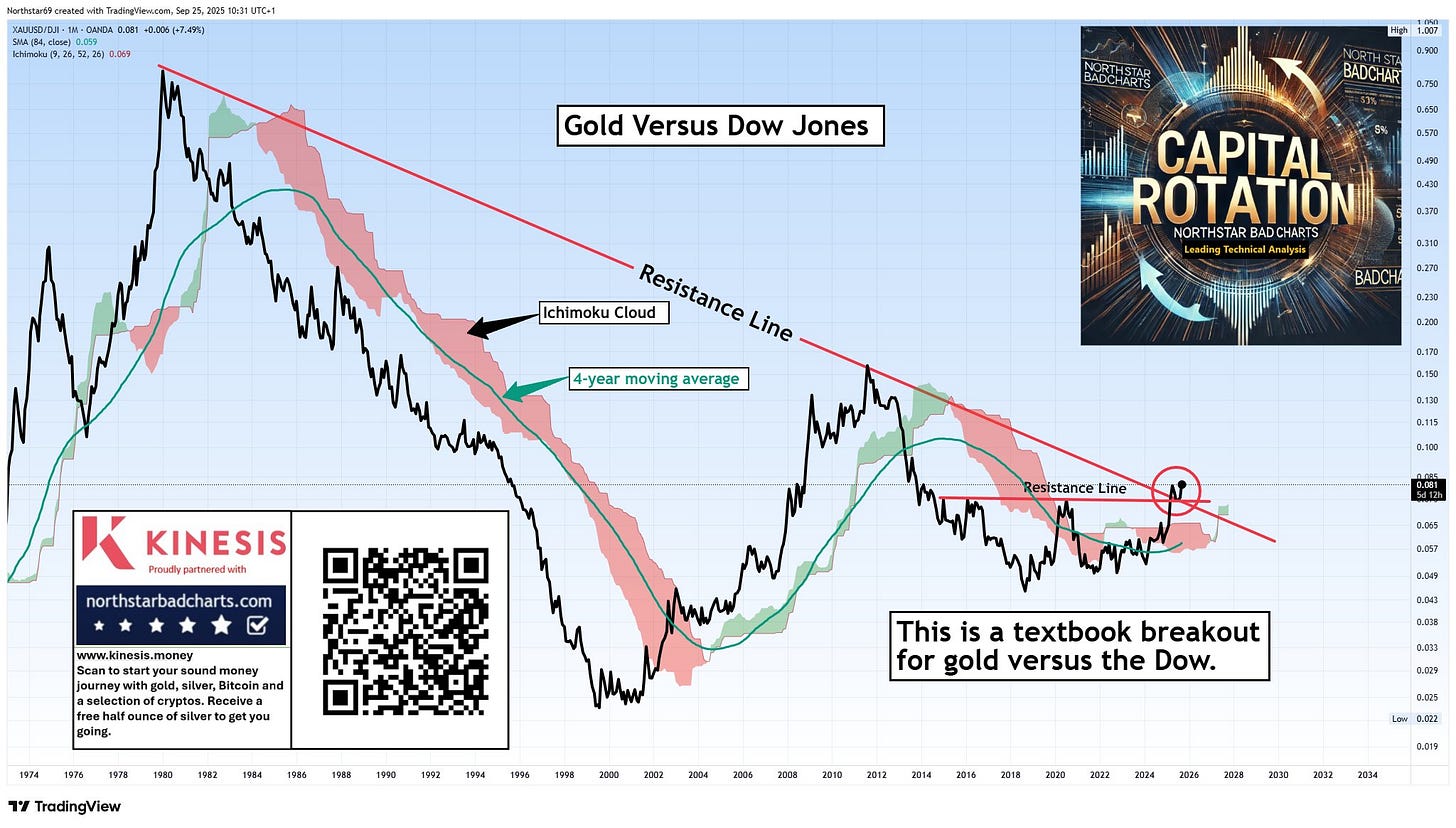

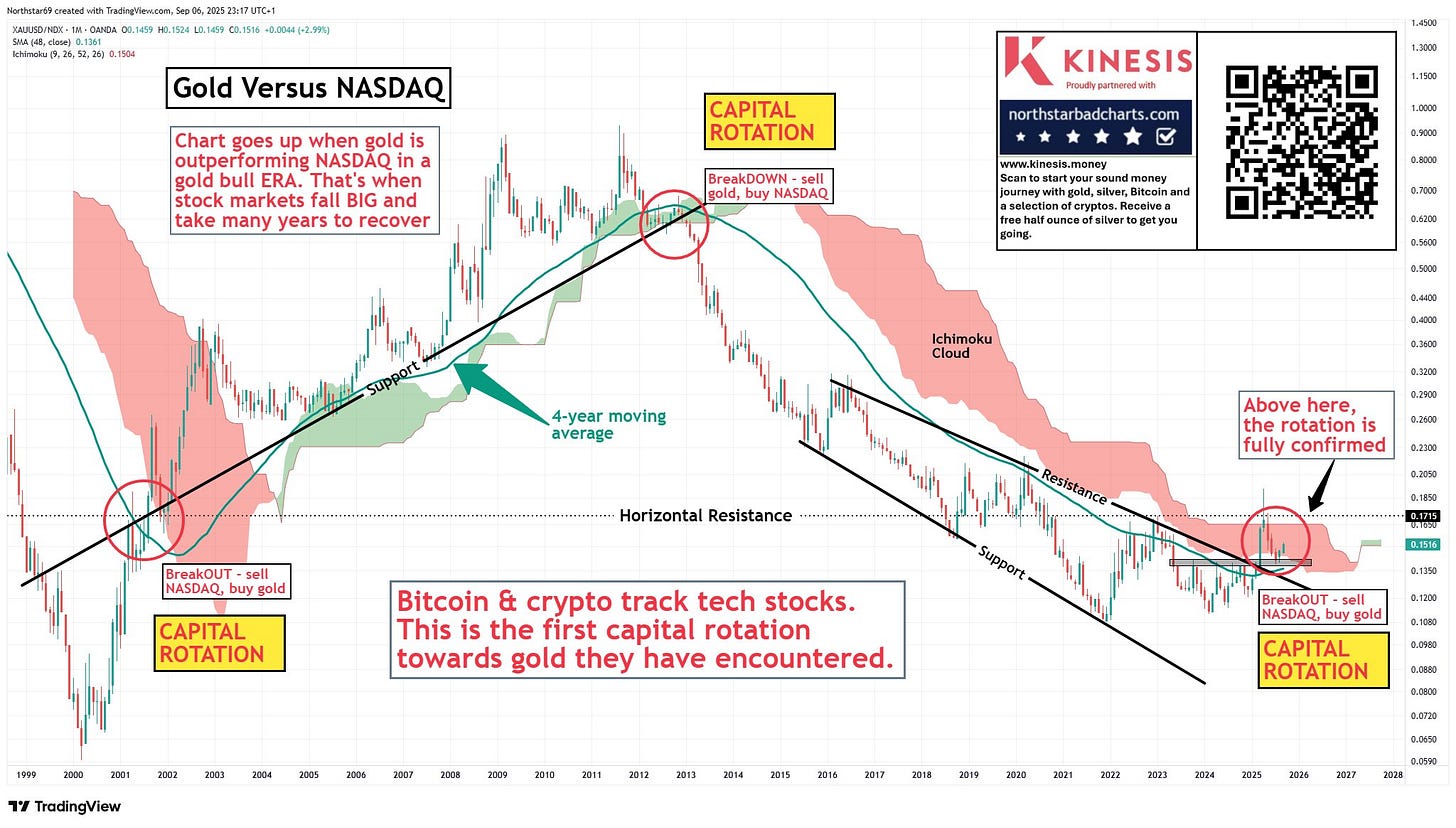

As the table above shows, we are simply awaiting final confirmation of the capital rotation event, in which capital rotates out of broader stock markets and into precious metals and other physical, hard-asset, commodities.

II. What does their technical analysis say about stock markets?

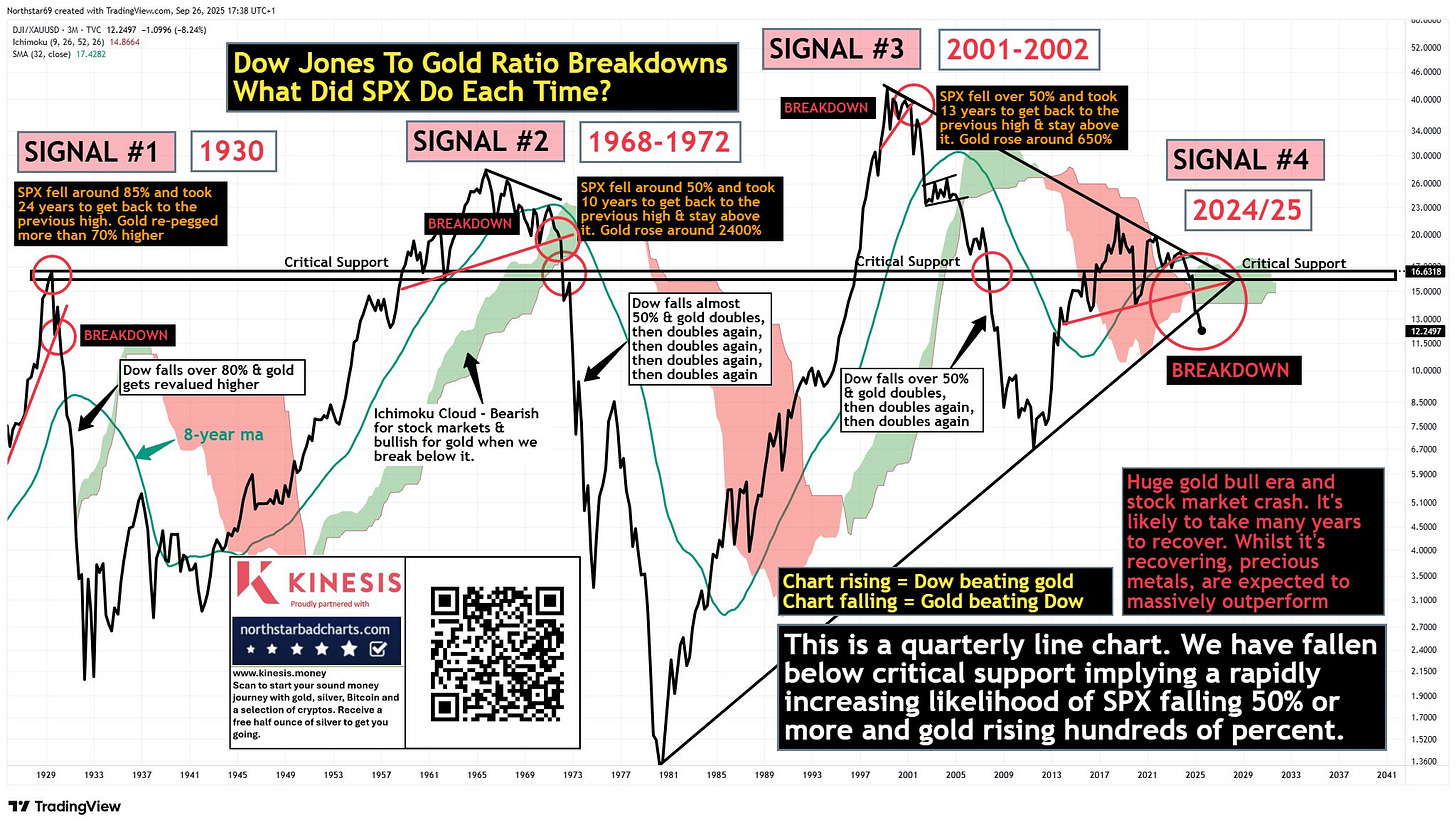

“Dow versus gold - Unless this reverses dramatically by Tuesday, it's done, beyond debate.”

“Your financial future depends on you understanding what this chart is telling you.”

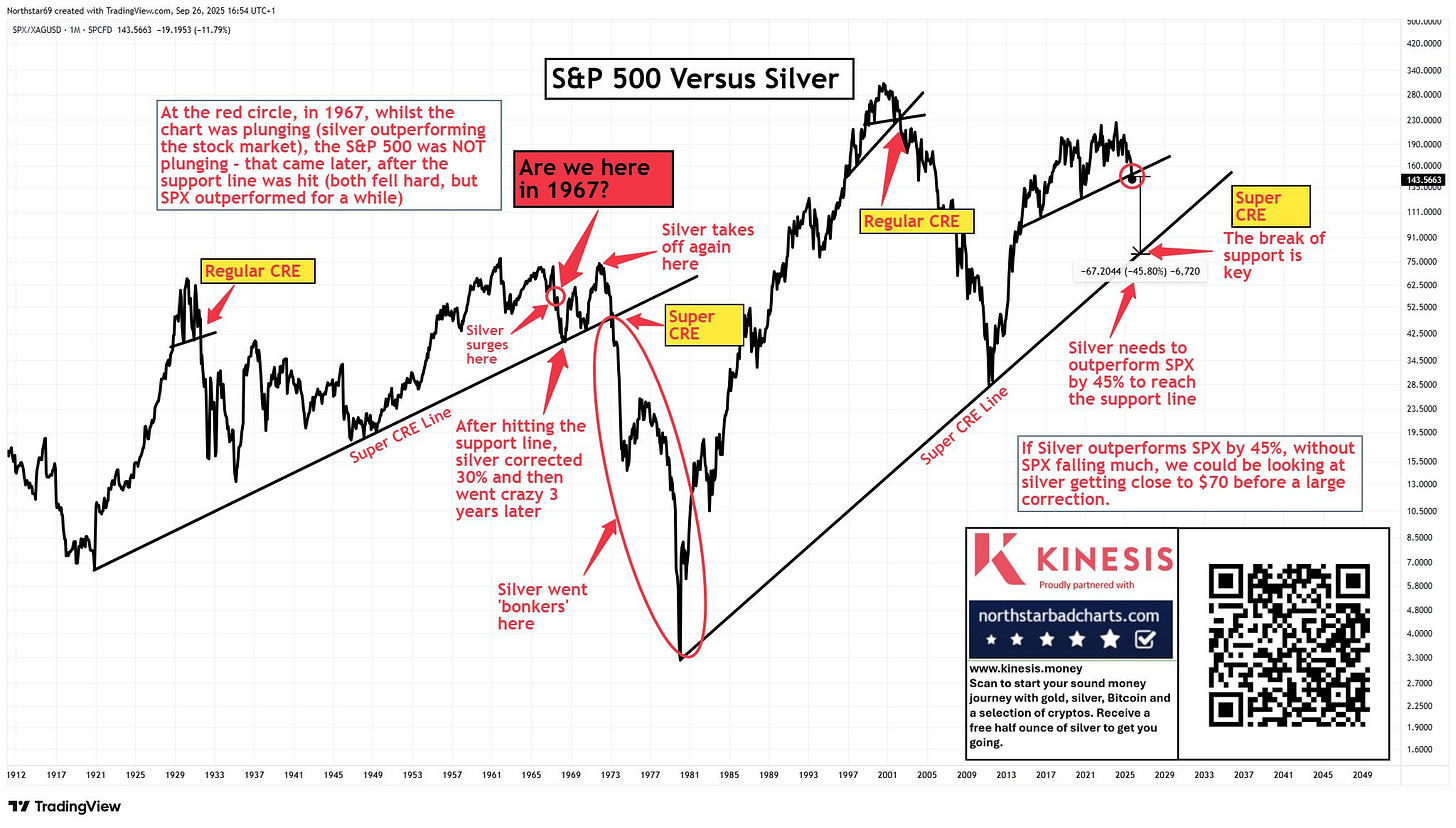

III. What does their technical analysis say about silver?

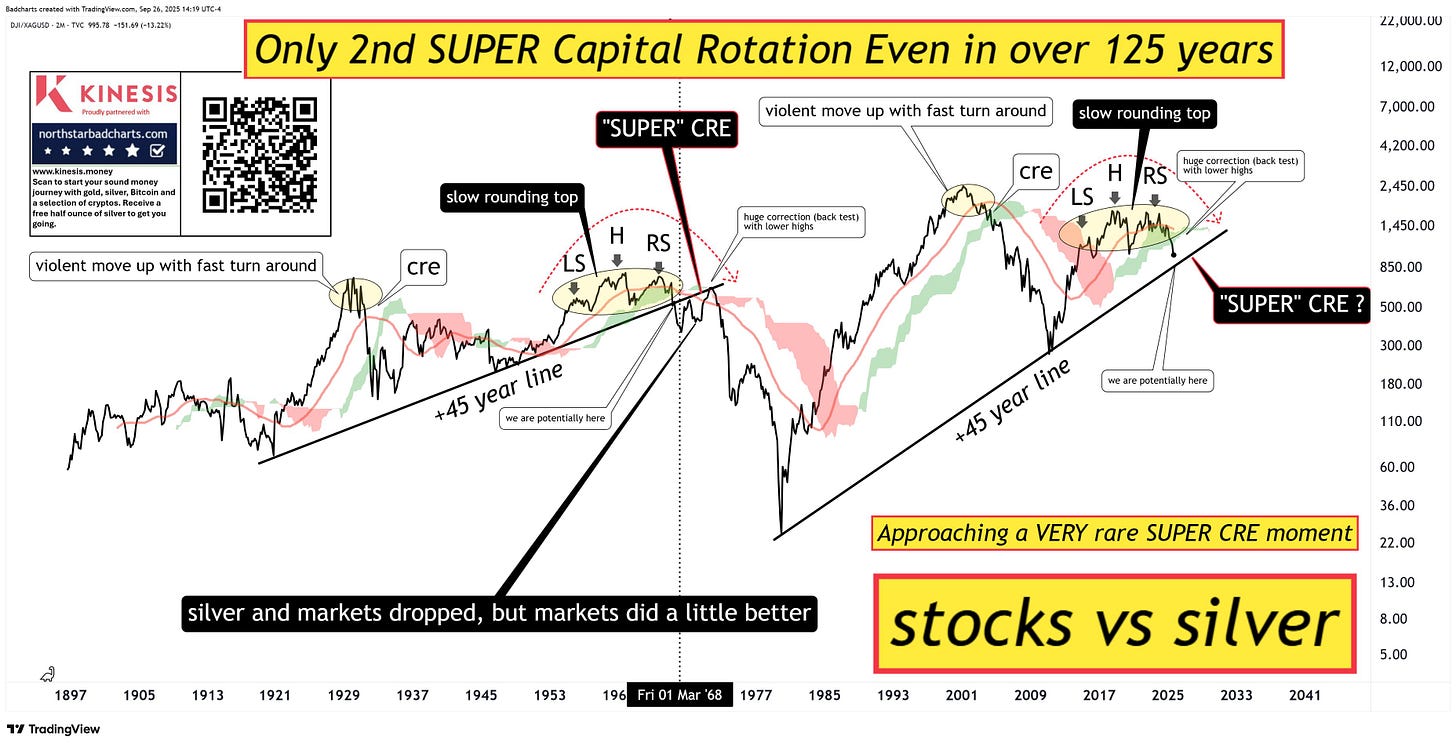

“We are close to a very RARE and HISTORICAL event.

This would be only the 2nd time in over 125 years that we get a "SUPER" Capital Rotation Event.

Stock markets get destroyed when adjusted for inflation...

While gold, silver and friends enjoy their BEST years of outperformance!”

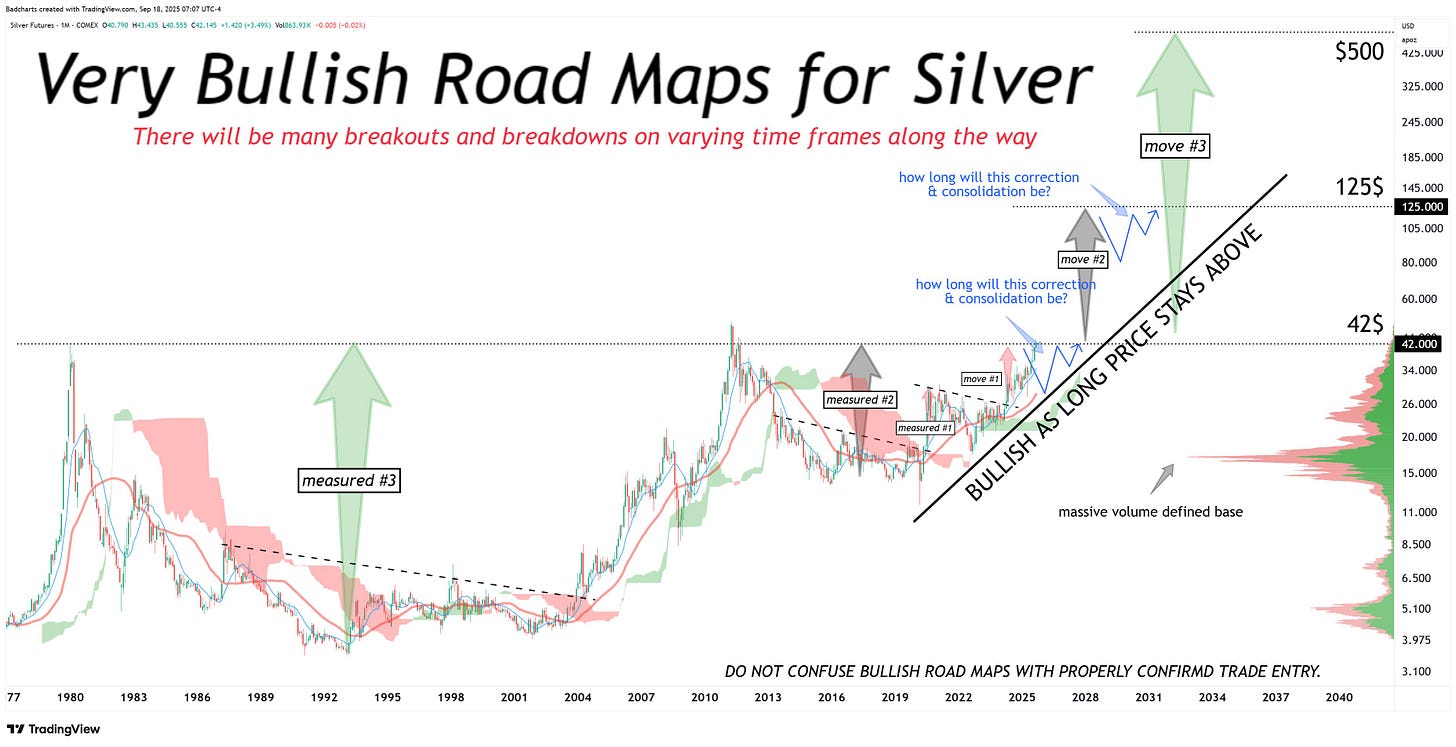

“Silver”

“My longer term roadmap for silver reached the first $42 target.

Was $22 back when I annotated this chart in late January 2024, over 20 months ago.

Yes, this chart shows some very bullish roadmaps for silver with targets up to $500/oz!”

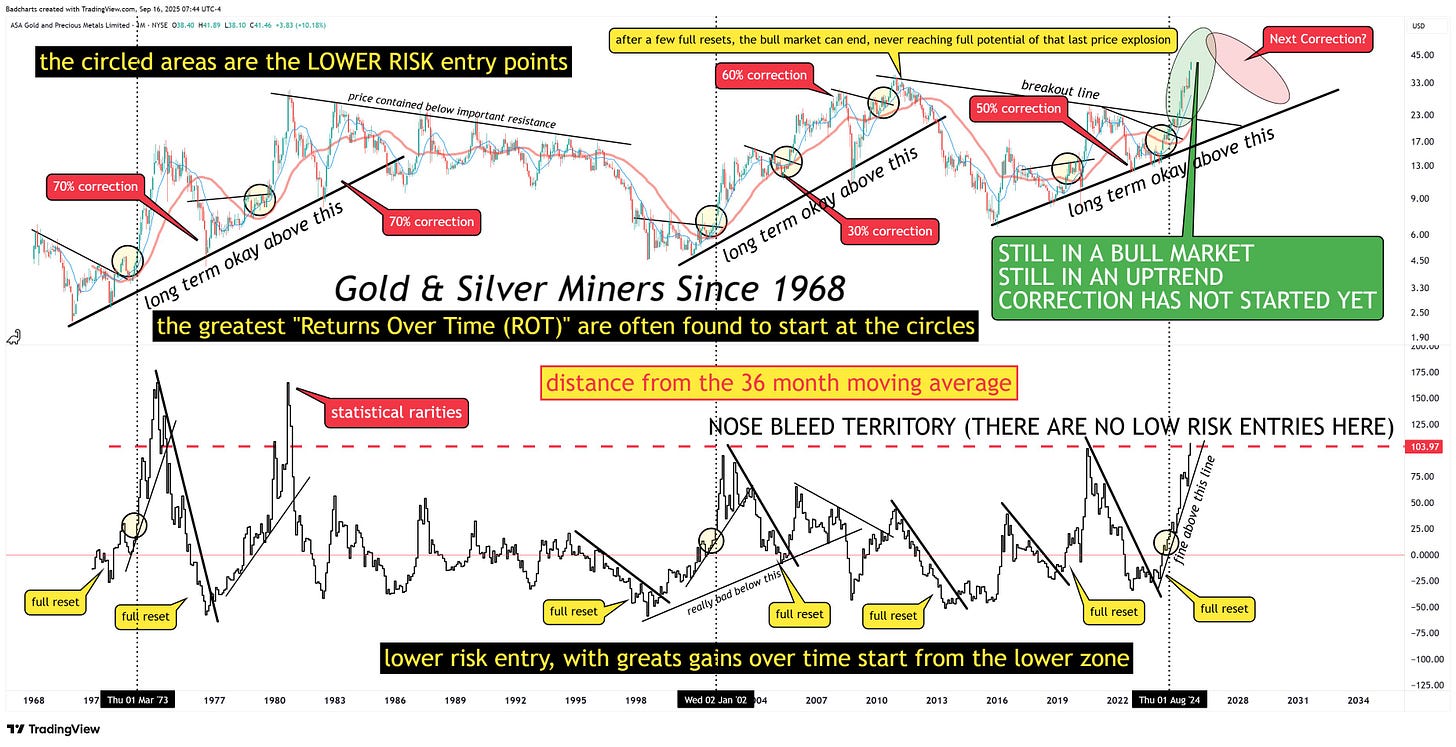

IV. Gold and silver miners?

“My comments come from objective & unbiased analysis.

I built this detailed long-term roadmap for the gold and silver miners to help you.

LOW risk entries are NOT found here.

Important CORRECTIONS can be found here, but has NOT STARTED YET.”

“HECLA - THIS IS HISTORIC. Symptomatic of the entire precious metals mining space right now.”

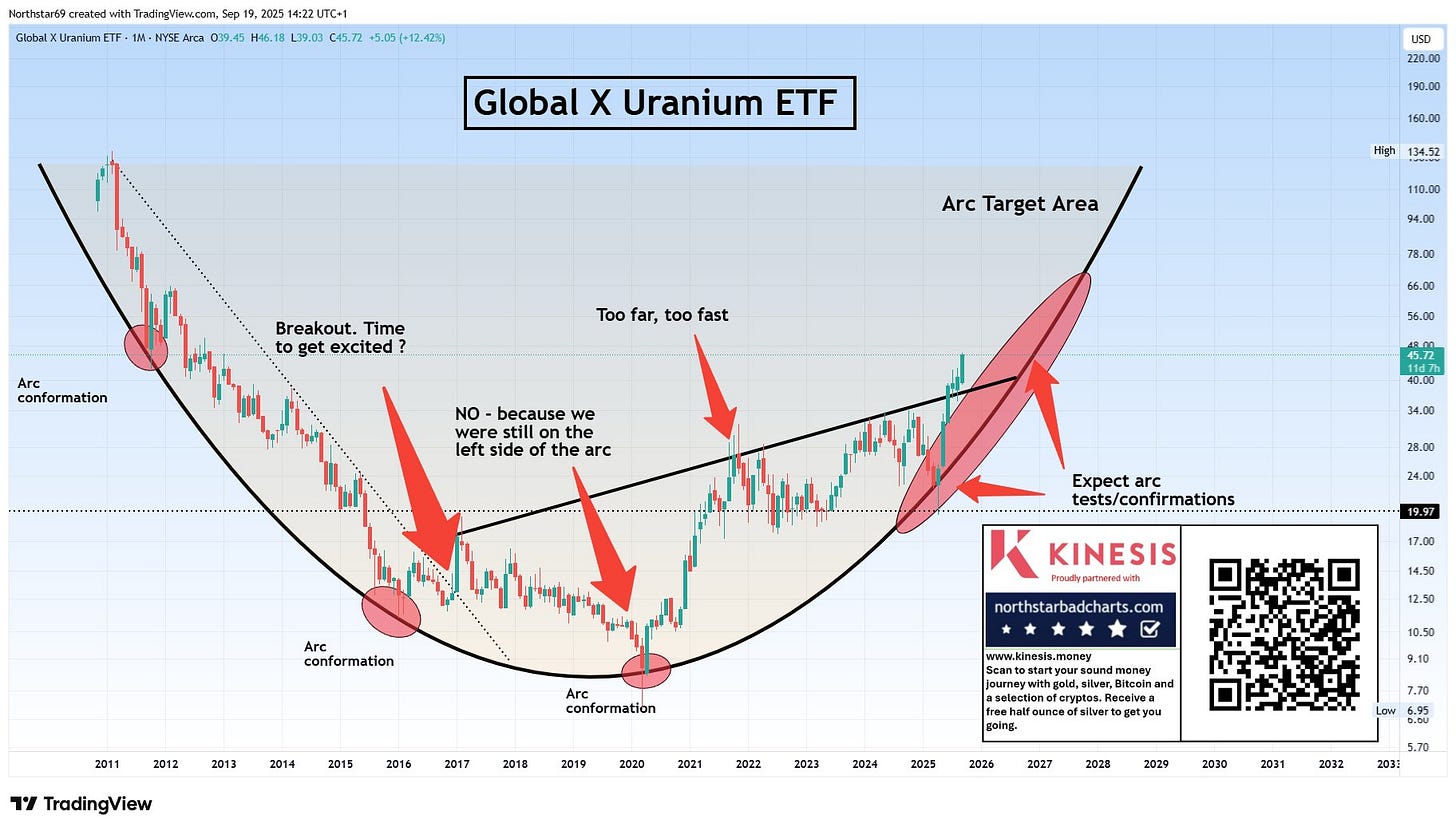

V. Uranium miners?

VI. Oil?

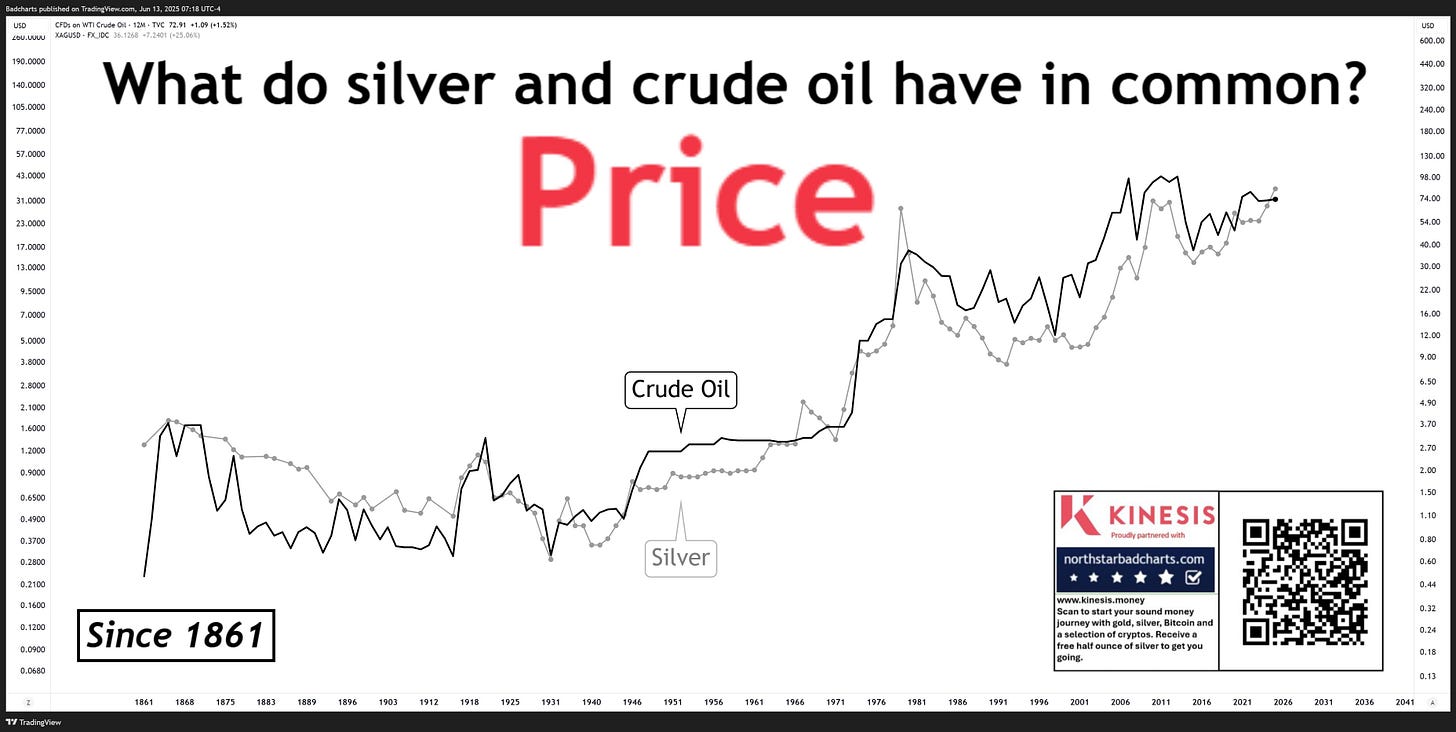

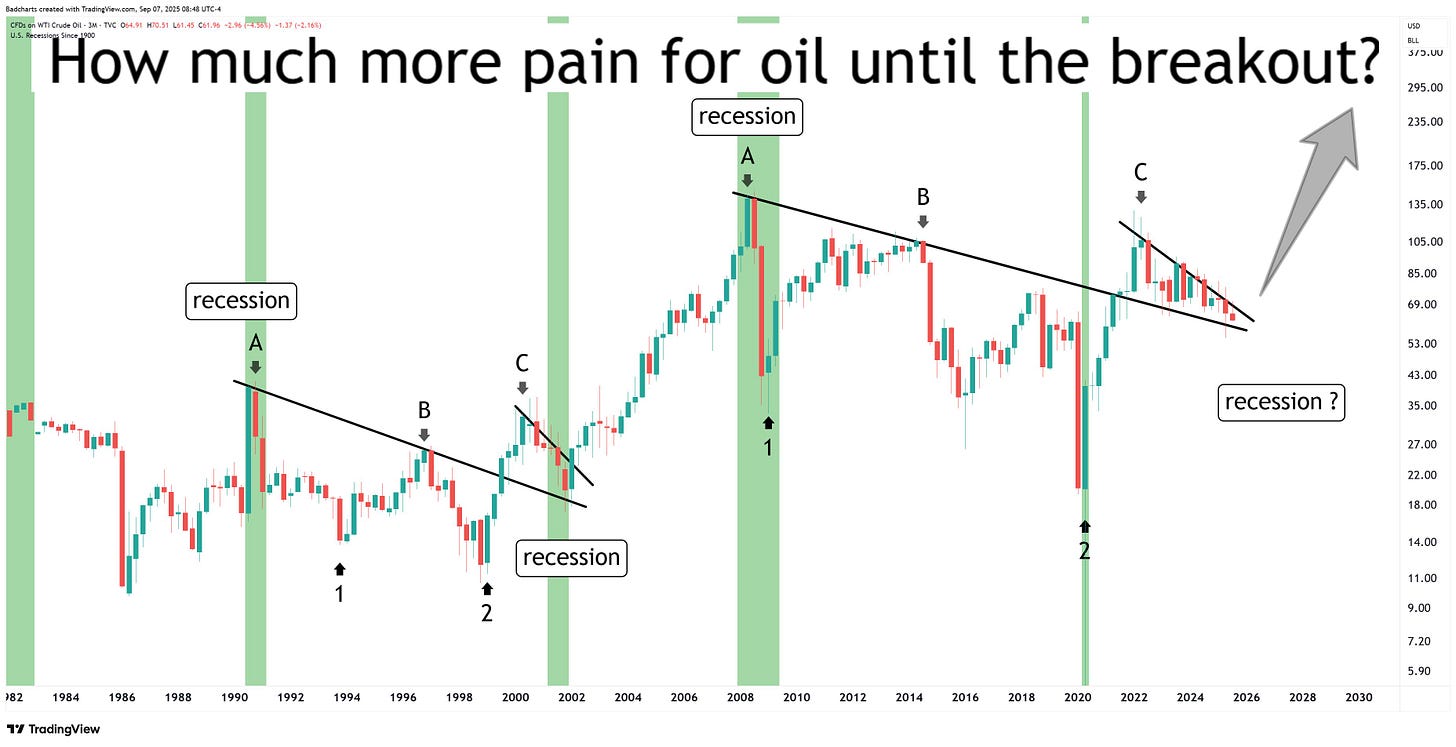

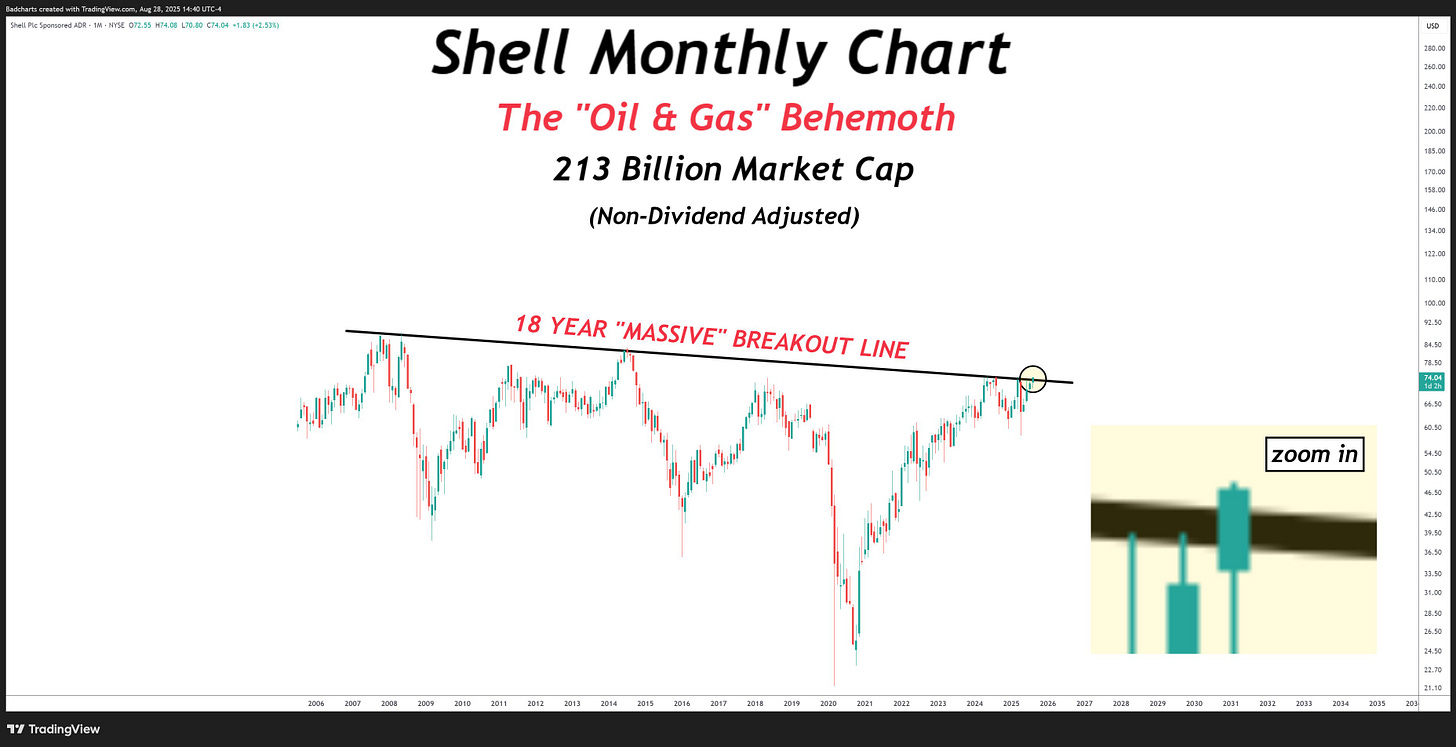

“If you are bullish on silver and gold, then you have to be bullish on oil.

“The road map for $300 crude oil.”

You won't see too many of these crazy chart patterns out in your lifetime!

Don't take my word for it, just check out the monthly chart for Shell Oil below...”

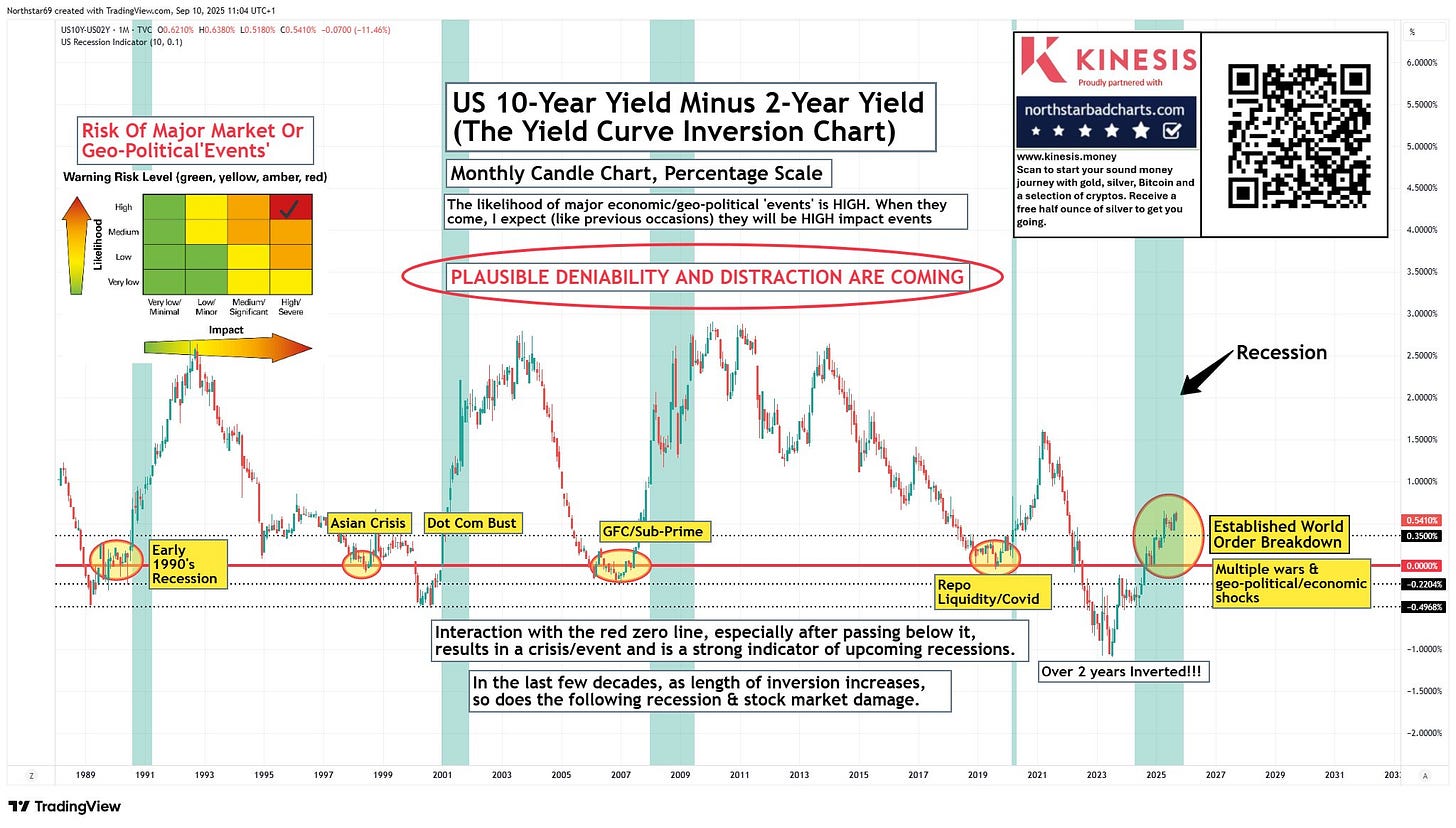

VII. Bond yields?

“It all makes sense now...here's the backfilled recession.”

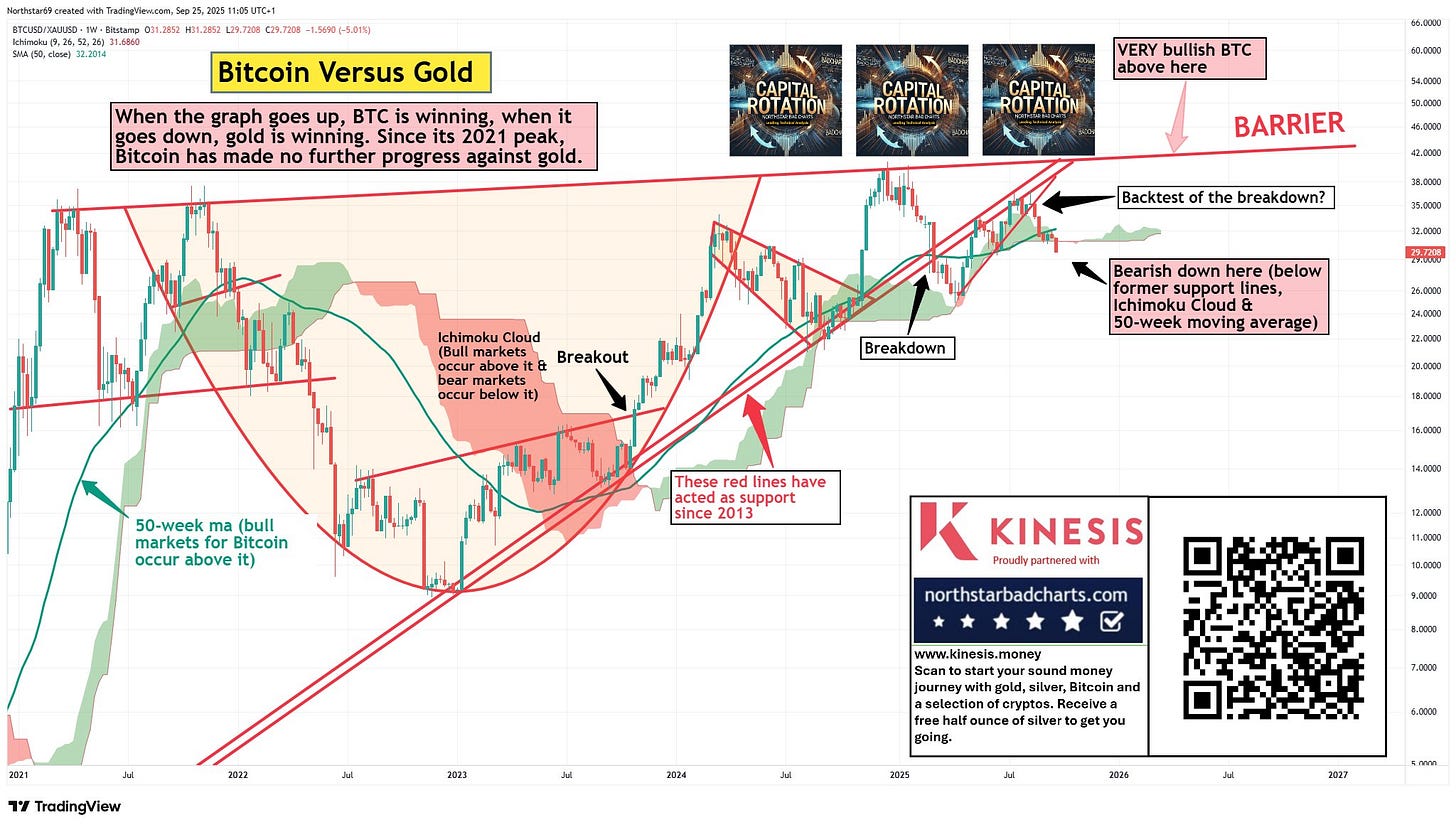

VIII. Bitcoin?

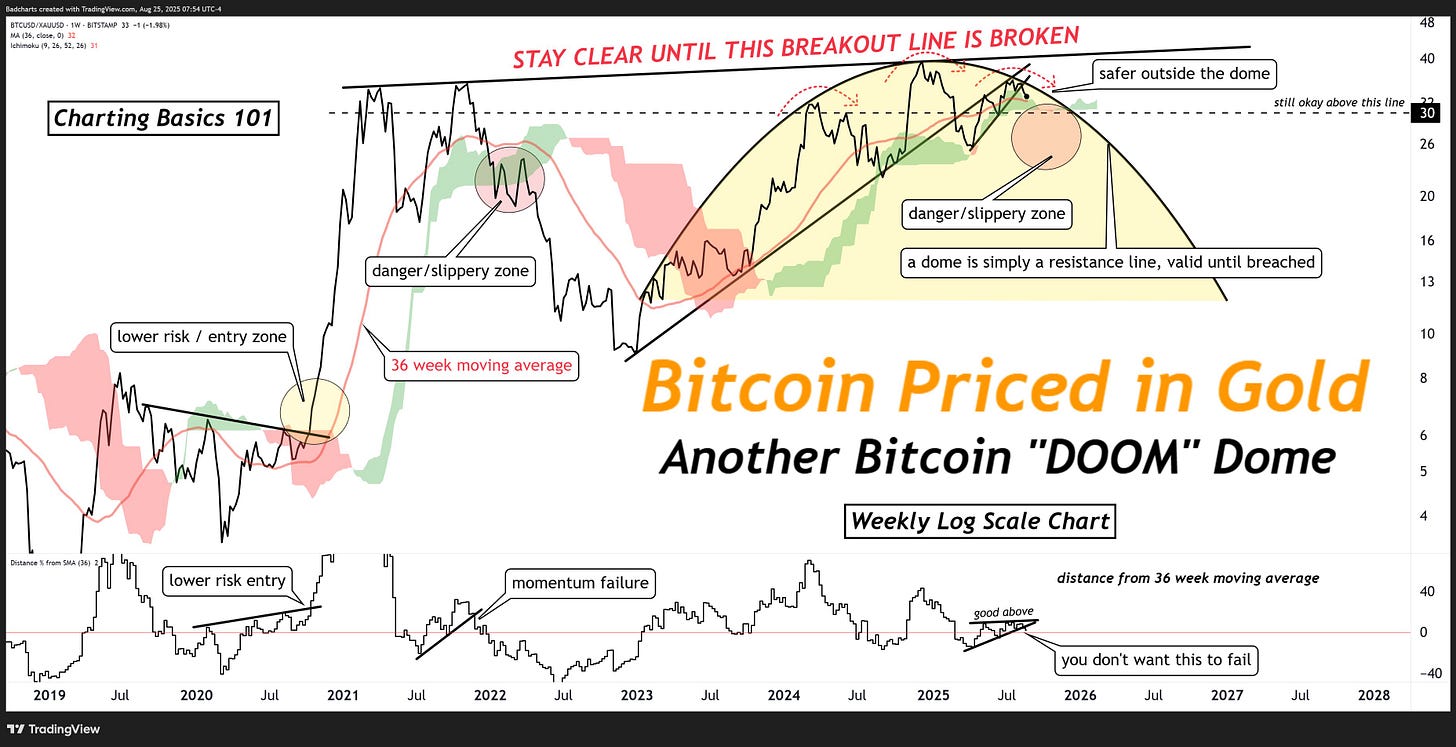

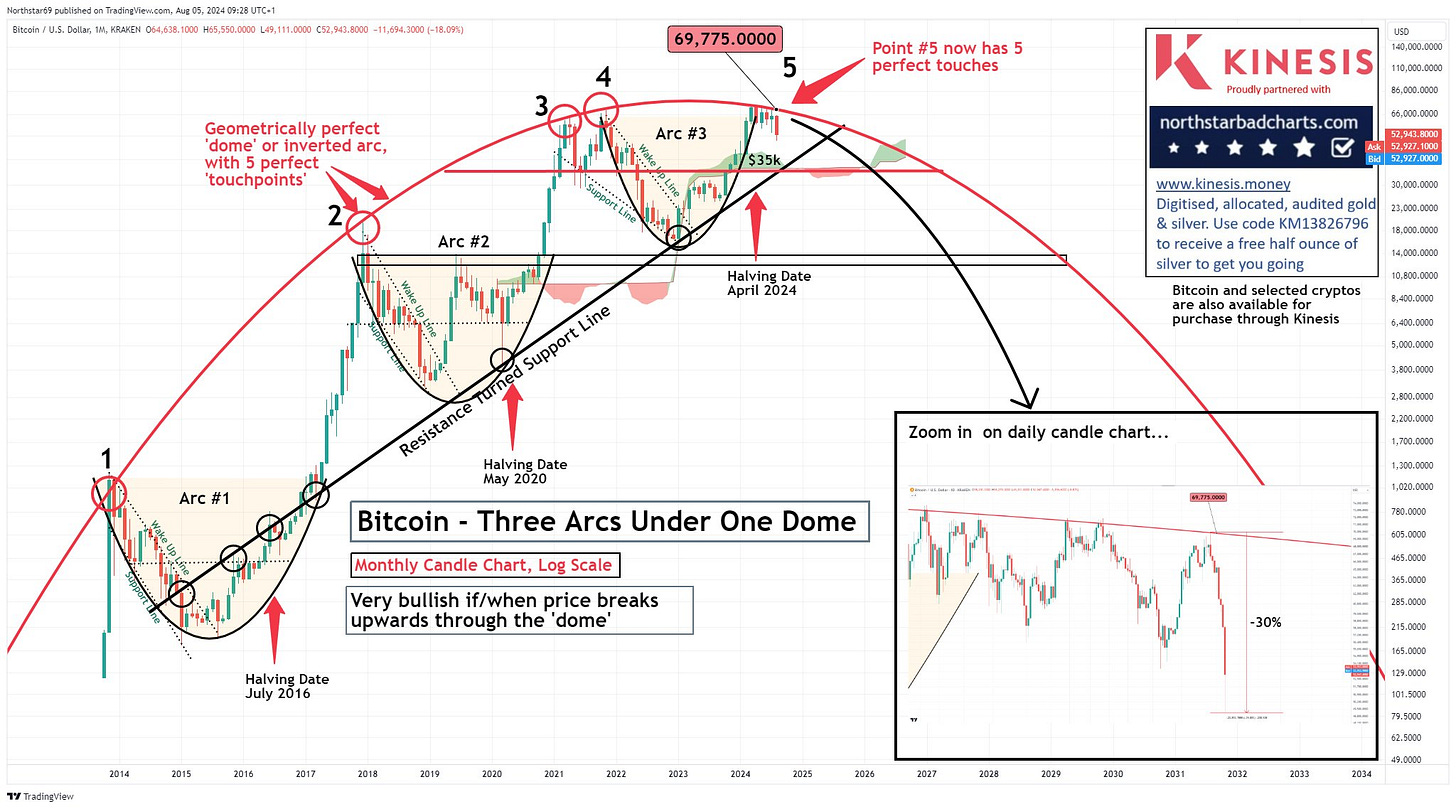

“Yes, here is another Bitcoin "DOOM" dome !!!

This time priced in gold, on the weekly time frame.

Take your time to read properly.”

IX. What does The X Project Guy have to say?

First, I have been trading and studying charts and technical analysis for thirty years. I discovered these guys a couple of years ago, and they were the first ones I came across that advocated for using logarithmic scales. They argue that logarithmic scales are superior for market price analysis because they represent price changes as percentages, providing a proportional view that accurately reflects performance over time, unlike linear scales which emphasize absolute dollar amounts. This percentage-based approach reveals long-term trends and growth rates more clearly, allows for accurate, consistent trendlines, and provides equal visual weight to different-magnitude percentage moves (e.g., a $10 to $20 gain is the same visual distance as a $1,000 to $2,000 gain).

Secondly, it is because of their charts and analysis above that I currently do not own any Bitcoin. I have continuously stated that I believe in being long Bitcoin as a long-term investment thesis, and I do believe that. I have made some good money, approximately quadrupling my Bitcoin account, by buying and trading the long side. But I also am a trader at heart, and it is hard for me to just sit on positions when they are not moving or moving against me. I will note that I have successfully been able to do that with gold and with gold miners over the last few years as I accumulated my positions. Anyway, it is the Bitcoin charts above that keep me currently on the sidelines as I do believe there is a significant equity market correction coming, and I think Bitcoin will break down with tech stocks, at least initially, and I will be ready to acccumulate then.

Lastly, no one has a perfect track record in trading or investing. I follow these guys because I have seen then to be correct almost always, but here is the chart from August 2024 that caused me to take my profits, and then I simpy wasn’t ready when the breakout to the upside did occur.

“I think we can now agree that the Bitcoin Doom Dome is real. BTC fell 30% after touching it. Please read the labels on the chart before making any silly comments.”

X. Why should you care?

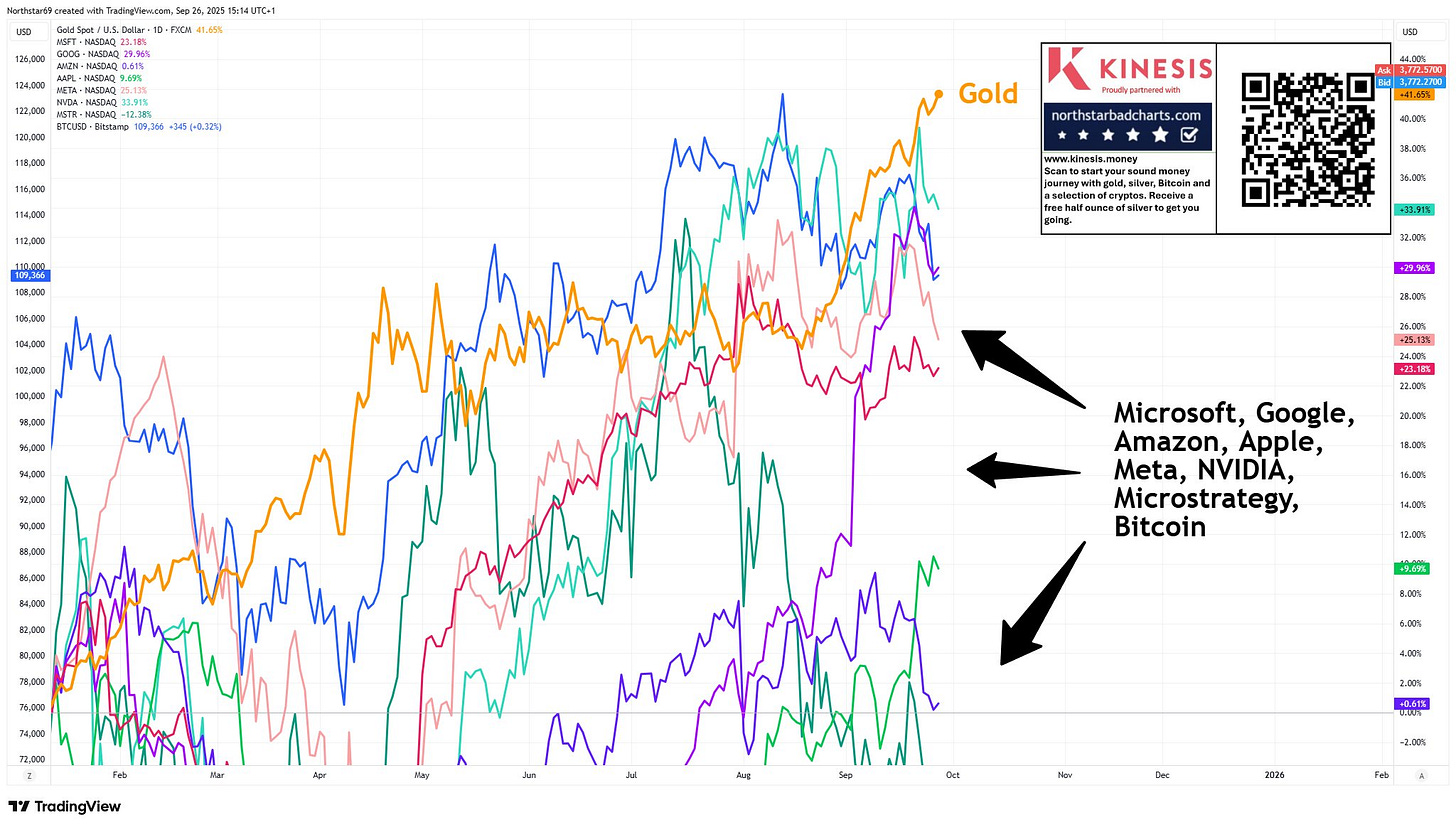

My portfolio based on the investment themes to which I subscribe was up 5% last week. As I covered in more detail in last week’s article, gold is by far my largest position with gold and silver miners next.

Aside from currently having no position in Bitcoin, I should also note that I have several December puts on XLK, the technology sector SPDR fund. I also have a November put on GDX, the VanEck Gold Miners ETF, and I will probably add to both if the market makes new highs in the next week or so. These are short-term speculative trading positions, and I am ok losing all my money on them. They do not change my long-term investment theses, which are as folllows:

Overweight cash and short-term U.S. T-bills for optionality, given expected INCREASING volatility related to the remaining list below.

Bullish gold and gold miner equities

Bullish Bitcoin

Bullish oil and oil-related equities

Bullish natural gas and related equities

Bullish uranium and related equities

Bullish industrial-associated commodities and equities

Bullish agricultural-associated commodities and equities

Bullish industrial and primarily electrical infrastructure equities

Bearish long-dated U.S. and other Western sovereign bonds

I’m sure you care, like I do, for the well-being of your family, friends, neighbors, and colleagues. And I’m sure, like me, many of those people you care about don’t understand and probably don’t care about economics, geopolitics, money, interest rates, debts, deficits, energy, commodities, demographics, & markets. However, I would appreciate it if you could share my articles that curate, summarize, distill, and synthesize knowledge & learning at the intersection of these topics to help me reach more people and expand my audience, helping people know what they need to know. Things are going to get messy and more stressful soon.

Please note that this is not investment advice or a recommendation to buy or sell securities or investment products. Everything written and said is for informational purposes only, and you should do your own research and due diligence. It is recommended that you consult with an investment advisor before making any investments or changes to your investments based on the information provided by The X Project.

Thank you for your subscription, especially if you are a paying subscriber. Your support is everything to The X Project and is greatly appreciated. If you agree, please take a moment to hit the like button and share your positive comments about my articles, assuming you have something constructive to say.