In this 15-minute article, The X Project will answer these questions:

I. Why this article now?

II. Who is Brent Johnson?

III. What is his “Dollar Milkshake Theory”?

IV. What has happened since developing the theory, and what does he currently think about the dollar's future?

V. What does he think about gold and silver now?

VI. What does he think of the S&P 500?

VII. The 10-year U.S. Treasury Bond?

VIII. Commodities?

IX. What does The X Project Guy have to say?

X. Why should you care?

Reminder for readers and listeners: nothing The X Project writes or says should be considered investment advice or recommendations to buy or sell securities or investment products. Everything written and said is for informational purposes only, and you should do your own research and due diligence. It would be best to discuss with an investment advisor before making any investments or changes to your investments based on any information provided by The X Project.

I. Why this article now?

Last week, The X Project published article #54, “What's Going on with Currencies These Days? An Introductory Primer to Foreign Exchange Markets.” In Section I of that article, I stated that there are some interesting debates about the future of the dollar, and Brent Johnson often vocalizes one of the positions in those debates. As it turns out, the day after I published last week’s article on currencies, Brent was Erik Townsend’s guest on the Macrovoices podcast and shared a presentation deck. That is one reason this article is now being published, and most of his views in this article come from that podcast and presentation.

Another reason is that in the conclusion to last week’s currency article in Section X, I stated:

“The more likely outcome, as I argued in the article titled “Why Rate Cuts, a lower US Dollar, and Inflation will All be Returning Soon” (another must-read article if you have not already done so), is that the Fed and Treasury will sacrifice the dollar in order to save the Treasury market. A weaker dollar is highly inflationary, which is why I subscribe to the investment themes listed below at the end of this section.

The big question is how will they get a lower dollar, especially when the dollar is strengthening against the currencies of the next four largest economies? I don’t know how, I just know they must weaken the dollar and that the consequences are dire if they don’t.”

Last week, the U.S. Treasury issued its Quarterly Refunding Announcement (QRA), the Federal Reserve had its latest FOMC meeting, and the U.S. Bureau of Labor Statistics issued its monthly employment report for April. The week ended with the 10-year Treasury Bond prices having rallied off their recent lows (also meaning yields fell from recent highs), and the U.S. Dollar Index fell about 1%. And importantly, the ICE BofAML MOVE Index closed down for the second week in a row and is now down 21% from its recent high on April 15. With the MOVE index indicating the bond market is functioning and not under stress, there is no reason for policymakers to inject liquidity and/or weaken the dollar - at the moment.

II. Who is Brent Johnson?

Brent Johnson is the CEO of Santiago Capital, an investment management firm that manages ~$175 million in assets for high-net-worth individuals with a minimum account of $3 million. Brent was previously Managing Director at BakerAvenue Wealth Management for nine years and spent nine years at Credit Suisse in their private client group.

Brent believes that the world has gotten itself into a bad situation with too much debt that can never be paid off and that, one way or another, all fiat will debase. Brent’s clients all have between 10% and 25% of their assets invested in gold. Given his views on fiat and gold, his Dollar Milkshake Theory is all the more interesting.

III. What is his “Dollar Milkshake Theory”?

Brent developed his Dollar Milkshake Theory and started talking about it in mid-to-late 2018, and here is a YouTube video of a presentation he did explaining his theory on January 28, 2019:

In this presentation, he has this slide:

Remember, this was in early 2019, and the Federal Reserve had raised interest rates nine times over the past couple of years and was doing quantitative tightening over the past year while the rest of the major central banks in the world were still injecting liquidity (hence the syringes in the slide) into to global financial system creating “one giant Milkshake of liquidity.” And so not only was there a demand for dollars to service all of the dollar-denominated debt that had been and continued to be created, but the interest rate differential the Fed had created swapped out its syringe for a straw and was now sucking all of the global liquidity into the dollar and dollar assets, and that meant that the dollar was going to continue going higher in the short to medium term.

Last week on the Macrovoices podcast, he summarized his Dollar Milkshake Theory with this slide:

IV. What has happened since developing the theory, and what does he currently think about the dollar's future?

A lot has happened since 2018-2019, but he has been mostly correct.

Since June 1, 2018, the dollar is up against almost every currency on the planet except the Mexican peso, Swiss franc, and Hong Kong dollar:

And he expects the U.S. Dollar to continue higher:

His note about barring central bank intervention is important because central banks DO intervene in currency markets. I have previously stated expectations for a lower dollar based on the Federal Reserve and/or Treasury Department managing to that outcome.

Here is another important point about the dollar:

He states that he is unsure which causes the correlation between crises and a rising dollar, and maybe it is some of both. He is sure that the world will get into more trouble and that “the dollar will go higher, and then that dollar going higher in and of itself, creates more trouble.” Ultimately, he sees the U.S. Dollar Index challenging its all-time highs from the early 1980s, which is the really big crisis that will cause some sort of global currency and financial system reset.

V. What does he think about gold and silver now?

Here is Brent’s first slide on gold:

Given how quickly gold prices have risen, Brent thinks gold is due for a pull-back. But, he wouldn’t short gold, and this slide explains why:

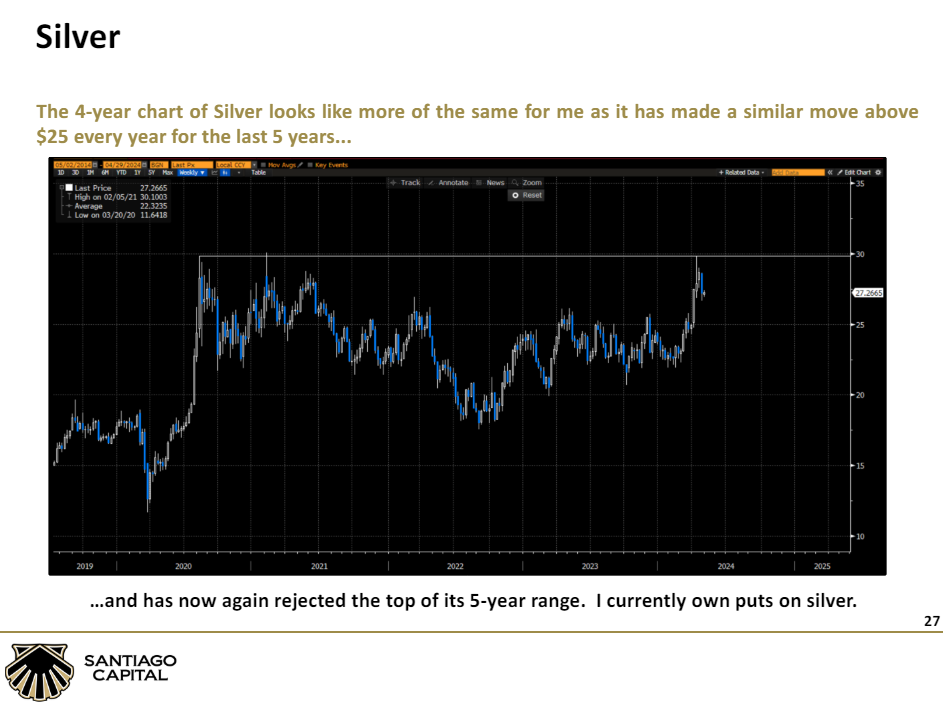

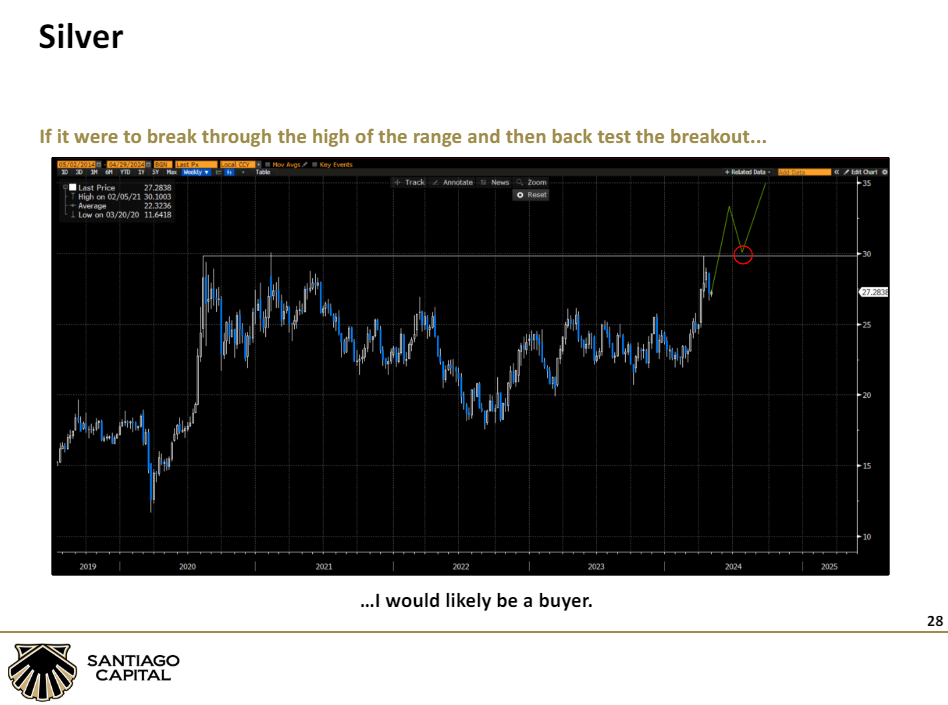

Here are his two slides and thoughts on silver:

VI. What does he think of the S&P 500?

The Dollar Milkshake Theory concludes that the U.S. Dollar, gold, and U.S. equities will all go higher. However, he expects a pull-back in the S&P 500 that could be as much as 20%, but he thinks it will be short-lived and then move on to new highs. Here is his chart of the S&P 500 showing the uptrend channel since the 2008 lows:

VII. The 10-year U.S. Treasury Bond?

He points out that the multi-decade trend of lower yields has been broken, and he expects yields to continue rising (which means bond prices falling):

The next section will examine his outlook for commodities, such as crude oil, copper, wheat, corn, and soybeans. In Section IX, I will tell you what I think. Then, in Section X, why should you care and, more importantly, what more can you do about it. However, I have just hit a new paid subscriber threshold, so you must now be a paid subscriber to view the last three sections. The X Project’s articles always have ten sections. Soon, after a few more articles, the paywall will move up again within the article so that only paid subscribers will see the last four sections, or rather, free subscribers will only see the first six sections. I will be moving the paywall up every few weeks, so ultimately, free subscribers will only see the first four or five sections of each article. Please consider a paid subscription.

All paid subscriptions come with a free 14-day trial; you can cancel anytime. Every month, for the cost of two cups of coffee, The X Project will deliver two articles per week ($1.15 per article), helping you know in a couple of hours of your time per month what you need to know about our changing world at the interseXion of commodities, demographics, economics, energy, geopolitics, government debt & deficits, interest rates, markets, and money.

You can also earn free paid subscription months by referring your friends. If your referrals sign up for a FREE subscription, you get one month of free paid subscription for one referral, six months of free paid subscription for three referrals, and twelve months of free paid subscription for five referrals. Please refer your friends!

VIII. Commodities?

Here is his slide on crude oil: