Why Rate Cuts, a lower US Dollar, and Inflation will All be Returning Soon

Revisiting Fiscal Dominance and the US Policymaker's Only Choice - Article #37

In this longer 15-minute article, The X Project will answer these questions:

I. Why this article now?

II. What is the more significant issue?

III. What’s the problem with it?

IV. What’s happening with inflation?

V. Why is inflation starting to rise again?

VI. Why U.S. Policymakers Need Higher Stock Markets?

VII. How do U.S. Policymakers affect equity prices?

VIII. Why is a lower U.S. Dollar policymakers’ only choice?

IX. What does The X Project Guy have to say?

X. Why should you care?

Reminder for readers and listeners: nothing The X Project writes or says should be considered investment advice or recommendations to buy or sell securities or investment products. Everything written and said is for informational purposes only, and you should do your own research and due diligence. It would be best to discuss with an investment advisor before making any investments or changes to your investments based on any information provided by The X Project.

I. Why this article now?

Last week, The X Project published “The Rising Tide of Global Liquidity Lifting All Assets: Michael Howell’s Powerful Analysis and Provocative Forecast - Article #35,” in which his view on rising asset prices was summarized. The genesis of that article goes back another week when The X Project originally started writing an article on some non-consensus opinions on why the stock market may continue rising and why the economy may avoid a recession. However, with the market closing at new all-time highs two weeks ago, The X Project’s contrarian soul pulled in another direction, and “Market Rules to Remember: Bob Farrell’s Legacy Applied to Today’s Market - Article #33” was published instead.

So, this article continues with some non-consensus views on why the stock market may continue rising without a recession. Still, the story here is a bit more complicated and ultimately has to do with a far more significant issue that will have much bigger consequences than higher stock markets and avoiding an economic recession.

II. What is the more significant issue?

U.S. Federal Debt and Deficit

The MOST significant issue facing us, our society, our government, our economy, our financial markets, and our overall standard of living is the U.S. Federal Debt and Deficit. Everyone should know that the U.S. has a significant debt and deficit issue. Here are some charts and figures to provide context, looking at the total debt first and then the federal budget deficit.

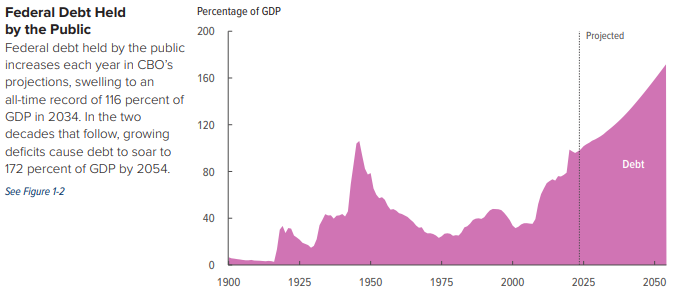

According to the Congressional Budget Office’s latest report, here is a historical view of Federal Debt Held by the Public, along with projections going out to 2054:

Here is a chart of the total federal debt from 1966, starting at $321 billion through Q3 of 2023 at $33.167 trillion:

Here is the current total U.S. federal debt and breakdowns per citizen and taxpayer according to the real-time U.S. National Debt Clock as of 9:33 AM CT on February 24, 2024:

Now let’s look at the federal budget deficit and start with the Congressional Budget Office’s latest report with a historical view along with projections going out to 2034:

Here is a longer historical view of the federal budget deficit (or surplus) going back to 1929 through the end of fiscal year 2022:

Here is the current total U.S. federal budget deficit according to the real-time U.S. National Debt Clock as of 10:00 AM CT on February 24, 2024:

III. What’s the problem with it?

The U.S. Treasury Market

The problem with the U.S. debt level and the current and future federal budget deficit is that the money has to come from somewhere. The primary way that the government borrows money is to issue and sell U.S. Treasury bills (short term), notes (medium term), and bonds (long term), and someone has to buy them. The primary concern with the current setup is who has the cash and balance sheet capacity to buy trillions and trillions of U.S. debt. The U.S. Treasury must issue approximately $1+ trillion in net new debt to fund the remainder of the current year’s budget deficit, plus nearly $9 trillion to refinance maturing U.S. Treasurys. Restating the problem another way is that there may be far more supply of U.S. Treasurys being issued than there is demand.

How do we know when we start seeing this problem? One way we know is when U.S. Treasury auctions go badly, and this past week, the U.S. Treasury auctioned $16 billion in 20-year notes that produced “very ugly” results. The mechanics of U.S. Treasury auctions are a bit complicated and beyond the scope of this article. But if you are interested,

has a thread on X/Twitter that explains Treasury auctions that can be found here. And here is Lavish’s description of this week’s auction:Another spicy Treasury auction, this time in the 20Yr:

- Tail was 3.3bps, *largest on record* for the 20Yr

- Foreign bidders dropped to *under 60%* from 74% in Nov.

- and Dealers were saddled with 21% of the auction, *double from Nov.*

In a word: Ugly.

What happens when the supply of something increases when demand is the same or decreases? According to Economics 101 and the basic supply and demand curve, prices will decrease. And if that something is a bond, what happens to its interest rate? It rises. While the Fed sets and controls the federal funds rate, the shortest of short-term interest rates, the market sets all other interest rates based on the economic laws of supply and demand.

For all these reasons, The X Project is bearish long-dated U.S. and other Western sovereign bonds.

IV. What’s happening with inflation?

Higher for Longer

Let’s pull on a different string before returning to the federal debt, deficits, and the Treasury market.

On Tuesday, February 13, the Bureau of Labor Statistics (BLS) released January’s latest Consumer Price Index (CPI) data. On Friday, February 16, the BLS released January’s latest Producer Price Index (PPI) data. Both reports came in hotter than expected on every indicator, and the table below summarizes the data:

Here is a chart of Supercore CPI, a recent favorite of the Fed, showing (white line) that it bottomed in October of 2023; it has been rising since then and, as of January, is accelerating:

The X Project is not surprised by this. On January 27, The X Project posted a note on Substack with these charts courtesy of Hedgeye:

V. Why is inflation starting to rise again?

Fiscal Dominance

The X Project first introduced the concept when it published “Fiscal Dominance: What the heck is it, and why does it matter?? - Article #6” in November 2023. The X Project revisited the topic when it published “An Introduction to Inflation: What is its relationship to interest rates, government debt/deficits, and fiscal dominance? - Article #9” also in November. The latter article outlined that the three most common factors causing inflation are increased demand for goods and services, reduced availability of goods or services, and/or an increase in money supply.

Regarding the reduced availability of goods or services, some impacts may start showing up related to shipping delays and increased shipping costs due to the situation in the Red Sea and reduced capacity due to low water in the Panama Canal. Still, no one is suggesting these are factors making an impact - at least not yet.

As for increased demand for goods and services, the economy continues to be resilient, posting an annual growth rate of 3.3% in the 4th quarter of 2023, down from a robust 4.9% in the third quarter of 2023. The Atlanta Fed’s GDPNow forecast for the first quarter of 2024 is currently at 2.9%. Demand for goods and services continues to grow, albeit at a slower rate.

And then there is the money supply. You may have heard that one measure, M2, has been contracting the fastest since the Great Depression. However, M2 is a narrow definition of money that does not distinguish between “financial” and “real-economy” money.

posted a great thread on X/Twitter yesterday explaining this and more, including…“if the govt spends more than it plans to collect in taxes for, new money has been created. Deficit spending increases the net worth of the private sector without adding a liability to it.”

Moreover, the federal government’s fiscal spending creates demand in the economy, keeping it from falling into a recession despite higher interest rates. Furthermore, the interest payments on the federal debt are approaching $1 trillion, and that money is being returned to the economy, which is ultimately stimulative. The irony is that higher interest rates create those higher interest payments. As Luke Gromen, who taught me almost everything I know about fiscal dominance, says:

“Fiscal dominance is the growing supremacy of fiscal policy over monetary policy in shaping economic outcomes.”

VI. Why U.S. Policymakers Need Higher Stock Markets?

Tax receipts

Ok, let’s start knitting the different threads of this article together. Luke Gromen also identified the critical correlation between stock prices and tax receipts, and this is a chart similar to one he has shown many times in his work:

And since the U.S. Treasury and Federal Reserve no doubt know and understand this relationship, it has become a powerful incentive and tool for them to use. If there are more tax receipts, there will be less of a deficit and, therefore, fewer U.S. Treasurys that must be supplied to the market.

VII. How do U.S. Policymakers affect equity prices?

U.S. Dollar

You may have thought the answer was interest rates. But if you read The X Project’s article published in December, “Everyone is Missing the Point about the Fed’s Rate Cuts in 2024: What is the point, what does it mean, and what can we expect? - Article #17” in which the Federal Reserve’s ultimate and primary mandate of keeping the U.S. Treasury market functioning was discussed. And yes, interest rates are part of the answer. But remember, the Fed only directly controls the federal fund’s interest rate, which is the interest rate at which commercial banks borrow and lend their extra reserves to one another overnight. The federal fund’s funds rate impacts the rest of the U.S. Treasury yield curve, but the impact is strongest at the shortest end and weakest to non-existent at the long end. The real economy, as highly financialized as it is, is affected more by longer-term U.S. Treasury rates set by the market. As was pointed out in the article above, when the MOVE index (a U.S. bond market volatility index) spikes, the Fed and/or U.S. Treasury respond by injecting U.S. dollar liquidity into the system to keep the U.S. Treasury market functioning - meaning there are buyers for our bonds. This has now happened five times since 2019.

But the question here is about equity prices. How does the U.S. dollar affect equity prices? Again, we turn to Luke Gromen, who found this chart courtesy of Jeremy Schwartz, Global Chief Investment Officer at Wisdom Tree Funds, on X/Twitter:

Since 2008 (Luke Gromen’s red arrow in the chart above), “the U.S. Dollar and stocks have NEVER again been positively correlated… when the U.S. Dollar gets too strong, stocks go down.”

VIII. Why is a lower U.S. Dollar policymakers’ only choice?

The alternative will blow up the global monetary and financial system

Luke Gromen explains this in his January 19 Tree Rings Report:

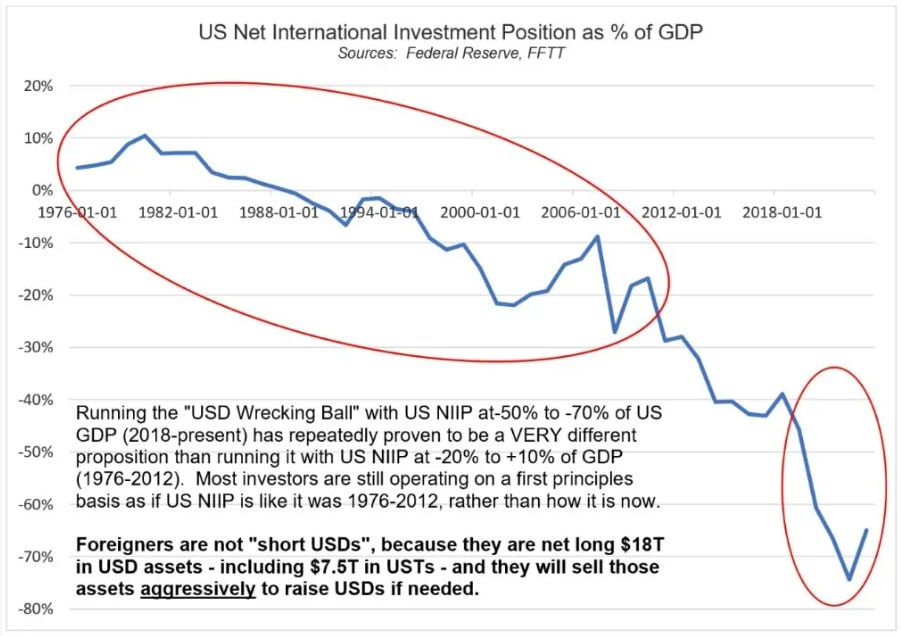

“What changed (in 2008)? The Fed’s actions to save the banking system (ZIRP and QE) turned the USD into more of a global funding currency, as foreign USD-denominated debt rose from ~$5T to ~$13T in 15 years, per the BIS:

While they were borrowing USDs with one hand, foreigners were buying USD-denominated assets with the other.

This drove the US NIIP from -15% of GDP in 2008 to -65% in 2023 and amounted to the US hocking the family silver (equity stakes of finite assets like equities and real estate) to fund the US economic recovery.

This is likely a major reason why the US recovery outperformed much of the rest of the world post-GFC…but now the devil has arrived to “take the hindmost” (as Edward Chancellor wrote he usually does in such cases in his book by the same name (“Devil Take the Hindmost”.))

The chart (above) from Jeremy Schwartz intimates why and how the devil will now “take the hindmost”:

The USD is highly negatively correlated to stocks…but as we saw in 2023, stocks are highly positively correlated to US tax receipts (chart below)… which are in turn negatively correlated to UST issuance… which is in turn positively correlated to interest rates… which in turn positively correlated to the USD… which is per above, negatively correlated to stocks.

The 35-year record high positive correlation between bonds and stocks combined with a near-record negative correlation between the USD and stocks is (failing a productivity miracle), mathematically certain to drive a US debt spiral in the context of how US policymakers have allowed the system to evolve since the GFC.

The gap between bond/stock and USD/stock correlations in the chart above means the global monetary system will unravel quickly any time the Fed and Treasury fail to supply whatever USD liquidity is needed, whenever it is needed. This is how the devil is going to “take the hindmost”, and consensus remains in dogmatic denial about this, even as this reality manifests itself in an increasing number of indicators, including via the chart above.

The chart above shows that both stocks and USTs are now “risk-on” assets, while the USD is the “risk-off” asset, and that for stocks and bonds to rise, the USD must fall.

The chart (above in section VI) shows that the US government needs stocks and bonds to rise in order to keep tax receipts up (red), stocks and bonds must rise, so the USD must fall. We have faith in Yellen, Biden, and Powell’s ability to make the USD fall in 1H24.

We continue to believe gold, BTC, and industrial equities will be the biggest beneficiaries. More USD liquidity will also support long-term USTs and bonds more broadly, but they will likely fall on a real basis (v. inflation), and likely fall significantly v. gold, BTC, and stocks. Let’s watch.”

IX. What does The X Project Guy have to say?

First, this article is longer than most, so I will keep it short. This article already said what I must say as it explains why inflation is not going away and my views and investment positions on eight of The X Project topics: commodities, economics, energy, government debt & deficits, interest rates, markets, and money.

Second, I want to thank all subscribers - primarily free and some paid - who have signed up thus far. Gaining additional subscribers daily is a decisive vote of confidence propelling The X Project forward. Substack tells me that nearly two-thirds of you have a 4-star or 5-star activity rating, meaning you consistently engage with my content - which is excellent! Please hit the heart icon indicating you like the article. The more “likes” I get, the more Substack will promote my content within the Substack community. If you don’t like my content or have any suggestions, please email me at TheXprojectGuy@gmail.com.

Lastly, in the next section, I will explain further why you should care and, more importantly, what you can do about it. However, The X Project now requires you to view the final section as a paid subscriber. In a few articles, the paywall will move up within the article so that only paid subscribers will see the last two sections, or rather, free subscribers will only see the first eight sections. I will be moving the paywall up every few weeks, so ultimately, free subscribers will only see the first four or five sections of each article. Please consider a paid subscription.

All paid subscriptions come with a free 14-day trial; you can cancel anytime. Every month, for the cost of two cups of coffee, The X Project will deliver two articles per week ($1.15 per article), helping you know in 1-2 hours of your time per month what you need to know about our changing world at the interseXion of commodities, demographics, economics, energy, geopolitics, government debt & deficits, interest rates, markets, and money.

You can also earn free paid subscription months by referring your friends. If your referrals sign up for a FREE subscription, you get one month of free paid subscription for one referral, six months of free paid subscription for three referrals, and twelve months of free paid subscription for five referrals. Please refer your friends!