What is the End-Game for the U.S. Debt?

And how it might play out, according to Luke Gromen - Article #58

In this 12-minute article, The X Project will answer these questions:

I. Who is Luke Gromen?

II. Why this article now?

III. Do U.S. Policymakers Think U.S. Debt to GDP is a Problem?

IV. Can the U.S. government delay the effects of the debt Doom Loop indefinitely, and how might this be done?

V. Why are the fiscal woes of the U.S. different this time?

VI. What would inflating away our debt and the dollar losing its reserve currency status look like for the average American?

VII. What is the U.S. Balance of Payments Vicious Cycle?

VIII. What are the only three choices for U.S. policymakers?

IX. What does The X Project Guy have to say?

X. Why should you care?

Reminder for readers and listeners: nothing The X Project writes or says should be considered investment advice or recommendations to buy or sell securities or investment products. Everything written and said is for informational purposes only, and you should do your own research and due diligence. It would be best to discuss with an investment advisor before making any investments or changes to your investments based on any information provided by The X Project.

I. Who is Luke Gromen?

As I said in my last article, I normally start my articles with the “Why this article now?” section. In this article, I also want to explain the origin of the ideas and concepts I’ll cover first.

I first introduced Luke Gromen in my article, “Fiscal Dominance—What the Heck Is It, and Why Does It Matter?” In that article, I said:

“Luke is the founder and president of FFTT, LLC, an independent research firm that provides insights on global macroeconomic, thematic, and sector trends. He has over 20 years of experience in the financial industry and is known for his ability to connect the dots between different data sources and perspectives. FFTT stands for the forest for the trees, and his other notable ability is to see the second and third-order derivatives beneath the surface.”

Luke introduced me to fiscal dominance and taught me most of my knowledge. The next time I mentioned Luke was in the article, “An Introduction to Inflation - What is its relationship to interest rates, government debt/deficits, and fiscal dominance?” And then I did more than a mention, I wrote an entire article covering some of his views in “Don't Miss The Forest For The Trees - Luke Gromen's Comprehensive Insights on the U.S. Dollar and U.S. Treasury Market Dynamics.”

II. Why this article now?

It has been a few months since the last article I cited above, so it is time to provide an update on some of Luke’s recent thoughts. This article will cover a more comprehensive view of a very important topic on which Luke has some very important insights and conclusions. I am a weekly paid subscriber to his Tree Rings reports; some of his views will be cited from those reports. However, it was his most recent video that he posted to his YouTube channel that prompted this article:

However, let’s tackle various answers in chronological order to the question in the title of this article.

III. Do U.S. Policymakers Think U.S. Debt to GDP is a Problem?

This question goes back to the February 23, 2024, Tree Rings report in which Luke commented on a Bloomberg article titled “US Risks Fiscal Crisis After Soaring Borrowing, Blanchard Warns.” Olivier Blanchard is a former Chief Economist at the International Monetary Fund, and what grabbed Luke’s attention is that Blanchard’s comments “are essentially diametrically opposite of what Blanchard said three years ago.” Luke is referring to this presentation that was streamed live on December 1, 2020:

Here is Luke’s conclusion:

“The logic is incredible, and because US policymakers likely pitched this logic to Biden and Congress in 2020, and will likely do so in response to the fiscal crisis that Blanchard now foresees, we must understand it. Here it is:

US debt/GDP is not a problem because if US interest rates remain below US GDP growth, the NPV of US GDP is infinite…so, as long as the Fed grows its balance sheet so as to keep UST rates below GDP growth, the US will never have a debt problem!

Do you see where this movie is going? They solved for rates and growth in 2020, so the release valve was the Fed’s balance sheet, the value of the USD, and shortly thereafter, significant inflation.

This in turn is helpful in two ways:

If the coming US fiscal crisis is now so obvious that policymakers like Blanchard (who along with his colleagues in that 2020 presentation wantonly ignored the signs of fiscal strains that were already obvious in 2020) are now calling it out, the issue must be getting acute (“So easy, even an establishment economist can see it.”)

If the issue is acute, the 2020 presentation above tells us how the US fiscal crisis will likely be dealt with – once again via the Fed’s balance sheet, the value of the USD, and shortly thereafter, resumed inflation.”

IV. Can the U.S. government delay the effects of the debt Doom Loop indefinitely, and how might this be done?

This question is taken from Luke’s YouTube video on April 24, 2024, cited in Section II above, and his answer is paraphrased as follows.

Yes, the U.S. government can delay the effects indefinitely. The primary release valve is the dollar. Lowering the dollar value decreases interest rates and alleviates debt problems. It's crucial to understand that U.S. fiscal dominance isn't permanent; the dollar's level influences it. When the dollar rises, the U.S. quickly faces fiscal dominance; when it falls, fiscal dominance wanes.

For example, after the U.S. deficit surged over $3 trillion post-COVID, we saw an everything bubble in 2021-2022, leading to booming tax receipts and a significant reduction in the deficit. Conversely, in 2022, when the Fed raised rates, and the dollar increased, tax receipts fell, and the deficit doubled despite stable unemployment. The release valve was the weaker dollar, which boosted tax receipts and reduced the deficit.

The Treasury market has shown dysfunction twice in 2023, each addressed with more dollar liquidity from the Fed or Treasury. If the dollar index (DXY) drops to 90 or 85, it could ease the debt spiral. Other non-currency methods include a productivity miracle, which could take various forms, from favorable geopolitical changes to technological advancements like small modular nuclear reactors or AI. However, these solutions come with their own sets of challenges and potential societal impacts.

V. Why are the fiscal woes of the U.S. different this time?

This question is also from Luke’s YouTube video cited in Section II above. The person who asked the question notes that we’ve been hearing about the U.S.’s fiscal woes for over half a century, yet international buying of U.S. debt is at an all-time high. Luke’s answer is paraphrased as follows.

It's not fundamentally different this time. In the past, the U.S. avoided going broke by devaluing the dollar and experiencing high inflation, which helped reduce real debt levels. For instance, from 1972 to 1980, the dollar index fell, inflation remained high, and nominal GDP growth consistently outpaced long-term treasury yields, leading to real losses for bondholders.

However, debt-to-GDP ratios and deficits are much higher now than in 1972, making the situation more severe. While the U.S. won't nominally go broke, it will likely inflate its way out of debt, devaluing bonds and other fixed-rate assets in real terms.

VI. What would inflating away our debt and the dollar losing its reserve currency status look like for the average American?

This is a third question from Luke’s YouTube video cited in Section II above. Luke does not believe the U.S. Dollar will lose its status as a global reserve currency. However, he believes that U.S. Treasurys will lose their primary role as a global reserve asset, which is being replaced by gold.

As for how inflating our debt away will look for the average American, this scenario could mean 10-20% annual inflation in goods and energy over 2-5 years, with an 8-10% wage inflation. Those with fixed-rate mortgages would benefit from a de facto debt jubilee as their mortgage payments become cheaper over time. Financialized assets, especially bonds, would lose real value, while industrial and commodity investments should perform well.

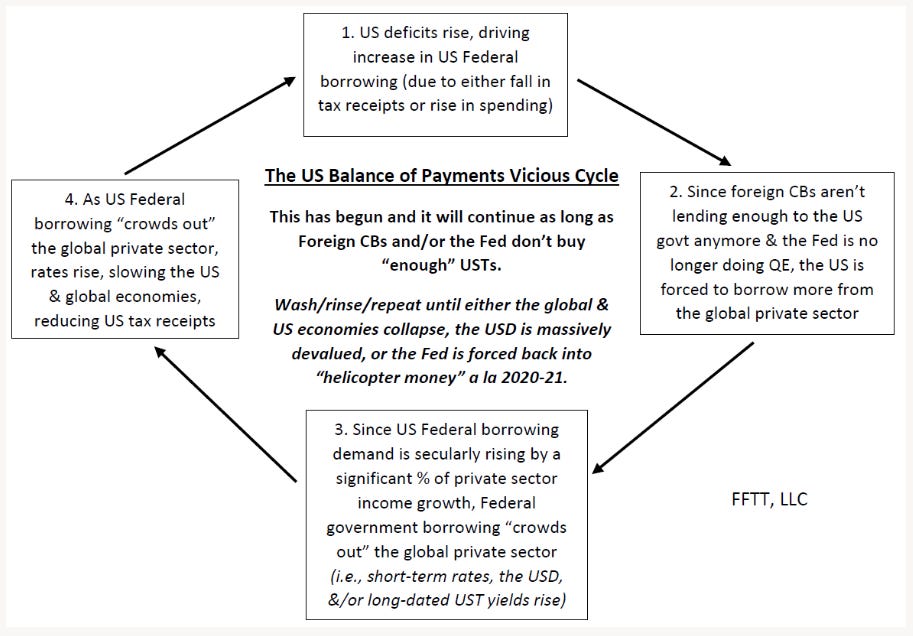

VII. What is the U.S. Balance of Payments Vicious Cycle?

First, what is “Balance of Payments”? According to toppr.com, “The Balance of Payments or BoP is a statement or record of all monetary and economic transactions made between a country and the rest of the world within a defined period (every quarter or year). These records include transactions made by individuals, companies and the government.”

As for the “Vicious Cycle,” Luke developed the following graphic some time ago and included it in the most recent Tree Rings report from May 10, 2024:

The next section will examine U.S. policymaker’s only three choices. In Section IX, I will tell you what I think. Then, in Section X, why should you care and, more importantly, what more can you do about it. However, I have just hit a new paid subscriber threshold, so you must now be a paid subscriber to view the last three sections. The X Project’s articles always have ten sections. Soon, after a few more articles, the paywall will move up again within the article so that only paid subscribers will see the last four sections, or rather, free subscribers will only see the first six sections. I will be moving the paywall up every few weeks, so ultimately, free subscribers will only see the first four or five sections of each article. Please consider a paid subscription.

Also, podcasts of the full articles narrated are available only to paid subscribers.

All paid subscriptions come with a free 14-day trial; you can cancel anytime. Every month, for the cost of two cups of coffee, The X Project will deliver two articles per week ($1.15 per article), helping you know in a couple of hours of your time per month what you need to know about our changing world at the interseXion of commodities, demographics, economics, energy, geopolitics, government debt & deficits, interest rates, markets, and money.

You can also earn free paid subscription months by referring your friends. If your referrals sign up for a FREE subscription, you get one month of free paid subscription for one referral, six months of free paid subscription for three referrals, and twelve months of free paid subscription for five referrals. Please refer your friends!

VIII. What are the only three choices for U.S. policymakers?

Policymakers really only have two choices. The third choice can be hoped for, encouraged, and incentivized by policymakers but requires other economic actors to create and implement it. Having said that here are the three options as Luke presented them:

“1. Slash US Entitlement and Defense spending by ~4-5% of GDP, immediately and permanently (this would require 27-33% cuts to Entitlements and Defense, immediately and permanently…and this assumes that the 4-5% drop in GDP this entails would not trigger a new Great Financial Crisis (where GDP fell 3% on an annual basis) that left US deficit/GDP even higher than where it is today.

Productivity miracle that does not arrive too fast (so that it hurts jobs and tax receipts) but also does not arrive too slowly either.

Increase USD liquidity, one way or another, into elevated US inflation and low US unemployment, effectively to finance US deficits.”

IX. What does The X Project Guy have to say?

The recurring answer to all of these questions including the big one in the title to this article is a lower U.S. Dollar. Based on the alternatives, that seems to be the best outcome for U.S. policymakers, for Americans (despite suffering through a prolonged and painful spell of higher inflation), and for the world that holds $350 trillion is dollar denominated debt. It also therefore means it the most probablistic outcome.

As I see it, there are two risks to this outcome. First, relative fiat currency values are largely predicated on relative interest rates. Many analysts refer to the “U.S. Dollar wrecking ball” that refers to the strengthening dollar from 2021-2023 that was driven by the Fed’s aggressive interest rate hiking campaign. What was wrecked were some banks that failed with backstops needed to prevent more failures and the U.S. Treasury market that started to dysfunction and required dollar liquidity injections into the financial system. Some analysts, notably

, refer to an imminent “U.S. Dollar Wrecking Ball 2.0” which will be caused by the rest of the world “out-doving” the Fed, meaning other central banks will cut interest rates faster and more aggressively than the Fed. Switzerland and Sweden have already cut, and the European Central Bank is expected to cut next month. If the Fed does surprise everyone and cut at its next meeting, then that will be a signal for the rest of the world to start cutting and there will likely be highly inflationary race to the bottom.The second major risk to a lower dollar outcome is geopolitics. If there is another war that starts or an escalation in any of the existing wars, then there is usually a flight to “safety” and the dollar is typically bid up in war and risky geopolitical situations. Furthermore, we have two geopolitical adversaries that are waging economic war against the U.S. and would like to “bankrupt” us (like we did to the Soviet Union) or see our financial system implode. There is more to be said on this last point, and we’ll save that for a future article.

Lastly, regarding the cadence of articles being published by The X Project, I have been publishing two articles per week on Wednesdays and Sundays. In an effort to ensure the highest quality and most relevant content to my subscribers, I am going to slightly reduce the cadence such that going forward articles will be published every other Wednesday and will continue to be published each Sunday.

X. Why should you care?

To reiterate a recurring theme, it will be very challenging to maintain or improve living standards in a highly inflationary environment, unless you are in the top one-two percent of income earners and/or wealth holders. For the rest of us therefore it is imperative that our investment portfolios not only keep pace with inflation, but outperform it. And that is why The X Project subscribes to these investment themes:

The X Project subscribes, including the stock market sectors and segments that should outperform in a higher inflationary environment:

Overweight cash and short-term U.S. T-bills for optionality, given expected volatility related to the remaining list below.

Bullish gold and gold miner equities

Bullish Bitcoin

Bullish oil and oil-related equities

Bullish natural gas and related equities

Bullish uranium and related equities

Bullish industrial-associated commodities and equities

Bullish agricultural-associated commodities and equities

Bullish industrial and primarily electrical infrastructure equities

Bearish long-dated U.S. and other Western sovereign bonds

Thank you for your paid subscription. Your support is everything to The X Project and is greatly appreciated. If you agree, please do me the favor of hitting the like button and posting positive comments about my articles - assuming you have positive things to say - especially about these final sections (soon to be more sections) that only you as a paid subscriber get to see.