Broken Money: Why Our Financial System is Failing Us and How We Can Make it Better

A summary of the book written by Lyn Alden (2023) - Article #38

In this 12-minute article, The X Project will answer these ten questions:

I. Why this book, and what’s it about?

II. Who is the author?

III. How popular is the book?

IV - VIII. What are the top five takeaways from the book?

IX. What does The X Project Guy have to say?

X. Why should you care?

Reminder for readers and listeners: nothing The X Project writes or says should be considered investment advice or recommendations to buy or sell securities or investment products. Everything written and said is for informational purposes only, and you should do your own research and due diligence. It would be best to discuss with an investment advisor before making any investments or changes to your investments based on any information provided by The X Project.

I. Why this book, and what’s it about?

In an era where the pulse of the global economy beats with uncertainty, Lyn Alden’s 2023 groundbreaking book Broken Money: Why Our Financial System is Failing Us and How We Can Make it Better emerges as a beacon of clarity in the fog of financial complexity. With a narrative as compelling as it is informative, Alden dissects the intricacies of our current financial ecosystem, laying bare the systemic frailties that threaten our economic stability. This book is not just a read; it’s an urgent call to understand the foundational cracks of our financial world, providing readers with the insight needed to navigate the treacherous waters of today’s economy.

At its core, Broken Money delves into the mechanics of how and why the financial system has drifted away from serving the many to favoring the few. Alden leverages her expertise to unravel the historical contexts and policy decisions that have scaffolded the current economic disparity and inefficiency state. The book is a masterful blend of economic theory, historical analysis, and forward-looking insights that manage to demystify complex concepts and make them accessible to a broad audience. Whether you’re a finance professional, a policy maker, or simply a concerned citizen, this book sheds light on the critical issues facing our financial system. It outlines actionable steps toward creating a more equitable economic future.

II. Who is the author?

Quoting directly from her website:

“I have a bachelor’s degree in electrical engineering and a master’s degree in engineering management, with a focus on engineering economics, systems engineering, and financial modeling. I used to work as an electrical engineer at the Federal Aviation Administration’s William J. Hughes Technical Center, and over the course of a decade, I worked my way up from being an intern to being the lead engineer and running the day-to-day operations and finances of the facility’s Cockpit Simulation Facility.

On the side, I’ve been an avid investor for a long time. I ran my first investing website as a part-time gig from 2010 to 2015 and sold it to a larger publishing company. In late 2016, I founded the website Lyn Alden Investment Strategy, and it eventually grew so large that I had to leave my engineering management work by 2021 to focus full-time on it.

Since then, I’ve been an independent analyst. My goal is to provide institutional-level research in plain English so that both institutional investors and retail investors can benefit from it. Additionally, I serve as an independent director on the board of Swan.com and am a general partner at the venture capital firm Ego Death Capital. I’m also the author of the 2023 best-selling book Broken Money, which is about the past, present, and future of money through the lens of technology.

My work has been editorially featured or cited in the Wall Street Journal, the Financial Times, Business Insider, Marketwatch, Time’s Money Magazine, The Daily Telegraph, The Philadelphia Inquirer, The Street, CNBC, US News and World Report, Kiplinger, the Asia Times, the Huffington Post, the Globe and Mail, and other media. I’ve appeared on Kitco, Real Vision, The Investor’s Podcast Network, The Rebel Capitalist Show, Macro Voices, Forward Guidance, What Bitcoin Did, and many other shows and podcasts.”

III. How popular is the book?

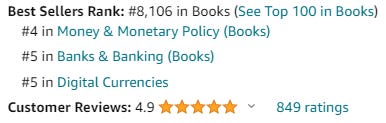

Here are the book’s rankings on Amazon:

Despite being the most recently published book out of The X Project’s list of twenty most influential books, it quickly became among the most popular and top-ranked in multiple categories.

IV. What is one of the top takeaways from the book?

The Illusion of Stability

Lyn Alden’s exploration of the financial system’s superficial stability is profound and unsettling. She diligently unravels how a precarious foundation built on excessive leverage and speculative finance lies beneath the veneer of economic prosperity signaled by bullish stock markets and low unemployment figures. This precariousness is masked mainly by short-term economic gains and policy measures prioritizing immediate growth over long-term stability. Alden points out that such measures, including aggressive monetary policies and fiscal stimulus, often do more to inflate asset bubbles than address the underlying weaknesses in the economy. The illusion of stability, as Alden posits, is a dangerous mirage that diverts attention from the structural reforms needed to safeguard against future crises.

The book further examines the role of debt in perpetuating this illusion. Alden meticulously explains how increasing public and private debt levels have become central to sustaining economic growth, creating a dependency on continuous borrowing. This reliance on debt magnifies the risk of financial collapse and limits the effectiveness of traditional policy tools in combating economic downturns. By dissecting historical precedents and drawing parallels with current trends, Alden demonstrates how this debt-fueled growth model is inherently unsustainable, leading inevitably to periods of severe economic correction. The analysis is a critical reminder of the importance of building an economy prioritizing genuine stability through sustainable growth and equitable wealth distribution.

In addressing the illusion of stability, Alden does not merely critique; she also offers insights into how individuals and policymakers can foster a more resilient financial system. She advocates for a shift in focus from short-term indicators of economic health to long-term fundamentals, including productive investment, financial regulation, and the reduction of systemic debt levels. By highlighting the interconnectedness of global financial markets, Alden underscores the need for international cooperation in addressing these challenges. Her call to action is clear: only by acknowledging and confronting the illusion of stability can we hope to achieve a financial system that is truly robust and equitable.

V. What is another top takeaway?

The Centralization of Wealth and Power

Alden’s analysis of the centralization of wealth and power is both a critique and a warning. She delves into the historical and systemic factors that have led to an unprecedented concentration of economic resources and decision-making authority in the hands of a few, highlighting how this centralization not only exacerbates social inequality but also undermines the very principles of free-market capitalism. Through a comprehensive review of tax policies, corporate governance practices, and financial regulations, Alden illustrates how the system has been skewed to favor the elite, often at the expense of the broader population. This centralization, she argues, distorts economic incentives and market outcomes, leading to inefficiencies and instability.

The book emphasizes the detrimental impact of this wealth and power concentration on democracy and societal cohesion. Alden points out that when a small segment of society holds a disproportionate share of wealth and influence, it can lead to policies and practices that further entrench their positions, creating a problematic feedback loop to break. This dynamic stifles innovation and competition, erodes public trust in institutions, and fuels social unrest. Alden uses case studies to demonstrate how countries with higher levels of economic inequality face more significant challenges in maintaining social harmony and political stability.

To counteract the centralization of wealth and power, Alden proposes a series of reforms to enhance economic fairness and opportunity. These include revising tax codes to ensure a more equitable distribution of wealth, implementing policies to promote competitive markets, and strengthening financial regulations to prevent excessive risk-taking by powerful institutions. By advocating for these changes, Alden envisions a financial system that supports sustainable growth and broad-based prosperity. Her analysis is a compelling call to action for policymakers, business leaders, and citizens alike to work towards dismantling the structures that perpetuate inequality and to build a more inclusive economy.

VI. What is the third top takeaway?

The Role of Technology in Financial Markets

In discussing technology’s impact on financial markets, Alden strikes a delicate balance between optimism and caution. She acknowledges the transformative potential of technological innovations in democratizing access to financial services and improving efficiency within the financial sector. Fintech innovations, blockchain technology, and digital currencies are opportunities to reduce transaction costs, increase transparency, and open new investment avenues for the average person. However, Alden highlights the double-edged nature of these advancements, pointing out the risks associated with increased automation, data privacy concerns, and the potential for new forms of financial exclusion.

Alden delves into the complex relationship between technological progress and job displacement, noting that while automation and artificial intelligence can lead to significant productivity gains, they also threaten traditional employment sectors. This displacement, if unaddressed, could exacerbate economic inequality and social division. Furthermore, Alden raises concerns about the concentration of technological power in the hands of a few large corporations, which could lead to monopolistic practices and further centralization of wealth. She argues for a regulatory framework that encourages innovation while ensuring that the benefits of technology are widely distributed and do not come at the expense of financial stability and social equity.

To harness the positive aspects of technology while mitigating its risks, Alden proposes a series of measures, including more robust data protection laws, support for digital literacy programs, and policies that promote competition in the tech sector. She also suggests that the financial industry should adopt ethical standards for the use of technology, ensuring that innovations contribute to a more inclusive and transparent financial system. By carefully navigating the intersection of technology and finance, Alden believes we can move towards a future where technological advancements serve as a force for economic empowerment and systemic resilience.

VII. What is the fourth top takeaway?

The Importance of Financial Literacy

Lyn Alden emphasizes the critical role of financial literacy in empowering individuals and fostering a more stable and equitable financial system. She argues that a lack of understanding of basic financial concepts among the general population is a crucial factor contributing to economic vulnerability and inequality. By demystifying the complexities of the financial world, Alden makes a case for education as a tool for empowerment. She points out that individuals equipped with financial knowledge are better positioned to make informed decisions about saving, investing, and borrowing, which can lead to improved personal financial outcomes and contribute to overall economic stability.

Alden delves into the systemic barriers that have historically limited access to financial education, highlighting how these barriers disproportionately affect marginalized communities. She discusses the role of public education systems, financial institutions, and policymakers in perpetuating a cycle of financial illiteracy by failing to provide accessible and relevant financial education for all. Alden advocates for a comprehensive overhaul of how financial literacy is approached, suggesting that it be integrated into the curriculum at all levels of education and made available through community programs. By promoting financial literacy, Alden argues, we can reduce the knowledge gap that often leads to predatory financial practices and exacerbates socio-economic disparities.

To enhance financial literacy, Alden proposes a multi-faceted approach that includes leveraging technology to create engaging and accessible financial education tools and encouraging public-private partnerships to expand the reach of financial education programs. She also emphasizes the importance of tailoring financial education to the needs of diverse populations, recognizing that different communities may face unique financial challenges and opportunities. By fostering a culture that values and prioritizes financial literacy, Alden believes individuals can gain the confidence and skills needed to navigate the financial system effectively, leading to more equitable economic outcomes and a more resilient financial system.

VIII. What is the fifth top takeaway?

A Blueprint for Reform

In the final section of Broken Money, Alden presents a comprehensive blueprint for reforming the financial system to address its inherent flaws and promote a more inclusive and sustainable economy. She outlines policy recommendations to correct the imbalances and inefficiencies that have led to financial instability and inequality. These recommendations span many areas, including monetary policy, financial regulation, tax policy, and social welfare programs. Alden advocates for a holistic approach to reform, arguing that piecemeal solutions are insufficient to address the systemic nature of the financial system’s problems.

One of the critical components of Alden’s blueprint is the call for greater transparency and accountability in both public and private financial institutions. She argues that a lack of oversight and opaque practices have contributed to risky behavior and ethical lapses, which in turn have undermined public trust in the financial system. To combat this, Alden suggests implementing stricter regulatory frameworks, enhancing whistleblower protections, and promoting ethical standards within the financial industry. Additionally, she emphasizes the need for fiscal policies that support sustainable growth and equitable wealth distribution, such as progressive taxation and investment in public goods and services.

Alden underscores the importance of grassroots movements and individual action in driving systemic change. She encourages readers to become more engaged with financial and economic issues, advocate for policy changes, and support initiatives promoting financial inclusion and sustainability. Through policy reform, public education, and collective action, Broken Money offers a vision of a future where the financial system works to benefit all, not just a privileged few.

IX. What does The X Project Guy have to say?

First, Broken Money is the most recently published book and, therefore, the last on the list of The X Project’s twenty most influential books. It shares some of the themes and conclusions of several other books on the list covered by The X Project, including:

This Time is Different: Eight Centuries of Financial Folly - A summary of the book written by Carmen Reinhart and Ken Rogoff (2009) = Article #5

FED UP: An Insider's Take on Why the Federal Reserve is Bad for America - A summary of the book written by Danielle DiMartino Booth (2017) - Article #14

Trade Wars are Class Wars: How Rising Inequality Distorts the Global Economy and Threatens International Peace - A summary of the book written by Matthew C. Klein and Michael Pettis (2020) - Article #20

Money and Empire: Charles P. Kindleberger and the Dollar System - A summary of the book written by Perry Mehrling (2022) - Article #30

The Price of Time: The Real Story of Interest - A summary of the book written by Edward Chancellor (2022) - Article #32

But Alden’s book is also unique in many ways, including that Alden brings a non-US and non-dollar perspective. She has family in Egypt and spends significant time there, and uses her own personal experience in describing the realities faced by the other 160+ fiat currencies in the world that are not the global reserve currency. In so doing, she is able to explain why and how Bitcoin solves many of the problems that plague traditional fiat currencies which condemn them all to an ultimate destiny of failure. Bitcoin is a new type of money based on new technology, and there is no guarantee that Bitcoin will exist in 50 or 100 years or even 5 or 10 years. However, Alden builds a compelling case for why Bitcoin has a possibility of succeeding where every fiat currency ever known has failed.

Next, I want to thank all subscribers - primarily free and some paid - who have signed up thus far. Gaining additional subscribers daily is a decisive vote of confidence propelling The X Project forward. Substack tells me that nearly two-thirds of you have a 4-star or 5-star activity rating, meaning you consistently engage with my content - which is excellent! Please hit the heart icon indicating you like the article. The more “likes” I get, the more Substack will promote my content within the Substack community. If you don’t like my content or have any suggestions, please email me at TheXprojectGuy@gmail.com.

In the next section, I will explain why you should care and, more importantly, what you can do about it. However, The X Project now requires you to view the final section as a paid subscriber. In a few articles, the paywall will move up within the article so that only paid subscribers will see the last two sections, or rather, free subscribers will only see the first eight sections. I will be moving the paywall up every few weeks, so ultimately, free subscribers will only see the first four or five sections of each article. Please consider a paid subscription.

All paid subscriptions come with a free 14-day trial; you can cancel anytime. Every month, for the cost of two cups of coffee, The X Project will deliver two articles per week ($1.15 per article), helping you know in 1-2 hours of your time per month what you need to know about our changing world at the interseXion of commodities, demographics, economics, energy, geopolitics, government debt & deficits, interest rates, markets, and money.

You can also earn free paid subscription months by referring your friends. If your referrals sign up for a FREE subscription, you get one month of free paid subscription for one referral, six months of free paid subscription for three referrals, and twelve months of free paid subscription for five referrals. Please refer your friends!