"Is Treasury Quietly Executing Miran's Gold-to-FX Playbook?"

Michael J. McNair's Stunning and Provocative Hypothesis to Consider - Article #111

In this 15-minute article, The X Project will answer these questions:

I. Why this article now?

II. According to Miran’s paper, what is the Gold-to-FX playbook? And Who is Michael McNair?

III. “Is Treasury Quietly Executing Miran’s Gold-to-FX Playbook? and ”How Miran’s Strategy Works:”

VI. What “Evidence Its Live”?

V. What are “Alternative Explanations (partial)”:

VI. Is there more? And, What’s an Important Note Worth Highlighting?

VII. What does this mean for inflation and gold prices?

VIII. What’s an Important Point Worth Highlighting?

IX. What does The X Project Guy have to say?

X. Why should you care?

Reminder for readers and listeners: nothing The X Project writes or says should be considered investment advice or recommendations to buy or sell securities or investment products. Everything written and said is for informational purposes only, and you should do your own research and due diligence. It would be best to discuss with an investment advisor before making any investments or changes to your investments based on any information provided by The X Project.

I. Why this article now?

Once again, I have to extend a major hat tip to

for bringing this to my attention in his latest Tree Rings report, to which I subscribe. Long-time readers of The X Project will know Gromen, as I have covered him in six prior articles, listed below in order of most recent to oldest:More Global Economic Shift Viewpoints: A collection of Luke Gromen’s recent non-consensus views

What is the End-Game for the U.S. Debt? And how it might play out, according to Luke Gromen

Fiscal Dominance - What the heck is it, and why does it matter??

The X Project curates, summarizes, distills, and synthesizes knowledge & learning at the interseXion of economics, geopolitics, money, interest rates, debts, deficits, energy, commodities, demographics, & markets - helping you know what you need to know.

(@LukeGromen on X) is one of my most highly regarded analysts from whom I have learned much, some of which I’ve shared in the articles above, and all of which are worth rereading today.Ok, but who is Miran?

I introduced Stephen Miran in “Triffin's Dilemma and The Mar-a-Lago Accords: The New World Order Coming to Our World Now.” Quoting from that article:

“He is a Senior Strategist at Hudson Bay Capital and an economics fellow at the Manhattan Institute for Policy Research. He previously served as a senior advisor for economic policy at the U.S. Department of the Treasury, where he contributed to fiscal policy decisions during the pandemic recession. Before his government role, he spent a decade as an investment professional. Miran holds a Ph.D. in economics from Harvard University and a B.A. from Boston University, bringing extensive expertise in financial markets, economic policy, and trade dynamics. He is President Trump’s Chairman of the Council of Economic Advisors (CEA) nominee.”

As background to this article, it would be helpful for you to read or reread my article, which covered at a high level the paper Miran published in November that created quite a stir: “A User’s Guide to Restructuring the Global Trading System.”

II. According to Miran’s paper, what is the Gold-to-FX playbook? And Who is Michael McNair?

Miran's Gold-to-FX playbook, described in the paper, involves strategically leveraging the U.S. government's gold reserves to accumulate foreign exchange. Under the Gold Reserve Act, the Treasury Secretary can sell gold in ways advantageous to public interests, specifically with proceeds intended to reduce national debt. The implementation involves the Treasury using its Exchange Stabilization Fund (ESF) to sell dollars forward, funded by gold sales. Structuring these transactions as debt contracts ensures compliance with statutory mandates. While politically sensitive, converting non-yielding gold reserves into interest-bearing foreign debt could generate income for the U.S. government, albeit changing the asset composition of the government's balance sheet significantly.

However, the playbook carries significant risks. The ESF has limited resources, and leveraging gold sales to purchase foreign currencies and securities introduces credit and market risks. Additionally, because gold pays no interest, exchanging it for foreign assets introduces exposure to foreign economies' vulnerabilities and policy decisions, including potential debt repudiation or currency devaluations. Furthermore, creating foreign exchange reserves by selling newly printed dollars (via the Fed) can be inflationary, potentially requiring monetary tightening measures to counteract inflationary pressures. Thus, while the approach is financially viable and legally defensible, it must be executed cautiously to manage domestic political backlash and international financial risks.

Ok, so now who is Michael McNair?

I just discovered him two days ago, thanks again to

. As McNair’s bio on X states, he is a fund manager, and through further digging, I discovered that he works for a multibillion-dollar state retirement fund. To better understand his views, here is his pinned post on X:“History is unambiguous that transitions between global monetary systems are inherently chaotic.

During the interwar period, there were repeated failed attempts to restore global economic order, but countries couldn't even agree on what caused the problems.

We had the 1920 Brussels Conference which achieved little more than vague recommendations because countries fundamentally disagreed about war reparations and debt forgiveness.

The 1922 Genoa Conference attempted to restore the gold standard but failed bc countries couldn't agree on exchange rates or how to handle Germany's debt.

Then the 1927 World Economic Conference in Geneva was a failure and no one could agree on tariff reductions.

The 1933 London Economic Conference collapsed spectacularly when Roosevelt withdrew support for currency stabilization.

The 1936 Tripartite Agreement was celebrated as the biggest achievement during the interwar period even though it was just a short term agreement to stop competitive devaluations. When simply agreeing not to actively harm each other is seen as a breakthrough, it shows just how low international cooperation had fallen.

And the reason they couldn’t cooperate is that countries had fundamental disagreements about the nature of the problems themselves. Some countries blamed rigid exchange rates, others blamed insufficient gold reserves, while others blamed war debts or trade barriers.

Just like today, when some countries view trade imbalances as America's problem to solve while others see them as a structural issue requiring global adjustments, these fundamental disagreements about diagnosis make coordinated solutions nearly impossible.

And this pattern of failed cooperation, fundamental disagreements, and prioritizing national interests over global stability is exactly what we should expect to see again as the dollar standard unwinds.

Countries built their entire economic models around exporting to the US while the dollar standard enabled America to run persistent deficits. Now they'll be competing for limited surpluses among themselves.

I genuinely hope I'm wrong, but history has played out this scenario repeatedly, and cooperation only emerges after a painful period of disorder.”

III. “Is Treasury Quietly Executing Miran’s Gold-to-FX Playbook? and ”How Miran’s Strategy Works:”

The first question is the title of McNair’s post on April 30, 2025, on X, and he says:

“We have compelling evidence of stealthy US FX reserve accumulation – using gold. Stephen Miran’s 2023 “User’s Guide” detailed how Treasury could convert gold into foreign reserves without congressional approval. Current market fingerprints suggest Miran’s playbook may already be active.”

With the second question, he goes on to explain :

1. Buy unlimited gold: Treasury, under 31 U.S.C. § 5116, can acquire bullion freely without new appropriations, typically financing via short-term T-bills. Gold is the only asset Treasury can later “monetize” into foreign cash without new appropriations.

2. Monetize gold later: The Gold Reserve Act requires proceeds from gold sales to retire Treasury debt.

3. Create a debt liability first: ESF sells dollars forward (ex. agreeing to deliver USD in six months for euros).

4. Settle using gold: Just before settlement, Treasury sells gold, immediately using dollars raised to retire the forward liability, satisfying statutory debt reduction.

Result: Treasury swapped idle bullion for interest-bearing FX reserves, all within existing law…no congressional vote, no hit to headline debt, no directional bet on gold.

That’s the whole playbook: buy gold freely and use it as collateral to flip into euros or yen via a forward sale of dollars.

IV. What “Evidence Its Live”?

His next section says:

1. 2000+ tonnes of gold shipped to New York since December, the largest inflow ever.

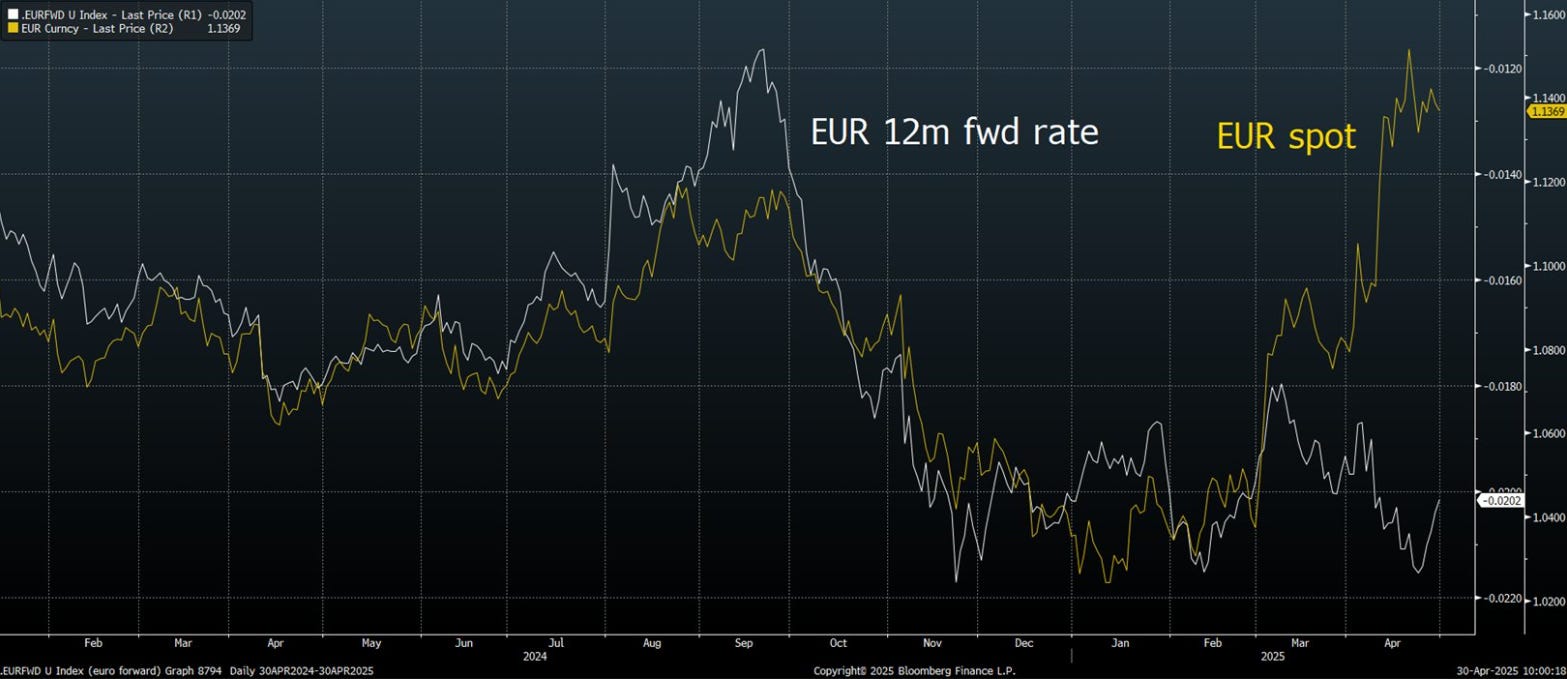

2. EUR fwd rate - essentially the 1yr fwd discount vs. spot EUR/USD - normally tracks spot closely but recently has diverged sharply (see chart).

This indicates someone, who is rate-insensitive, is supplying dollars (or demanding euros) in the forward market strongly enough to flatten the curve even as the cash market pushes spot higher. That is precisely the footprint you would expect if a large player were selling USD fwd in size while simultaneously accumulating euros: the forward supply leans on basis/forward points, but the spot legs of those trades, whether outright EUR buys or the mirror leg of a gold swap, push spot up. In other words, the correlation break is further circumstantial evidence that the fwd leg is being used to fund something structural, not a speculative punt.

3. Last week, Treasury abruptly raised its Q2 borrowing estimate by $390 billion, primarily in short-dated bills, precisely how you'd prefund a substantial fwd settlement requiring cash delivery.

V. What are “Alternative Explanations (partial)”:

He offers this as an alternative explanation:

“Admittedly, this theory could partially be explained by other factors:

1. European institutional investors have sold large unhedged USD asset holdings, pressuring spot EUR/USD upward.

2. The massive bullion inflows to COMEX were partly driven by tariff fears, creating a profitable arb and prompting dealers to deliver gold against COMEX futures.

3. The extra bills issuance could merely be “catch-up” financing to get the TGA back to $850 bn once the debt ceiling is lifted.

But if Treasury were also buying bullion for a forthcoming FX swap, the mechanics would look identical on headline borrowing data: issue bills now (shows up as higher net borrowing), pay bullion suppliers (cash outflow eats into the TGA), sell the gold for dollars at forward settlement.

It also doesn’t fully explain why the EUR/USD fwd curve has flattened steadily across longer maturities, nor why the forward vs spot correlation would break so decisively, nor the curious alignment with Treasury’s sudden borrowing spike, and why COMEX stocks would remain persistently high after the tariff exemption - only bled ~1.5 mn oz...small vs the inflow. Why isn’t the metal racing back to London now that the arb is gone?

Also, important to note that public ledgers still show flat official FX assets. That means either: dealer banks are warehousing the euro and yen leg until forward settlement - perfectly consistent with Miran’s structure; or we’re still “testing the plumbing” with modest ticket sizes.

We should know for certain in short order, as Treasury must publish Sovereign Wealth Fund details by Sunday, May 4 and Thursday’s H.4.1 release and upcoming TIC banking data will confirm whether we're witnessing the first genuine US fx reserve build in decades, or if it’s simply an improbable set of coincidences that just happen to perfectly align with the mechanics of Miran’s gold-reserve accumulation strategy.”

VI. Is there more? And, What’s an Important Note Worth Highlighting?

A few hours later, he added another post:

“Notice the S&P bottomed and turned sharply higher exactly as EUR spot ripped away from EUR fwd.

If my theory is true then that’s no coincidence. When the ESF/Treasury sells dollars fwd and then monetizes gold to fund those trades, it does three things:

1. Eases dollar funding as dealers carry fewer USD obligations in money markets, so basis and repo strains relax.

2. Releases collateral as new Tbill issuance and freed-up gold funding boost available high quality assets.

3. Drains private fx as official buying of euros,yen,ect injects liquidity into those markets.

Together that mix is functionally like a stealth QE or swap line injection…better funding, more collateral, cheaper dollars. Traders saw the fwd curve break and jumped back into risk. I can’t definitively say it’s causal, but the timing around April 7th, is suspiciously aligned w/ the COMEX drawdown beginning, EUR forward/spot divergence, S&P inflection. It suggests thats when Miran’s “loop” transitioned from warehousing to execution.”

VII. What does this mean for inflation and gold prices?

A couple of hours later, McNair adds this post:

“This passage from Miran’s ‘User’s Guide’ is absolutely crucial bc it flags the other half of the story.

Once Treasury floods the fx market w/ dollars and swaps gold into euros/yen, it’s mechanically adding base money and liquidity…much more than a vanilla spot only intervention. Bc when gold is sold to fund fwd dollar delivery, those newly created dollars don’t just retire debt, they circulate through dealer funding lines, repos, money markets and into the banking system. So much will depend on the Fed’s response (do they sterilize and to what extent).

Risk assets likely rally hard on the initial liquidity and FX relief, then run into headwinds as rate sensitive sectors price in Fed tightening. Things to watch for to tell you Fed is sterilizing are: if RRP spikes, reverse repo widening vs repo spreads, and OIS forwards steepening. Also if the dollar stops weakening then Fed’s sterilizing. So Fed response will be critical. And if they decide to sterilize then it will be a tug of war bw ESF injections and Fed sterilization that will drive the market response after the initial pure liquidity pump.”

And then a little later, McNair posts again, answering a question about gold:

“It certainly put a bid in gold during the “warehousing” phase as they bought gold. But now that I believe the ESF/Treasury has begun selling that warehoused gold into its fwd settlement the direct support to gold prices should fade and be neutral to slightly bearish around each settlement date (at least increased vol around these dates). But one source of support, even as the fwd leg sells, is that the mkt will know Treasury is swapping gold for fx to build reserves. That should create a back stop to put a floor in gold. The thought being that if gold price falls too far, Treasury will just defer or slow the fwd delivery, leaving metal on the books. In effect, the ESF’s willingness to hold gold until it likes the price becomes a permanent bid. And just as importantly, mkt will know Treasury can reenter as a buyer whenever it wants to restart the loop, which will put a floor preventing large dips. All of this being dependent on my theory being correct in the first place.”

VIII. What’s an Important Point Worth Highlighting?

On May 1, 2025, McNair adds another post:

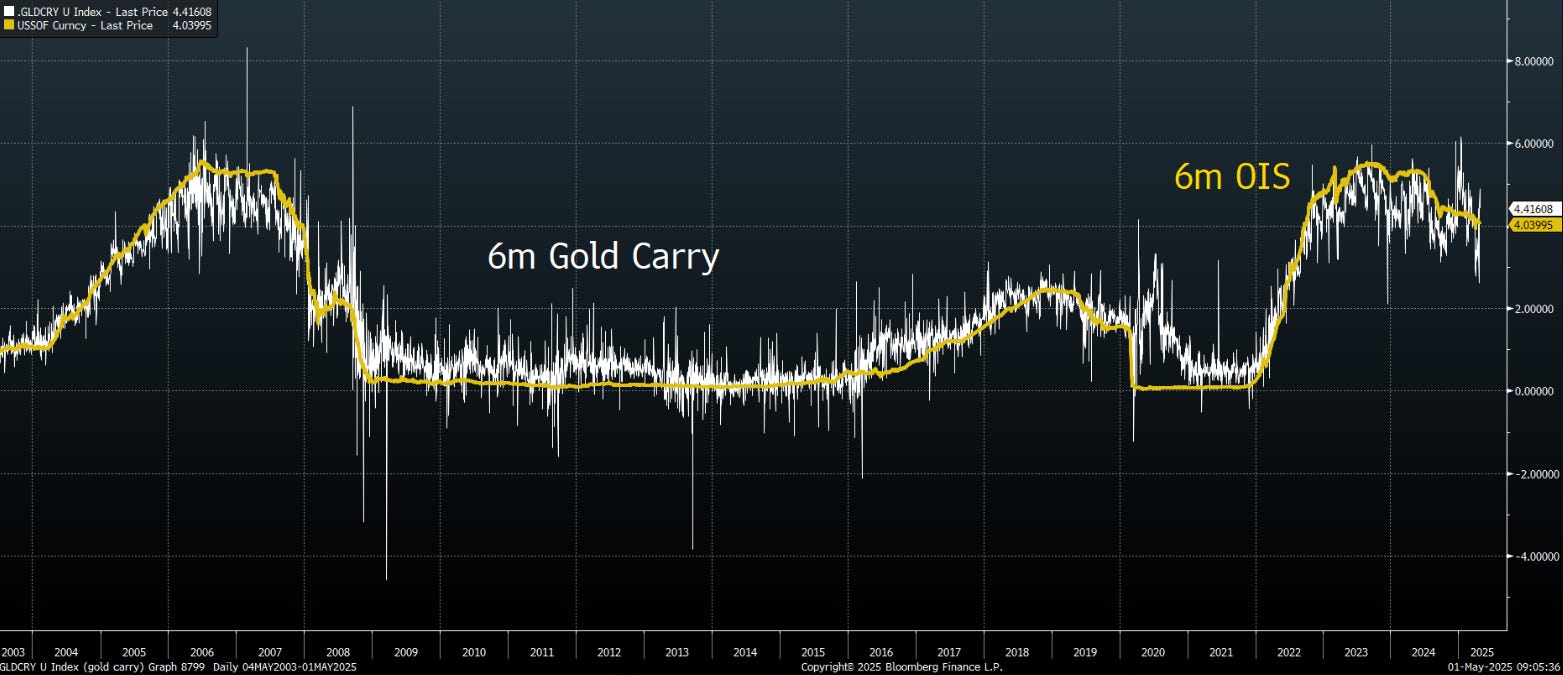

An important point worth highlighting: when you buy spot gold and sell it forward (gold carry), you’re synthetically replicating USD funding. That’s bc gold fwd points = the cost of funding in dollars (OIS) minus the gold lease rate.

Under Miran’s fx reserve strategy, Treasury buys gold (financed with short-term bills), then sells dollars fwd against fx. When the fwd matures, it sells the gold to raise the dollars it owes - satisfying the Gold Reserve Act’s “reduce debt” clause.

The reason this matters is that the gold fwd structure effectively funds the fx purchase at the prevailing USD rate without any permanent addition to public debt and without a congressional appropriation. Gold itself is the interim funding mechanism.

So if Treasury is running this loop, it’s not just swapping gold for euros and yen, it’s synthetically recreating the USD funding curve through gold. It’s actually a brilliant strategy…and people claimed Miran was “out of his depth”.

IX. What does The X Project Guy have to say?

If you have to re-read McNair’s posts a few times, don’t worry. I had to re-read them several times over a couple of days to comprehend fully what might be (likely is) happening. This article is a bit wonky and longer than most, so I will keep this short.

If McNair is correct, this is a brilliant strategy, and it would prove that Trump and his administration are playing 3-D, and maybe even 4-D, chess.

Even so, there is a downside. Global monetary systems do not change easily and without pain.

X. Why should you care?

Once again, I will turn to Gromen in his own words to explain why you should care:

“We will be watching the outcome on this with great interest; if McNair is correct, it is hard to overstate the importance of this development, for three reasons:

It is likely highly inflationary for asset prices and headline inflation, especially as it would likely be being done into increasingly disrupted supply chains (a la COVID.)

If Bessent was forced to resort to this measure, it would imply he needed to in order to suppress UST volatility (per above), because Yellen had largely exhausted the other more mainstream ways of suppressing UST volatility (TGA rundown, shifting issuance forward to rundown RRP, etc.)

Bigger picture, it would mean Bessent used US gold to circumvent/preempt Fed monetary policy in a manner directionally similar to what Yellen did in 3q22 (when she ran down TGA to offset QT) and 4q23 (when she shifted UST issuance to bills to mobilize RRP)…in our view, Bessent using gold like this would be a sort of “crossing the monetary Rubicon”, undertaken by Bessent under auspices of national emergency (i.e., Powell would not fund the financing the reshoring of US re-industrialization initiatives, so Bessent began taking matters into his own hands…a solution which every other Treasury Secretary from now on will likely avail themselves of.)

The propriety of Bessent’s possible actions in circumventing the Fed to engage in what would essentially be “gold QE” is debatable dependent on one’s politics; what is undebatable are the impacts of Bessent’s actions if McNair is right:If McNair is right, they would likely be quite inflationary in coming months, very good for gold, BTC, equities broadly (esp. US industrial equities), and negative for the USD (and therefore paradoxically, initially positive for LT USTs…which will be like picking up nickels in front of a steamroller on real basis. .)

Let’s watch.”

Thank you for your subscription, especially if you are a paying subscriber. Your support is everything to The X Project and is greatly appreciated. If you agree, please do me the favor of hitting the like button and posting positive comments about my articles, assuming you have positive things to say.