On Commodities, Carry Regimes & Changes in Global Monetary Regimes

A Summary of GoRozen's Latest Quarterly Market Commentary - Article #106

In this 15-minute article, The X Project will answer these questions:

I. Why this article now?

II. Why is now a timely opportunity to invest in natural resources, and what could catalyze the next commodity bull market?

III. What are G&R’s views and outlook on the crude oil and natural gas markets?

IV. What does G&R have to say about copper?

V. What does G&R think about precious metals?

VI. What are G&R’s views and outlook for uranium?

VII. What does G&R think about agricultural markets?

VIII. What about coal?

IX. What does The X Project Guy have to say?

X. Why should you care?

Reminder for readers and listeners: nothing The X Project writes or says should be considered investment advice or recommendations to buy or sell securities or investment products. Everything written and said is for informational purposes only, and you should do your own research and due diligence. It would be best to discuss with an investment advisor before making any investments or changes to your investments based on any information provided by The X Project.

I. Why this article now?

On March 7th, Goehring & Rozencwajg (GoRozen or G&R) published their fourth quarter 2024 market commentary. I consider their quarterly market commentaries a “must-read,” and I have previously summarized three of them in these articles:

If you are unfamiliar with Goehring & Rozencwajg, please check out their website to learn more.

II. Why is now a timely opportunity to invest in natural resources, and what could catalyze the next commodity bull market?

Now is a particularly timely opportunity to invest in natural resource equities due to their historically significant undervaluation relative to broader markets. Commodities typically move in dramatic cycles characterized by prolonged periods of undervaluation, which inevitably shift into robust bull markets following structural shocks to global monetary systems. Presently, commodities are at one of their most extreme points of undervaluation compared to equities, creating an ideal investment window before an anticipated significant upswing in commodity markets.

Historical patterns strongly support this thesis. Throughout market history, commodities have periodically reached severe undervaluation levels, each preceding extensive bull markets lasting multiple years. Notable examples include market transitions following the undervaluation periods in 1929, 1969, and 1999, each leading to significant commodity rallies and substantial outperformance of natural resource equities compared to the broader market indices. The current phase of undervaluation, initiated in 2011 and deepened during both the 2016 market downturn and the COVID-19 pandemic in 2020, closely parallels these historical precedents. This similarity strongly suggests we are nearing another major inflection point.

Furthermore, periods of commodity undervaluation often align with speculative financial bubbles in other market sectors, particularly technology. Historical analogs include speculative booms in radio stocks during the 1920s, semiconductor stocks in the 1960s, and dot-com stocks in the 1990s. Today, this speculative pattern is evident in the market's concentration on large-cap technology stocks known as the "Magnificent Seven," mirroring past scenarios that led to subsequent commodity bull markets. Speculative cycles tend to divert capital from commodities, amplifying their undervaluation until eventual market corrections redirect investor interest back toward tangible assets.

Central to understanding the current investment opportunity is the concept of the "carry regime," wherein investors exploit low-interest-rate environments by leveraging to invest in higher-yielding assets, assuming continued suppressed volatility and market stability. The present carry regime, established after the Global Financial Crisis, has resulted in significant financial market distortions, including hyper-financialization, concentrated capital flows toward large-cap equities, and consistently low volatility. This environment has disproportionately hurt natural resource stocks, which historically recover strongly once carry regimes collapse due to shifts in global monetary frameworks.

A potential catalyst for the upcoming commodity bull market is an imminent and fundamental shift in global monetary policy, specifically the rumored "Mar-a-Lago Accords." This transformation might involve restructuring U.S. Treasury debt, revaluing the Federal Reserve's gold reserves, and imposing strategic tariffs to reorganize global economic alliances around the U.S. dollar. Such significant changes would disrupt current monetary arrangements, potentially weakening the dollar relative to gold and prompting renewed investor interest in commodities and natural resources.

Given these conditions, investors are encouraged to position their portfolios strategically. Genuine diversification through investing in natural resource equities provides protection and significant upside potential during market corrections triggered by the unwinding of leverage-based speculative investments. Historical evidence and current market dynamics underscore the urgency of increasing exposure to commodities and natural resource equities to capitalize on the expected transformation and the next major commodity bull market.

III. What are G&R’s views and outlook on the crude oil and natural gas markets?

G&R presents an insightful and contrarian outlook on crude oil and natural gas markets, emphasizing structural factors likely to drive significant market shifts. In the crude oil sector, G&R challenges prevailing pessimism, which largely stems from projections by organizations such as the International Energy Agency (IEA) forecasting a persistent surplus in global supply relative to demand. G&R strongly contests these assumptions, arguing the IEA consistently underestimates non-OECD demand growth and overstates potential non-OPEC supply expansions, particularly from U.S. shale. They point to recent trends indicating that shale production—historically the primary driver of non-OPEC supply growth—is plateauing or declining, suggesting an impending market realignment reminiscent of the 2003-2008 period, when similar supply constraints led to significant price increases.

G&R further underlines that oil is extraordinarily undervalued relative to gold historically, signaling a potential major investment opportunity. They reference historical instances where similar undervaluation was followed by substantial price rallies, suggesting current market conditions offer a comparable opportunity.

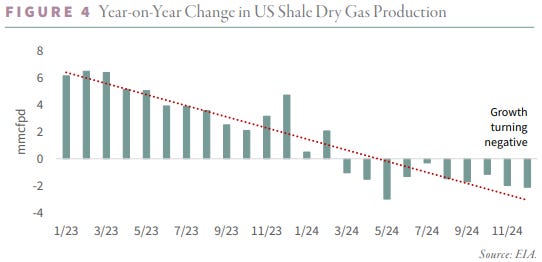

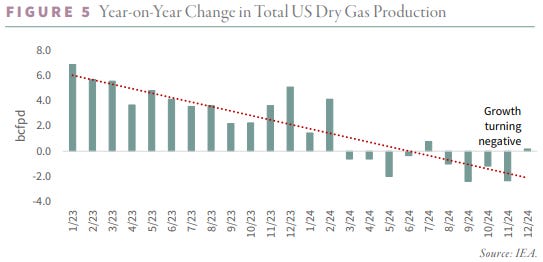

Regarding natural gas, G&R highlights that recent price increases reflect more profound structural shifts rather than temporary market fluctuations. They note the turning point in U.S. shale gas production, which has recently begun to decline year-over-year, signaling an impending structural deficit. The tightening market fundamentals and increasing demand driven by new LNG export capacity coming online in 2025 are expected to substantially reduce the long-standing price discrepancy between U.S. and international markets.

G&R argues that consecutive mild winters previously masked underlying supply issues by keeping inventory levels artificially high, but now this buffer is significantly reduced. They foresee a scenario in which the North American natural gas market moves into a sustained period of deficits, potentially triggering significant price volatility and a dramatic upward adjustment in prices. Consequently, G&R advocates that natural gas production equities, currently trading at substantial discounts, represent strategic investments poised to benefit from the anticipated market correction.

Overall, G&R’s analysis suggests both crude oil and natural gas markets are positioned for significant upward movements, driven by underestimated demand, overstated supply projections, and emerging structural supply deficits. They recommend investors reassess their positions to capitalize on these potentially transformative market conditions.

IV. What does G&R have to say about copper?

G&R provides a nuanced perspective on the copper market, underscoring immediate opportunities and emerging long-term challenges. G&R remains bullish on copper prices in the short term, highlighting persistent global deficits that began in 2021. Their analysis indicates that despite recent inventory build-ups following a short squeeze on the COMEX, copper inventories are declining sharply again, suggesting the structural deficit remains intact. The World Bureau of Metal Statistics (WBMS) data supports this view, with global copper demand outpacing supply, driven mainly by strong growth in non-OECD nations and moderated but substantial demand from China.

China's role in the copper market continues to be critical, with its demand growth accounting for 65% of global demand increases in 2024. Historically, analysts have underestimated China's copper consumption, but G&R cautions that this trend may soon reverse. After years of intense infrastructure investment and renewable energy projects, Chinese copper demand may experience slower growth, potentially disappointing market expectations and creating a headwind for copper prices as the decade progresses.

Demand remains robust Outside of China, particularly in Brazil, Indonesia, Malaysia, Saudi Arabia, Vietnam, and India. These nations have increasingly driven demand growth, potentially setting the stage for a broader transition in the global copper market. After a brief slowdown in 2024, India's copper consumption is expected to resume its rapid expansion, potentially mirroring China's early 2000s trajectory.

On the supply side, early-year production surges from expansions in the Democratic Republic of Congo have primarily tapered off, leaving minimal expected growth for 2025. With limited new projects coming online—aside from incremental supply from Ivanhoe’s Kamoa-Kakula expansion and Rio Tinto’s Oyu Tolgoi—the supply-side dynamics remain tight, reinforcing the likelihood of continued deficits.

In the longer term, however, G&R expresses caution regarding widely held optimistic assumptions around copper demand, particularly from renewable energy sectors. They suggest that market expectations might be overly optimistic, potentially requiring substantial downward revisions if renewable-driven demand disappoints. Concurrently, emerging technological advancements and exploration methods could alter the traditional copper supply outlook, potentially introducing new significant copper deposits and economically viable extraction methods.

In summary, G&R remains short-term bullish but emphasizes the necessity of caution and adaptability over the longer horizon. The shifting dynamics in global copper demand, particularly around China's economic evolution and the potential rise of new copper sources, suggest investors must carefully monitor these factors to capitalize on emerging opportunities and navigate potential future disruptions.

V. What does G&R think about precious metals?

G&R presents a robust outlook on precious metals, highlighting significant structural and market-driven factors that suggest a major bullish phase is imminent. Despite short-term struggles in the fourth quarter—due primarily to U.S. dollar strength triggered by Trump’s reelection and associated tariff policies—G&R strongly maintain that these pressures are merely short-lived disruptions overshadowing deeper, bullish undercurrents.

Central to their bullish outlook is the conviction that a fundamental shift in global monetary policy is underway, driven by developments dubbed the "Mar-a-Lago Accords," which propose substantial changes to the structure of the global financial system. G&R emphasizes the potential for a revaluation of the Federal Reserve's gold holdings, a restructuring of U.S. Treasury debt, and the implementation of strategic tariffs. Such shifts, they argue, would profoundly disrupt the current global monetary order, significantly benefiting gold and other precious metals as traditional stores of value.

Despite recent investor apathy toward precious metals, particularly in Western markets, G&R notes substantial ongoing gold accumulation by central banks. In 2024 alone, central banks purchased over 1,000 tonnes of gold for the third consecutive year, with countries like Poland, India, and China significantly increasing their reserves. This buying spree underscores a broader strategic recognition of gold's value amid growing geopolitical and economic uncertainties.

Moreover, G&R highlights the marked disconnect between physical gold demand and Western investor sentiment. Even as ETF investors have pulled back, gold prices continue to rise, driven by central bank purchases and emerging market demand. They predict this Western investor disinterest is temporary, anticipating renewed interest as monetary and geopolitical instability intensifies, driven by further policy interventions and economic disruptions.

Lastly, G&R underscores the unique market opportunity presented by gold mining equities, which remain undervalued relative to the rising gold price. They expect a significant re-rating of these equities once Western investor capital returns, emphasizing that gold miners currently offer a particularly compelling entry point for investors looking to benefit from the anticipated long-term bull market in precious metals.

In conclusion, G&R's analysis strongly suggests that the precious metals market, particularly gold, is poised for substantial growth driven by strategic central bank accumulation, anticipated global monetary policy shifts, and eventual renewed interest from Western investors. Investors are advised to consider gold and gold equities positions as essential components of a diversified and strategically positioned portfolio.

VI. What are G&R’s views and outlook for uranium?

G&R has a bullish outlook on uranium, underpinned by a robust fundamental backdrop despite recent volatility. Although spot uranium prices declined nearly 10% during the fourth quarter of 2024—dropping from $82 to $73 per pound—long-term contract prices held firm at around $81 per pound. This divergence suggests speculative investors, who propelled uranium's rise earlier in 2023, have largely exited, reducing volatility and creating a stable price floor.

One critical event that impacted investor sentiment was the announcement by Chinese AI developer DeepSeek that their new algorithms could significantly reduce the energy consumption required for complex AI tasks. This news initially spurred a significant sell-off in uranium-related stocks due to fears that lower AI-related energy demands could diminish future nuclear energy usage. However, G&R argues that this interpretation was flawed. Citing Jevons' Paradox, they assert that efficiency improvements historically lead to exponential increases in consumption rather than decreases. Consequently, if AI processing becomes substantially more efficient, demand for such computing—and thus, associated energy demand—will increase dramatically.

Supporting this bullish stance, G&R highlights a notable resurgence in the interest of major corporations and utilities in nuclear power. Companies like Meta, Amazon, Google, and Microsoft are actively integrating nuclear energy into their long-term power strategies, signaling a significant shift in corporate America’s perception of nuclear power's role in providing stable, carbon-free baseload power. For instance, Oklo, a prominent developer of molten sodium small modular reactors (SMRs), signed a significant agreement to deploy 12 gigawatts of capacity to power Switch's data centers across the U.S.

Further underpinning G&R’s positive outlook is the renewed interest in large-scale nuclear projects, exemplified by South Carolina utility Santee Cooper's decision to seek bids for completing construction of two previously abandoned reactors at the VC Summer Nuclear Station. This renewed activity symbolizes an emerging investment cycle in nuclear energy and accelerating momentum supporting strong long-term uranium demand. G&R thus perceives current market conditions—characterized by improving fundamentals, increasing corporate interest, and growing adoption of innovative nuclear technologies—as heralding a sustainable, long-term bull market for uranium.

VII. What does G&R think about agricultural markets?

G&R holds a bullish view of agricultural markets, stating that they are currently at a critical turning point. Throughout 2024, agricultural markets experienced downward trends, punctuated by a mixed performance in the fourth quarter. Specifically, corn prices rallied by 8% due to the USDA's sharp downward revision in U.S. corn yield estimates, while soybean and wheat prices declined further. Fertilizer markets were similarly mixed, with urea prices rising by 7% and phosphate and potash prices declining by 2% and 6%, respectively.

Earlier in 2024, sentiment among speculative traders in agricultural markets became extremely bearish, particularly in corn and soybeans, reaching negative extremes not witnessed in four decades. Conversely, commercial traders—seen as the "smart money"—adopted a significantly bullish stance, accumulating record net long positions. This divergence between commercial and speculative traders signaled a significant market bottom forming, validated by the subsequent strong price rebound. Corn prices have since risen nearly 40%, and soybean prices are up by approximately 15% from their summer lows.

The primary reason for this recent price rally was the realization that the USDA had significantly overestimated 2024 corn and soybean yields. Initially, USDA forecasts projected record-high corn yields, creating an illusion of oversupply that heavily depressed market prices. When yields came in much lower than expected, markets corrected strongly upwards.

G&R also highlights a potentially significant catalyst: extreme drought conditions affecting major grain-exporting regions, such as Brazil, Argentina, Ukraine, and western Russia. These areas collectively represent a substantial portion of global grain exports. With drought risks associated with the 88-year Gleissberg sunspot cycle rising, G&R believes a global supply shock could emerge in 2025, fundamentally altering market dynamics and possibly igniting a significant agricultural bull market.

After two years of substantial price declines—by as much as 50% since peaks following Russia’s 2022 invasion of Ukraine—valuations within the agricultural sector have reset dramatically. G&R argues that even a modest improvement or a slight shift in fundamentals could provoke an outsized market reaction. Given current low investor sentiment and undervalued equities, they see an attractive risk-reward scenario for investors positioning themselves in agricultural markets.

VIII. What about coal?

G&R holds a bullish view on coal markets, highlighting significant underlying strength despite recent market stagnation and investor apathy. In their assessment, G&R underscores the paradox between quiet market performance and robust underlying fundamentals. During the fourth quarter, U.S. coal prices experienced limited volatility, with incremental increases in the Powder River Basin and Central Appalachian coal. Internationally, prices of Australian Newcastle and South African Richards Bay thermal coal declined modestly. Coal equities mirrored this subdued momentum, showing little change during the quarter.

However, behind this apparent calm, global coal demand has been steadily increasing, primarily driven by heightened energy needs in China and India, which continue to surpass the rapid expansion of renewable energy sources. According to the International Energy Agency (IEA), coal markets have not only rebounded from a temporary COVID-induced downturn but have reached record highs in production, consumption, trade, and coal-fired power generation due to rising natural gas prices exacerbated by geopolitical events such as Russia's invasion of Ukraine.

G&R challenges the IEA’s projection that global coal consumption will peak in 2027, particularly questioning the assumption that China's massive expansion into renewables will substantially curb its coal use. G&R argues that China's renewable energy strategy primarily aims to reduce oil imports rather than to advance climate objectives. They emphasize that renewables, while politically favorable, often destabilize power grids and increase energy costs, a scenario already evident in countries like Germany and the UK. As a strategic response, China has accelerated the construction of coal-fired baseload power generation capacity, a trend G&R expects to continue, suggesting Chinese coal demand might not peak until the early 2030s.

Additionally, G&R points out the looming risk of a natural gas supply crisis, as U.S. shale gas growth, previously a stabilizing factor in global markets, is now stagnating. This potential crisis could further boost coal demand, especially in Asia, where coal remains a reliable backup fuel. Despite growing global coal usage, investor hostility towards coal remains high, which G&R describes as shortsighted. Historically, coal equities have been front-runners in commodity bull markets, outperforming other natural resources over extended periods. Given the current undervaluation and suppressed investor interest, G&R identifies a significant investment opportunity in coal equities. They contend that market participants who recognize coal’s ongoing and vital role in global energy systems—and invest accordingly—stand to be substantially rewarded in the upcoming cycle.

IX. What does The X Project Guy have to say?

Generally, I agree with G&R’s overall views and market positions, and my investment theses as follows are generally aligned:

Overweight cash and short-term U.S. T-bills for optionality, given expected INCREASING volatility related to the remaining list below.

Bullish gold and gold miner equities

Bullish Bitcoin

Bullish oil and oil-related equities

Bullish natural gas and related equities

Bullish uranium and related equities

Bullish industrial-associated commodities and equities

Bullish agricultural-associated commodities and equities

Bullish industrial and primarily electrical infrastructure equities

Bearish long-dated U.S. and other Western sovereign bonds

From the outset of The X Project, gold has been and continues to be my highest conviction position, as long-time readers are aware, given the number of articles I’ve devoted to the topic directly and indirectly. Half of the gold I own is in physical form in my custody under my lock and key. I consider gold my longest-term position, and I never intend to sell it unless I have to. If I have to, I will liquidate every other investment before I sell my physical gold. I consider gold to be less of an investment and more of savings in real money that protects me against the debasement of the currency in which all my other savings and investments are denominated.

X. Why should you care?

I strongly encourage everyone to accumulate gold as a form of long-term savings. You may have noticed that gold prices have continued marching higher, posting another all-time high on Friday. You also probably noticed that the stock market has been heading in the opposite direction recently.

So, let’s look at the long-term relative performance of gold versus the S&P500. Here is the total return of Friday’s current price compared to that of the price 10 years ago and every additional decade going back to 60 years ago:

Going back 60 years, gold has outperformed the S&P500 by about 35%. Compared to 20 years ago, gold has outperformed the S&P500 by 64%. Going back 10 years ago, the S&P500 has a slight edge of about 6%. However, compared to 30, 40, and 50 years ago, the S&P500 outperformed by 44%, 226%, and 305% respectively.

Doesn’t this argue in favor of the S&P500 over gold? No. This table represents the fact that there are extended periods when the S&P500 outperforms gold and the opposite long periods when gold outperforms the S&P500. G&R and I are suggesting that we are about to embark on an extended period of gold (and other authentic, hard, tangible assets) outperforming the S&P500. In fact, it has already begun:

But don’t worry - if we are correct, we are only just starting. Before the end of this decade, I expect gold prices to at least double, probably triple, and possibly quadruple from current prices. At that time, the comparisons to the S&P500 will strongly favor gold over every look back time horizon.

Next week, I will provide an update on this article from six months ago: “CAPITAL ROTATION – A visual article of X posts and charts from the guys at Northstarbadcharts.com”

Thank you for your subscription, especially if you are a paying subscriber. Your support is everything to The X Project and is greatly appreciated. If you agree, please do me the favor of hitting the like button and posting positive comments about my articles - assuming you have positive things to say.