Generational Opportunities

A Summary of "The Norwegian Illusion," GoRozen's Latest Market Commentary - Article #46

In this 16-minute article, The X Project will answer these questions:

I. Why this article now?

II. What is the Norwegian Illusion?

III—VIII. What is the outlook for the crude oil, natural gas, copper, uranium, precious metals, and agricultural commodities markets?

IX. What does The X Project Guy have to say?

X. Why should you care?

Reminder for readers and listeners: nothing The X Project writes or says should be considered investment advice or recommendations to buy or sell securities or investment products. Everything written and said is for informational purposes only, and you should do your own research and due diligence. It would be best to discuss with an investment advisor before making any investments or changes to your investments based on any information provided by The X Project.

I. Why this article now?

First, this article is long overdue. The X Project curates, summarizes, distills, and synthesizes knowledge & learning at the interseXion of economics, geopolitics, money, interest rates, debts, deficits, energy, commodities, demographics, & markets - helping you know what you need to know. Of these ten topics, commodities are the topic that has yet to be covered directly, with the exception of articles #15 and #23 on crude oil and articles #13, #31, and #41 on gold. The X Project has repeatedly published the investment themes to which it subscribes, of which these 6 are commodity-related:

Bullish gold and gold miner equities

Bullish oil and oil-related equities

Bullish natural gas and related equities

Bullish uranium and related equities

Bullish industrial-associated commodities and equities (primarily copper and copper miners)

Bullish agricultural-associated commodities and equities

With the exception of gold and oil, The X Project has as of yet explained the bullish case for natural gas, uranium, copper, and agricultural commodities, and so again this is overdue.

Second, Leigh Goehring and Adam Rozencwajg of their firm, Goehring and Rozencwajg, are favorites, highly influential, and respected by The X Project. In late February 2024, they published their latest quarterly market comment, The Norwegian Illusion. Their report summarizes the bullish case for the six commodities well, but first, we need to explain the title of their report.

II. What is the Norwegian Illusion?

The authors refer to the "Norwegian Illusion" in the context of electric vehicle (EV) adoption and its implications for energy consumption, carbon emissions, and the broader assumption that EVs will significantly reduce global oil demand and carbon emissions. They critically examine Norway's experience with EVs to highlight what they perceive as misconceptions surrounding the transition to electric transportation.

Firstly, they challenge the widespread belief that the transition to EVs will lead to a peak and subsequent decline in global oil demand. Despite predictions and significant investments in EV technology, global oil consumption is expected to increase, not decrease. The authors argue that the assumption of a swift and substantial shift from internal combustion engines (ICEs) to EVs is overly optimistic, primarily because of the inherent energy inefficiency of EVs compared to ICE vehicles when considering the full lifecycle energy consumption, including battery production and the electricity generation mix.

Secondly, the authors scrutinize Norway's heavy subsidization of EVs and its efforts to promote electric transportation as a model for reducing carbon emissions. They point out that despite Norway's substantial incentives for EV purchases and use, the overall impact on reducing oil consumption and carbon emissions has been minimal. They highlight the financial burden of EV subsidies on Norway's economy and question the scalability of such a model to other countries without similar financial resources and favorable energy mixes (e.g., Norway's abundant hydroelectric power).

Lastly, they discuss the "illusion" that EVs offer a cleaner alternative to ICE vehicles by significantly reducing carbon emissions. By analyzing the entire lifecycle of EVs, including the energy-intensive processes involved in mining materials for batteries and the manufacturing of the vehicles, they argue that the shift to EVs may, in some cases, increase total carbon emissions. The example of Norway is used to demonstrate that despite the high penetration of EVs, the expected decrease in carbon emissions and oil consumption has not materialized to the anticipated extent, partly because of the continued use of ICE vehicles alongside EVs and the overall increase in energy demand.

III. What is the outlook for the crude oil market?

Very bullish as the structural deficit worsens with increased demand and reduced supply

Contrary to the expectations of imminent “peak oil demand,” the report highlights that global oil consumption is not only poised to continue growing but is also expected to reach new highs in the coming years. This projection is based on the underestimation of energy demand growth, particularly in developing regions where the transition to alternative energy sources is slower and more complex than in developed economies. The authors argue that the persistence of robust oil demand, coupled with potential constraints on supply, could lead to tighter market conditions than many anticipate.

“Although few people care to admit it, global oil markets slipped into a “structural deficit” in the summer of 2020, causing OECD crude and refined product inventories to fall by 600 mm bbl over the next twenty-four months – a record. To prevent a price spike, OECD governments arranged a coordinated release of 320 mm barrels from their strategic petroleum reserves. In response to the government’s SPR releases, commercial inventories rose. Since March of 2022,when SPR releases commenced, OECD commercial stocks have risen by almost 175 mm barrels. Many analysts, including the International Energy Agency (IEA), have failed to comment on the true reasoning why commercial inventories have risen—SPR releases. Instead the IEA has implied inventories rose simply because supply exceeded demand. However, if one adjusts for SPR liquidations, inventories are unchanged, suggesting a market that is not in surplus—but balanced. Given our models of both supply and demand, we firmly believe oil markets will once again fall into a sustained deficit in 2024. Although few people agree, we believe the deficit could prove so acute as to require further SPR liquidation later this year. The last period of structural deficit, between 2020 and 2022, saw crude prices advance three-fold from $40 to $120 per barrel. Could we experience the same again now? We recommend investors position themselves accordingly.”

In discussing the supply side of the crude oil market, the report places significant emphasis on Saudi Arabia, a key player in the global oil landscape. They express concerns over Saudi Arabia's oil reserve estimates and production capacity, suggesting that the kingdom might be closer to its peak production levels than previously thought. This analysis is grounded in a critical examination of Saudi Aramco's reserve disclosures and production strategies, which, according to the authors, might mask underlying challenges in sustaining long-term production growth. The skepticism towards Saudi Arabia's ability to indefinitely expand its oil output contributes to the report's broader narrative of potential supply-side constraints in the crude oil market.

Finally, the report contemplates the question, "Is US Oil Production Surging?" The report critically assesses the apparent acceleration in U.S. crude production, challenging the accuracy of prevailing data that suggests robust growth. The authors argue that contrary to Energy Information Agency (EIA) reports indicating significant year-on-year increases in production, the reality of U.S. oil output growth is markedly overstated. By adjusting for a methodological change in how the EIA accounts for crude blending and under-reporting of field-level production, the authors present an analysis suggesting a dramatic deceleration in growth rates throughout 2023. They predict that U.S. crude production may not only plateau but potentially decline as early as the year's second quarter, countering widespread industry optimism and highlighting a potential underestimation of market tightness and its implications for future oil prices and supply dynamics. This contrarian view points to structural challenges within the U.S. shale industry. It raises questions about the sustainability of its role as a pivotal source of non-OPEC oil supply growth.

IV. What is the outlook for the natural gas market?

As bullish as the uranium market was five years ago

In the section "Is Gas the New Uranium?", the authors draw a compelling parallel between the current North American natural gas market and the uranium market of five years ago, suggesting that both have been on the brink of shifting from a surplus to a structural deficit without widespread recognition from investors. They posit that similar to uranium before its price surge, natural gas is undervalued and overlooked, with market dynamics poised for a significant turnaround. The authors highlight key factors contributing to this impending shift, including the depletion of major shale gas basins like the Marcellus and Haynesville, which are approaching their peak production limits. They note that these basins, responsible for a significant portion of the U.S. gas supply, are showing signs of slowing output, contrary to the expectations of perpetual growth. This slowdown in production growth, combined with a surge in demand from new LNG export capacities, sets the stage for a tightening gas market.

The report meticulously analyzes the production dynamics of these shale gas basins, employing proprietary neural network models to estimate recoverable reserves and the lifecycle of well productivity. According to their analysis, these basins are nearing the point of half of their reserves being depleted — a critical inflection point that typically heralds a decline in production. Furthermore, the report notes a significant reduction in well productivity, indicating that the most prolific Tier 1 drilling locations have been largely exploited. This observation is bolstered by real-time data showing a reduction in drilling productivity, which the authors interpret as an early indicator of forthcoming production declines.

The authors conclude that the natural gas market is on the cusp of a significant transformation, driven by the confluence of slowing production growth and increasing demand, particularly from the LNG sector. They assert that this shift towards a structural deficit will likely lead to higher natural gas prices, mirroring the uranium market's trajectory in recent years. The report challenges the prevailing market sentiment by drawing attention to the overlooked signs of impending supply constraints and the burgeoning demand. It suggests that strategic investors could benefit from recognizing and acting upon these early indicators of change in the natural gas market.

V. What is the outlook for the copper market?

Short-term bullish and cautious longer-term

The outlook for the copper market presents a nuanced view of the industry's near-term challenges and long-term opportunities. In the short term, the report highlights a potentially bullish scenario for copper, driven by robust demand growth in non-OECD countries, notably China, India, and Indonesia, which have exhibited substantial increases in copper consumption. This surge in demand is juxtaposed against a backdrop of disappointing mine supply projections for 2024, exacerbated by significant production cuts at key mines such as the Cobre Panama and Los Bronces. These factors and declining inventories at major metal exchanges suggest a tight copper market in the near term, which could support higher prices.

Looking further ahead, the report shifts focus to the impact of new copper technologies and their potential to disrupt traditional supply and demand dynamics. It acknowledges the growing optimism around medium- and long-term copper demand, fueled by electrification and renewable energy projects requiring substantial amounts of the metal. However, the authors caution against overly bullish projections, citing possible supply responses that could arise from technological advancements in copper mining and processing. These innovations, which include more efficient ore processing techniques and the exploration of untapped resources, might increase the available supply of copper and potentially offset some of the anticipated demand growth.

In conclusion, the outlook for the copper market is characterized by short-term bullishness due to supply constraints and robust demand, particularly from emerging economies undergoing rapid industrialization and infrastructure development. However, the long-term picture is more complex, with new technologies posing both challenges and opportunities for the copper industry. These advancements have the potential to expand the supply of copper significantly, which could moderate prices in the future. As such, stakeholders in the copper market are advised to closely monitor technological developments and adjust their strategies accordingly to navigate the evolving landscape of the copper industry.

VI. What is the outlook for the uranium market?

“The uranium rally has only started”

The outlook for the uranium market underscores a bullish sentiment driven by a combination of growing demand and supply-side constraints. The demand for uranium is on an upward trajectory, bolstered by a global recognition of nuclear power's role in achieving carbon-neutral energy goals and the development of new reactor technologies, including Small Modular Reactors (SMRs). These reactors promise higher efficiency and lower costs, potentially accelerating the adoption of nuclear energy. Moreover, financial investors and uranium investment trusts have begun stockpiling uranium, anticipating further price increases. This emerging demand from financial players, alongside traditional utility buyers, has contributed to uranium's price surge and is expected to maintain upward pressure on prices.

However, the uranium supply chain faces significant challenges that could exacerbate the market's tightening. A key issue is the announcement by Kazatomprom, the world's leading uranium producer, indicating that it cannot meet its production guidance for 2024 and 2025 due to a lack of sulfuric acid and construction delays. This unexpected shortfall from one of the industry's largest suppliers highlights the vulnerabilities in the uranium supply chain and underscores the potential for supply deficits. The report emphasizes that these supply-side challenges are not isolated incidents but part of a broader trend of underinvestment in uranium mining and the complexity of bringing new production online amidst increasing regulatory and environmental considerations.

In conclusion, the uranium market is poised for continued growth and price increases, driven by robust demand from the energy sector and speculative financial investments. The global shift towards cleaner energy sources and technological advancements in nuclear reactor designs underpins this demand growth. However, significant supply-side challenges, highlighted by the recent developments at Kazatomprom, signal potential hurdles in meeting this demand. These dynamics suggest a market that could experience tighter supplies and higher prices in the medium to long term, making uranium an increasingly critical and potentially lucrative commodity in the global transition to sustainable energy sources.

VII. What is the outlook for the precious metals markets?

“Gold equities are likely one of the most undervalued asset classes in the world today”

The "Precious Metals" section of the report provides an insightful analysis of the gold and silver markets, noting a significant uptick in their prices during the fourth quarter. This increase is attributed to a 4% depreciation of the US dollar, alongside real interest rates that surged throughout the year. Despite substantial investor liquidation from Western markets, where physical gold ETFs saw a notable reduction in holdings, gold achieved a new all-time high price in December. This was largely due to aggressive buying by central banks, which offset the selling pressure from Western investors. The central banks' purchases, particularly by the People's Bank of China, are highlighted as a pivotal factor buoying gold prices amidst rising real interest rates and investor skepticism. The report speculates that this pattern of central bank purchases is indicative of a broader strategic move, possibly in anticipation of shifts in the global monetary regime, given the historical undervaluation of commodities relative to financial assets.

Concluding, the report posits a bullish outlook for precious metals, particularly gold, in the coming periods. It suggests that the current real interest rate environment, combined with potential future rate cuts hinted at by the Federal Reserve, could reverse the trend of Western investor liquidation, setting the stage for a new rally in gold prices. The authors underscore the potential for precious metals, especially gold equities, as undervalued assets that could offer significant returns. This outlook is based on a nuanced understanding of market dynamics, including speculative investment trends, central bank policies, and underlying economic indicators, pointing towards precious metals as a key area of interest for investors in the context of global economic uncertainties and shifts in monetary policy.

VIII. What is the outlook for the agricultural commodities markets?

“Grain prices are poised to enter a potentially massive bull market”

The report provides an in-depth analysis of the agricultural commodities market, with a particular focus on corn, soybeans, wheat, and the fertilizer market. The narrative begins by acknowledging the mostly flat performance of corn and soybeans in the fourth quarter, contrasting with a significant 15% rise in wheat prices driven by strong export demand and ongoing geopolitical tensions affecting key producing regions. The report also notes the volatility in fertilizer prices, with urea experiencing a significant drop, highlighting the intricate dynamics affecting agricultural input costs and their impact on overall agricultural productivity and commodity pricing.

Diving deeper, the report examines the underlying factors contributing to the current state of the agricultural markets, including weather patterns, geopolitical conflicts, and shifting trade dynamics. It points to the La Nina Modoki weather pattern as a key driver of drought conditions in northern Brazil, adversely affecting soybean and corn production forecasts and potentially tightening global supply. Furthermore, the report raises concerns about the significant upward revisions by the USDA to their corn yield assumptions, suggesting a potential oversupply scenario that could pressure prices. However, it cautions that these projections could be overly optimistic, given the unpredictable nature of weather impacts on crop yields.

Lastly, the sections emphasize the sentiment among grain traders, who have reached near-record bearish levels in their market positioning. This pessimism is juxtaposed with the backdrop of potentially disruptive weather patterns and geopolitical uncertainties that could dramatically alter supply expectations and market dynamics. While reflective of current supply forecasts and market dynamics, the authors suggest that this bearish sentiment may not fully account for the latent risks in global agriculture markets, including the possibility of adverse weather events and their cascading effects on global supply chains. This analysis underscores agricultural commodity markets' inherent unpredictability and volatility, suggesting that traders and investors should remain vigilant to rapidly changing conditions that could upend current market expectations.

“We believe the current positioning indicates that grain prices are poised to enter a potentially massive bull market. The eighteen-month sell-off is likely nearing an end. Investors should position themselves accordingly.”

In the next section, I will explain what I think about all of this, and then in the final section why you should care and, more importantly, what more you can do about it. However, I have just hit a new paid subscriber threshold, and so you now have to be a paid subscriber to view the last two sections. The X Project’s articles always have ten sections. Soon, after a few more articles, the paywall will move up again within the article so that only paid subscribers will see the last three sections, or rather, free subscribers will only see the first seven sections. I will be moving the paywall up every few weeks, so ultimately, free subscribers will only see the first four or five sections of each article. Please consider a paid subscription.

All paid subscriptions come with a free 14-day trial; you can cancel anytime. Every month, for the cost of two cups of coffee, The X Project will deliver two articles per week ($1.15 per article), helping you know in a couple of hours of your time per month what you need to know about our changing world at the interseXion of commodities, demographics, economics, energy, geopolitics, government debt & deficits, interest rates, markets, and money.

You can also earn free paid subscription months by referring your friends. If your referrals sign up for a FREE subscription, you get one month of free paid subscription for one referral, six months of free paid subscription for three referrals, and twelve months of free paid subscription for five referrals. Please refer your friends!

IX. What does The X Project Guy have to say?

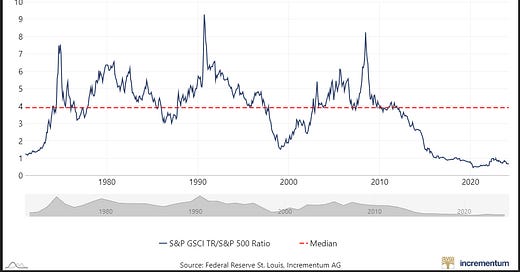

The title of this article summarizes my overall thoughts - generational opportunities come along once in a generation, and this one is perhaps the best one we will see in our lifetimes. The chart at the beginning of the article illustrates this well, as it shows the Goldman Sachs Commodity Index ratio over the S&P 500 index. As you can see, it shows commodities are at the lowest level relative to the S&P 500 in my lifetime. As of the end of March 2024, the ratio is at 0.69, with its recent low being 0.46 in April 2020. The September 1990 high was 9.27. Not only do I think that investing in commodities has relatively little downside risk from current prices, but there is enormous upside potential unlike anywhere else to be found.

Can commodities prices still go lower? Yes. That is why you always want to keep enough cash available to take advantage of such a situation should it develop, but not so much that you feel like you missed an opportunity should prices take off from here.

Can commodity prices go sideways and not go higher for a long time yet? Yes. As the chart shows, the most recent high was 0.97 in October 2022, and the last time prior to then that the ratio was that high was in October 2018.

However, if we look at just the GSCI chart, it suggests otherwise:

Not to get too technical, but this chart shows that commodity prices are breaking out to the upside of a bullish descending or falling wedge pattern. Typically, you see prices accelerate to the upside with this type of pattern.

X. Why should you care?

I have repeatedly argued that we are likely to experience a structurally and systemically higher inflationary environment going forward. Usually, the context in which I have made this argument is our government’s unsustainable debt and deficits, which require more debt and liquidity (i.e., money creation) to sustain. Inflation devalues our fiat currency, and a structurally and systemically higher inflationary environment is the greatest threat to our economic and financial well-being.

For example, according to the CPI Inflation Calculator, one dollar in 2019 is worth $1.21 cents today. Assuming we experience the same average inflation over the next five years as the last five years (which I believe is an overly optimistic and conservative assumption), then everything priced in dollars today will be 21% higher five years from now, all else equal.

When we look at the economic fundamentals of supply and demand for the six commodities that GoRozen has analyzed, we see a strong and clear bullish case for those commodities independent of currency debasement. Furthermore, higher commodity prices feed through the supply chains and primarily cause higher future inflation, further debasing the currency.

And since commodities are priced and traded in U.S. Dollars, the currency debasement only adds an additional layer of bullishness for commodity prices above and beyond the supply and demand economics.

The only way to succeed in an inflationary environment is to earn a return on capital higher than the inflation rate and currency debasement rate. Investing in these six commodities is perhaps the best opportunity in a generation, if not in our lifetimes, to achieve that goal.

Thank you for your paid subscription. Your support is everything to The X Project and is greatly appreciated. If you agree, please do me the favor of hitting the like button and posting positive comments about my articles - assuming you have positive things to say - especially about these final sections (soon to be more sections) that only you as a paid subscriber get to see.