The End of the World is Just the Beginning: Mapping the Collapse of Globalization

A summary of the book written by Peter Zeihan (2022) - Article #28

In this 12 min article, The X Project will answer these questions:

I. Why this book, and what’s it about?

II. Who is the author?

III. How popular is the book?

IV. What is one of the top takeaways from the book?

V. What is another top takeaway?

VI. What is the third top takeaway?

VII. What is the fourth top takeaway?

VIII. What is the fifth top takeaway?

IX. What does The X Project Guy have to say?

X. Why should you care?

I. Why this book, and what’s it about?

In an era where the global order seems as malleable as clay, Peter Zeihan's The End of the World is Just the Beginning emerges as a guiding beacon, dissecting the complexities of our world with the precision of a surgeon. Why this book? Because in the labyrinth of commodities, economics, and geopolitics, Zeihan offers not just a map, but a GPS. This book isn't just about understanding the present; it's about predicting the future.

Zeihan, with his characteristic flair, paints a picture of a world standing on the precipice of monumental change. The book dives into how the post-World War II global order, underpinned by free trade and American military might, is eroding. It's not just a book; it's a prophecy – forecasting a world where traditional alliances crumble, economic norms are turned on their heads, and geopolitical landscapes undergo seismic shifts.

When The X Project originally launched its service, it started by identifying the ten most influential books read in 2022 or before, along with the ten most influential books read in 2023. The reason for starting with an original list of twenty books to review and summarize was to set the foundation for The X Project’s perspective. This is the fifteenth book on the list of twenty.

II. Who is the author?

Newer subscribers may be unaware, but Peter Zeihan is a geopolitical strategist who is the author of four books, all of which made The X Project’s list of top twenty most influential books. The three books covered thus far are The Accidental Superpower, The Absent Superpower, and Disunited Nations, in article #7, article #12, and article #18, respectively. Each of those articles has a different and longer biography of Peter Zeihan that you can check out.

In addition to his books, Zeihan is a prolific content generator on YouTube. The X Project covered his views on China from several YouTube videos in the article #25, “The Dragon's Descent: China's Demographic Disaster and Imminent Collapse.”

III. How popular is the book?

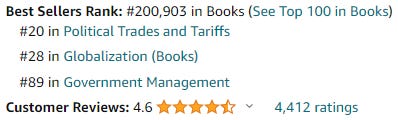

Here are the book’s rankings on Amazon:

This is the second most popular book on The X Project’s list after Ray Dalio’s Principles for Dealing with The Changing World Order: Why Nations Succeed and Fail covered in article #24.

IV. What is one of the top takeaways from the book?

Commodities and Global Trade

It's clear that the erosion of global trade networks will fundamentally alter how nations access and value commodities. He posits that countries currently dependent on global supply chains for essential resources like oil, rare earth metals, and even basic agricultural products will face significant challenges. This shift could lead to a resurgence in local production methods but at a higher cost and potentially lower efficiency. The crux of Zeihan's argument lies in the acknowledgment that nations historically reliant on imports for their economic and industrial growth will have to rapidly adapt to a new reality of self-sufficiency or seek new, less stable trade alliances.

Moreover, Zeihan argues that the changing landscape of global trade will lead to a realignment of geopolitical power. Countries like the United States, with its vast natural resources, stand to gain a significant strategic advantage. In contrast, resource-poor nations, particularly those in regions like Europe and East Asia, could find themselves in a precarious position, having to navigate a new world order where resource diplomacy becomes a key tool in international relations. This would redefine global alliances and potentially spark conflicts over resources, reminiscent of historical struggles but in a modern context.

V. What is another top takeaway?

Demographic Dilemmas

Zeihan's analysis of demographic trends underscores a pivotal force reshaping the global economic and political landscape. He notes that while Western nations grapple with aging populations and a shrinking workforce, countries in Africa and parts of Asia face the opposite challenge: a burgeoning youth population. This demographic divide will have profound implications on global labor markets, potentially leading to significant shifts in where and how companies operate. Developed nations might face labor shortages, pushing them towards automation and AI, while developing nations could struggle with high unemployment rates, potentially leading to social unrest.

Furthermore, Zeihan highlights how demographic shifts will influence global migration patterns. As developed nations seek to address labor shortages, policies around immigration could become a central political issue. This might lead to a paradoxical situation where countries with historically stringent immigration policies may find themselves competing to attract foreign workers. The impact on global economics is significant – shifts in labor force dynamics could lead to changes in consumer markets, innovation trends, and even the global balance of economic power. Zeihan’s analysis suggests that understanding demographic trends is crucial for predicting the future of global economies.

VI. What is the third top takeaway?

Energy and Geopolitics

In his deep dive into energy, Zeihan predicts a future where energy resources dictate geopolitical strategies. He argues that the transition towards renewable energy sources will not be uniform across the globe, leading to significant disparities in energy independence. Countries rich in renewable resources like solar and wind, or those with the technological prowess to leverage these resources effectively, will gain significant geopolitical leverage. This shift could decrease the geopolitical influence of traditional oil-rich nations, fundamentally altering longstanding power dynamics.

Zeihan also warns of the potential for new forms of energy conflicts. As nations compete for dominance in renewable energy technologies and resources, this competition could replace the oil-centric conflicts of the 20th century. He foresees a world where control over rare earth elements and technological supremacy in renewables could become central to national security strategies. This new energy landscape could lead to alliances and conflicts based on energy resource availability and technology access, making energy policy a central pillar of national security.

VII. What is the fourth top takeaway?

Government Debt, Deficits, and the Global Economy

Zeihan's discussion on government debt and deficits is particularly prescient in light of the potential collapse of the post-World War II global order. He suggests that as international trade diminishes, nations will struggle with reduced economic growth, leading to ballooning deficits and unsustainable debt levels. This crisis could be exacerbated by aging populations in developed countries, where increased spending on healthcare and pensions, coupled with reduced tax revenues due to a shrinking workforce, could lead to fiscal insolvency.

Moreover, Zeihan argues that this fiscal crisis will challenge the very role of governments in economies. As nations grapple with limited resources and economic contractions, the possibility of widespread social unrest and political instability increases. This could lead to reevaluating the welfare state model and potentially foster a shift towards more protectionist and inward-looking economic policies. Zeihan's analysis indicates that understanding fiscal policy and government debt will be crucial for navigating the economic turbulence ahead.

VIII. What is the fifth top takeaway?

Interest Rates, Markets, and Money

In his analysis of finance, Zeihan forecasts a tumultuous future for markets and monetary systems. He suggests that the decline in global trade and shifting geopolitical power structures will lead to increased market volatility. Countries will find it increasingly difficult to maintain the balance of their currencies, leading to fluctuations that could have far-reaching implications for international trade and investment. This instability could prompt a reassessment of global financial systems and potentially lead to new forms of international monetary cooperation or competition.

Zeihan also delves into the role of interest rates in this new economic landscape. He posits that as governments struggle with fiscal challenges, interest rates will become even more critical tools for economic management. However, the effectiveness of traditional monetary policy tools may be limited in a world where global financial systems are under strain. This could lead to innovative approaches to monetary policy and a rethinking of the role of central banks. Zeihan’s analysis suggests that understanding the interplay between monetary policy, interest rates, and global markets will be key to navigating the economic challenges of the future.

IX. What does The X Project Guy have to say?

First, I want to thank all subscribers - mostly free and some paid - who have signed up thus far. Gaining additional subscribers every day at this point is a strong vote of confidence that continues to propel The X Project forward. Substack tells me that nearly two-thirds of you have a 4-star or 5-star activity rating, meaning you are consistently engaging with my content - which is great! Please hit the heart icon indicating you like the article. The more “likes” I get, the more Substack will promote my content within the Substack community. If you don’t like my content or have any suggestions, please email me at TheXprojectGuy@gmail.com.

Second, this book was one of the most influential of all the books I read and certainly one of the most enjoyable. One of the things that I liked most about it is how Zeihan pulled together nearly all of The X Project’s topics of focus into one cohesive narrative. It laid the foundation for many of the investment themes to which The X Project subscribes based on emerging new, longer-term, secular trends. And, despite all of the disruptive change and challenges to be expected, Zeihan’s outlook for the United States is generally positive and bullish.

In the final section, I will reveal other reasons why you should care about the future as described by this book and, more importantly, what you could do about it. However, The X Project now requires you to be a paid subscriber to view the final section. In a few articles, the paywall will move up within the article so that only paid subscribers will see the last two sections, or rather, free subscribers will only see the first eight sections. I will be moving the paywall up every few weeks, so ultimately, free subscribers will only see the first four or five sections of each article. Please consider a paid subscription.

All paid subscriptions starting in January will come with a free 30-day trial, and you can cancel at any time. Every month, for the cost of two cups of coffee, The X Project will deliver two articles per week ($1.15 per article), helping you know in 1-2 hours of your time per month what you need to know about our changing world at the interseXion of commodities, demographics, economics, energy, geopolitics, government debt & deficits, interest rates, markets, and money.

You can also earn free paid subscription months by referring your friends. If your referrals sign up for a FREE subscription, you get one month of free paid subscription for one referral, six months of free paid subscription for three referrals, and twelve months of free paid subscription for five referrals. Please refer your friends!

X. Why should you care?

First, thank you for your paid subscription. Your support is everything to The X Project and is greatly appreciated. If you agree, please do me the favor of posting positive comments about my articles - assuming you have positive things to say - especially about the final section (soon to be more sections) that only you get to see.

Second, nothing that The X Project writes and says should be considered investment advice or recommendations to buy or sell any securities or investment products. Everything written and said is for informational purposes only, and you should do your own research and due diligence. You should discuss with an investment advisor before making any investments or changes to your investments based on any information provided by The X Project.

The X Project expects a lot of volatility in various markets as we head toward increasingly frequent and intense crises and as our policymakers do everything possible to keep the system functioning, serving the status quo and responding to the crises as they erupt.

If you do nothing different with your investments and assets, or worse, if you make the wrong moves at the wrong time, there is a good chance you will lose quite a bit of what you have accumulated by the time you get to the other side of this period of turmoil.

On the other hand, there will be tremendous opportunities to capitalize on the volatility if you can anticipate certain market reactions and be positioned accordingly. This final section will be reserved for discussing the investment theses to which The X Project subscribes, which are as follows:

Overweight cash and short-term US T-bills for optionality, given expected volatility related to the remaining list below.

Bullish gold and gold miner equities

Bullish Bitcoin

Bullish oil and oil-related equities

Bullish natural gas and related equities

Bullish uranium and related equities

Bullish industrial commodities and related equities

Bullish agricultural commodities and related equities

Bullish industrial and especially electrical infrastructure equities

Bearish long-dated US and other Western sovereign bonds

These are long-term investments with a 5-10 year time horizon. Many, if not most, of these bullish ideas have a short-term bearish outlook. The X Project sees the overall stock market has relatively little short-term upside potential at current over-valued levels after the rally in the fourth quarter of last year and recent new highs this year. In fact, The X Project sees much larger, short-term downside risk in the stock market at the moment, with the lagged effects of the Fed’s interest rate hikes finally starting to bite and the U.S. and global economies potentially heading for a recession in 2024 - despite Gromen’s contrarian opinion.

Going forward, The X Project intends to discuss one or more of these investment theses in the final section of each article; the following section in bold is new for this article.

Zeihan’s outlook can be distilled to be secularly inflationary due to the following basic trends:

Higher U.S. Labor costs due to U.S. workforce shrinkage as half of the boomer generation has yet to retire.

Higher capital costs as U.S. boomers spend their capital, and there are fewer GenXers in their high-earning, high-saving, and, therefore, capital-producing years than there were boomers in their capital-producing years.

Higher materials and international labor costs due to deglobalization.

Due to rebuilding and expanding the U.S. industrial plant, there are higher costs across the board.

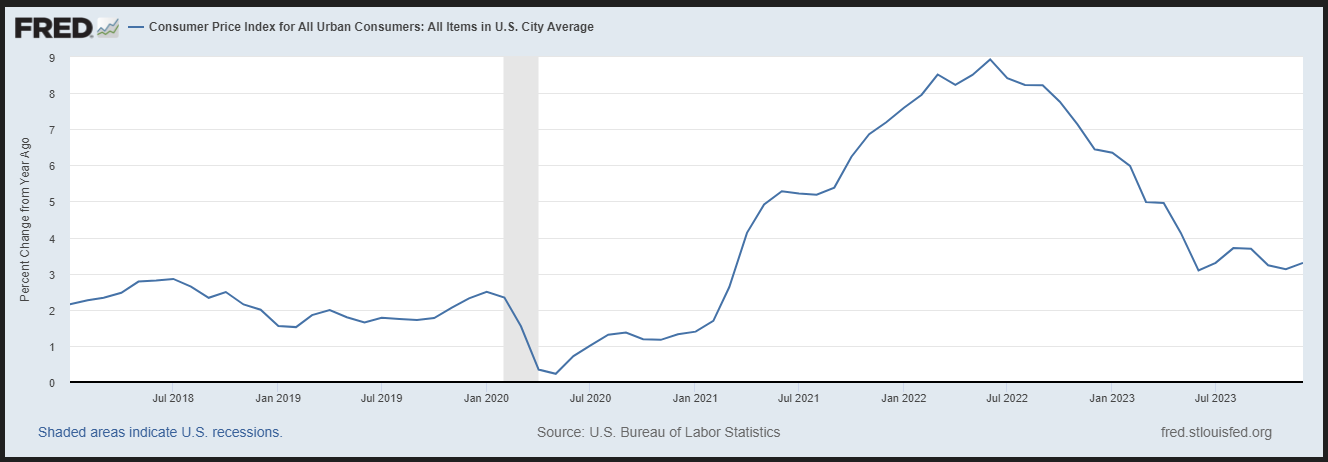

And then there is the possibility of geopolitical crises or wars that would only add to these inflationary pressures. While we have been experiencing disinflation since the inflation rate of change peaked in June of 2022, don’t be mistaken that we still have inflation and that it compounds over time. The government and the financial press like to talk about inflation rates and how they have been coming down, which is true for the year-over-year rate of change, as this chart from 2018-2023 shows:

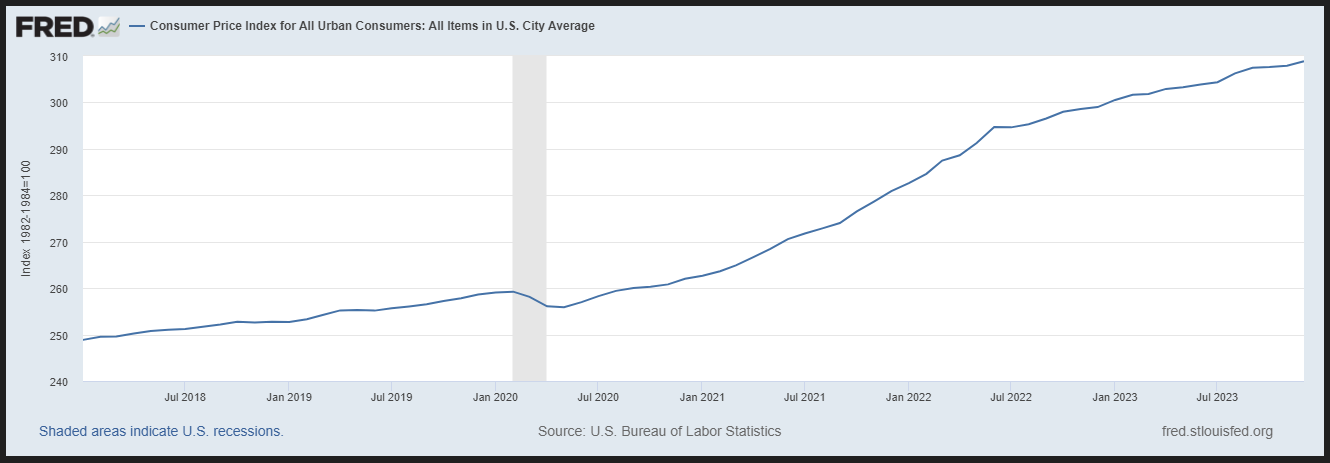

Those figures and the chart above fool most people into thinking inflation is down and under control, but inflation and price levels are two different things. Here is the chart of the actual CPI price level index from 2018-2023, and it is up 24% in five years:

In the near term, we may still see a little bit more disinflation - which again is the rate of price increases falling, and we may even see actual deflation - which is the rate of price increases going negative or prices actually falling if we ever get a recession. However, The X Project generally expects much higher inflation in the coming decade. Virtually all of the investment themes to which The X Project subscribes are based on an inflationary outlook.