Unsustainabilities and Breaking Points

Do you Understand Why Generational Changes Happening? - Article #105

In this 15-minute article, The X Project will answer these questions:

I. Why this article now?

II. What was the first sign of unsustainability?

III. What other unsustainabilities did this point to?

IV. What has been the impact?

V. What unsustainability led to the first breaking point?

VI. What is the most significant breaking point?

VII. What is another breaking point that has happened?

VIII. What is the plan?

IX. What does The X Project Guy have to say?

X. Why should you care?

Reminder for readers and listeners: nothing The X Project writes or says should be considered investment advice or recommendations to buy or sell securities or investment products. Everything written and said is for informational purposes only, and you should do your own research and due diligence. It would be best to discuss with an investment advisor before making any investments or changes to your investments based on any information provided by The X Project.

I. Why this article now?

On Wednesday of this past week, a friend of mine sent me this message from a friend of his:

“Hey fellas, The business community is in somewhat a state of panic over the last few days. I was with a manufacturer this week contending with the impact of a 25% tariff passed along to their customers on shipped products as well as tariffs on component parts from Mexico. They are a U.S. manufacturer, but would need years to build plants to create the parts they import. They are projecting a halt in revenue and layoffs. The Private Equity world is forecasting major shifts in how interest and financing affects both current portfolio companies as well as future buys. Conservatives and liberals alike are more concerned than encouraged. Even the ones that could see the long term benefit feel that we may not be able to survive short term pain only to see a potential change in parties in 4 years and all the pain for nothing.

My first reaction was, “Yep—not surprised. Everything we have known and taken for granted about the world for the past several decades is changing. The next several decades will be very different from the past several.” This is why I started The X Project and continue reading, listening, and learning about and studying economics, geopolitics, money, interest rates, debts, deficits, energy, commodities, demographics, and markets.

My second reaction was, “This has nothing to do with politics or who is in office. Both parties perpetuated the trends of the past that drove us to this point, and the changes that are occurring started under both parties (think Trump 1.0 tariffs that were not only maintained by Biden but increased and expanded) and will continue to change out of necessity regardless of who is in office. Start with looking at this from the broadest possible perspective, and read “The Fourth Turning is Here: What the Seasons of History Tell Us about How and When This Crisis Will End - A summary of the book written by Neil Howe (2023).””

Hopefully, long-time readers will have reacted to my friend’s text like I did. This article will attempt to explain my initial reactions.

II. What was the first sign of unsustainability?

For me, the notion that “things” had reached unsustainable extremes was first that we needed 6+ years of ZIRP (zero interest rate policy) to keep the economy afloat from 2009 through 2015.

Of course, the pandemic followed a short period of rising interest rates from 2016 to 2019, after which they returned to zero.

Meanwhile, the longer-term, 10-year Treasury yield, which is set by the market and upon which the vast majority of interest rates in the economy are based, had been falling most of my life until it hit zero in 2012 and again in 2020.

Remember that as the yield falls on the 10-year bond, the price or value of existing bonds increases. This was one of the longest bull markets anyone alive has experienced. But I knew it could not go on forever. Once the yield hits zero, it can’t go any lower. Yes - interest rates went negative briefly in the U.S. and a bit longer in Europe, but how does a negative-yielding bond make sense? Instead of earning interest, I am willing to pay the bondholder (a Federal Government) interest while also loaning it the principal! That makes no sense!! And yet, by 2019, there was $17 trillion in negative-yielding government debt. Something was wrong, and something needed to change. But first, let’s look at how yields got so low.

III. What other unsustainabilities did this point to?

Everyone probably knows that the shortest-term interest rate is the Federal Funds rate that the Federal Reserve sets. It is the interest rate that banks charge each other for overnight loans. That rate then influences the yield curve or all interest rates along the spectrum of bonds with different maturities, starting with government bills (4-week to 52-week maturities), notes (2-year to 7-year maturities), and bonds (10-year to 30-year maturities). The market sets these interest rates as the U.S. Treasury sells these bills, notes, and bonds at regular auctions to fund the government’s operations.

However, the “market” became distorted during the zero-interest rate policy after the 2008 financial crisis when the Federal Reserve embarked on QE or “Quantitative Easing," which meant buying U.S. Treasuries.

The amount of U.S. Treasuries (and federally backed mortgage securities) owned by the Federal Reserve went from $790 billion in 2007 to $2.87 trillion in 2017 to $6.25 trillion in 2022). There is no question that interest rates would have been somewhat, if not substantially, higher had it not been for the Fed buying up a large portion of the government’s debt.

How much government debt? $36 trillion and counting…

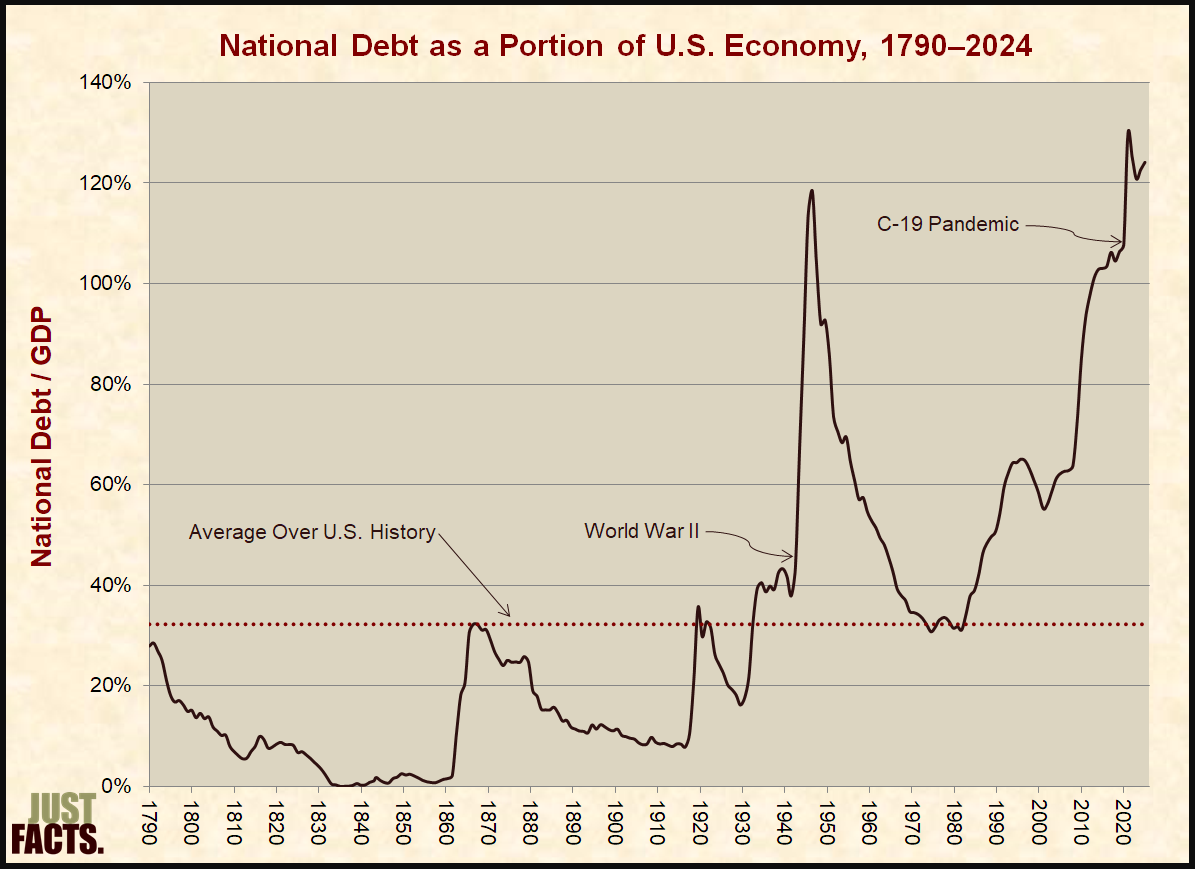

And here is total government debt as a percent of gross domestic product or debt relative to the size of our economy:

However, the total debt in the two charts above does not include unfunded Social Security and Medicare liabilities. According to a Penn Wharton paper by Gokhale and Smetters, federal debt, including these unfunded liabilities for those living today, is $103.2 trillion.

IV. What has been the impact?

The most significant impact, in my opinion, has been stagnant real wages for the bottom 50% of wage earners:

Ok, but that is real wages, adjusted for inflation according to official government inflation data, which has evolved. Since 1980, the average hourly earnings of total production and nonsupervisory private employees was $6.57 per hour in 1980. Today, it is $30.89 per hour, according to the Federal Reserve Economic Data (FRED), or 470% of 1980 wages. The median sales price of houses sold in 1980 was $67,700; today, it is $419,200 or 619%. The U.S. middle class has been hallowed out and downgraded into a significantly lower social and economic tier and standard of living (see “We’re all Soviets now” - Niall Ferguson's sobering, provocative, and controversial article.)

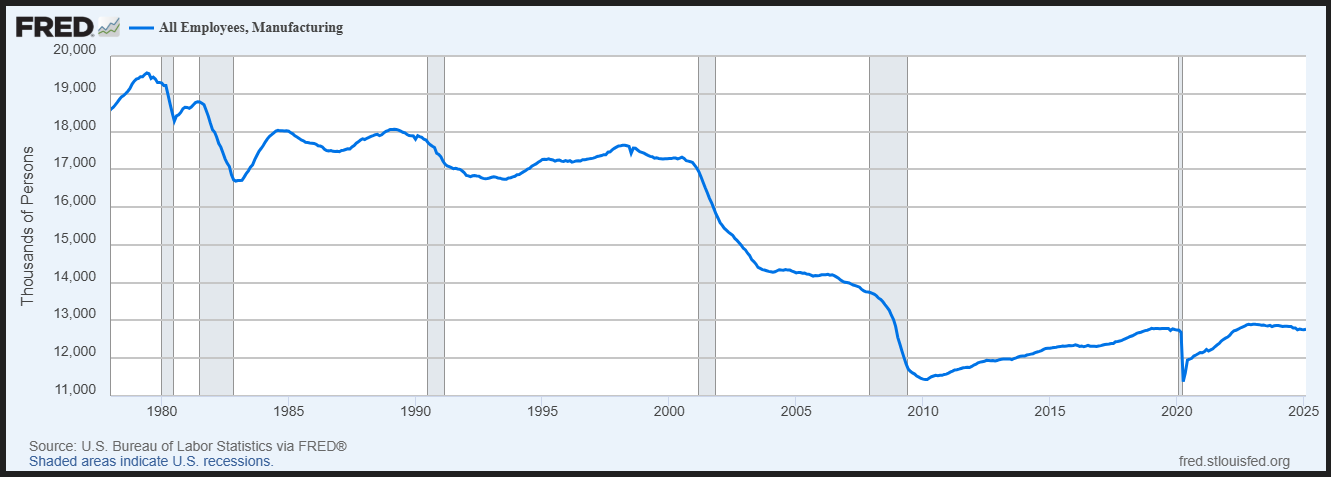

The second most significant impact has been the allowing out of our manufacturing sector:

Manufacturing employment peaked in June 1979 at 19.553 million employees or 8.7% of the total population. Today, it is 12.765 million employees, or only 3.7% of the population.

Ok, but isn’t outsourcing manufacturing to lower-cost producers overseas benefit U.S. consumers? Yes, it was up to a point that was reached and exceeded long ago. Now, there is a much bigger problem. Our defense industry supply chains have become dependent on the geopolitical rival from which we must be able to defend ourselves. See these alarming charts from data analytics firm Govini:

And then recently, NATO Secretary General Mark Rutte said this on January 13, 2025:

“When you look what Russia is producing now in three months, it’s what all of NATO is producing from Los Angeles up to Ankara in a full year, and then Russia is not bigger than the Netherlands & Belgium combined as an economy, the two of you together is the Russian economy, and they’re producing in three months what the whole of NATO is producing in the year.”

Everything I have shown you so far has been unsustainable. However, unsustainability can continue for far longer than many think. Eventually, breaking points are reached that force the unsustainability to end or change. So, let’s look at some of the breaking points, but first, one more unsustainability.

V. What unsustainability led to the first breaking point?

Where did the Fed get the money to spend trillions of dollars on U.S. Treasuries? The easy answer is it “printed” the money or created it out of thin air. It is more complicated than that and beyond the scope of this article, but you can read Lyn Alden’s superb book or at least the article I wrote summarizing it: “Broken Money: Why Our Financial System is Failing Us and How We Can Make it Better - A summary of the book written by Lyn Alden (2023).” The Fed did its pre-pandemic QE without increasing the money supply, but not the pandemic-era QE. And there was more than just QE in the pandemic, but also direct transfers of money to individuals and businesses:

M1 is the narrowest measure of money supply and only includes currency and checkable deposits in the economy.

M1 money supply exploded by over 5x from February 2020 to April 2022.

M2 is a broader measure of money supply that includes cash, bank deposits, and money market funds, and it jumped by over 40% between February 2020 and April 2022:

Why can’t the federal debt keep going up? And why can’t the Fed keep buying more of our debt with printed money?

All else being equal, if you increase the supply of money faster than the supply of goods and services, the price of goods and services will increase. Said another way, the currency's value or purchasing power is debased or diminished if its supply is increased faster than the supply of goods and services. In June of 2022, the “official” CPI inflation measure peaked at a 9% annual rate, the highest since 1981.

VI. What is the most significant breaking point?

This is the biggest one.

The top blue line shows the federal government's total tax receipts, which are $3.11 trillion. However, our government’s annual expenditures are $1.508 trillion for Social Security, $1.14 trillion for Medicare, and $1.124 on interest payments on its debt. Add those up, and it equals $3.772 trillion. Do you see the problem? Our government’s true interest expense, since our Social Security and Medicare payments are essentially the interest on the unfunded liabilities, is 121% of our tax receipts. Our government is borrowing money to pay interest on its debt.

That is like taking out a home equity line of credit to pay your mortgage or taking a cash advance on your credit cards to make the minimum payments. It cannot last long. Eventually, an individual’s credit lines get maxed, and he is forced to default.

Regarding governments, lenders (investors or buyers of their bonds) eventually demand a higher yield. Worse, there is a failed bond auction where there aren’t enough buyers to buy all the government bonds being issued to cover expenses.

This is where the Federal Reserve’s unspoken third mandate, which trumps its official mandates of low unemployment and stable prices, is to keep the government funded by ensuring there are buyers for the government’s bonds. This is where QE and other financial tricks of the trade come in, many of which lead to more currency debasement.

VII. What is another breaking point that has happened?

The American people (as a majority) reached a breaking point, and they decided that the whole system was so broken that they wanted to smash it to pieces to try building something new. This is where the most loved and simultaneously most hated President of our lives gets voted back into office. For the record, I did not vote for Trump, nor do I like him or respect him. However, in my effort to be a practical analyst, I try to filter out the noise to see and understand what is happening and why.

Those who live in wealthy, white suburban communities and who are among the top 10% of income earners in our country have a hard time understanding how and why Trump was elected because they live in a wholly different and increasingly inaccessible world than the rest of the country. Critics will argue that Trump and his administration are creating chaos because they don’t know what they are doing and don’t have a plan. I believed that to be the case with Trump 1.0, and so I understand why people think that with Trump 2.0. The Journal’s podcast “Trump 2.0: ‘Just Getting Started’” from two days ago points out that everything Trump and his administration have done so far is pretty much what he said he would do on the campaign trail.

Given how quickly Trrump’s administration came together and how quickly they acted with many executive orders and other actions in such a short time, it seems they do have a plan.

VIII. What is the plan?

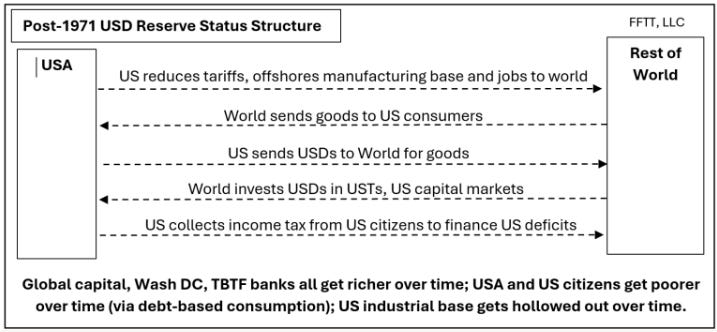

I shared the plan last week in “The America First Investment Policy That Got Lost in the Noise - And What it Means for Global Trade Rebalancing and a New Global Economic Order.” Still, it is important enough to understand that I want to share it again. Luke Gromen pulled this together at FFTT and shared it in his February 21, 2025, Tree Rings Report.

Here is a concise articulation of the significant unsustainable trends that have led up to this moment:

In contrast, here are the flows (explicit and implied) that will occur under what the Trump administration is proposing and starting to execute:

Please reread both structures above. If you have any questions or aspects you don’t understand, please leave a comment, and I will try to address them in a future article.

IX. Why should you care?

Quoting Luke Gromen:

“CAPITAL FLOWS UNDER WHAT TRUMP, BESSENT AND LUTNICK ARE PROPOSING ARE 180-DEGREES OPPOSITE OF THE FLOWS OF THE PAST 40-50 YEARS AND VERY BULLISH FOR US AND GLOBAL GROWTH, THE US INDUSTRIAL BASE, AND GOLD AND BTC. What Trump, Bessent, and Lutnick are advocating will force the world to settle net trade imbalances in a neutral reserve asset…we care not what Bessent says about revaluing gold; if the Trump Administration continues pursuing the policies they appear to be, those policies will likely revalue gold far higher than anyone can imagine.”

And further:

“In our view, there are two most likely outcomes to this path:

Either this “MAGA restructuring” that appears to be underway will work (in which case the price of gold will likely soar (overall and relative to US stocks) as it resumes its role as a global neutral reserve asset), or;

The “MAGA restructuring” will fail and gold will skyrocket as the USD system collapses chaotically.

At the moment, we have no strong view on which outcome is more likely, but either outcome seems bullish for gold.”

X. What does The X Project Guy have to say?

I launched The X Project 17 months ago, in November 2023, when I was unemployed and taking some time off from my career. I wanted to share my passion, but more importantly, I had concerns about the world I saw changing in unprecedented ways. My mission has been to try to understand what is happening so I can be prepared and take advantage financially, as I expected these changes to be challenging and very disruptive. Writing this Substack has helped me focus my thoughts and conclusions as I consume content across various analysts and commentators, and this is my 105th article. I have accumulated a couple hundred free and a couple dozen paying subscribers. I am honored and humbled by your interest in what I think and have to say.

This past November, I became employed again, and it has become challenging to maintain the pace of one article per week that I had been maintaining consistently until the beginning of this year. I will be traveling for the next three weeks, so keeping my reduced goal of three monthly articles will be even more difficult.

As such, I have removed my paywall that had restricted the last four sections for paying subscribers only. I will continue learning, reading, listening, and studying The X Project topics, and I intend to write and publish when I can. However, since I cannot commit to a regular cadence given my other commitments, I understand if paying subscribers wish to cancel their paid subscriptions. And if you paid for an annual subscription, I will happily refund the unused portion. I appreciate any paid subscribers who continue to pay. It is not a lot of money and mostly goes to pay for the other subscriptions I pay for, and I often summarize and synthesize them in my articles here.

Again, thank you for your support. I might be able to publish another article in March, but otherwise, expect to publish two or three articles in April.