What in the World is going on with Energy?

Reviewing the Energy Institute's 2024 Statistical Review of World Energy - Article #72

In this 14-minute article, The X Project will answer these questions:

I. Why this article now?

II. What does the report say about global energy consumption trends?

III. What does it say about carbon emissions and climate change?

IV. What about oil market dynamics?

V. What does it report on natural gas market developments?

VI. What does it tell us about coal consumption and production?

VII. What does it say about renewable and nuclear energy growth?

VIII. What about regional energy and sustainability disparities?

IX. What does The X Project Guy have to say?

X. Why should you care?

Reminder for readers and listeners: nothing The X Project writes or says should be considered investment advice or recommendations to buy or sell securities or investment products. Everything written and said is for informational purposes only, and you should do your own research and due diligence. It would be best to discuss with an investment advisor before making any investments or changes to your investments based on any information provided by The X Project.

I. Why this article now?

The 2024 Statistical Review of World Energy provides a comprehensive overview of global energy trends, and it was published on June 20, 2024, by the Energy Institute (EI). According to Wikipedia, the EI “is a professional organization for engineers and other professionals in energy-related fields. The EI was formed in 2003 by the merger of the Institute of Petroleum (dating back to 1913) and the Institute of Energy (dating back to 1925). It has an international membership of about 20,000 people and 200 companies.”

This year’s report is the 73rd edition and the second published by the EI. Previously, this report was published by BP (formerly The British Petroleum Company) since 1971.

Last month, just before the 2024 Statistical Review of World Energy was published, I wrote an article titled “What Does the IEA's Latest Crude Oil Report Tell Us? And should we believe it?”

Prior articles written on energy include:

"Electravision": A Summary of Michael Cembalest's 14th Annual Energy Paper

Energy Transition Crisis - A summary of the 8-part docuseries by Erik Townsend

Why is energy one of the ten topics studied by The X Project? Paraphrasing Doomberg, energy is life, and the economy is simply energy transformed. This article is being written now to cover the recent release of Statistical Review of World Energy, considered an energy industry benchmark.

II. What does the report say about global energy consumption trends?

In 2023, global primary energy consumption reached new heights, marking a second consecutive year of record consumption. Total primary energy consumption increased by 2% over its 2022 level, surpassing the ten-year average growth rate by 0.6% and exceeding pre-COVID-19 levels by over 5%. This growth reflects the easing supply chain issues and a strong rebound in energy demand post-pandemic. This is particularly driven by China’s relaxation of its zero-COVID policies, significantly boosting oil consumption. Renewables also saw substantial growth, with their share of total primary energy consumption reaching 14.6%, although fossil fuels continued to dominate the global energy mix, accounting for 81.5% of primary energy consumption.

The rebound in energy demand was uneven across regions, with significant growth in the Asia Pacific region driven by economic giants such as China, India, and Indonesia. In contrast, energy consumption in North America and Europe showed modest increases, with Europe even witnessing a slight decline in overall demand. This regional disparity highlights the varying stages of economic recovery and energy transition efforts.

III. What does it say about carbon emissions and climate change?

2023 saw global energy-related greenhouse gas emissions exceed 40 gigatonnes of CO2 equivalent for the first time, underscoring the significant environmental impact of increased fossil fuel consumption. The increase in emissions was driven by the heightened use of carbon-intensive fuels like oil and coal, while natural gas consumption remained flat. Notably, CO2 emissions from energy use alone breached 35 gigatonnes, reflecting the ongoing challenges in reducing global carbon footprints.

This record level of emissions severely challenges achieving international climate goals, such as those outlined in the Paris Agreement. The data suggests a pressing need for accelerated efforts to transition to low-carbon energy sources and implement carbon capture, utilization, and storage (CCUS) technologies. The disparity in emissions intensity across regions also highlights the need for tailored strategies to address regional energy use and emissions specificities.

IV. What about oil market dynamics?

The oil market experienced significant shifts in 2023, with global oil production reaching a record 96 million barrels per day. The United States remained the largest producer, contributing significantly to this increase. Despite a drop in Brent crude oil prices by 18% to an average of $83 per barrel, prices remained 29% above pre-COVID-19 levels, indicating persistent market volatility and geopolitical influences.

Regionally, oil consumption trends varied, with North America showing modest growth, while Asia Pacific, particularly China, saw substantial increases driven by economic recovery and increased industrial activity. China also surpassed the US in refining capacity for the first time, though the US maintained a higher throughput of refined products. These trends underscore the shifting landscape of global oil production and consumption, influenced by economic recovery and structural changes in the energy sector.

V. What does it report on natural gas market developments?

Natural gas markets in 2023 were characterized by stable production levels but significant regional variances in consumption and trade. The US maintained its position as the largest producer, accounting for a quarter of global supply. However, European and CIS regions saw notable declines in production due to geopolitical factors, particularly the ongoing impact of the Russia-Ukraine conflict.

“Global gas demand remained stable in 2023 rising by just 1 bcm. This was not sufficient to recover the losses seen in 2022 when overall demand dropped by 0.4% (15 bcm). In Euruoe, natural gas demand fell by 7% (34 bcm) in 2023, down to its lowest level since 1994. Similarly, gas production in the region declined by around 7% driven by decreases in its top producing countries, Norway, UK, and the Netherlands. Gas demand in the Asia Pacific region grew by nearly 2%, driven by China and India’s 7% growth increases. When combining all trade routes, whether by sea or pipeline, the Russian Federation’s share of EU gas imports fell from 43% in 2021 to 23% in 2022, and then a further 14% in 2023 to sit behind Norway and the US. In just ten years, LNG exports from the US rocketed from just 0.2 bcm in 2013 to 114 bcm in 2023, making it the world’s leading LNG supplier, moving ahead of Qatar and Australia in 2023.”

These changes highlight the evolving landscape of natural gas markets, influenced by supply-side adjustments and shifting demand patterns across regions.

VI. What does it tell us about coal consumption and production?

Coal remained a significant part of the global energy mix in 2023, with production and consumption reaching record levels. Global coal production increased to 179 exajoules, with the Asia Pacific region accounting for nearly 80% of this output, primarily from China, India, and Indonesia. Consumption also grew, driven by the energy needs of these rapidly developing economies.

Despite global efforts to reduce coal use, its consumption continues to rise in developing regions, highlighting the challenge of balancing economic growth with environmental sustainability. The increased use of coal in Asia contrasts with declining consumption in Europe and North America, where energy policies and market dynamics align more with transitioning to cleaner energy sources.

VII. What does it say about renewable and nuclear energy growth?

Renewables saw unprecedented growth in 2023, with solar and wind capacity additions reaching new records. Solar energy led the charge, accounting for 75% of the capacity additions, with China contributing significantly to this growth. Wind energy also saw substantial increases, particularly in China and Europe, where offshore wind capacity is expanding rapidly.

Renewables' increasing competitiveness drives their growth, supported by technological advancements and policy incentives. However, integrating these renewable sources into existing energy systems poses challenges, particularly regarding grid stability and energy storage. The significant investments in grid-scale battery storage capacity, particularly in China, reflect ongoing efforts to address these challenges and enhance the reliability of renewable energy supply.

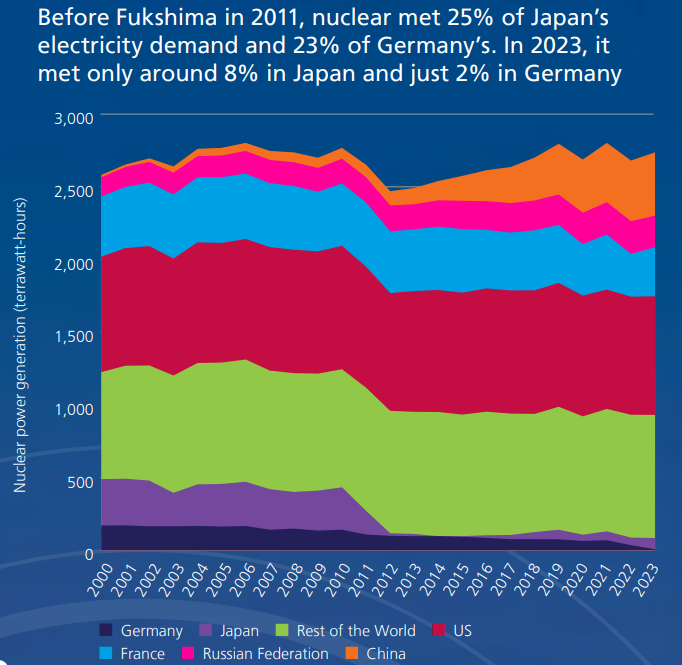

“Despite a small drop in total installed capacity, electricity generation from nuclear power plant increased in 2023 by 2%. However, it was still 58 terawatt-hours below its 2019 pre-COVID level and 2% below its peak output in 2006. Output from nuclear in Europe fell by 1% with the recovery of France’s nuclear fleet from prolonged outages in 2022 offset by Germany’s closure of its last three remaining units early in the year. China continues to lead the way in building new capacity. Since 2000 it has built around 60% of all new nuclear capacity additions.”

“In late 2023, commercial operations began at China’s onshore small modular reactor (SMR) demonstration project, a world-first featuring the latest Generation IV technology and incorporating inherent safety systems. Following events in Fukushima in 2011, Japan has gradually returned units to service and, in 2023 output increased by 50%. Whilst output from nuclear in the US remained relatively flat, it was still equal to the combined outputs of China and France, operators of the second and third-largest fleets.”

The following section will examine the Pentagon. In Section IX, I will tell you what I think. Then, in Section X, why should you care and, more importantly, what more can you do about it. However, I have just hit a new paid subscriber threshold, so you must now be a paid subscriber to view the last three sections. The X Project’s articles always have ten sections. Soon, after a few more articles, the paywall will move up again within the article so that only paid subscribers will see the last four sections, or rather, free subscribers will only see the first six sections. I will be moving the paywall up every few weeks, so ultimately, free subscribers will only see the first four or five sections of each article. Please consider a paid subscription.

Also, podcasts of the full articles narrated are available only to paid subscribers.

All paid subscriptions come with a free 14-day trial; you can cancel anytime. Every month, for just the cost of two cups of coffee, The X Project will deliver 6-8 articles (weekly on Sundays and every other Wednesday), helping you know in a couple of hours of your time per month what you need to know about our changing world at the interseXion of commodities, demographics, economics, energy, geopolitics, government debt & deficits, interest rates, markets, and money.

You can also earn free paid subscription months by referring your friends. If your referrals sign up for a FREE subscription, you get one month of free paid subscription for one referral, six months of free paid subscription for three referrals, and twelve months of free paid subscription for five referrals. Please refer your friends!