In this 14-minute article, The X Project will answer these questions:

I. Who is the IEA, and why this article now?

II. What does the IEA say about the impact of electric vehicles?

III. What is the IEA’s crude oil supply outlook?

IV. What does the IEA say about demand for crude oil?

V. Is the IEA credible?

VI. What is the illusion of electric vehicles?

VII. What are the counterarguments to demand?

VIII. What about the supply counterarguments?

IX. What does The X Project Guy have to say?

X. Why should you care?

Reminder for readers and listeners: nothing The X Project writes or says should be considered investment advice or recommendations to buy or sell securities or investment products. Everything written and said is for informational purposes only, and you should do your own research and due diligence. It would be best to discuss with an investment advisor before making any investments or changes to your investments based on any information provided by The X Project.

I. Who is the IEA, and why this article now?

According to Wikipedia:

“The International Energy Agency (IEA) is a Paris-based autonomous intergovernmental organisation, established in 1974, that provides policy recommendations, analysis and data on the global energy sector. The 31 member countries and 13 association countries of the IEA represent 75% of global energy demand.

The IEA was set up under the framework of the Organisation for Economic Co-operation and Development (OECD) in the aftermath of the 1973 oil crisis to respond to physical disruptions in global oil supplies, provide data and statistics about the global oil market and energy sector, promote energy savings and conservation, and establish international technical collaboration. Since its founding, the IEA has also coordinated use of the oil reserves that its members are required to hold.

In subsequent decades, the IEA's role expanded to cover the entire global energy system, encompassing traditional fuels such as gas, and coal as well as cleaner and fast-growing energy sources and technologies including renewable energy sources; solar photovoltaics, wind power, biofuels as well as nuclear power, and hydrogen, and the critical minerals needed for these technologies.”

The IEA’s website offers a wealth of information, data, and reports, including the latest “Oil 2024” report released this past week. Not only did this report’s controversial conclusions prompt this article, but so did the reporting on it, such as the article by the Financial Times titled “World faces ‘staggering’ oil glut by the end of the decade, energy watchdog warns.”

This is the third article The X Project has written on crude oil. The first two were:

If you have not yet read these articles, you should click on the links above and do so now.

II. What does the IEA say about the impact of electric vehicles?

The rapid adoption of electric vehicles (EVs) is a major factor influencing oil demand. The report projects that global EV sales could reach around 40 million by 2030, accounting for nearly one in two new cars sold globally. This surge in EV sales is expected to displace approximately 6 mb/d of road fuel demand by the end of the forecast period. China remains the key driver of this growth, with significant contributions from Europe and the United States.

The dominance of EVs, particularly in China, highlights the shifting landscape of automotive fuel consumption. The report notes that while EV growth faces challenges in Western countries due to high prices and infrastructure limitations, continued industrial policy support and falling prices are expected to drive further adoption. This trend signifies a substantial reduction in oil consumption from the transportation sector, which is traditionally a major consumer of petroleum products.

III. What is the IEA’s crude oil supply outlook?

The "Oil 2024" report by the International Energy Agency (IEA) projects a significant shift in crude oil supply dynamics over the next decade. The primary conclusion is that global oil supply is expected to outstrip demand from 2025 onwards, leading to an unprecedented surplus in production capacity. This increase in supply will be driven predominantly by non-OPEC+ producers, particularly in the Americas. The United States is forecasted to play a pivotal role, contributing substantially to the rise in global supply capacity, alongside notable increases from Brazil, Guyana, and Canada. By 2030, total global supply capacity is anticipated to rise by 6 million barrels per day (mb/d) to nearly 113.8 mb/d, far exceeding the projected global demand of 105.4 mb/d.

A key factor in this shift is the strategic pivot by major producers like Saudi Arabia, which has halted plans to increase crude oil capacity and instead focuses on expanding natural gas liquids (NGLs) and condensates. This move aligns with Saudi Arabia's efforts to boost domestic gas supply and acknowledges the burgeoning surplus in global crude oil production capacity. The rise of petrochemicals as a primary driver of oil demand growth further supports this trend, as NGLs are crucial for petrochemical production. This anticipated surplus challenges the current OPEC+ market management strategy, which aims to support oil prices through coordinated production cuts. The substantial cushion of spare capacity projected by the end of the decade could disrupt this strategy, potentially leading to lower price environments and challenging the adaptability of producers, particularly in the US shale industry.

IV. What does the IEA say about demand for crude oil?

The report indicates that global oil demand is set to plateau by 2030. This projection is driven by a combination of factors, including the accelerating deployment of clean energy technologies, increased use of electric vehicles (EVs), and more stringent efficiency policies. While the post-pandemic rebound in demand has faded, the macroeconomic drivers remain weak. Emerging economies in Asia, particularly China and India, are expected to account for all global demand growth, while demand in advanced economies is projected to decline sharply.

This demand plateau is significant as it marks a departure from the historical trend of continuous growth. The report highlights that despite a net increase of 3.2 million barrels per day (mb/d) during the 2023-2030 forecast period, growth will decelerate progressively, eventually leading to a narrow contraction by the final year. This shift underscores the impact of the energy transition on traditional oil markets.

V. Is the IEA credible?

The answer is unfortunate. I noted that this report by the IEA is controversial, and some of the controversy comes from the IEA’s diminished credibility from previous inaccurate forecasts. This was pointed out in “U.S. Crude Oil Production at New All-Time High”:

Goehring & Rozencwajg point out that IEA has “chronically underestimated global oil demand in twelve of the fourteen years (including COVID-impacted 2020). Excluding 2020, the IEA increased demand by an incredible 800,000 b/d on average from its initial expectation. If the IEA’s error were a country, it would be the world’s 21st largest oil consumer.”

Aside from its poor performance of previous forecasts, the IEA has also been accused of straying from its core mission - promoting energy security, by John Barrosso, M.D., Ranking Member, U.S. Senate Committee on Energy and Natural Resources, and Cathy McMorris Rodgers, Chair, U.S. House Committee on Energy and Commerce in a letter to the IEA dated March 20, 2024:

“Indeed, we would argue that in recent years the IEA has been undermining energy security by discouraging sufficient investment in energy supplies—specifically, oil, natural gas, and coal. Moreover, its energy modeling no longer provides policymakers with balanced assessments of energy and climate proposals. Instead, it has become an “energy transition” cheerleader.

Until recently, the IEA has served as a valuable source of reliable information on the security of oil markets, and it has provided a mechanism whereby oil-consuming countries can respond effectively to oil shortages. The IEA also provides global energy forecasts as part of its mission. As you have noted, IEA forecasts have a tremendous influence on shaping how the world sees future energy trends. Consequently, the IEA must conduct its energy security mission in an objective manner. We believe the IEA is failing to fulfill these responsibilities.

By its own admission, the IEA has placed greater emphasis on “build[ing] net-zero emission energy systems to comply with internationally agreed climate goals.” Climate change is an extraordinarily complex issue deserving IEA’s attention. Excessive focus on an “energy transition,” however, has led the IEA to veer away from objectively informing and educating policymakers and toward promoting an agenda with little regard to its implications for economic growth and energy security. Sadly, French President Macron’s recent observation that IEA has become the “armed wing for implementing the Paris Agreement” is true.”

VI. What is the “illusion” of electric vehicles?

The “illusion” is about Goehring and Rozencwajg’s 4Q2023 Market Commentary that The X Project covered in “Generational Opportunities: A Summary of "The Norwegian Illusion," GoRozen's Latest Market Commentary.” If you are interested, GoRozen dedicates the first five pages of their commentary to a very deep and detailed analysis of EVs and Norway’s experience, and they draw multiple conclusions that should be concerning to those who advocate for EVs as a solution for reducing carbon-based fuel consumption and emissions. For the purpose of this article and a counterargument to the IEA report, GoRozen states:

“EVs in Norway have not affected fossil fuel demand or carbon emissions as expected. Although oil demand and carbon emissions have fallen by 15% since 2010, most of this is unrelated to EV sales. Over the period, total oil demand fell by only 34,000 b/d, with gasoline and diesel making up a mere 10% of the decline. Most of the decline came from heating, lighting, and petrochemical demand, which we estimate collapsed by more than a third. Despite 20% of all vehicles on the road now being electric, Norway’s gasoline and diesel demand fell by a mere 4%.”

The IEA’s report does not consider actual evidence and data on EV adoption’s impact, which starkly contrasts the assumptions and models that led to its controversial conclusion, which is, therefore, not credible.

VII. What are the counterarguments to demand?

Once again, let’s turn to GoRozen’s deep and detailed analysis. As mentioned in Section V above, they highlighted that the IEA has consistently underestimated demand. In their 3Q2023 Market Commentary, the first eight pages are dedicated to breaking down and critiquing the IEA’s methodology, as well as countering with their own model and forecast of demand:

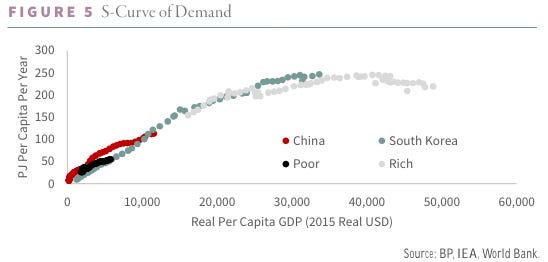

“Our demand models are fundamentally different. We believe economic development drives energy demand, and our models capture that relationship explicitly. The result is our S-Curve demand model, where we plot per capita energy demand against real GDP. When an economy is very poor, it consumes little energy; any growth goes towards subsistence. As it reaches middle-income, its energy demand grows materially. Finally, energy demand begins to flatten at $20,000 of real per capita GDP.

Our S-Curve holds well across different regions and times. In 1965, South Korea had a $1,300 real per capita GDP and consumed 9.4 petajoules (PJ) per person. By 2010, Korean GDP had grown to $25,000, while energy demand reached nearly 220 PJ per person. Four decades earlier and an ocean away, US real GDP hit $23,000 while energy demand was 250 PJ per person – remarkably similar. China currently sports a real GDP of $12,000 and consumes 113 PJ – comparable to Korea in 1994 in terms of GDP and energy demand. For China to exit the middle-income trap and top $20,000 per capita, the S-Curve suggests its energy demand must grow by at least 60%.

Once an economy reaches $20,000 per capita, energy demand still grows, albeit much slower. After $40,000 per capita, the economy is mainly saturated, and energy demand stays essentially flat, with efficiency gains offsetting economic growth.

Therefore, countries between $5,000 and $20,000 per capita real GDP are the most significant when studying growth trends. While an economy’s real per capita GDP is less than $5,000, energy consumption is inconsequential; consumption begins to flatten when it is above $20,000. For most of the twentieth century, people between $5 and $20,000 per capita GDP remained relatively constant at 500 mm. While new countries would enter the bloc (such as Brazil in 1975), others would leave (such as Japan in 1981). Between 2000 and 2010, the population of energy-hungry consumers surged from 600 mm to 2.4 bn, and by 2022, the number had reached 2.6 bn. A third of the world’s population is now in the “sweet spot” of energy demand growth, representing half of all economic growth. Never before have so many people simultaneously been in a period of energy-intensive economic growth. So long as this is true, global energy demand will remain a tailwind.

Of course, GoRozen talks about total energy demand, of which crude is a large component. Here is a breakdown of comparative liquid fuels consumption:

The following section will examine the supply counterarguments. In Section IX, I will tell you what I think. Then, in Section X, why should you care and, more importantly, what more can you do about it. However, I have just hit a new paid subscriber threshold, so you must now be a paid subscriber to view the last three sections. The X Project’s articles always have ten sections. Soon, after a few more articles, the paywall will move up again within the article so that only paid subscribers will see the last four sections, or rather, free subscribers will only see the first six sections. I will be moving the paywall up every few weeks, so ultimately, free subscribers will only see the first four or five sections of each article. Please consider a paid subscription.

Also, podcasts of the full articles narrated are available only to paid subscribers.

All paid subscriptions come with a free 14-day trial; you can cancel anytime. Every month, for just the cost of two cups of coffee, The X Project will deliver 6-8 articles (weekly on Sundays and every other Wednesday), helping you know in a couple of hours of your time per month what you need to know about our changing world at the interseXion of commodities, demographics, economics, energy, geopolitics, government debt & deficits, interest rates, markets, and money.

You can also earn free paid subscription months by referring your friends. If your referrals sign up for a FREE subscription, you get one month of free paid subscription for one referral, six months of free paid subscription for three referrals, and twelve months of free paid subscription for five referrals. Please refer your friends!