What in the World is Going on with Energy?

Reviewing the Energy Institute's 2025 Statistical Review of World Energy - Article #118

In this 12-minute article, The X Project will answer these questions:

I. Why this article now?

II. How is global energy demand changing?

III. Why does China's energy strategy matter globally?

IV. Is the global energy transition becoming disorderly?

V. What role does electrification play in the energy future?

VI. How is energy security influencing global strategies?

VII. What are the climate implications of current energy trends?

VIII. What shifts are happening in the oil, gas, and coal markets?

IX. What does The X Project Guy have to say?

X. Why should you care?

Reminder for readers and listeners: nothing The X Project writes or says should be considered investment advice or recommendations to buy or sell securities or investment products. Everything written and said is for informational purposes only, and you should do your own research and due diligence. It is recommended to consult with an investment advisor before making any investments or changes to your investments based on information provided by The X Project.

I. Why this article now?

I know it has only been three weeks since my last article on energy. Still, energy is one of the most underappreciated topics driving The X Project, which curates, summarizes, distills, and synthesizes knowledge and learning at the interseXion of economics, geopolitics, money, interest rates, debts, deficits, energy, commodities, demographics, and markets - helping you know what you need to know.

When I say 'underappreciated,' what I mean is that many people do not fully appreciate the vital role energy plays in our daily lives, our personal and national standard of living, our individual and national security, micro- and macroeconomics, geopolitics, and more.

In my previous article on energy, ““Heliocentrism” – A Summary of Michael Cembalest’s 15th Annual Energy Paper,” I list out linked titles to the twelve prior articles on energy in Section I that cover energy and why it is such an important topic in understanding what and why things are happening now and likely will be in the future.

Last July, I wrote “What in the World is going on with Energy? Reviewing the Energy Institute's 2024 Statistical Review of World Energy,” and I provided a brief overview of The Energy Institute in Section I. On June 26, 2025, the latest annual report was published, and so here we are.

II. How is global energy demand changing?

Global energy demand continued its upward trajectory, rising by 2% in 2024 to a record 592 EJ. This growth was notably uneven across different regions. Asia Pacific dominated with 68% of the global increase, primarily driven by rapid development and industrialization. Conversely, North America and Europe experienced much slower growth rates of 0.4% and 0.7%, respectively. Africa recorded the smallest absolute increase, reflecting ongoing disparities in economic growth and access to energy.

Interestingly, the growth in energy demand encompassed all primary energy sources—renewables, fossil fuels, nuclear, and hydroelectric power—mirroring a similar trend last observed in 2006. Despite global ambitions to reduce carbon footprints, fossil fuels still accounted for 87% of the energy mix, underscoring ongoing global dependency. Renewables, however, experienced the highest growth rate at 9%, showcasing their rising importance in global energy strategies.

III. Why does China's energy strategy matter globally?

China remains pivotal in shaping the global energy landscape. Its demand for coal surpasses that of the rest of the world combined, yet simultaneously, it leads globally in renewable energy deployment and electric vehicle adoption. This duality highlights a crucial paradox: rapid expansion in clean energy infrastructure coexists with significant reliance on fossil fuels.

In 2024, China accounted for 56% of global renewable energy demand growth, reflecting its strategic emphasis on renewable sources. China’s renewable additions alone doubled the combined additions of the U.S., Europe, and India, indicating a decisive shift towards renewables in its energy policy. However, China remains the world's largest greenhouse gas emitter, contributing significantly to global emission increases, alongside India.

IV. Is the global energy transition becoming disorderly?

The global energy transition continues to progress, but its trajectory has grown increasingly disorderly. Despite the rapid expansion of renewable energy, fossil fuels have seen concurrent growth, complicating climate objectives. Wind and solar energy grew at an impressive rate of 16%, nearly nine times faster than the overall growth rate in energy demand; however, fossil fuel consumption also rose by just over 1%.

This uneven transition reflects geopolitical tensions and economic uncertainties, causing companies to recalibrate their energy strategies. Many energy firms have prioritized short-term profitability and operational efficiency, delaying investments in less mature renewable technologies and risky ventures. Thus, resilience and risk hedging have become critical strategic considerations, contributing to a fragmented and volatile global energy market.

V. What role does electrification play in the energy future?

Electrification stands out as a central pillar for decarbonizing the global energy system. Global electricity demand grew by 4% in 2024, surpassing the growth in total energy demand and highlighting a sustained global shift toward electrification. Over the last decade, global electricity generation has grown at twice the annual growth rate of energy demand. A significant portion of this growth was met by renewables, reinforcing the importance of electrification as a viable pathway towards energy decarbonization.

Particularly notable was China’s electrification rate, which nearly doubled over the past decade, adding 405 TWh more than Europe's entire electricity generation in 2024. This scale of electrification underscores its central role in future global energy strategies, as economies strive to balance growth with climate targets.

VI. How is energy security influencing global strategies?

Energy security and affordability have emerged as competing priorities alongside climate action, particularly amid escalating geopolitical tensions such as Russia’s invasion of Ukraine. This event profoundly disrupted European gas supplies, prompting significant reductions in gas demand through efficiency and demand-response mechanisms. Europe's gas demand decreased by 13% in response to these disruptions, underscoring the importance of energy security in shaping regional energy strategies.

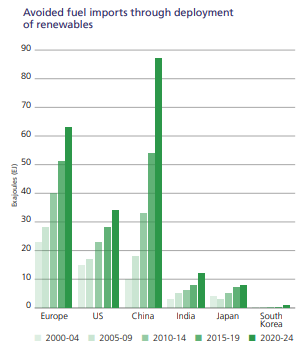

Countries increasingly view renewable energy as essential to achieving energy independence and security. However, integrating renewables, such as wind and solar, into grids requires careful planning to maintain stability. Successful renewable energy deployments in Iceland, Bhutan, and Norway demonstrate the feasibility of achieving high renewable energy penetration while maintaining grid stability through the use of complementary technologies, such as energy storage and smart grids.

VII. What are the climate implications of current energy trends?

Despite advancements in renewable energy, global carbon emissions from energy sources rose by 1% in 2024, reaching a new record of 40.8 GtCO2e. This continued increase signals ongoing challenges in decoupling energy growth from carbon emissions. Renewables and nuclear energy have significantly contributed to avoided emissions, preventing approximately 109 gigatonnes of greenhouse gas emissions since 2010, more than double the amount emitted globally in 2024 alone.

China and India drove 62% of the global emission increase in 2024, highlighting regional disparities in climate impact. Meanwhile, the U.S. and Europe saw a decline in emissions, reflecting stronger climate policies and shifts in energy mixes. Europe's emissions, in particular, were nearly 16% below levels a decade ago, signaling positive trends but underscoring the need for accelerated global climate action.

VIII. What shifts are happening in the oil, gas, and coal markets?

Oil remains the most significant global energy source, accounting for 34% of total energy demand, although growth slowed to just 0.7% in 2024. The U.S. maintained its position as the world's largest oil producer, equivalent to Saudi Arabia and Russia combined. Natural gas production and demand also rose significantly, especially in the Asia Pacific region, where China significantly increased its domestic production capacity.

Coal reached a record in global demand, driven primarily by the Asia Pacific region, particularly China, despite a concurrent rise in investments in renewable energy. Europe experienced a notable 7% decline in coal use, with coal’s share falling below that of nuclear energy for the first time. These trends reflect complex regional dynamics and highlight the ongoing challenges in transitioning away from coal, despite the increased renewable capacity.

IX. What does The X Project Guy have to say?

As a member of Generation X born in 1970, concerns about climate change and carbon emissions have been a part of my life since birth. These concerns intensified in the 1990s, following the establishment of the United Nations Framework Convention on Climate Change in 1992 and the adoption of the Kyoto Protocol in 1997. Since then, there has been considerable discussion about commitments from global institutions, national governments, corporations, and numerous other stakeholders. However, here we are in 2025, and coal consumption reached another all-time high last year, with fossil fuels satisfying 87% of overall energy demand.

If human progress is to continue and global living standards are to continue increasing, which I believe are reasonable, just, ethical, and moral expectations, then energy supply and demand will also continue to rise.

Because I believe human progress should continue and global living standards should continue to rise, I think an “all of the above” energy approach is what will ultimately happen, especially since that is what has happened. When it comes to climate change, I believe part of human progress involves adapting to it, rather than something that can or should be sacrificed in an attempt to stop it.

X. Why should you care?

Some of you will take issue with my last sentence above, and that is fine. When it comes to your money and financial security, the rational focus should be on what something is rather than what you wish it to be. Do I want to have a realistic alternative to burning coal and to eliminate the associated carbon emissions? Yes. Does that alternative exist that does not reduce total energy supply, human progress, or global human living standards? No.

This is why primary fossil fuel energy remains part of the investment themes to which I subscribe:

Overweight cash and short-term U.S. T-bills for optionality, given expected INCREASING volatility related to the remaining list below.

Bullish gold and gold miner equities

Bullish Bitcoin

Bullish oil and oil-related equities

Bullish natural gas and related equities

Bullish uranium and related equities

Bullish industrial-associated commodities and equities

Bullish agricultural-associated commodities and equities

Bullish industrial and primarily electrical infrastructure equities

Bearish long-dated U.S. and other Western sovereign bonds

NOTE: Real estate is also a real, tangible, hard asset that I believe in and invest in. I think land and productive real estate directly related to any of the themes above are wise investments. For example, I began accumulating farmland in 2020 through platforms such as acretrader.com and similar platforms.

Please note that this is not investment advice or a recommendation to buy or sell securities or investment products. Everything written and said is for informational purposes only, and you should do your own research and due diligence. It is recommended that you consult with an investment advisor before making any investments or changes to your investments based on the information provided by The X Project.

Thank you for your subscription, especially if you are a paying subscriber. Your support is everything to The X Project and is greatly appreciated. If you agree, please take a moment to hit the like button and share your positive comments about my articles, assuming you have something constructive to say.