Is Everything Really This Expensive?

The Dollar Illusion and The Alternate Reality - Article #124

In this 14-minute article, The X Project will answer these questions:

I. Why this article now?

II. What is the historical price of food in gold?

III. What is the historical price of college tuition in gold?

IV. What is the historical price of the S&P 500 in gold?

V. What is the historical price of crude oil in gold?

VI. What is the historical price of U.S. home prices in gold?

VII. What is the historical price of U.S. wages in gold?

VIII. What is the historical price of the U.S. dollar in gold?

IX. What does The X Project Guy have to say?

X. Why should you care?

Reminder for readers and listeners: nothing The X Project writes or says should be considered investment advice or recommendations to buy or sell securities or investment products. Everything written and said is for informational purposes only, and you should do your own research and due diligence. It is recommended to consult with an investment advisor before making any investments or changes to your investments based on information provided by The X Project.

I. Why this article now?

I am writing this article now because it has been too long since I last addressed the topic of prices. And there is a reason I am thinking about prices and what’s coming, but I’ll get to that at the end of this article. However, before we proceed, there are a couple key points that need to be established.

First, I need everyone to understand that a price is not a number, but a ratio with a numerator and a denominator. Here in the United States, as well as in many parts of the world, the price denominator is typically $1. And as we learned in grade school math, a ratio with a denominator of 1 is reduced to simply the numerator. So, the point is that we typically don’t think that a price is actually a ratio, and we usually don’t care what the price is denominated in other currencies or other types of money because we only transact in dollars.

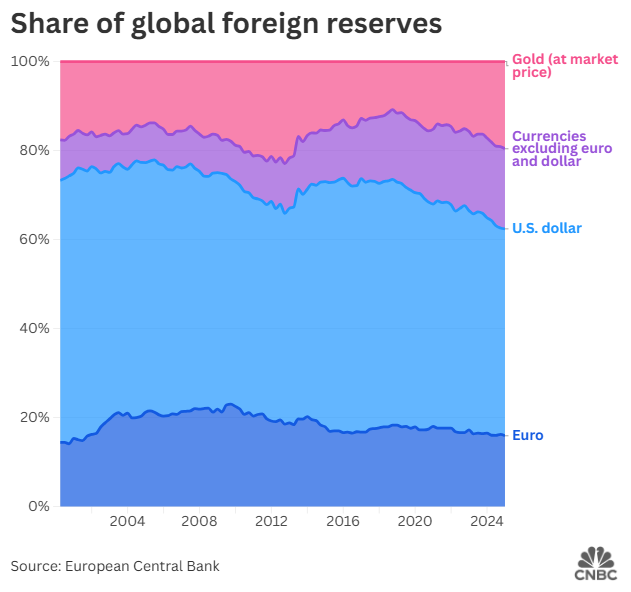

Second, you should know that currency is a tangible form of money, while money is the broader, intangible concept of value. Currency includes the paper bills and metal coins you carry, but money also encompasses other assets, such as bank deposits and gold. This is a gross oversimplification of the definitions of currency and money. You should revisit my article that summarized Lyn Alden’s excellent book, Broken Money, for a deeper dive into the concepts. However, the key point here is that gold is money. To reinforce that point, the chart above shows that as of June of this year, gold has become the second-largest holding of reserve assets of global central banks.

This article is going to update my prior article, “Priced in Gold: Looking at inflation, the dollar, and the world from a different perspective”, which would be good for you to re-read now to reinforce the point I am making: Looking at prices in dollars is an illusion. Looking at prices in gold is an alternate, and superior, reality.

II. What is the historical price of food in gold?

The price that we are probably confronted with the most daily is the price for food. I just returned from a family vacation in Eastern Europe, and I was struck by how affordable dining out was compared to back home. The dinner bill for five people, even after converting from Euros to Dollars, was less than the typical dinner bill for three people where I live. Is dining out really that less expensive in Eastern Europe? Are the currency exchange rates out of whack? What is really going on?

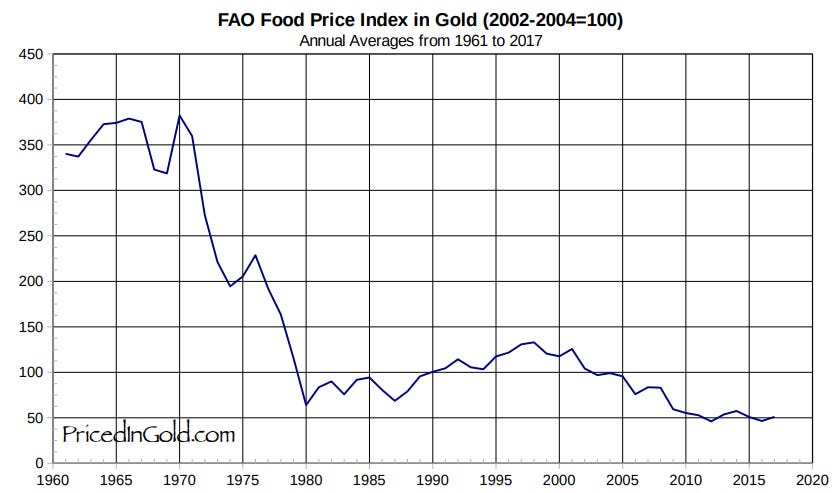

In my prior article, I did not look at food prices, but the Priced in Gold website does cover food:

“The UN Food and Agriculture Office tracks prices of food around the world, converts local prices to US Dollars, and calculates an index with 100 being the average for 2014-2016. Prices for meats, cereals, oils/fats, dairy, and sugar make up the components of the index, which is updated monthly.”

And here are the charts of the FAO Global Food Price Index

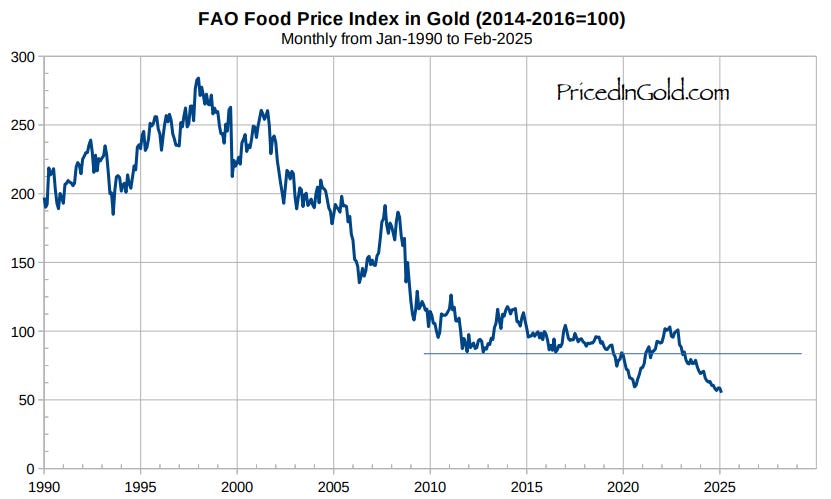

And here are the more recent prices:

Note that this last chart extends through February 2025, and we know that gold prices have made new highs in virtually every currency since then, which means global food prices are at their lowest levels ever.

Does this surprise you? Can you see that it is not that food prices are high, but that the value of the dollar (or other currencies) in which we denominate prices is low?

III. What is the historical price of college tuition in gold?

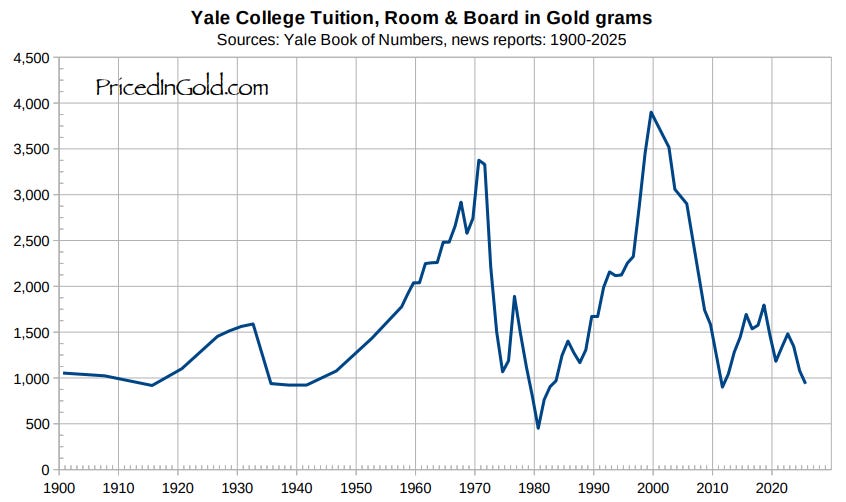

With kids heading back to school, a recent topic of conversation among friends has been the rising cost of college tuition. I have a hard time with these conversations because everyone is focused on the numerator. College tuition is another price that I did not consider in my previous article, but let’s examine what it looks like when priced in gold.

“This chart shows the cost of tuition, room, and board at Yale College in grams of gold. Although the dollar cost of attending Yale has increased consistently over the years, the fluctuating value of the dollar has often created bargains for those using gold as their money.

For example, in 2009, the cost of a year at Yale was almost the same as it was in 1932. But the rapidly falling value of the US Dollar makes prices for most things, including college, appear to be sky-high. In 1932, the cost was $1,056 for a year. In 2017, the cost was $66,900. Yet the true cost, measured in gold, was the same: around 1,600 grams – about average for the 115 year period.”

Are you starting to get the picture?

IV. What is the historical price of the S&P 500 in gold?

The following five sections are updates from my first article, “Priced in Gold,” from March 2024.

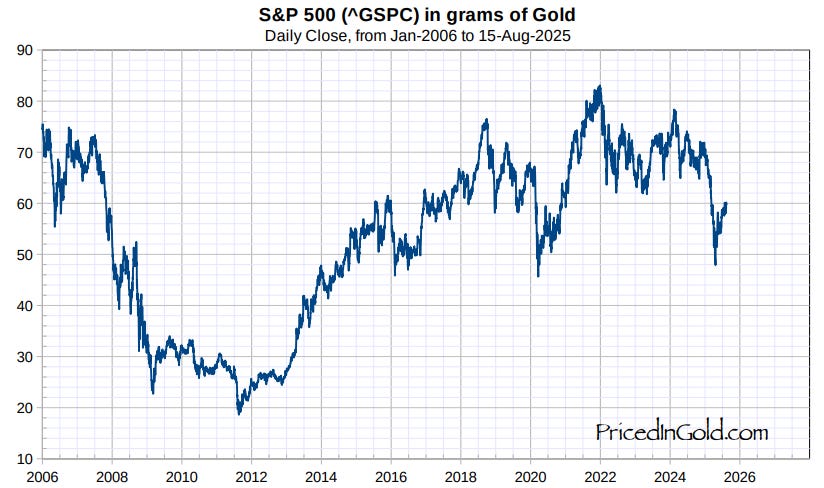

Everyone seems to be cheering the big rally in equity markets on Friday, taking the S&P 500 to within just a couple of points of its all-time closing high. But is that really the case? Here is the S&P 500 priced in gold:

As of August 15, we were nowhere near the high price in gold of the S&P 500 from late 2021.

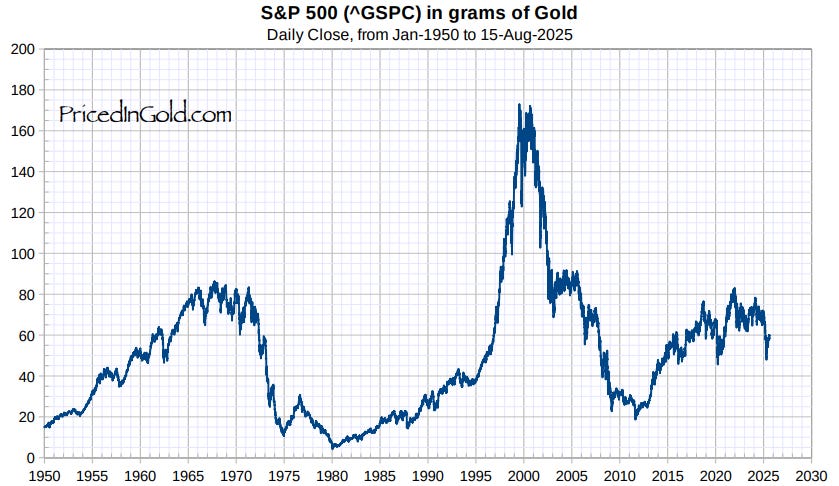

Stepping back and taking a longer view, the S&P 500 is roughly one-third of its all-time high price in gold in late 1999 and early 2000.

So, what does this mean? It means that the S&P 500 at the dot.com highs from twenty-five years ago represented roughly three times the purchasing power that the S&P 500 has today.

V. What is the historical price of crude oil in gold?

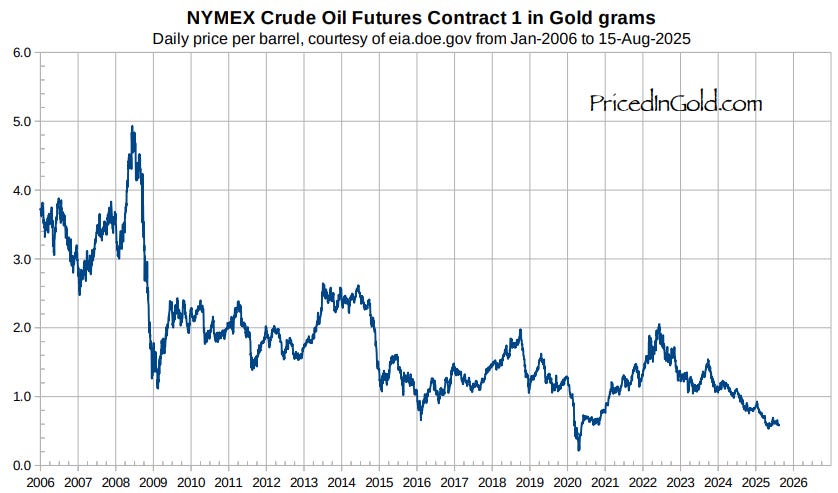

Let’s take a look at crude oil:

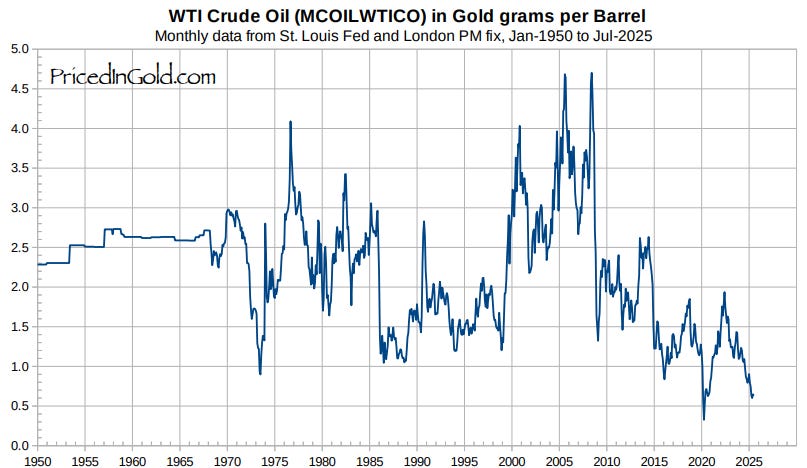

“As you can see in the long term chart below, oil is a volatile commodity, with it's price swinging wildly in a range from less than 1 gram per barrel to almost 5 grams per barrel. But this chart also shows that these oscillations are part of a sideways price movement centered around 2.5 grams per barrel. Crude's current price around 1.5 grams is quite a bit below its historical average.”

The trend since 2022 is clearly downward, with crude oil prices in gold at the lowest levels ever, except for the initial COVID-19 shutdown.

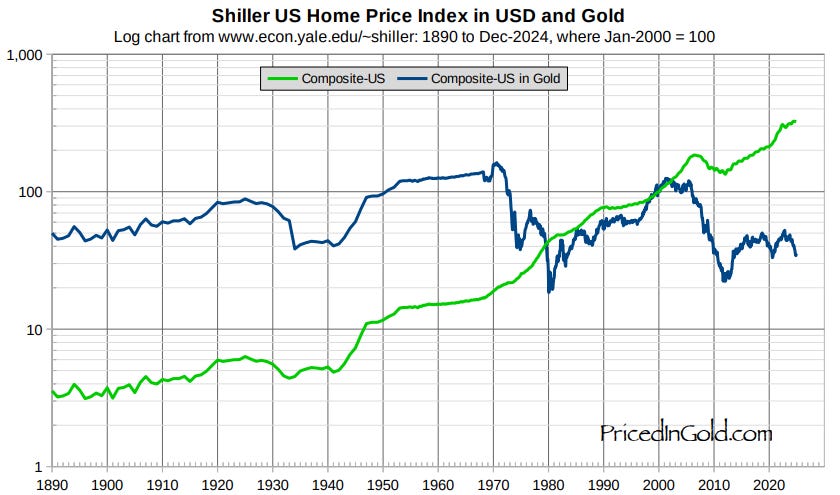

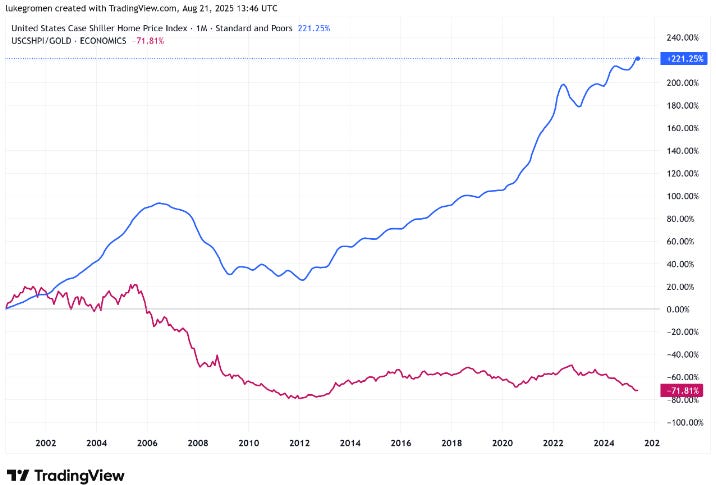

VI. What is the historical price of U.S. home prices in gold?

Here is another frequent topic of conversation - home prices.

Going back to 1890, home prices, according to the Shiller US Home Price Index in gold, are the lowest ever, except for the early 1980s and the early 2010s.

The Priced in Gold website does not have this chart updated recently, but

created an updated chart that he shared in his latest Tree Rings report:Home prices in gold are cheap, and getting cheaper.

Are you experiencing cognitive dissonance yet?

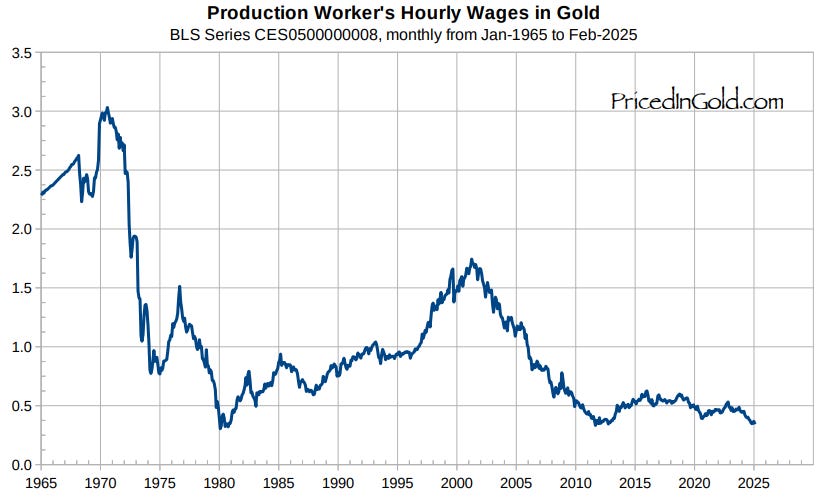

VII. What is the historical price of U.S. wages in gold?

This one will probably make sense in that most people believe U.S. wages are low in dollars, and this is also true in gold:

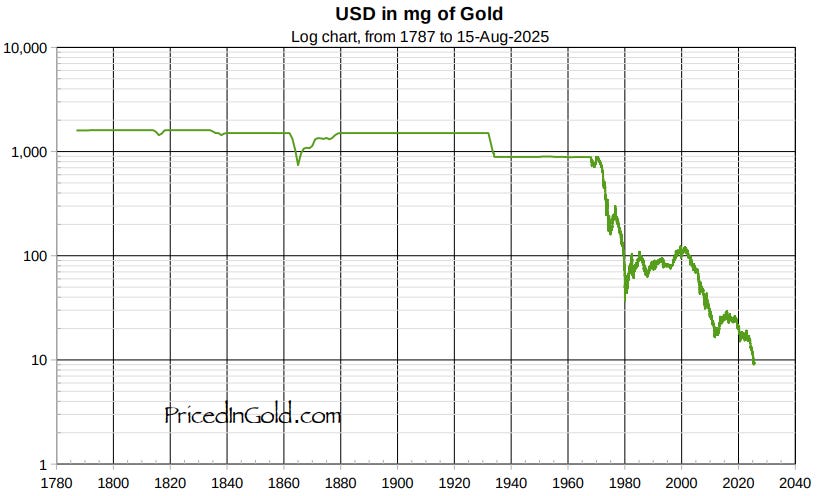

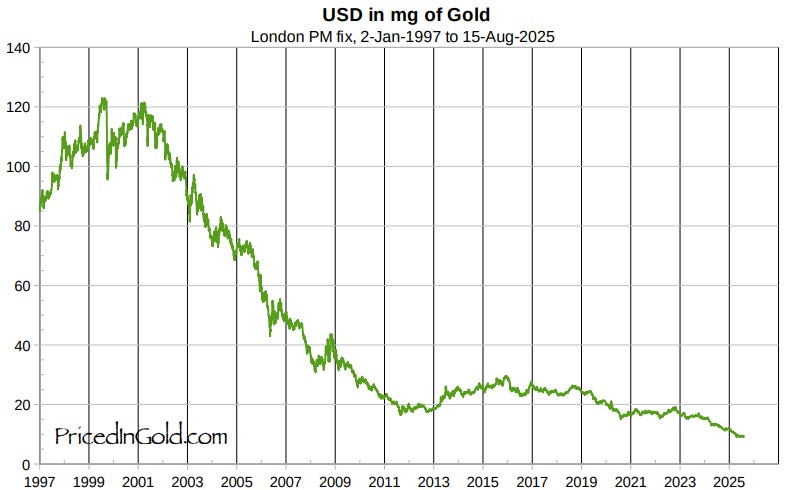

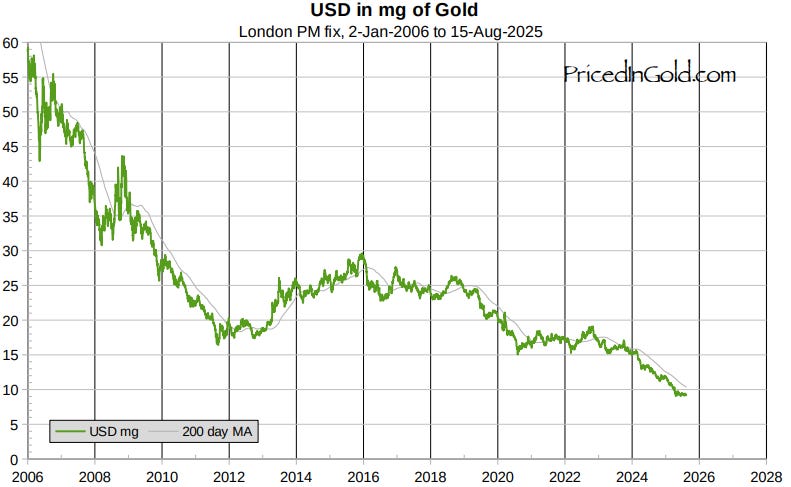

VIII. What is the historical price of the U.S. dollar in gold?

This is the final one, which really tells the whole story:

The United States abandoned the gold standard in 1971, as you can obviously see in the chart above. After a sharp fall bottoming in the early 1980s, the dollar’s value mostly held and rebounded into the early 2000s.

But since then, it has been nothing but a downhill ride:

And the downhill slide continues:

IX. What does The X Project Guy have to say?

What is the primary reason why The X Project came into existence? It is this decimation of the purchasing power of the dollar (and all fiat currencies) that threatens our ability to secure our own personal financial futures.

I am on a mission to help everyone understand that this is happening and that this will continue to happen. Why am I so sure this will continue to happen?

There are a lot of reasons, but this is the biggest:

Everyone should bookmark and keep watching the US Debt Clock.

Throughout history, every nation-state that has faced debts this large relative to its economy has inflated its currency, effectively reducing the value of its debt. Want proof of that assertion?

X. Why should you care?

Let me put this another way:

$1 in 1970 is worth $8.33 today.

Which means the dollar has lost 88% of its value since I was born.

$1 in 2000 is worth $1.88 today

Which means the dollar has lost 47% of its value over the past 25 years.

$1 in 2020 is worth $1.25 today

Which means the dollar has lost 20% of its value over the past 5 years.

So why did equity markets rally on Friday on the news that Fed Chair Powell indicated interest rate cuts are likely soon? Is it because the value of equities is suddenly greater with lower interest rates?

Absolutely and unequivocally NO!

It is NOT the numerator of the price of stocks going up. It is the denominator going down!

Lower interest rates lead to an acceleration in the decline of the dollar's value. Or said another way, the rate of inflation is likely to start accelerating again soon.

This is why I think the investment themes I subscribe to below will protect me and serve me well, with gold being my largest overweight position, followed by gold miner equities:

Overweight cash and short-term U.S. T-bills for optionality, given expected INCREASING volatility related to the remaining list below.

Bullish gold and gold miner equities

Bullish Bitcoin

Bullish oil and oil-related equities

Bullish natural gas and related equities

Bullish uranium and related equities

Bullish industrial-associated commodities and equities

Bullish agricultural-associated commodities and equities

Bullish industrial and primarily electrical infrastructure equities

Bearish long-dated U.S. and other Western sovereign bonds

NOTE: Real estate is also a real, tangible, hard asset that I believe in and invest in. I think land and productive real estate directly related to any of the themes above are wise investments.

Please note that this is not investment advice or a recommendation to buy or sell securities or investment products. Everything written and said is for informational purposes only, and you should do your own research and due diligence. It is recommended that you consult with an investment advisor before making any investments or changes to your investments based on the information provided by The X Project.

Thank you for your subscription, especially if you are a paying subscriber. Your support is everything to The X Project and is greatly appreciated. If you agree, please take a moment to hit the like button and share your positive comments about my articles, assuming you have something constructive to say.