Priced in Gold

Looking at inflation, the dollar, and the world from a different perspective - article #43

In this 15-minute article, The X Project will answer these questions:

I. Why this article now?

II. What does inflation mean for the U.S. dollar?

III. What is the problem with pricing in dollars?

IV. What is the historical price of the S&P 500 in gold?

V. What is the historical price of crude oil in gold?

VI. What is the historical price of U.S. home prices in gold?

VII. What is the historical price of U.S. wages in gold?

VIII. What is the historical price of the U.S. dollar in gold?

IX. What does The X Project Guy have to say?

X. Why should you care?

Reminder for readers and listeners: nothing The X Project writes or says should be considered investment advice or recommendations to buy or sell securities or investment products. Everything written and said is for informational purposes only, and you should do your own research and due diligence. It would be best to discuss with an investment advisor before making any investments or changes to your investments based on any information provided by The X Project.

I. Why this article now?

Everyone knows the most significant economic story of the past few years has been the return of the highest inflation since the early 1980s. The story has certainly been entertaining and perhaps frightening, given all the drama surrounding the Federal Reserve’s original assertion that we need not worry because inflation will prove to be “transitory.” Of course, it was not long before the Fed backtracked and embarked on the most aggressive tightening of interest rates in the institution’s history. And then, most recently, the Fed’s pause in hiking rates last summer, followed by the anticipated and hoped-for pivot to lowering rates at some point this year, has kept the story of inflation and interest rates in the headlines.

The latest Consumer Price Index (CPI) report, released this week on Tuesday, March 12, is the catalyst for this article. While avoiding the story's continuing drama has been impossible, I want to make several important points that may not be new to some readers. However, this is a good opportunity to remind you of and reinforce them.

The first point is the difference between inflation, disinflation, and deflation. The government reports the CPI and PPI figures in terms of the rate of change compared to the previous month and year. When you hear that CPI peaked at 9% in June 2022, the prices in June 2022 were 9% higher than in June 2021. A year later, in June 2023, CPI was 3%. That’s good news, right?

Well, yes and no. As you can see in the chart above, yes - the rate of change has declined, and so prices in June 2023 are only 3% higher than in June 2022. (Oh, and by the way, that is when disinflation ended - meaning inflation has not been lower since 3.05% in June last year. Last week’s report for February 2024 was 3.17%.)

But the bad news is that prices are still higher than last year and last month. Here is the chart of the actual CPI:

Using the “rate of change” figures leads us to believe that inflation is coming down. It is not. To see inflation come down would mean a negative rate of change, called deflation. And that has only occurred a few times, very briefly. Deflation is considered to be very bad by economists because it is associated with the Great Depression and with Japan’s multi-decade experience of slow, low, or no economic growth. Why aren’t falling prices a good thing? Well, the thinking goes that if consumers expect prices to be lower tomorrow, they would wait and not spend today- which would cause a depression or at least Japanese-style malaise. And so inflation is a good thing? And is that why policymakers target 2% inflation? Well, no, inflation is far from being a being good thing. And as to why policymakers target 2% inflation, that is a good question and maybe a topic for a future article. In 1996, Alan Greenspan argued that the target should be 0%. But I digress…

Back to the chart of actual price levels, the actual index was 311.054 as of February 2024. A year ago, in February 2023, it was 301.509. Dividing 311.054 by 301.509 gives us 1.0317, the reported 3.17% annual or 1-year inflation rate.

Why don’t they report on the rate of change over other time frames? Let’s take a look, and I think you’ll see why.

Feb. 2022, CPI = 284.535, 2-year inflation rate = 9.3%, average = 4.7%

Feb. 2019, CPI = 253.319, 5-year inflation rate = 22.8%, average = 4.6%

Feb. 2014, CPI = 235.547, 10-year inflation rate = 32.1%, average = 3.2%

Feb. 2004, CPI = 186.700, 20-year inflation rate = 66.6%, average = 3.3%

Feb. 1994, CPI = 146.700, 30-year inflation rate = 112.0%, average = 3.7%

Feb. 1984, CPI = 102.600, 40-year inflation rate = 203.2%, average = 5.1%

Feb. 1974, CPI = 47.800, 50-year inflation rate = 550.7%, average = 4.7%

Those numbers don’t look good and are nowhere near the Fed’s 2% target.

(Oh, and one more thing to note: the U.S. government keeps tinkering and tweaking how it calculates the CPI, and each iteration seemingly lowers the price index. Check out www.shadowstats.com, which tracks CPI under the same methodology employed before 1980 and suggests annual CPI rates of change would have been approximately 7-9% higher for at least the past 25 years under the old methodology.)

II. What does inflation mean for the U.S. dollar?

On to the second point: What’s the big deal with inflation? Inflation is a big deal unless your income, savings, and investment portfolio are consistently up by more than inflation. If they aren’t, you are falling behind. Said another way, your income, savings, and investments must increase by the inflation rate to stay even.

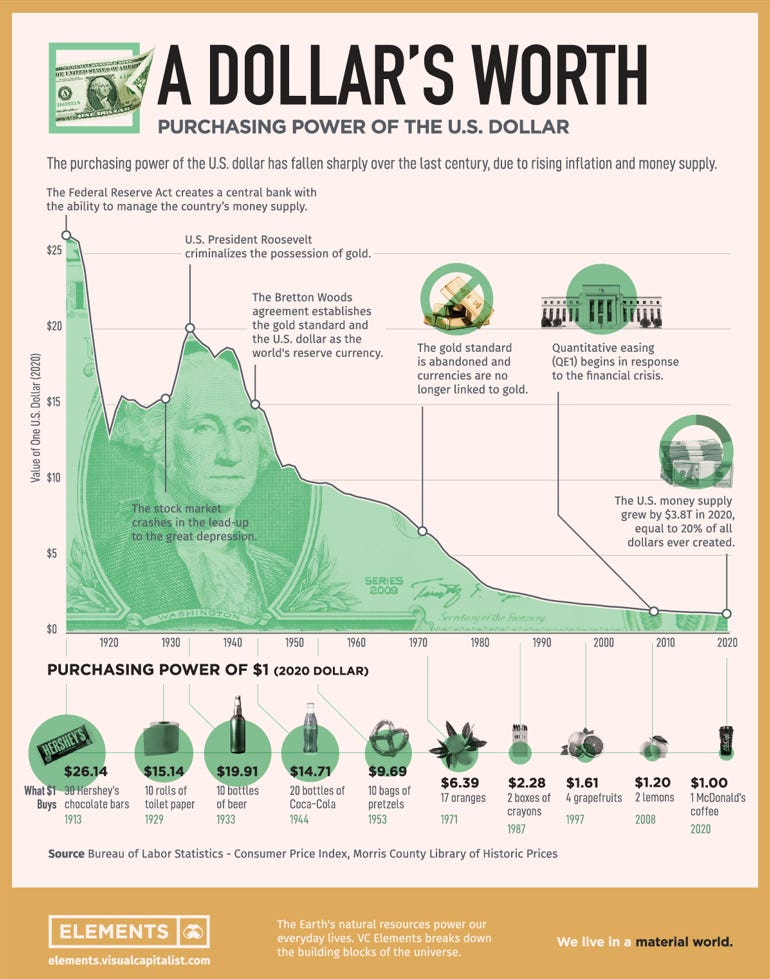

Inflation means that a dollar today is worth more now than it will be in the future, and a dollar today is worth less than it was in the past. I introduced this concept and shared the following chart and figures in Article #13: “Gold Prices Are at New All-Time Highs - Why Now? And what does it possibly mean?”:

How much purchasing power has the US Dollar lost? The figures in the infographic above are based on the dollar's value in 2020, before our recent spike in inflation.

Here are updated numbers based on the online CPI Inflation Calculator developed by Ian Webster through the latest CPI report:

Since 1924, the US Dollar has lost 94% of its purchasing power

Since 1974, the US Dollar has lost 84% of its purchasing power

Since 1999, the US Dollar has lost 46% of its purchasing power

Since 2014, the US Dollar has lost 24% of its purchasing power

Since 2019, the US Dollar has lost 17% of its purchasing power

Do you see the problem? We are earning, saving, and investing in a currency that has been and is losing value. It will continue to do so, and I believe at a faster average rate over the next decade or two than we’ve experienced in the past several decades.

III. What is the problem with pricing in dollars?

It is the same problem I just stated. We are pricing things in a currency that has been and will continue to lose its value. If I compare the price of something today with the price of that same thing at some point in the past, I am not comparing two variables but actually four variables. The dollar is not constant across time. As I illustrated, quantified, and said in the section above, inflation means that a dollar today is worth more now than it will be in the future, and a dollar today is worth less than it was in the past. Is the S&P 500 at all-time highs? Or is the U.S. Dollar’s purchasing power at all-time lows? Can both be true? These are good questions that we will consider in the next section.

This problem is why you sometimes see historical price charts “adjusted for inflation.” The problem with adjusting for inflation is that inflation is a moving target, with the official calculation changing over time.

The third point of this article is that there is another way to look at prices, and that is to look at things priced in gold. Gold is considered an ancient form of money that has held its value over time. For instance, an old saying is that an ounce of gold can always buy a nice tailored men’s suit. This was true in 1935, when gold was $35 per ounce, and it is true today.

The problem with pricing things in gold is that the calculation requires the price of gold in dollars, which is volatile over time. Nonetheless, looking at things priced in gold, especially over more extended time frames, can provide a different and meaningful perspective on the value of that thing - which is what we will do in the following five sections. We will get these prices from the pricedingold.com website.

IV. What is the historical price of the S&P 500 in gold?

As of March 8, 2024, the S&P 500 was priced at 73.4 grams of gold. This was down 5.8% from the previous week, down 4.2% from the last month, up 7.4% from a year ago, and up 11.6% from five years ago.

Here is a long-term chart going back to 1871:

Also, keep in mind that if the price of gold doubled overnight, the S&P 500 price in gold would drop by half, and this would be true for everything priced in gold.

For comparison’s sake, here is a chart of the S&P 500 priced in U.S. dollars adjusted for inflation from multpl.com as of the close on March 14, 2024

The inflation-adjusted S&P 500 reached an all-time high of 5,179 in November 2021, while the S&P 500 priced in gold reached an all-time high in 1999 at 168 grams. Which chart is correct? They both are, and they both offer a different perspective.

Here is an interesting third perspective courtesy of Game of Trades:

V. What is the historical price of crude oil in gold?

As of March 8, 2024, crude oil was priced at 1.118 grams of gold per barrel. This was down 7.9% from the previous week, down 4.4% from the last month, down 14.9% from a year ago, and down 17.8% from five years ago.

Here is a long-term chart going back to 1950:

VI. What is the historical price of U.S. home prices in gold?

Here is a chart of Robert Schiller’s long-term price index in U.S. dollars and gold:

Here is a chart of the median sales price of new homes in U.S. dollars and grams of gold:

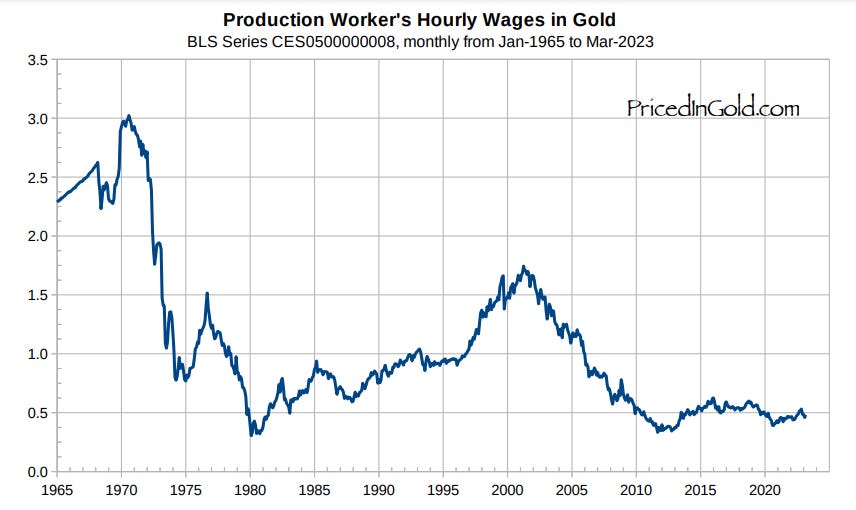

VII. What is the historical price of U.S. wages in gold?

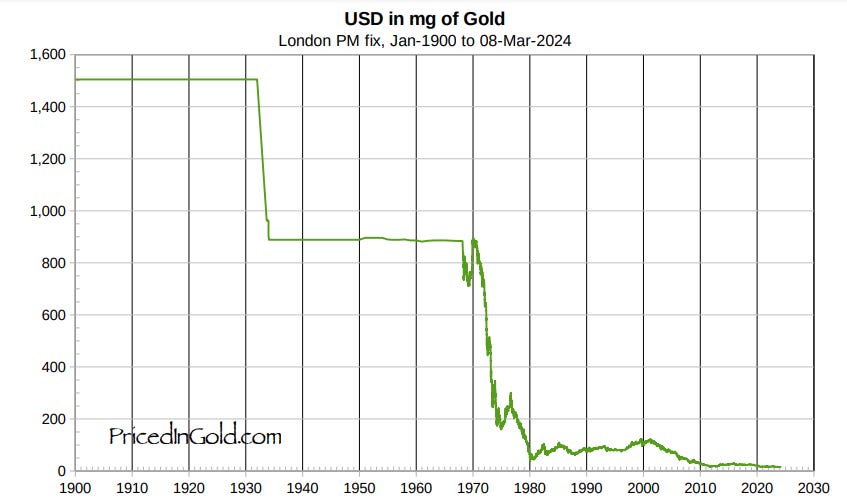

VIII. What is the historical price of the U.S. dollar in gold?

As of March 8, 2024, the U.S. dollar was priced at 14.3 milligrams of gold. This was down 5.6% from the previous week, down 6.6% from the previous month, down 16.3% from a year ago, and down 40.3% from five years ago.

IX. What does The X Project Guy have to say?

First, regarding the S&P 500, I think that there will be a major crash taking the equity indices down hard and fast, but I think that is not likely in the short-term. The November presidential election might be a catalyst - see my note regarding

’s article about RFK, Jr potential smashing the two-party system:Otherwise, I tend to agree with

that global liquidity will need to keep rising to service the global debt (see Article #35: The Rising Tide of Global Liquidity Lifting All Assets) which will lift asset prices. Policymakers know this and know that rising asset prices are highly correlated to tax receipts, and so they will do whatever they can to keep the party going - for now. But at some point, maybe 2025 or 2026 when the global liquidity cycle goes into reverse, it will get ugly.Regarding oil, I am bullish and if gold continues to rise then oil priced in gold will get even cheaper. We are already at the low end of the historical range in oil priced in gold, and so oil should rise in gold terms as gold rises which is especially bullish oil in dollar terms.

Looking at U.S. house prices in gold terms was shocking to me, especially since I expect gold to rise meaningfully in the short-term. House prices are not near recent record highs. It is the dollar that is making new record lows, and you see that clearly in the charts above.

Wages were no surprise as I’ve often looked at inflation-adjusted wage figures, and those too don’t look good.

But it is the last charts of the U.S. dollar in gold that really made me anxious, especially the new break-down to new lows below 15 milligrams. This obviously just the inverse of the price of gold in dollars, which has broken out to new highs. The gold market is telling us what is happening and likely to continue happening with inflation and the dollar.

So, you do know what you can and should do about it, right? Buy gold if you don’t own enough yet. Don’t wait for a pull-back, buy now. Don’t buy as an investment, although you can. Don’t buy speculatively, although you can do that too. Buy gold as your long-term savings vehicle and strategy. If you have money in savings, keep some cash on hand but otherwise start building long-term savings in an asset that won’t lost its value over the long-run.

For more information on gold and how to buy, check out my prior articles:

Article #13: “Gold Prices are at New All Time Highs”

Article #31: “Navigating the Golden Tide”

Article #41: “Gold Prices Decisively Break Out to New All-Time Highs Surging 4.5% This Past Week”

In the next section, I will explain a few more reasons why you should care and, more importantly, what more you can do about it. However, The X Project now requires you to view the final section as a paid subscriber. In a few articles, the paywall will move up within the article so that only paid subscribers will see the last two sections, or rather, free subscribers will only see the first eight sections. I will be moving the paywall up every few weeks, so ultimately, free subscribers will only see the first four or five sections of each article. Please consider a paid subscription.

All paid subscriptions come with a free 14-day trial; you can cancel anytime. Every month, for the cost of two cups of coffee, The X Project will deliver two articles per week ($1.15 per article), helping you know in 1-2 hours of your time per month what you need to know about our changing world at the interseXion of commodities, demographics, economics, energy, geopolitics, government debt & deficits, interest rates, markets, and money.

You can also earn free paid subscription months by referring your friends. If your referrals sign up for a FREE subscription, you get one month of free paid subscription for one referral, six months of free paid subscription for three referrals, and twelve months of free paid subscription for five referrals. Please refer your friends!

X. Why should you care?

Inflation is one of the biggest risks to our economy, our prosperity, our wealth, and our standard of living, and that is a big reason why I have such strong convictions about owning gold. But that is only one of the risks I see converging in a perfect storm over the next few years, and owning gold is only one of my ten investment theses to which I subscribe.

Tangential to inflation is the debt situation, both at the federal government level and also at the entire financial system-wide level. We are already facing fiscal dominance (see article #6, article #9, article #17, article #27, and article #37) and teetering on the edge of falling into a debt-death spiral that threatens all fiat currencies and the entire global financial system.

As I pointed out in the note I liked above about the 2024 presidential election, there are several influential books that I have read that predict major social and political upheaval. Certainly, inflation and people’s struggle with trying to keep up but with many falling behind contribute to this outlook. But there are other convincing reasons to expect a breaking point before some sort of major reset.

Finally, there is the geopolitical outlook based on several influential books that I have read that predict major international conflicts and wars for a myriad of convincing reasons.

All four of these areas reinforce each other in feedback loops that compelled me to start The X Project and to share what I see, what I hear, what I know, what I believe, and what I think will happen as a result.

The X Project expects a lot of volatility in various markets as we head toward increasingly frequent and intense crises and as our policymakers do everything possible to keep the system functioning, serving the status quo and responding to emergencies as they erupt. There will be tremendous opportunities to capitalize on the volatility if you can anticipate certain market reactions and be positioned accordingly.

The continuation and acceleration of inflation, indebtedness and fiat currency devaluation are the core foundational reasoning for the following investment theses to which The X Project subscribes:

Overweight cash and short-term U.S. T-bills for optionality, given expected volatility related to the remaining list below.

Bullish gold and gold miner equities

Bullish Bitcoin

Bullish oil and oil-related equities

Bullish natural gas and related equities

Bullish uranium and related equities

Bullish industrial-associated commodities and equities

Bullish agricultural-associated commodities and equities

Bullish industrial and primarily electrical infrastructure equities

Bearish long-dated U.S. and other Western sovereign bonds

These are long-term investments with at least a 5-10 year time horizon.

I found this article to be an outstanding, and well constructed, foundational reference towards establishing a basis for the proportion of gold one should maintain in your own portfolio over time. In my own case, this is for myself, children and grandchildren. Thank you for sharing your thoughts and research.