"The New Gold Playbook"

Reviewing Incrementum's 18th Annual "In Gold We Trust" Report - Article #66

In this 14-minute article, The X Project will answer these questions:

I. Why this article now?

II. Who are the authors?

III. What is the status quo of gold and how to master the new gold playbook?

IV. What is the Eastern push for gold?

V. What is the image problem of gold in the West?

VI. What is Roy Jastram’s “Golden Constant”?

VII. What is the report’s long-term gold price forecast?

VIII. What are the valuation and beta of the gold mining industry?

IX. What does The X Project Guy have to say?

X. Why should you care?

Reminder for readers and listeners: nothing The X Project writes or says should be considered investment advice or recommendations to buy or sell securities or investment products. Everything written and said is for informational purposes only, and you should do your own research and due diligence. It would be best to discuss with an investment advisor before making any investments or changes to your investments based on any information provided by The X Project.

I. Why this article now?

Gold is a favorite topic of The X Project, and I’ve written five prior articles on the subject:

Gold Prices are at New All Time Highs - Why now? And what does it possibly mean?

Priced in Gold – Looking at Inflation, the Dollar, and the World from a Different Perspective

What’s Up with Gold? The Latest News, Analysis, and Thoughts on Gold

Gold has also appeared in sections of several other articles that I won’t list here. If you have not read the articles above, you should do so. The last article was published a little over a month ago, but the impetus for this article was finishing reading the 400+ page “The New Gold Playbook,” which is the 18th annual “In Gold We Trust Report.”

II. Who are the authors?

The authors, Ronald-Peter Stoferle and Mark J. Valek are partners at Incrementum. According to the report,

“Incrementum AG is an owner-managed and FMA-licensed investment and asset management company based in the Principality of Liechtenstein. Our core competence is the management of investment funds and asset management. We evaluate investments not only on the basis of the global economic situation, but also always see them in the context of the current global monetary system. Independence and self-reliance are the cornerstones of our philosophy, which is why the five partners own 100% of the company.

Ronnie is managing partner of Incrementum AG and responsible for Research and Portfolio Management.

He studied business administration and finance in the USA and at the Vienna University of Economics and Business Administration, and also gained work experience at the trading desk of a bank during his studies. Upon graduation he joined the research department of Erste Group, where in 2007 he published his first In Gold We Trust report. Over the years, the In Gold We Trust report has become one of the benchmark publications on gold, money, and inflation.

Since 2013 he has held the position as reader at scholarium in Vienna, and he also speaks at Wiener Börse Akademie (the Vienna Stock Exchange Academy). In 2014, he co-authored the international bestseller Austrian School for Investors, and in 2019 The Zero Interest Trap. He is a member of the board of directors at Tudor Gold Corp. (TUD), and Goldstorm Metals Corp. (GSTM). Moreover, he is an advisor to VON GREYERZ AG, a global leader in wealth preservation in the form of physical gold stored outside the banking system.”

Mark is a partner of Incrementum AG and responsible for Portfolio Management and Research.

While working full-time, Mark studied business administration at the Vienna University of Business Administration and has continuously worked in financial markets and asset management since 1999. Prior to the establishment of Incrementum AG, he was with Raiffeisen Capital Management for ten years, most recently as fund manager in the area of inflation protection and alternative investments. He gained entrepreneurial experience as co-founder of philoro Edelmetalle GmbH.

Since 2013 he has held the position as reader at scholarium in Vienna, and he also speaks at Wiener Börse Akademie (the Vienna Stock Exchange Academy). In 2014, he co-authored the book Austrian School for Investors.”

III. What is the status quo of gold and how to master the new gold playbook?

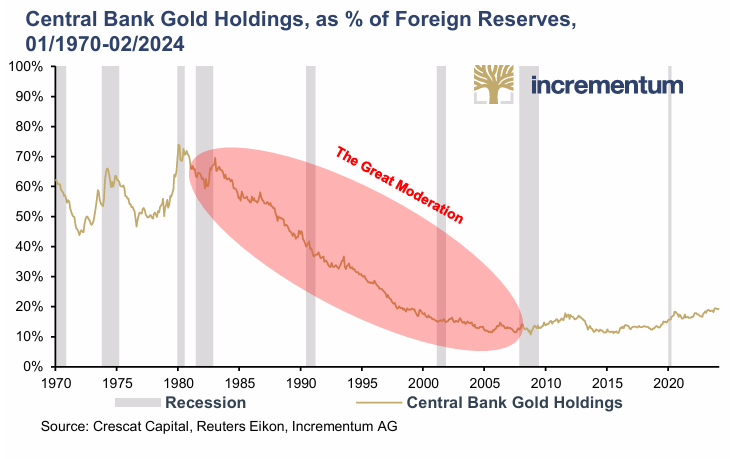

The "Status Quo of Gold" section of the report comprehensively analyzes gold's performance and its evolving role in the global financial landscape. One of the central takeaways is the significant transformation in the relationship between gold, stocks, bonds, and commodities. Historically, gold has been viewed primarily as a safe-haven asset, but recent market dynamics suggest a broader role. The decoupling of gold and bonds is particularly noteworthy, as both markets now indicate that inflation is the new norm. This shift challenges traditional portfolio models, such as the 60/40 portfolio, which relies heavily on bonds for stability. Instead, the report suggests that gold might increasingly take on this stabilizing role, providing a hedge against inflation and economic uncertainty.

The "Mastering the New Gold Playbook" section introduces a strategic framework for understanding and leveraging gold's role in the current economic climate. The report emphasizes that traditional investment strategies may no longer be sufficient in light of recent macroeconomic shifts. One of the key points is the importance of adjusting portfolios to account for the changing dynamics of gold and other commodities. The report notes that while industrial metals hedge demand-driven inflation, gold and silver perform best when there is a loss of confidence in central banks and the broader banking system. This insight is crucial for investors seeking to navigate the complexities of the current market environment.

The report also addresses the momentum in the commodity bull market, suggesting that commodities, including gold, are poised for significant gains. This is part of a broader trend towards increased inflation and economic instability, which could drive demand for gold as a safe-haven asset. The "new gold playbook" thus involves a strategic shift towards incorporating more gold and commodities into investment portfolios to hedge against inflation and capitalize on potential gains in the commodity markets.

“Our interpretation of a new standard portfolio for long-term investors envisages the following allocation:

Of course, we do not see this allocation as a rule set in stone. Rather, it is intended as a guideline derived from the current monetary, fiscal and geopolitical realities. In our view, the new gold playbook applies as long as we are in a phase of currency instability, characterized by high debt levels and geopolitical instability. A simple quantitative measure of currency stability are inflation rates. If average inflation rates remain below 3% over a 24-month period, this would be a good indication that the situation has stabilized.”

IV. What is the Eastern push for gold, and what is happening with the Chinese?

The "Enter the Dragon: De-dollarization and the Eastern Push for Gold" section of the report delves into the significant geopolitical and economic shifts driving the global move away from the US dollar and towards gold, especially in the East. This theme explores how emerging markets, particularly in Asia, increasingly view gold as a strategic asset amidst growing distrust in the US dollar. The report highlights that central banks in these regions are accelerating their gold purchases, motivated by a desire to reduce dependency on the dollar and hedge against geopolitical risks.

The push for de-dollarization is largely driven by geopolitical events and economic policies undermining confidence in the dollar. The sanctions on Russian currency reserves by the US and EU have served as a stark reminder to other nations about the vulnerabilities of holding dollar reserves. As a result, countries like China and Russia are leading the charge in increasing their gold reserves. This strategic accumulation of gold by central banks in the East underscores a significant shift in the global monetary landscape, signaling a move towards a more multipolar world where gold plays a central role in national reserves.

Furthermore, the report discusses the broader implications of de-dollarization for global financial stability and economic sovereignty. The growing demand for gold in the East is not just a response to geopolitical tensions but also reflects a long-term strategic move towards diversifying away from the US dollar. This trend is expected to continue, driven by the economic policies of major emerging markets and their ongoing efforts to establish alternative financial systems that are less reliant on the Western-dominated financial infrastructure. The implications of this shift are profound, potentially leading to increased volatility in currency markets and a reconfiguration of global financial power dynamics.

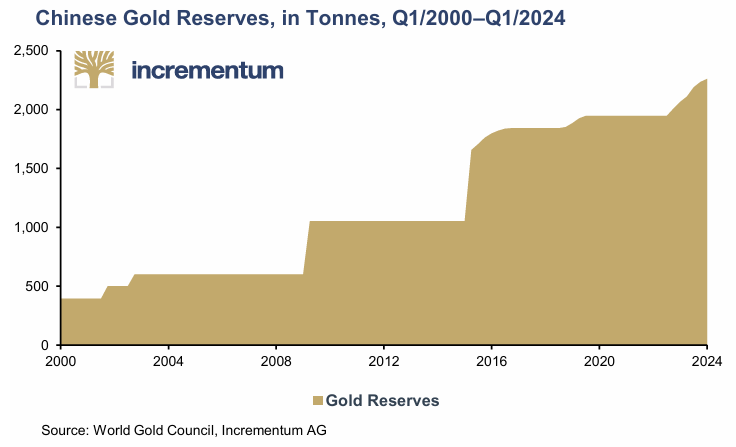

The "China’s Economic Situation and Its Consequences for Gold Consumption" section provides an in-depth analysis of how economic developments in China influence gold demand. As the world's largest consumer and producer of gold, China plays a pivotal role in the global gold market. The report highlights that despite economic challenges, including a slowing economy and a troubled real estate sector, Chinese demand for gold remains robust. This resilience is attributed to cultural factors, high savings rates, and a lack of attractive investment alternatives.

The report emphasizes that Chinese private investors increasingly turn to gold as a safe-haven asset amidst economic uncertainty. With traditional investment avenues like real estate facing turbulence, gold has emerged as a preferred investment for wealth preservation. The Chinese central bank's continuous accumulation of gold reserves further reinforces the strategic importance of gold in China's economic policy. This trend indicates a broader shift in investment preferences among Chinese investors, who seek stability and security in gold amidst a volatile economic environment.

Additionally, the report examines the implications of China's gold demand for global markets. The sustained high demand for gold in China is expected to support global gold prices, providing a buffer against potential downturns in other markets. This dynamic underscores the interconnectedness of global financial markets and China's critical role in shaping global gold trends. The report suggests that understanding the economic situation in China is essential for investors seeking to navigate the complexities of the global gold market, as developments in China will continue to have significant ripple effects worldwide.

V. What is the image problem of gold in the West?

The "The Image Problem of Gold in the West" section explores the complex and often negative perception of gold among Western investors and financial institutions. This theme delves into the cultural and psychological factors contributing to gold's image problem, contrasting it with the more favorable view of gold in Eastern markets. The report highlights how Western financial advisors and institutions tend to undervalue gold, often viewing it as a relic of the past rather than a viable modern investment. This perspective is influenced by a long-standing bias towards financial assets like stocks and bonds, which are seen as more sophisticated and lucrative.

The report argues that this image problem has significant implications for gold's market dynamics and investment potential in the West. It points out that despite gold's proven track record as a hedge against economic uncertainty and inflation, it remains underrepresented in Western investment portfolios. This underrepresentation is partly due to a lack of education and awareness about gold's benefits and the financial industry's preference for assets that generate fees and commissions. The report suggests that changing this perception requires a concerted effort to educate investors about gold's strategic value and to challenge the entrenched biases that have historically marginalized it. By addressing the image problem, there is potential for a broader acceptance and increased investment in gold, which could enhance portfolio diversification and stability for Western investors.

VI. What is Roy Jastram’s “Golden Constant”?

The section “Roy Jastram’s The Golden Constant and Inflationary Deflation" explores Jastram's seminal work, a book he published in 1977 while a business administration professor at the University of California Berkeley. The book delves into the historical performance of gold during periods of inflation and deflation, demonstrating gold's unique ability to maintain its purchasing power over long periods. The report revisits Jastram's findings to provide insights into the current economic landscape, which is marked by significant inflationary pressures and the potential for deflationary spirals.

The analysis emphasizes that gold has consistently served as a stable store of value during tumultuous economic periods, acting as a hedge against inflation and deflation. This dual functionality is particularly relevant today, where central banks are grappling with high inflation rates while facing deflation risk due to economic slowdowns and debt overhangs.

The report suggests that investors consider these historical patterns when formulating their strategies, highlighting gold's role as a reliable asset in preserving wealth amidst economic uncertainties. By understanding the principles outlined in "The Golden Constant," investors can better navigate the complexities of the current economic environment and safeguard their investments against the twin threats of inflation and deflation.

VII. What is the report’s long-term gold price forecast?

The report's long-term gold price forecast is particularly optimistic, projecting a price target of around USD 4,800 by the end of 2030. This forecast is based on the gold coverage ratio and reflects the anticipated impacts of inflation, interest rates, and geopolitical factors. The recent surge in gold prices is a precursor to an imminent turnaround in interest rates and a stagflationary environment in the US. This outlook reinforces the importance of gold as a core component of investment portfolios, offering both stability and significant growth potential in the face of economic uncertainty.

“If this price target sounds too ambitious to some readers, we would like to put the return derived from this target into historical perspective. Based on a current gold price of USD 2,300, this would mean a price increase of just under 12% p.a. by the end of the decade. By comparison, the gold price rose by over 14% p.a. in the 2000s and over 27% p.a. in the 1970s.”

The following section will examine the valuation and beta of the gold mining industry. In Section IX, I will tell you what I think. Then, in Section X, why should you care and, more importantly, what more can you do about it. However, I have just hit a new paid subscriber threshold, so you must now be a paid subscriber to view the last three sections. The X Project’s articles always have ten sections. Soon, after a few more articles, the paywall will move up again within the article so that only paid subscribers will see the last four sections, or rather, free subscribers will only see the first six sections. I will be moving the paywall up every few weeks, so ultimately, free subscribers will only see the first four or five sections of each article. Please consider a paid subscription.

Also, podcasts of the full articles narrated are available only to paid subscribers.

All paid subscriptions come with a free 14-day trial; you can cancel anytime. Every month, for just the cost of two cups of coffee, The X Project will deliver 6-8 articles (weekly on Sundays and every other Wednesday), helping you know in a couple of hours of your time per month what you need to know about our changing world at the interseXion of commodities, demographics, economics, energy, geopolitics, government debt & deficits, interest rates, markets, and money.

You can also earn free paid subscription months by referring your friends. If your referrals sign up for a FREE subscription, you get one month of free paid subscription for one referral, six months of free paid subscription for three referrals, and twelve months of free paid subscription for five referrals. Please refer your friends!