Where are We with Our Federal Debt and Deficits?

An Update on Our Fiscal Situation and What it Means - Article #117

In this 12-minute article, The X Project will answer these questions:

I. Why this article now?

II. How have recent fiscal results impacted the deficit

III. What are the Treasury's borrowing needs in the near term?

IV. What are the implications of current interest rate dynamics on federal debt?

V. How has economic performance influenced the fiscal outlook?

VI. What role does inflation play in the current fiscal environment?

VII. How is the debt limit influencing financial market stability and borrowing costs?

VIII. What strategies is the Treasury employing to manage federal debt?

IX. What does The X Project Guy have to say?

X. Why should you care?

Reminder for readers and listeners: nothing The X Project writes or says should be considered investment advice or recommendations to buy or sell securities or investment products. Everything written and said is for informational purposes only, and you should do your own research and due diligence. It is recommended to consult with an investment advisor before making any investments or changes to your investments based on information provided by The X Project.

I. Why this article now?

Longtime and loyal readers of The X Project know that The X Project curates, summarizes, distills, and synthesizes knowledge and learning at the interseXion of economics, geopolitics, money, interest rates, debts, deficits, energy, commodities, demographics, and markets - helping you know what you need to know.

But why did I start The X Project? The unsustainable growth of our Federal debt is a big reason, as I explained in “Unsustainabilities and Breaking Points: Do you Understand Why Generational Changes Happening?” This was the last article I wrote discussing our federal debt and deficits, which was published a little more than three months ago.

So why this article now? Something important happened this week that was predicted in “Debt Monetization and Yield Curve Control - What are they and will we experience them?” over a year ago. This one is worth re-reading to see if you can identify what happened this past week. It would also be beneficial to quickly re-read my most recent article linked above, as well as my other previous articles on this topic.

In this article, I summarize the latest U.S. Treasury Department Quarterly Refunding Documents, released on April 28 and April 30, as well as the latest Monthly Treasury Statement (MTS) documents, released on June 10.

II. How have recent fiscal results impacted the deficit?

The fiscal outlook for the U.S. federal government remains concerning, with receipts and outlays continuing to diverge sharply.

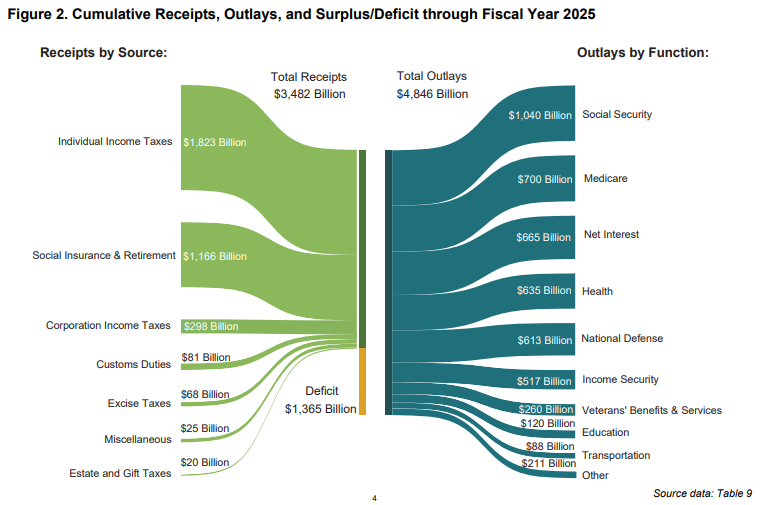

Through May 2025, total receipts reached approximately $3.48 trillion, marking a 6% increase year-over-year, primarily driven by individual income and customs duties.

However, federal outlays accelerated even faster, totaling $4.85 trillion —a 10% rise, primarily due to increased spending on interest payments, Medicare, Medicaid, and defense programs.

The net result is a widening deficit, currently standing at approximately $1.36 trillion for the fiscal year to date, reflecting an ongoing structural imbalance between government spending and revenue generation. This trend highlights the continuing reliance on borrowing, which further exacerbates the fiscal challenges ahead.

III. What are the Treasury's borrowing needs in the near term?

The Treasury expects to borrow significantly over the next quarters to fund government operations and maintain a cash buffer. For the April-June quarter of 2025 alone, the Treasury plans to borrow $514 billion, reflecting an upward revision due primarily to lower-than-expected initial cash balances and net cash flow challenges. For July to September, borrowing needs are projected to rise further to $554 billion.

Such borrowing estimates are predicated on the assumption of maintaining an $850 billion cash balance at quarter-end, highlighting a delicate balancing act of meeting financial obligations while managing cash reserves. Continued uncertainty regarding fiscal policy, economic outlook, and potential debt limit issues remains central to these borrowing projections.

IV. What are the implications of current interest rate dynamics on federal debt?

Interest costs remain one of the fastest-growing components of federal expenditures, significantly influenced by higher interest rates and increasing debt stock. Through the second fiscal quarter of 2025, interest payments on federal debt have surged to $776 billion, reflecting a 7% year-over-year increase, underscoring the direct financial impact of elevated borrowing costs.

Treasury yields across different maturities have seen substantial fluctuations due to policy uncertainty and economic developments. The combination of higher rates and expanding debt could lead to interest payments further crowding out other essential federal spending programs, posing long-term concerns about fiscal sustainability.

V. How has economic performance influenced the fiscal outlook?

Despite early-year disruptions from winter storms, the overall economic performance remains resilient, with real GDP growth projected at a modest annual rate of approximately 0.4% in the first quarter of 2025. However, economic forecasts have generally been downgraded, reflecting concerns about international trade tensions and inflationary pressures.

Labor markets remain relatively robust with stable unemployment rates around 4.2%, although job growth has decelerated compared to previous periods. This mixed economic performance adds complexity to fiscal planning, particularly given persistent inflation challenges, necessitating careful management of spending and borrowing policies.

VI. What role does inflation play in the current fiscal environment?

Inflation trends are mixed, with core consumer price pressures remaining elevated despite some moderation. Core PCE inflation, a key indicator for monetary policy, has hovered around 2.8%, exceeding the Federal Reserve's long-term target. Persistent inflationary pressures lead to increased nominal government outlays, particularly in entitlement programs that are adjusted for cost-of-living increases.

The interaction of elevated inflation and high interest rates creates a challenging fiscal environment by driving up both direct government expenditures and borrowing costs, thus amplifying budgetary deficits. Policymakers face difficult choices between managing inflation and maintaining fiscal discipline.

VII. How is the debt limit influencing financial market stability and borrowing costs?

Repeated debt limit impasses have significantly disrupted financial markets, increasing borrowing costs and risking the creditworthiness of the U.S. sovereign debt. These impasses result in heightened market volatility, reduced investor confidence, and occasional credit rating downgrades. As of early 2025, the debt limit debate remains a politically charged and financially disruptive issue.

The Treasury Borrowing Advisory Committee highlighted the substantial negative impacts of debt limit uncertainty, including higher interest payments, increased market volatility, and broader economic disruptions. Recommendations have been made to reform or abolish the debt limit to ensure market stability and reduce unnecessary fiscal stress.

VIII. What strategies is the Treasury employing to manage federal debt?

To effectively manage federal borrowing needs, the Treasury continues to utilize diversified debt issuance strategies, including nominal coupon securities, Treasury Inflation-Protected Securities (TIPS), floating-rate notes (FRNs), and the strategic use of buybacks to enhance market liquidity. The Treasury’s buyback program, initiated in May 2024, aims to manage liquidity and reduce long-term borrowing costs effectively.

Additionally, the Treasury is adjusting issuance sizes cautiously, maintaining flexibility to accommodate unexpected borrowing needs through adjustments in bill auction sizes and cash management bills. This prudent management is crucial for maintaining investor confidence and ensuring smooth debt market operations amid continuing fiscal pressures and economic uncertainty.

IX. What does The X Project Guy have to say?

The bottom line is that the debt is still growing, as government outlays are growing faster than receipts, despite DOGE spending cuts and increased tariff revenues.

Ok, so what does that mean? First and foremost, the government needs, and I cannot emphasize enough how strongly the need is, and to what lengths the government will go to maintain nominal GDP growth (“G”) to be greater than interest rates (“R”). Said another way, real interest rates need to be negative for an extended period as a starting prerequisite of lowering the debt to GDP ratio.

With federal government spending comprising roughly 23% of GDP, the government cannot cut its spending and maintain “G > r.” So while the government will do everything it can to increase, and at least not lower, G,” it will also do everything it can to lower “r".

As it relates to interest rates, this past week, the administration launched an aggressive verbal attack on Fed Chair Powell, following the recent Fed meeting and subsequent press conference, where Powell indicated reluctance to lower short-term interest rates. However, if you recall, longer-term yields (interest rates) rose as a result of the last interest rate cuts in the second half of last year, because all other interest rates, except the shortest duration (overnight) Fed-controlled Fed Funds rate, are set by the market.

If the debt continues to grow, which it is, that means the supply of bills, notes, and bonds entering the market is also increasing. If the supply of something grows faster than the demand, then the price decreases. When it comes to bills, notes, and bonds, a lower price means a higher yield or interest rate. When it comes to the government needing to maintain “G > r,” that means that the government must grow demand for government debt faster than supply.

And that is what we are seeing. First, earlier this month, Wells Fargo, the third-largest bank in the U.S., was released from a limit on the amount of assets it is allowed to hold, which had been in place for the past seven years as a punishment by the Federal Reserve for previous widespread consumer abuses and compliance breakdowns. Second, last week, a new stablecoin bill passed the U.S. Senate that would require stablecoin companies to hold highly liquid assets, such as short-term government debt, to back their digital tokens. And third, this week (the answer to my question in Section I), the Federal Reserve took significant action to lower the Supplementary Leverage Ratio (SLR). Lowering this key bank capital requirement would free up more of large banks’ reserves to buy government debt.

X. Why should you care?

The first thing you should expect from negative real interest rates is that owning longer maturity government bonds will be a money-losing proposition. 10-year and 30-year Treasury bond prices peaked in the second half of 2020, fell to multi-decade lows in late 2023, and have been hovering near those lows ever since.

The second thing you should expect is that the U.S. Dollar will continue to weaken against other currencies, but more importantly, in real purchasing power terms against real, tangible hard assets. A weaker dollar is an essential negative feedback loop to create and maintain, but also an outcome of “G > r.”

And this (and virtually every article I write) is why I subscribe to the following investment themes:

Overweight cash and short-term U.S. T-bills for optionality, given expected INCREASING volatility related to the remaining list below.

Bullish gold and gold miner equities

Bullish Bitcoin

Bullish oil and oil-related equities

Bullish natural gas and related equities

Bullish uranium and related equities

Bullish industrial-associated commodities and equities

Bullish agricultural-associated commodities and equities

Bullish industrial and primarily electrical infrastructure equities

Bearish long-dated U.S. and other Western sovereign bonds

NOTE: I have not mentioned this before, but real estate is also a real, tangible, hard asset that I believe in, although I have not previously highlighted it. I think land and productive real estate directly related to any of the themes above are wise investments. For example, I began accumulating farmland in 2020 through platforms such as acretrader.com and similar platforms.

Remember, this is not investment advice or a recommendation to buy or sell securities or investment products. Everything written and said is for informational purposes only, and you should do your own research and due diligence. It is recommended to consult with an investment advisor before making any investments or changes to your investments based on information provided by The X Project.

Thank you for your subscription, especially if you are a paying subscriber. Your support is everything to The X Project and is greatly appreciated. If you agree, please take a moment to hit the like button and share your positive comments about my articles, assuming you have something constructive to say.