"The Unfolding Inflationary Boom"

The Outlook for and How to Invest in an Increasing Growth + Inflation Environment- Article #52

In this 10-minute article, The X Project will answer these questions:

I. Why this article now?

II. What is an “Inflationary Boom”?

III. What asset classes do best in an Inflationary Boom?

IV. What asset classes do best in a Quad 2 regime?

V. What is driving the outlook for economic growth?

VI. What is another reason to expect continued economic growth?

VII. What is a third reason for economic growth expectations?

VIII. What is a fourth reason for economic growth?

IX. What does The X Project Guy have to say?

X. Why should you care?

Reminder for readers and listeners: nothing The X Project writes or says should be considered investment advice or recommendations to buy or sell securities or investment products. Everything written and said is for informational purposes only, and you should do your own research and due diligence. It would be best to discuss with an investment advisor before making any investments or changes to your investments based on any information provided by The X Project.

I. Why this article now?

In The X Project’s prior article, “Is Inflation About to Make a Comeback?”, I wrote:

“Louis-Vincent Gave is a founding partner and CEO of Gavekal, a financial services company organized around three key activities: financial research for institutional investors, funds and private wealth management, and portfolio construction tools. Last week, he shared a recording of a Webinar he hosted with the two other founding partners of Gavekal titled “Forward to the 1970s? Investing for An Inflationary Age.” There was a lot of content in the hour-long recording and the three information-packed presentation decks they each prepared but did not actually present. I will cover more of that content in another article soon…”

And so soon is here, soon enough. I borrowed Louis-Vincent Gave’s (LVG) title for his presentation slide deck for this article. Since the last article covered inflation, this article will focus on the economic framework or regime in which we find an inflationary boom, what assets do best and worst in an inflationary boom, and why the economy is expected to continue expanding.

II. What is an “Inflationary Boom”?

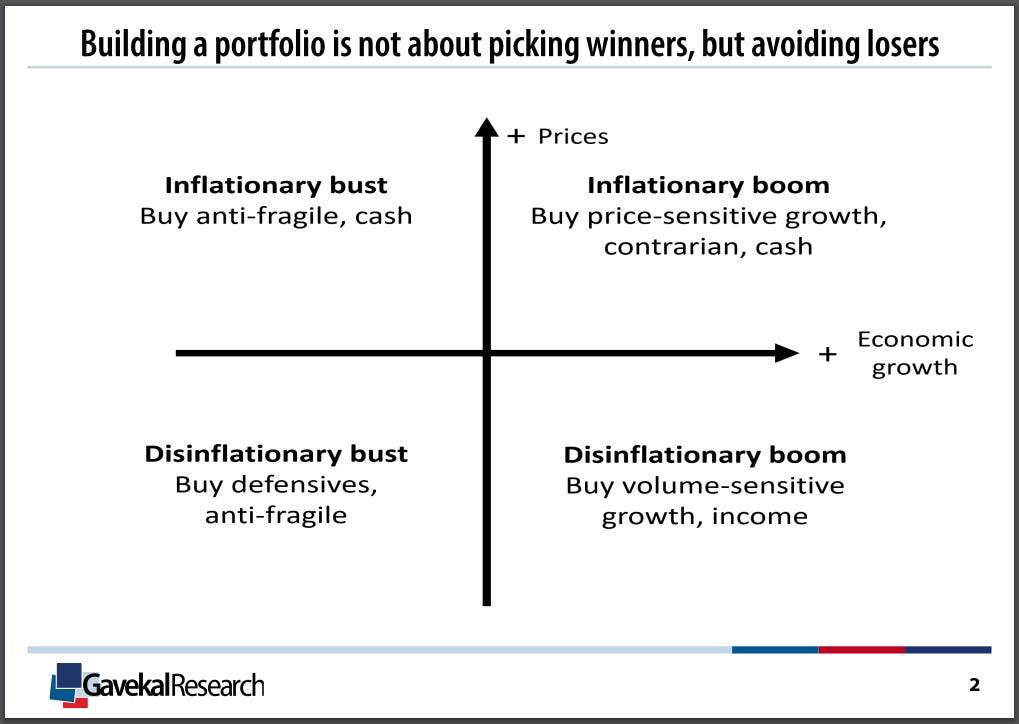

Here is slide 2 of LVG’s deck:

An inflation boom occurs when economic growth and inflation accelerate simultaneously, as shown in the upper right quadrant above. As a long-time subscriber to Keith McCullough’s Hedgeye, a provider of hedge fund-quality research for everyday investors, I immediately recognized the Hedgeye Growth, Inflation, and Policy (GIP) framework, a.k.a. “The Quads”:

Quad 1 Goldilocks = GVK’s Disnflationary Boom

Economy growing and inflation slowing

Quad 2 Reflation = GVK’s Inflationary Boom

Economy growing and inflation growing

Quad 3 Stagflation = GVKs Inflationary Bust

Economy slowing and inflation growing

Quad 4 Deflation = GVK’s Disinflationary Bust

Economy slowing and inflation slowing

LVG and Keith McCullough are well-aligned in their frameworks and outlooks. In mid-February, Hedgeye shifted to a Quad 2 Reflation outlook.

III. What asset classes do best in an Inflationary Boom?

LVG’s slide indicates one should “buy price-sensitive growth, contrarian, cash.” That doesn’t tell us too much. However, if you listen to Gavekal’s “Forward To The 1970s? Investing For An Inflationary Age” Webinar, LVG and his partners discussed these asset classes that investors should consider in an inflationary boom environment:

Commodities: They strongly emphasize commodities as crucial assets during inflationary times. They mentioned that commodities, including energy and copper, have seen significant price breakouts recently, supporting that they are beneficial during inflationary periods.

Equities in Specific Sectors: The discussion highlighted a shift in investment from growth stocks towards industrials, financials, and commodity stocks, which are typically more favorable during inflationary periods.

Energy Stocks: Energy stocks are specifically mentioned as part of the broader category of commodities that should perform well in an inflationary environment.

Gold: Gold is discussed as an inflation hedge. The speakers consider it an essential part of a portfolio designed to withstand inflation, as it traditionally holds its value in real terms despite currency fluctuations and inflationary pressures.

Emerging Market Debt: Although traditionally riskier, emerging market debt is mentioned as having performed exceptionally well compared to Western government debt markets, making it an intriguing option for portfolio diversification during inflationary times.

LVG and his partners also state that, aside from emerging market debt, bonds should be avoided, given the underperformance of bonds in an inflationary environment. The speakers noted that bonds, traditionally used as a diversification tool against equity risk, have failed to provide this benefit in recent years. The discussion particularly highlights that bonds no longer function as reliable deflation hedges and that their role in portfolios should be re-evaluated in the context of persistent inflation.

Specific mention is made of avoiding U.S. Treasuries, with concerns about their ability to cushion portfolios in the current economic scenario, given the fiscal and monetary challenges facing the U.S.

IV. What asset classes do best in a Quad 2 regime?

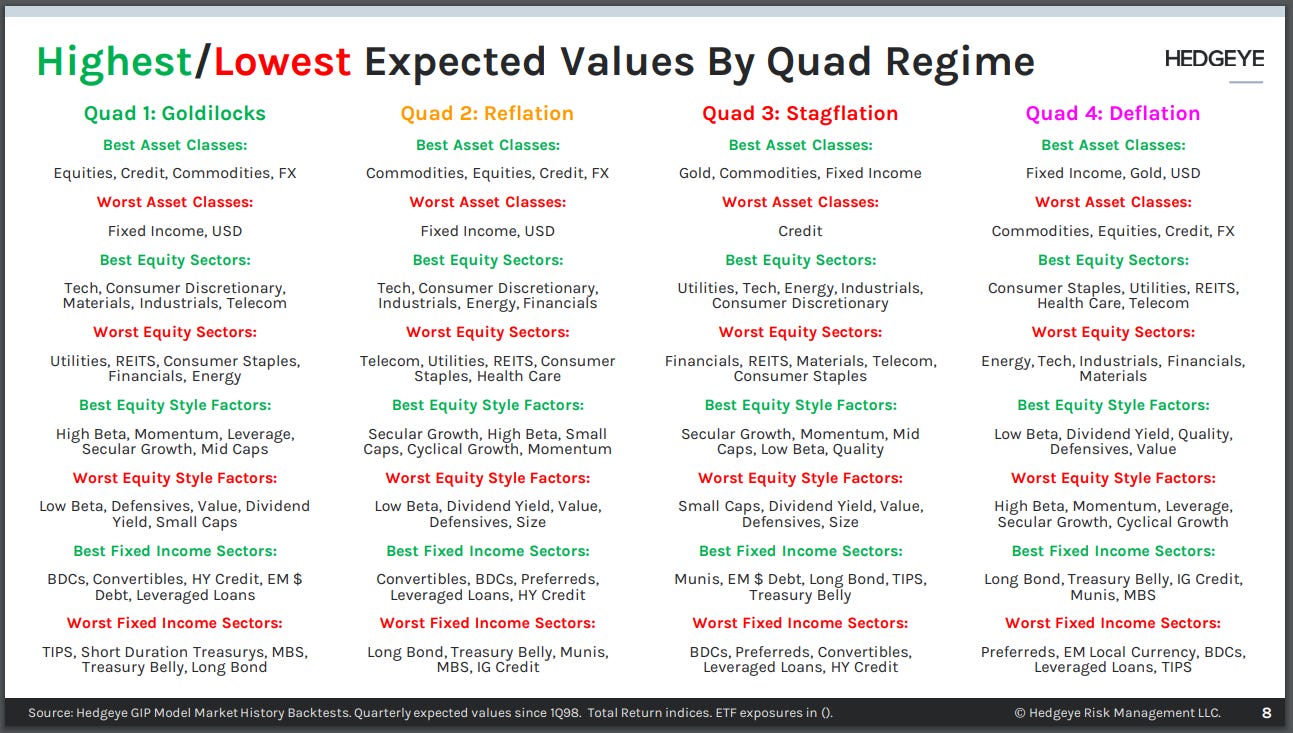

Here is a slide from Hedgeye that outlines very specifically what asset classes are best and worst in a Quad 2 Reflation Regime:

Hedgeye and Gavekal are also mostly aligned on where to invest.

V. What is driving the outlook for economic growth?

The Gavekal partners highlighted that the economic growth is partly or largely driven by the expansive fiscal policies implemented by many Western countries. These policies, designed to stimulate the economy following the pandemic, have increased government spending and investments, leading to higher economic activity.

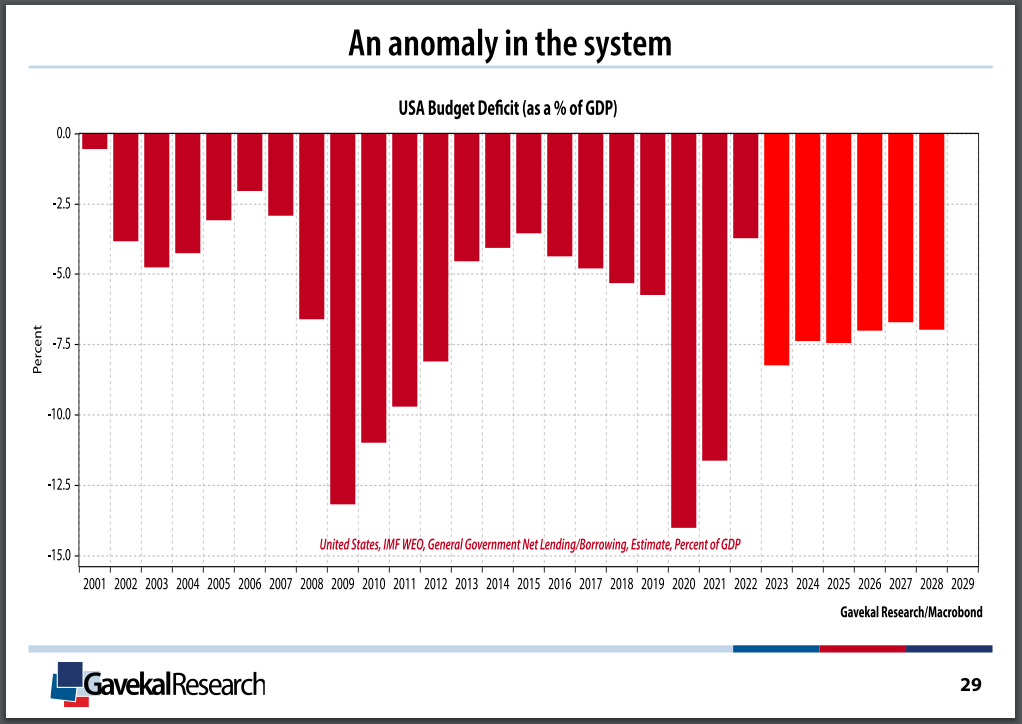

In LVG’s slide deck, he has a section subtitled “Insane Fiscal Policies,” with the next slide showing the anomalous U.S. budget deficits as a percentage of GDP from 2023-2028:

This is consistent with the Fiscal Dominance arguments that Luke Gromen and Lyn Alden have been making and which The X Project believes and has written about in the following articles:

VI. What is another reason to expect continued economic growth?

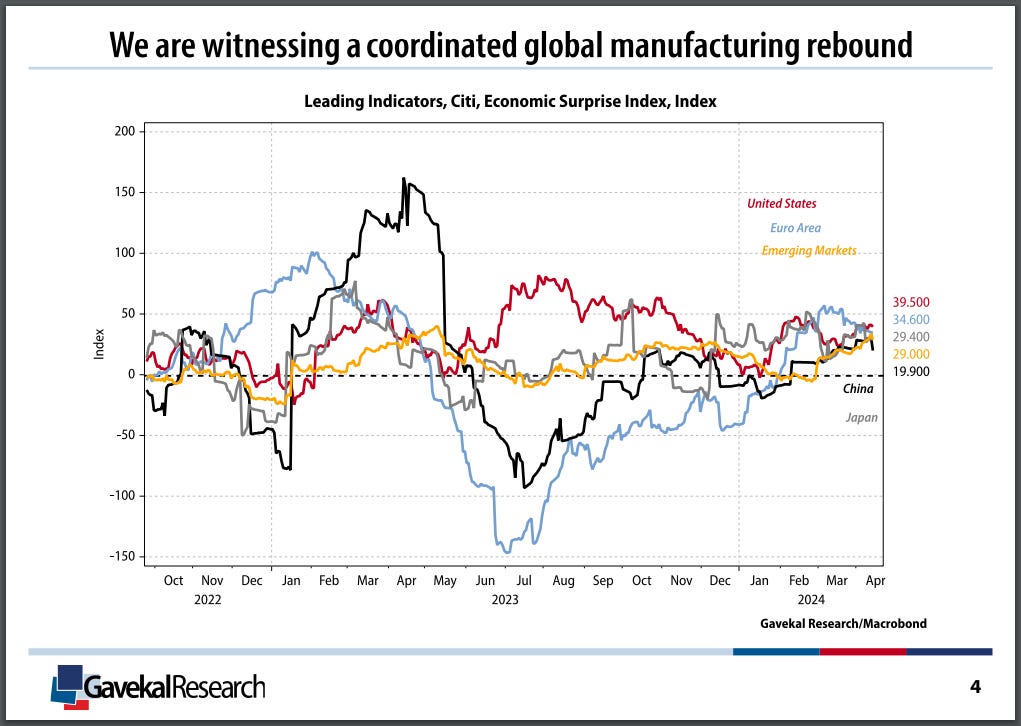

The webinar emphasizes improved economic data from previously lagging manufacturing and industrial production sectors. These sectors have shown significant upticks in activity, contributing to broader economic growth.

Slide four of LVG’s deck shows we are witnessing a coordinated global manufacturing rebound in the U.S, Euro area, emerging markets, China, and Japan:

VII. What is a third reason for economic growth expectations?

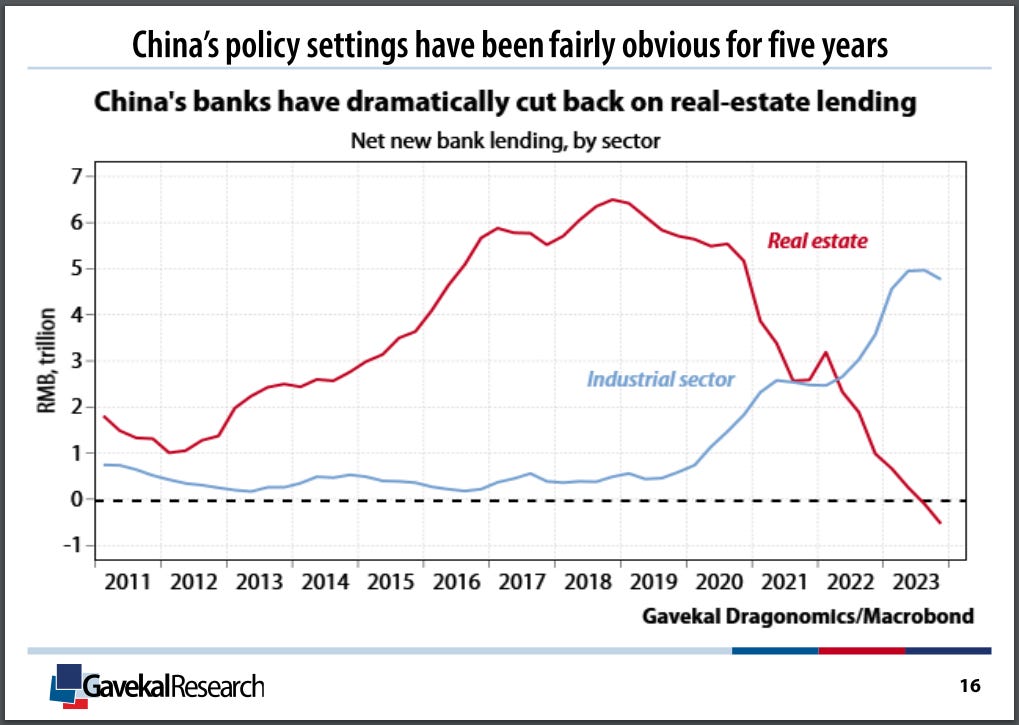

The booming growth in emerging markets that few expected is another reason for expecting global economic growth. LVG points out that China’s policy settings have been fairly obvious for five years when you look at net new bank lending by sector and see the decline in real estate lending and the corresponding increase in industrial lending starting in 2019:

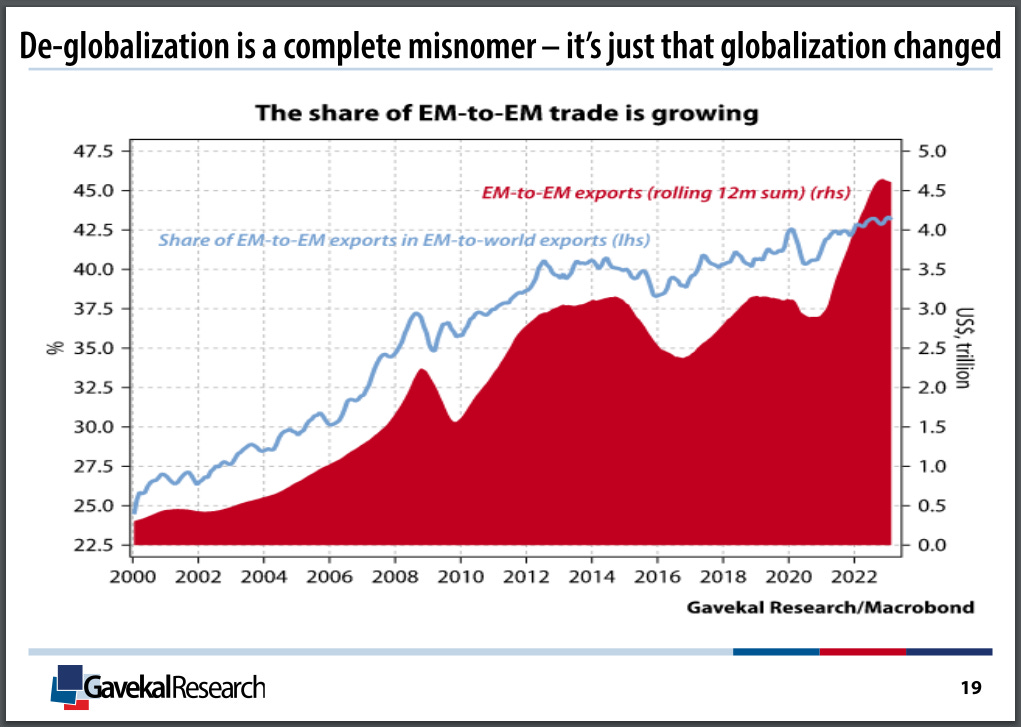

Then he points out that de-globalization is a complete misnomer - it’s just that globalization changed and shows that the share of EM-to-EM trade is growing:

In the next section, I will explain a fourth reason Gavekal expects continued economic growth. In Section IX, I will tell you what I think about all of this. And then in Section X, why you should care and, more importantly, what more you can do about it. However, I have just hit a new paid subscriber threshold, so you must now be a paid subscriber to view the last three sections. The X Project’s articles always have ten sections. Soon, after a few more articles, the paywall will move up again within the article so that only paid subscribers will see the last four sections, or rather, free subscribers will only see the first six sections. I will be moving the paywall up every few weeks, so ultimately, free subscribers will only see the first four or five sections of each article. Please consider a paid subscription.

All paid subscriptions come with a free 14-day trial; you can cancel anytime. Every month, for the cost of two cups of coffee, The X Project will deliver two articles per week ($1.15 per article), helping you know in a couple of hours of your time per month what you need to know about our changing world at the interseXion of commodities, demographics, economics, energy, geopolitics, government debt & deficits, interest rates, markets, and money.

You can also earn free paid subscription months by referring your friends. If your referrals sign up for a FREE subscription, you get one month of free paid subscription for one referral, six months of free paid subscription for three referrals, and twelve months of free paid subscription for five referrals. Please refer your friends!

VIII. What is a fourth reason for economic growth?

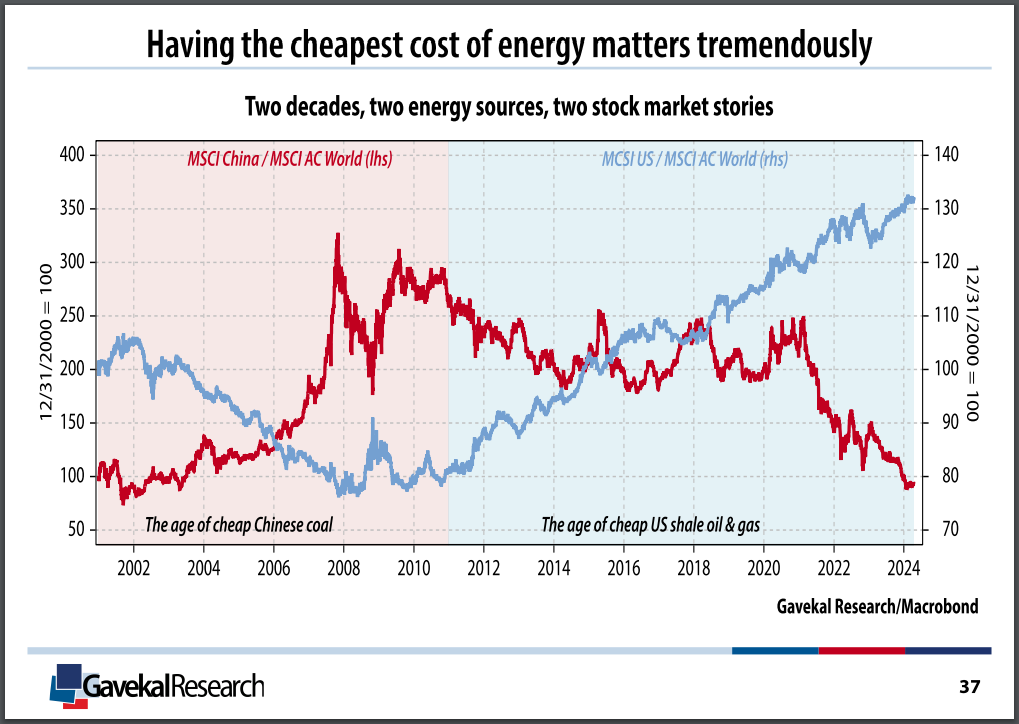

Echoing the sentiments of Doomberg, who has been arguing consistently that the U.S. economy will continue to grow with access to cheap energy, LVG points out in his deck that the U.S. shale revolution was perhaps the most important macro event of the past decade. In this insightful slide, he points out that having the cheapest cost of energy matters tremendously by showing two decades, two energy sources, and two stock market stories with the MCSI China outperformance from 2001-2011 and the MCSI U.S. outperformance from 2011 to the present:

He implies a question about how long it will last with his energy section titled “Will U.S./World be bailed out by another energy miracle?” In the Webinar, they talk about rising energy and crude oil prices being good for investing in that sector. Still, they don’t say anything about high energy costs being a headwind for the economy. And so listeners and readers of the presentation decks are left to believe that relatively cheap energy for now is a plus for economic growth. While higher energy prices are expected, we are left to believe they won’t derail economic growth in the short run.

IX. What does The X Project Guy have to say?

The webinar and the presentation decks Gavekal shared confirm my views on rebounding inflation and economic growth, at least for the remainder of this year. It was also gratifying to see that Gavekal uses a similar framework as Hedgeye, and Hedgeye’s and Gavekal’s outlooks and investment recommendations are very much aligned.

I am aware of confirmation bias and actively work to ensure I am not falling victim to it. That is why I wrote the articles “What About the Possibility of Deflation?” on April 14 and “Is a Recession Coming in 2024?” on April 17. I recently listened to Danielle DiMartino Booth, another influential analyst I respect and to whom I listen, and she is also still calling for a recession and even suggested one may have already started. She is closely watching layoffs and expects unemployment to tick up soon; the data she cites is worrisome. However, I continue to believe that fiscal dominance and “The Rising Tide of Global Liquidity Lifting All Assets” (Article #35) will continue to dominate and overpower any economic weaknesses.

X. Why should you care?

While equity markets should generally continue higher (but not without pullbacks and corrections), keep in mind that an Inflationary Boom or a Quad 2 is a different economic and investment regime than Quad 1 or a Disinflationary Boom, which is much of what we experienced pre-pandemic. Aside from the investment themes to which I have been personally subscribing and suggesting readers consider, take another close look at Section IV above. You may want to consider reviewing that with your investment advisor and tweaking your portfolio accordingly.

Thank you for your paid subscription. Your support is everything to The X Project and is greatly appreciated. If you agree, please do me the favor of hitting the like button and posting positive comments about my articles - assuming you have positive things to say - especially about these final sections (soon to be more sections) that only you as a paid subscriber get to see.