The Great Demographic Reversal: Ageing Societies, Waning Inequality, and an Inflation Revival

A summary of the book written by Charles Goodhart and Manoj Pradhan (2020) - Article #22

In this 12 min article, The X Project will answer these questions:

I. Why this book, and what’s it about?

II. Who are the authors?

III. How popular is the book?

IV. What does The X Project Guy have to say?

V. What is one of the top takeaways from the book?

VI. What is another top takeaway?

VII. What is the third top takeaway?

VIII. What is the fourth top takeaway?

IX. What is the fifth top takeaway?

X. Why should you care?

I. Why this book, and what’s it about?

In an era where buzzwords like AI, blockchain, and quantum computing dominate the discourse, Charles Goodhart and Manoj Pradhan's The Great Demographic Reversal emerges as a riveting anomaly. This book isn't just a read; it's a journey into the undercurrents of our global economy, driven by forces as ancient as time - demographics. Goodhart and Pradhan, with their incisive intellect, unravel how aging populations, declining birth rates, and the consequent shrinking workforce are not just footnotes in economic theories but potent catalysts that will reshape our world.

At its core, the book audaciously forecasts the economic and political climate of the near future, extrapolating from demographic trends. The authors argue that the era of abundant labor and low inflation, which has underpinned much of the economic stability and growth since the 1980s, is waning. This reversal, they assert, will have profound implications on everything from interest rates to the balance of global economic power. Their narrative is not just a compilation of data and trends; it's a compelling story about how the most fundamental aspect of our existence - the human population - shapes our world.

II. Who are the authors?

According to Wikipedia, “Charles Albert Eric Goodhart is a British economist. His career can be divided into two sections: his term with the Bank of England and its associated public policy and his academic work with the London School of Economics. Charles Goodhart's work focuses on central bank governance practices and monetary frameworks. He also conducted academic research into foreign exchange markets. He is best known for formulating Goodhart's Law, which states: "When a measure becomes a target, it ceases to be a good measure."

According to Texas A&M International University, which hosted Manoj Pradhan as a speaker, he is the founder of Talking Heads Macroeconomics, an independent research firm. Dr. Pradhan was most recently Managing Director at Morgan Stanley, where he led the Global Economics team. He joined Morgan Stanley in 2005 after serving on the faculty of George Washington University and the State University of New York. Dr. Pradhan works on thematic global macroeconomics with a focus on emerging markets. He has a Ph.D. in Economics from George Washington University and a Masters in Finance from the London Business School.

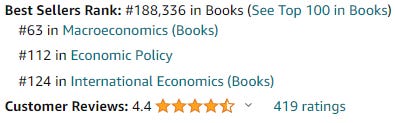

III. How popular is the book?

According to Amazon, here are the book’s rankings:

IV. What does The X Project Guy have to say?

This is the twelfth book covered by The X Project. When The X Project first launched, I wanted to set a foundation for the general themes and theses that underpin my thinking on The X Project topics of commodities, demographics, economics, energy, geopolitics, government debt and deficits, interest rates, markets, and money. And so, my first two articles outlined the top 20 most influential books I’ve read:

And here are the first eleven books I’ve covered so far:

The Fourth Turning: An American Prophecy by Neil Howe and William Strauss (1996)

The Next 100 Years: A Forecast for the 21st Century by George Friedman (2009)

This Time is Different: Eight Centuries of Financial Folly by Carmen Reinhart and Ken Rogoff (2009)

The Accidental Superpower: The Next Generation of American Preeminence and the Coming Global Disorder by Peter Zeihan (2014)

Flashpoints: The Emerging Crisis in Europe by George Friedman (2015)

The Silk Roads: A New History of the World by Peter Frankopan (2015)

The Absent Superpower: The Shale Revolution and a World Without America by Peter Zeihan, (2016)

Fed Up: An Insider’s Take on Why The Federal Reserve is Bad for America by Danielle DiMartino Booth, (2017)

The Storm Before the Calm: America's Discord, the Coming Crisis of the 2020s, and the Triumph Beyond by George Friedman (2020)

Disunited Nations: The Scramble for Power in an Ungoverned World by Peter Zeihan (2020)

Trade Wars are Class Wars: How Rising Inequality Distorts the Global Economy and Threatens International Peace by Matthew C. Klein and Michael Pettis (2020)

Peter Zeihan first introduced the importance of understanding demographics to me. While his books introduce and reference the issues of demographics, he has videos and presentations that go much deeper into the topic. If you are interested, much of the data and many of those videos can be found here.

The Great Demographic Reversal made it onto the list of books because I wanted a second opinion on demographics. It did not disappoint, largely confirming Zeihan’s assertions and conclusions about demographics. However, the book is also a roadmap to understanding and navigating the economic and political landscapes of the future, and I think Zeihan would agree with Goodhart and Pradhan.

After this book, I have eight more to cover. At this point, I have been interspersing a book summary article with an article on an X Project topic, which means I will be done covering my initial list of twenty books by the end of February.

V. What is one of the top takeaways from the book?

The End of Deflationary Pressure

Global economies have enjoyed low inflation for decades, largely due to the vast labor supply from China and the re-integration of post-communist Eastern European countries. Goodhart and Pradhan predict this era is ending. As populations age and labor becomes scarce, wages rise, sparking inflationary pressures unseen in recent history. This shift challenges conventional monetary policies and demands a rethinking of economic strategies globally.

VI. What is another top takeaway?

Healthcare and Pension Systems in Crisis

The book paints a grim picture of the future of public finances, especially concerning healthcare and pensions. With fewer young people to support an aging population, the strain on these systems will be immense. This demographic imbalance could lead to increased government borrowing, higher taxes, and potentially, the reevaluation of the very structure of welfare states.

VII. What is the third top takeaway?

Shift in Global Economic Power

One of the more provocative themes is the forecasted shift in global economic power. As Western nations grapple with aging populations, countries with younger demographics (e.g., parts of Africa, South Asia, and India) could see their economic influence surge. This shift might redefine global trade dynamics and geopolitical alliances.

VIII. What is the fourth top takeaway?

Rethinking Immigration Policies

Immigration emerges as a pivotal theme in the book. The authors suggest that countries might need to radically rethink their immigration policies to mitigate the labor shortage caused by aging populations. This could lead to a more globalized labor market with significant socio-political implications.

IX. What is the fifth top takeaway?

A Call for Proactive Policy Making

Finally, Goodhart and Pradhan’s work is a clarion call for proactive and innovative policymaking. The demographic trends are irreversible; thus, governments and institutions must anticipate and plan for these changes. This involves everything from rethinking fiscal policies to innovating healthcare and redefining the social contract between the state and its citizens.

X. Why should you care?

Demographic realities are unavoidable. The first two takeaways are destined to become realities, and in fact, they already are. The United States Social Security and Medicare obligations have helped drive our country into a state of fiscal dominance, a concept The X Project introduced in Fiscal Dominance: What the heck is it, and why does it matter?? - Article #6. The X Project explored the issue further in An Introduction to Inflation: What is its relationship to interest rates, government debt/deficits, and fiscal dominance? - Article #9.

The bottom line is that the next couple of decades are destined to be very different from the past several decades. Are you prepared for what this means? Is your investment portfolio and its asset allocation positioned to be shielded from the risks and to take advantage of the opportunities? Is your company or business aware? How will your occupation and your kids’ future be impacted?

This is the very essence of why The X Project exists. Please help ensure The X Project can continue its mission by…

Hitting the heart icon indicating you like this article

Sharing this article (and prior articles) with anyone and everyone you know and care about.

Considering a paid subscription. The paywall will go up within a few days, restricting each new article's final sections to paid subscribers only. All paid subscriptions in January will come with a free 30-day trial. Every month, for the cost of two cups of coffee, The X Project will deliver ten articles per month ($1 per article), helping you know in 1-2 hours of your time per month what you need to know about our changing world at the intersection of commodities, demographics, economics, energy, geopolitics, government debt & deficits, interest rates, markets, and money.

Being generous and aggressive in referring friends. Click the link to see the rewards where you can earn free paid subscriptions as well as the link to use for making referrals.

Thanks for your summary, which was pretty spot on. The couple of takes I had from reading this book and having the privilege to speak with Professor Goodhart were the following two things:

1. Ageing populations are inflationary - which means countries that have a higher proportion of old people will experience higher inflation, as there is more demand (from the retired population) and less supply, as not as many people are working. For those of us in London after Brexit, we saw this with the cost of plumbers, as many went back to Europe;

2. Consumption is a young person's passion and economies with a higher proportion of young people will see more consuming, which equates into more jobs and thereby economic growth. The reverse is true for ageing communities. To a degree you can negate that through selective immigration, which is easier for a country like the US with so much land, less so for Holland, which is getting pretty full.

Great book, great insight, really pleased you provided the summary above on it.